Chair Market Size 2025-2029

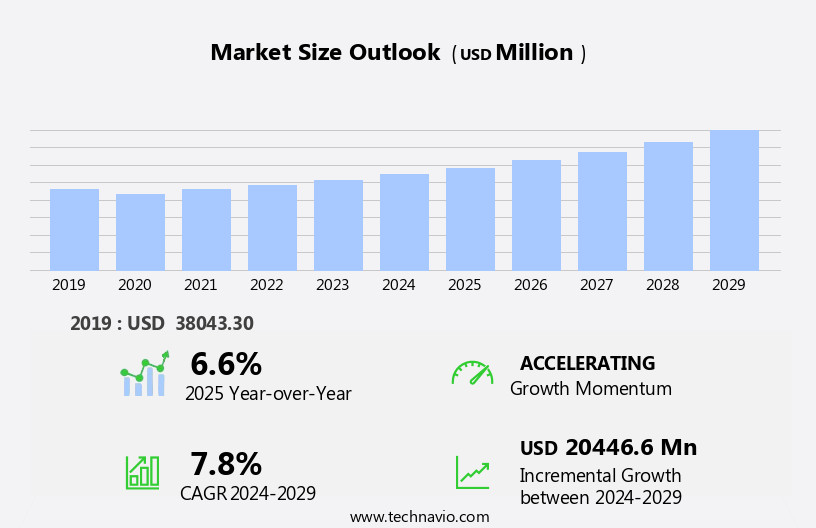

The chair market size is forecast to increase by USD 20.45 billion at a CAGR of 7.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by several key factors. One notable trend is the increasing recognition of the health benefits associated with using gaming chairs. As more individuals prioritize their well-being, the demand for ergonomic and comfortable seating solutions has grown. The office furniture market encompasses a wide range of products, with chairs being a significant segment. Sustainability is a growing concern, with stainless steel and recycled plastic being preferred low-maintenance materials. Additionally, the convenience of online shopping has contributed to the market's growth, allowing consumers to easily access a wide range of chair options from the comfort of their homes. However, uncertainty In the prices of raw materials poses a challenge for manufacturers, potentially impacting production costs and profitability. Overall, the market is expected to continue expanding, driven by these and other factors.

What will be the Size of the Chair Market During the Forecast Period?

- This market exhibits growth, driven by the increasing demand for ergonomic and adjustable chairs in various workspaces, including commercial and residential spaces. Swivel chairs, in particular, have gained popularity due to their versatility and ability to improve workspace efficiency. Steel and plastic chairs continue to dominate the market, catering to both commercial and residential applications. The rise of online sales and social media platforms has significantly impacted the market dynamics, enabling easy access to a diverse range of chair offerings from international manufacturers.

- Capital investments in office infrastructure, corporate hubs, and interior arrangements have fueled the demand for office furniture. Innovative ergonomic chairs, designed to alleviate neck pressure and enhance user comfort, have emerged as a key trend. Lead times and product customizations are essential considerations for buyers, with made-to-stock varieties and imports offering cost-effective solutions. Retailers, including those with owned exclusive stores, retail outlets, and brick-and-mortar stores, play a crucial role in catering to the diverse needs of consumers. The price point remains a significant factor In the market, with various options available to suit different budgets.

How is this Chair Industry segmented and which is the largest segment?

The chair industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Regular use chairs

- Office chairs

- Massage chairs

- Gaming chairs

- Others

- End-user

- Commercial

- Residential

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- South America

- Middle East and Africa

- APAC

By Distribution Channel Insights

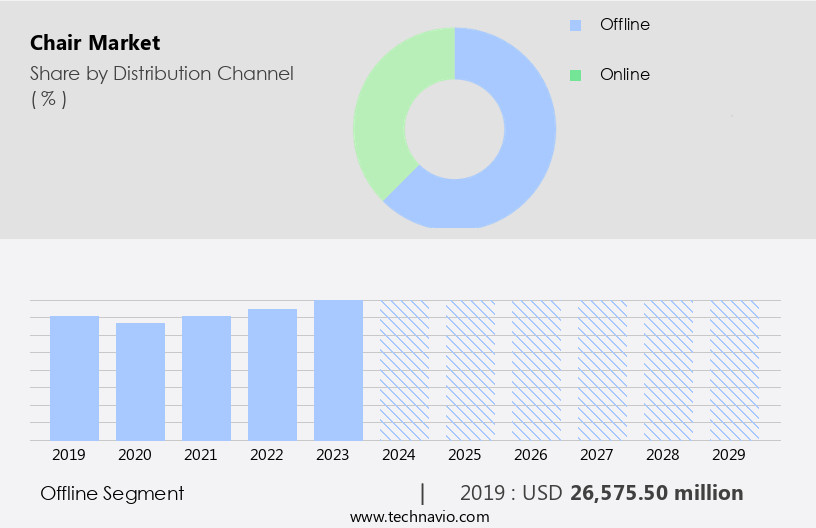

- The offline segment is estimated to witness significant growth during the forecast period. The Office furniture market encompasses a substantial segment of the chair industry, with demand driven by ergonomic seating systems, office remodeling activities, and remote working trends. Domestic manufacturers compete with international players, supplying adjustable chairs, swivel chairs, and multipurpose ergonomic chairs in commercial and residential segments. Economic Impact Studies highlight the importance of this sector, with businesses investing in capital infrastructure, interior arrangements, and ergonomic market growth. Online sales are increasingly popular, with retailers offering various price ranges, from made-to-stock varieties to product customizations. Social media platforms play a significant role in marketing these chairs, reaching a wide audience.

- Design elements, such as ergonomics, comfort, and space usage, are crucial factors influencing consumer preferences. Commercial spaces, including corporate hubs and collaborative workspaces, and residential spaces require ergonomic chairs for staff comfort and productivity. Ergonomic swivel chairs, adjustable chairs, and stainless-steel outdoor chairs cater to these needs. Designs, lengths, and finishes vary, with quality and price ranges determining the market's competitive landscape. Ergonomics, including neck pressure relief, are essential considerations in chair design. Innovative ergonomic chairs offer a superior sitting experience, reducing aches and improving workplace environment.

Get a glance at the market report of share of various segments Request Free Sample

The offline segment was valued at USD 26.58 billion in 2019 and showed a gradual increase during the forecast period. The construction sector's impact choices influence product durability and the need for replacements. Thus, the market is a dynamic and evolving industry, with various factors influencing demand, competition, and consumer preferences. Companies must adapt to changing market trends, including online sales, social media marketing, and sustainability concerns, to remain competitive.

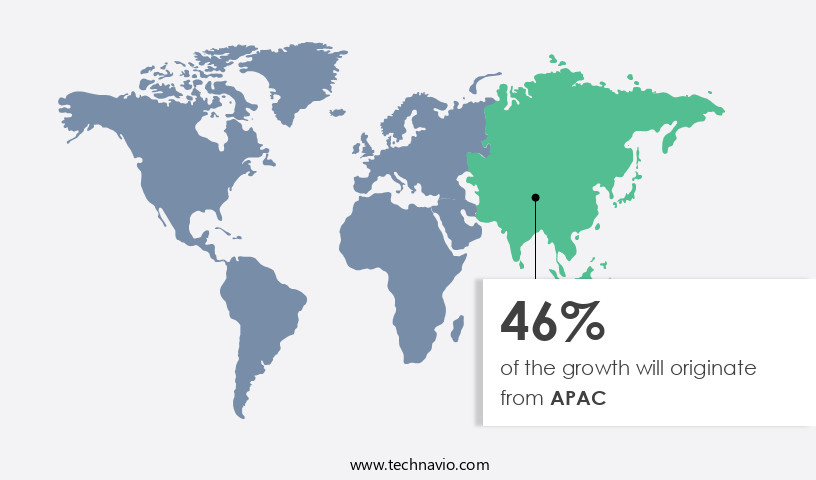

Regional Analysis

- APAC is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The Office furniture market, specifically the ergonomic chair segment, is experiencing significant growth due to increasing demand for comfortable and adjustable seating solutions in both commercial and residential spaces. Domestic manufacturers and international players are responding to this trend by offering a range of ergonomic swivel chairs and adjustable chairs in steel and plastic materials.

For more insights on the market size of various regions, Request Free Sample

- Online sales and social media marketing are driving product demand, with consumers prioritizing ergonomic seating systems for their workspaces and home offices. Office remodeling activities and the rise of remote working have further boosted market growth. Ergonomic chairs cater to the needs of businesses and their staff, providing comfort and reducing aches during long workdays.

- Product durability and design elements are key considerations for businesses making capital investments in office infrastructure. The ergonomic market is a consumer product with supply chain preferences leaning towards innovative, multipurpose ergonomic chairs that offer customizations and lengthy product lifespans. However, concerns over product customizations, imports, and lead times may impact market growth. The commercial and residential segments each represent significant opportunities for growth, with collaborative workspaces and construction sector activities contributing to the overall market impact. The ergonomics of seating solutions are increasingly important for individual health and workplace environment, with ergonomic swivel chairs and stainless-steel outdoor chairs offering high-quality, low-maintenance materials like carbon, iron, and metal alloys. Prices and product customizations are key factors influencing consumer purchasing decisions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Chair Industry?

- The health-related benefits of using gaming chairs is the key driver of the market. The Office Furniture Market encompasses various product categories, including swivel chairs and adjustable chairs, which significantly impact the economic landscape. Domestic manufacturers compete with international counterparts, offering ergonomic seating systems designed for both commercial and residential segments. Online sales and social media marketing have transformed the way businesses engage with their staff and consumers. Ergonomic chairs, as a consumer product, have gained prominence due to the increasing trend of office remodeling activities, remote working, and the need for innovative ergonomic chairs that cater to comfort and workdays' length. Office furniture suppliers cater to the demands of various industries, offering customizations and multipurpose ergonomic chairs that fit different workspaces and interior arrangements. The ergonomic market's growth is influenced by factors such as product durability, ergonomics, and the impact of choices on individual health and workplace environment.

- Ergonomic swivel chairs, made from materials like stainless steel, carbon, iron, and metal alloys, offer quality and price ranges that cater to diverse business needs. Commercial spaces and residential spaces alike benefit from ergonomic seating systems, which contribute to capital investments in office infrastructure and corporate hubs. Design elements such as neck pressure relief, adjustable lumbar support, and sitting experience are essential considerations for ergonomic chairs. Despite the benefits, challenges like long lead times and product customizations pose challenges for businesses. The use of materials like stainless steel, a low-maintenance material, and recycled plastic, which addresses environmental concerns, further adds to the market's complexity. The market dynamics are influenced by factors such as product durability, lack of innovation, and the impact of choices on individual health, workplace environment, and the construction sector.

What are the market trends shaping the Chair Industry?

- The growing prominence for online shopping is the upcoming market trend. The office furniture market, including chairs, experiences significant growth due to the increasing demand for ergonomic seating systems in both commercial and residential segments. An Economic Impact Study reveals that domestic manufacturers and international competitors offer various designs and price ranges, catering to diverse fitting needs and space usage. Online sales dominate the market, driven by the convenience and cost savings for businesses and their staff. Social media plays a crucial role in product promotion and brand awareness. In the commercial segment, adjustable swivel chairs and adjustable ergonomic chairs made of steel and plastic are popular choices for workspaces and commercial spaces. Design elements and ergonomics are essential considerations for office remodeling activities, especially in corporate hubs and collaborative workspaces. Ergonomic chairs, including ergonomic swivel chairs, offer comfort and reduce workdays' aches and neck pressure. Retailers sell ergonomic chairs through company-owned exclusive stores, retail outlets, and brick-and-mortar stores.

- However, online sales have gained popularity due to their lower prices, longer product customizations, and shorter lead times. The ergonomic market is a consumer product with significant capital investments in office infrastructure. The market's supply chain preferences include innovative ergonomic chairs made of stainless steel, carbon, iron, and metal alloys, offering product durability and low-maintenance material. Some manufacturers offer made-to-stock varieties, while others focus on imports. Product demand is influenced by the workplace environment, office building construction, and remodeling activities. The impact of choices between ergonomic chairs and traditional seating systems affects individual health, sitting habits, and the environment. The market's growth is driven by the need for ergonomic solutions, increasing demand for multipurpose ergonomic chairs, and the construction sector's ongoing activities.

What challenges does the Chair Industry face during its growth?

- The uncertainty in prices of raw materials is a key challenge affecting the industry growth. The Office furniture market experiences significant fluctuations in raw material costs, posing a challenge to market growth. Steel, plastics, textiles, wood particleboard, and cartons are essential components in furniture manufacturing, and their prices have risen substantially. The increase in steel costs, in particular, significantly impacts the industry due to its extensive use in producing various types of furniture. Moreover, the volatility in input and transportation costs, as well as reduced production capacities, contributes to the rise in wood particleboard prices. These rising costs negatively affect the profit margins of both manufacturers and retailers. In response, some businesses have turned to online sales, social media marketing, and product customizations to remain competitive.

- The ergonomic market, a consumer product in high demand, has seen an increase in demand for innovative designs, adjustable features, and ergonomic seating systems. Commercial and residential spaces, including offices, workspaces, and commercial and residential buildings, continue to prioritize ergonomic seating solutions for staff comfort and productivity. Despite these challenges, the market remains dynamic, with companies focusing on capital investments in office infrastructure, collaborative workspaces, and ergonomic seating systems to enhance the workplace environment. Additionally, some manufacturers are exploring alternative materials, such as stainless steel, carbon, iron, and metal alloys, to create low-maintenance, high-quality, and eco-friendly products. Meanwhile, retailers are adapting to consumer preferences by offering multipurpose ergonomic chairs, company-owned exclusive stores, and retail outlets in brick-and-mortar and online formats. The market continues to evolve, with businesses and individuals seeking ergonomic solutions that cater to their unique fitting needs and sitting experiences, ensuring comfort during workdays and reducing the risk of aches and pressure points.

Exclusive Customer Landscape

The chair market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the chair market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, chair market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Corsair Gaming Inc. - The company offers chairs such as TC70 gaming chairs, TC200 gaming chairs, and T3 rush gaming chairs under the gaming and creator peripherals segment.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ace Casual Furniture

- AKRacing America Inc.

- Arozzi North America

- Bristol Technologies Sdn Bhd

- Corsair Gaming Inc.

- DXRacer USA LLC.

- Haworth Inc.

- HNI Corp.

- Impakt S.A.

- Kimball International Inc.

- MillerKnoll Inc.

- Okamura Corp.

- Pro Gamersware GmbH

- Secretlab SG Pte. Ltd.

- Steelcase Inc.

- Thermaltake Technology Co. Ltd.

- ThunderX3

- TOPSTAR GMBH

- True Innovations

- Vertagear Inc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of products designed for various workspaces, including commercial, residential, and outdoor settings. This dynamic industry is influenced by numerous factors, including economic conditions, design trends, and technological advancements. One significant trend In the office furniture market is the increasing importance of ergonomic seating systems. As businesses and individuals recognize the importance of employee comfort and productivity, demand for adjustable chairs and swivel chairs has grown. These chairs offer features such as adjustable height, backrest, and armrests, allowing users to customize their seating experience and reduce the risk of aches and pains. Another trend In the office furniture market is the rise of online sales and social media marketing. With the convenience of e-commerce and the ability to easily research and compare products, more businesses are turning to online retailers for their office furniture needs. Additionally, social media platforms provide a cost-effective way for companies to reach a large audience and showcase their products. The office furniture market also includes a diverse range of materials, from steel and plastic to more innovative options like carbon and iron. The choice of material can impact both the price and the durability of the product.

For example, stainless steel is a popular option for commercial outdoor sitting due to its low-maintenance properties, while single-use plastic waste is a concern for those seeking more sustainable options. Product customizations and lead times are also important considerations In the office furniture market. As businesses look to create unique workspaces that reflect their brand and culture, there is a growing demand for made-to-order and customizable furniture. However, this can lead to longer lead times and higher prices, which may be a challenge for some businesses. The office furniture market is also influenced by broader economic factors, such as capital investments and office infrastructure. Corporate hubs and commercial buildings are major consumers of office furniture, as they seek to create functional and attractive workspaces for their staff. However, the impact of choices made In these areas can extend beyond the individual business, affecting the broader economy and the environment. Thus, the office furniture market is a dynamic and complex industry that is influenced by a range of factors, from design trends and economic conditions to sustainability concerns and technological advancements. As businesses and individuals continue to prioritize comfort, productivity, and sustainability In their workspaces, the demand for innovative and ergonomic office furniture is expected to remain strong.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.8% |

|

Market growth 2025-2029 |

USD 20.45 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

US, China, Japan, India, Canada, South Korea, UK, Germany, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Chair Market Research and Growth Report?

- CAGR of the Chair industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the chair market growth of industry companies

We can help! Our analysts can customize this chair market research report to meet your requirements.