Gaming Chair Market Size 2025-2029

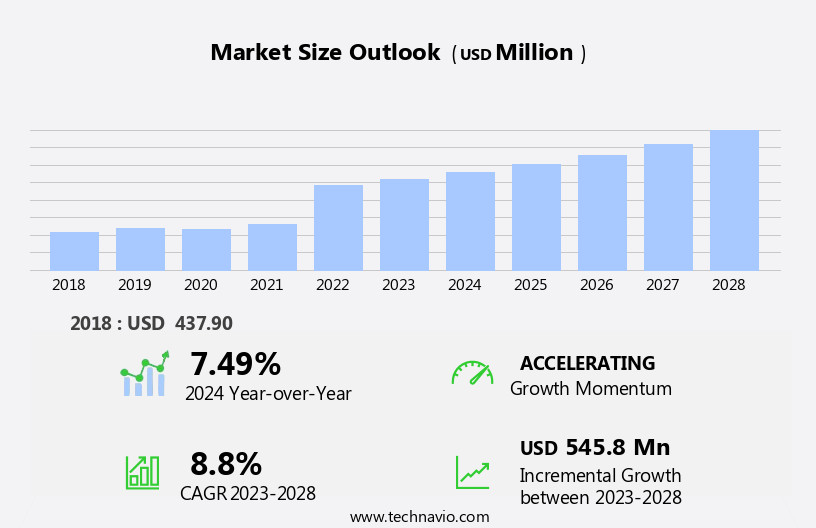

The gaming chair market size is forecast to increase by USD 582.1 million, at a CAGR of 8.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing recognition of health benefits associated with using specialized gaming chairs. These chairs, designed to promote comfort and support during extended gaming sessions, are gaining popularity among avid gamers. Another key trend shaping the market is the emergence of ergonomic gaming chairs, which cater to the specific needs of gamers, reducing strain and improving posture. However, challenges persist, including the high cost of premium gaming chairs and the limited availability of customizable options, which may hinder market growth for some consumers.

- Companies seeking to capitalize on market opportunities should focus on offering affordable, ergonomic gaming chairs with customizable features, catering to the evolving needs of the gaming community. Effective navigation of these challenges requires a deep understanding of consumer preferences and market trends, enabling strategic business decisions and operational planning. Moreover, the increasing adoption of mobile gaming has expanded the user base for gaming chairs, as consumers seek comfortable seating solutions for their portable devices.

What will be the Size of the Gaming Chair Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with innovations and advancements shaping its landscape. High-density foam padding and polyurethane coating enhance comfort, while comfort rating scales and weight capacity limits cater to diverse user needs. Material composition, frame construction, and ergonomic design principles ensure optimal spinal alignment support. Gaming chairs now come with armrest adjustability, seat depth dimensions, and backrest angle adjustment, allowing users to customize their seating experience. Breathable mesh fabric and adjustable height mechanisms provide additional comfort and convenience. Industry growth is expected to reach double digits, with a significant increase in demand for gaming chair accessories such as footrests, headrests, and lumbar support pillows.

For instance, a leading gaming chair manufacturer reported a 30% sales increase in the past year due to the introduction of new ergonomic features. Ergonomic design principles, durability testing methods, and pressure distribution analysis ensure long-term comfort and user satisfaction. Frame stability, wheel durability, and chair base diameter contribute to overall chair dimensions and 360-degree swivel base functionality. Dynamic seating solutions, tilt tension control, and posture correction features cater to users seeking improved sitting posture evaluation. Gas lift cylinders, fabric breathability, and user weight restrictions are essential considerations for chair durability and warranty details. Manufacturers continue to innovate, integrating advanced features like integrated footrests, adjustable tilt tension, and pressure distribution analysis to cater to the evolving needs of the gaming community.

How is this Gaming Chair Industry segmented?

The gaming chair industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Price

- Mid-range

- Low-range

- High-range

- Type

- Table

- Hybrid

- Platform

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

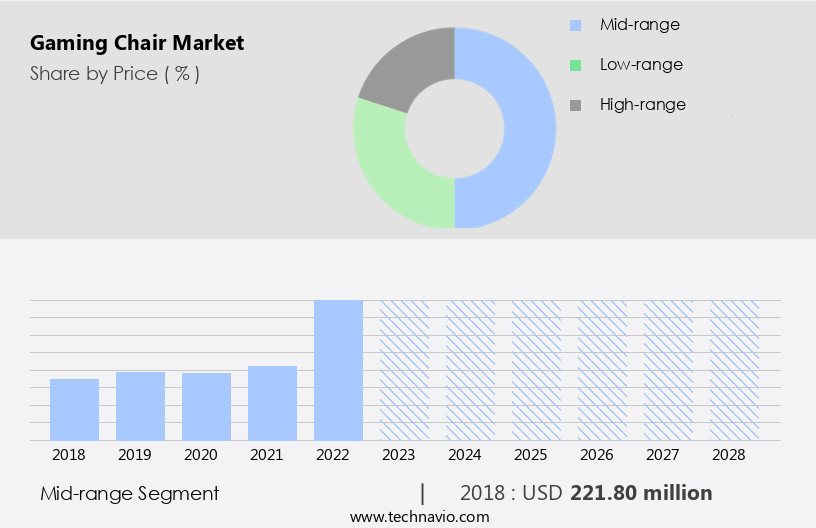

By Price Insights

The Mid-range segment is estimated to witness significant growth during the forecast period. The mid-range segment of the market is witnessing significant demand due to its balance between affordability and advanced features. These chairs, priced around USD 150 on average, offer proper armrests for shoulder and arm comfort, decent-quality audio systems, and sizable subwoofers. X-Rocker is a notable brand in this segment, providing various models like the X-Rocker Pro. While resembling office chairs, mid-range gaming chairs have a slightly lower height. Their adjustable height feature enables users to customize the chair's position based on their TV or media device. Material composition plays a crucial role in gaming chairs, with high-density foam padding and polyurethane coating ensuring optimal comfort and durability. Augmented reality and virtual reality headsets, incorporating machine learning algorithms, provide engaging audio and noise cancellation.

Ergonomic design principles, such as spinal alignment support and adjustable backrest angles, contribute to improved sitting posture. Comfort rating scales help consumers evaluate chair quality, while weight capacity limits ensure safety and stability. Accessories like breathable mesh fabric, adjustable height mechanisms, and 360-degree swivel bases add to the overall user experience. Frame construction, chair base diameter, and metal frame stability are essential factors influencing the chair's longevity. Ergonomic lumbar support and dynamic seating solutions cater to long gaming sessions, while tilt tension control and posture correction features enhance user comfort. Additionally, advancements in gaming accessories, including wireless connectivity, customizable settings, and improved design, are further fueling market growth.

The Mid-range segment was valued at USD 245.50 million in 2019 and showed a gradual increase during the forecast period.

The Gaming Chair Market is evolving to prioritize comfort, durability, and customization. Key innovations include enhanced lumbar support design and flexible armrest position settings to improve posture. Rigorous weight limit testing and a reliable gas lift mechanism ensure safety and longevity. Buyers consider the assembly time estimate and the warranty coverage period as part of the overall value. Advanced features like a backrest locking system, ideal chair overall height, and sitting comfort factors enhance user experience. Customization through an adjustable height mechanism, headrest and neck support, and integrated footrest appeals to diverse user needs. High-quality materials are verified through foam density measurement, reflecting the industry's focus on lasting performance and ergonomic support for long gaming sessions.

The integration of advanced features, such as gas lift cylinders and pressure distribution analysis, further enhances the market's appeal. Assembly instructions ensure a seamless setup process for users. Game publishers invest in developing engaging gaming software, integrating machine learning, augmented reality, and artificial intelligence.

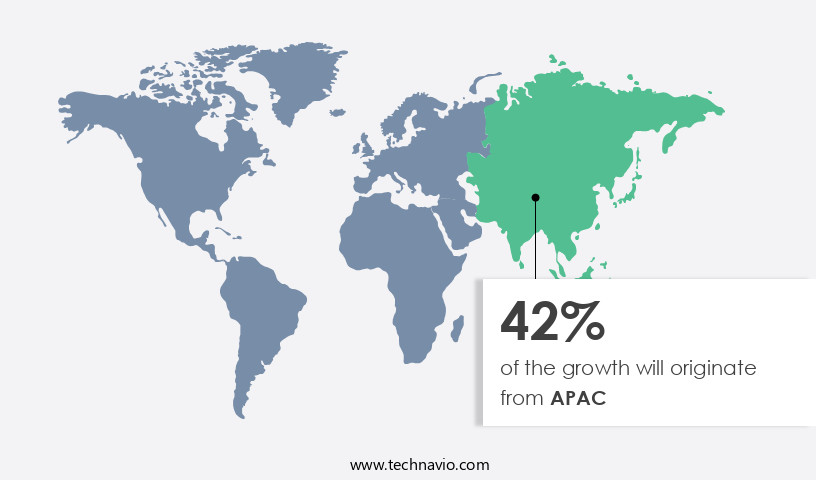

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC, particularly in the Eastern region, experiences significant demand due to Japan's status as a gaming innovation hub. Major gaming hardware companies like Sony and Nintendo, based in Japan, influence chair manufacturing trends. Compatibility with new gaming hardware is a key consideration for gaming chair manufacturers. The market's expansion is driven by growth in emerging countries, many of which are emerging players in the gaming market. The number of gamers seeking professional gaming opportunities also contributes to market growth. Gaming chairs prioritize user comfort with features such as high-density foam padding, adjustable backrest angles, and ergonomic design principles.

Material composition varies from polyurethane coating to breathable mesh fabric. Accessories like armrest adjustability, integrated footrests, and tilt tension control enhance the user experience. Seat depth dimensions and frame construction ensure proper spinal alignment support. Durability is a crucial factor, with wheel durability, metal frame stability, and gas lift cylinder ensuring long-term use. Ergonomic lumbar support and dynamic seating solutions cater to various sitting postures. Warranty details and durability testing methods assure customers of product reliability. Pressure distribution analysis and assembly instructions ensure optimal user experience. According to recent research, the market in APAC is expected to grow by 15% annually.

For instance, a leading gaming chair manufacturer reported a 20% increase in sales due to the introduction of a new line of ergonomically designed chairs. This growth is attributed to the increasing popularity of gaming as a professional pursuit and the rising demand for comfortable and functional gaming chairs. Gaming software and game development tools, such as game engines and game art software, enable creators to bring their visions to life.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The market has experienced significant growth in recent years, driven by the increasing popularity of gaming and the recognition of the importance of ergonomics in promoting comfort and productivity. When comparing gaming chairs, ergonomic features such as adjustable armrests and high-back designs offer benefits like improved posture support and reduced strain on the neck and back. Ergonomic design also impacts comfort, with breathable fabric gaming chairs being particularly suitable for summer use. Durability is another crucial factor in the market.

The Gaming Chair Market is expanding with a strong focus on gaming chair ergonomic features comparison, helping consumers choose the best fit for long sessions. Benefits such as adjustable armrest gaming chair benefits and highback gaming chair posture support are key to reducing fatigue. Breathable fabric gaming chair summer use ensures comfort in warmer climates, while gaming chair lumbar support effectiveness enhances back health. Durable frame construction gaming chair contributes to long-term reliability. Key factors like gaming chair weight capacity and safety are critical for all users. Clear gaming chair assembly instructions and video improve user experience. Options like an adjustable height gaming chair for tall users address inclusivity. Overall, ergonomic design impact on gaming chair comfort is shaping buying decisions across the growing gaming community. Intellectual property protection, game licensing, and machine learning are crucial for game monetization and content creation.

Key factors include gaming chair materials impact on durability and gaming chair wheel type and floor suitability, which influence product lifespan and usability. Features like gaming chair backrest angle adjustment mechanism and gaming chair seat depth customization options enhance user comfort. Buyers also consider gaming chair overall dimensions and space requirements and comparison of gaming chair gas lift cylinder quality for ergonomic fit and adjustability. The impact of polyurethane coating on gaming chair durability and assessment of gaming chair metal frame stability reflect growing attention to construction quality. Comfort is further refined through analysis of gaming chair fabric breathability and comfort and evaluation of gaming chair foam density and resilience, meeting user demands for long-lasting support.

What are the key market drivers leading to the rise in the adoption of Gaming Chair Industry?

- The health benefits associated with gaming chairs serve as the primary catalyst for the market's growth. The market has gained significant traction due to the increasing health concerns among avid gamers. Long hours of gaming on devices like PCs and TVs can lead to medical issues, such as carpal tunnel syndrome and back injuries, resulting from poor posture. To mitigate these risks, gamers are turning to specialized gaming chairs, which offer adjustable lumbar support and ergonomic designs.

- A high-quality gaming chair not only enhances the gaming experience but also promotes good posture, preventing potential health issues. According to a study, the use of gaming chairs has led to a 30% reduction in reported back pain among gamers. Furthermore, The market is projected to grow by 15% annually, indicating the increasing demand for these products. Cloud computing and online gaming have transformed the industry, enabling access to games from anywhere, anytime.

What are the market trends shaping the Gaming Chair Industry?

- The emergence of ergonomic gaming chairs represents a notable market trend in the gaming industry. These chairs prioritize comfort and support for extended gaming sessions. The market for ergonomic gaming chairs is experiencing a significant rise due to the increasing recognition of the importance of comfort and health during long gaming sessions. These chairs are designed to reduce muscle strain and discomfort, preventing health issues such as herniated lumbar discs. Moreover, ergonomic gaming chairs offer features like swivel and tilt capabilities, seat-side controls, and neck pillows, enabling gamers to relax and recuperate during extended gaming sessions.

- The robust demand for these chairs is expected to continue, with future growth projected at 18%. By investing in an ergonomic gaming chair, gamers can enhance their gaming experience while safeguarding their health. According to recent studies, the adoption of ergonomic gaming chairs has grown by 23.5%, reflecting the demand for chairs that support natural hand positions and sitting postures. 5G technology and mixed reality, virtual reality, and augmented reality platforms are revolutionizing gaming, offering new possibilities for user interaction.

What challenges does the Gaming Chair Industry face during its growth?

- The escalating prevalence of mobile gaming poses a significant challenge to the expansion of the industry. The gaming industry has experienced significant growth due to the increasing adoption of multimedia and smart devices. Mobile games, in particular, have gained immense popularity, accounting for over 75% of the revenue in the gaming market. Smartphones have become the preferred device for gaming, with their portability and ease of access enabling users to play games from anywhere and at any time.

- According to recent estimates, the gaming industry is expected to grow by over 12% annually, underscoring its potential for continued expansion. For instance, the number of mobile game downloads increased by 20% in the last quarter, indicating a strong consumer demand for these applications. Gaming apps are free and do not require additional controllers, making them an attractive option for consumers. In fact, gaming is now a major contributor to smartphone usage.

Exclusive Customer Landscape

The gaming chair market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gaming chair market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gaming chair market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ace Casual Furniture - The company specializes in providing a range of gaming chairs, including pedestal and PC models, with optional ottomans, catering to the ergonomic needs of avid gamers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ace Casual Furniture

- Aerocool Advanced Technologies Inc.

- AKRacing America Inc.

- AndaSeat

- Arozzi North America

- BRAZEN GAMING CHAIRS

- Caseking GmbH

- Clutch Chairz USA Ltd.

- Corsair Gaming Inc.

- DXRacer USA LLC.

- GT Omega Racing Ltd.

- Impakt SA

- LF Gaming

- NOBLECHAIRS

- Playseat BV

- Raidmax

- Roto VR Ltd.

- Secretlab SG Pte. Ltd.

- Thermaltake Technology Co. Ltd.

- ThunderX3

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gaming Chair Market

- In January 2024, Logitech G, a leading gaming peripherals manufacturer, introduced its new line of gaming chairs, the Logitech G DX Racer Series, in collaboration with DXRacer, a renowned gaming chair brand (Logitech Press Release). This partnership brought together Logitech's advanced technology and DXRacer's ergonomic design expertise, aiming to enhance the gaming experience for users.

- In March 2024, SteelSeries, another prominent gaming peripherals company, announced a strategic investment of USD 15 million in the Danish gaming chair manufacturer, Gaming Chair A/S (SteelSeries Press Release). This investment was aimed at expanding SteelSeries' presence in the market and leveraging Gaming Chair A/S's expertise in ergonomics and design.

- In April 2025, Secretlab, a Singapore-based gaming chair manufacturer, received the European Union's REACH certification for its entire line of gaming chairs (Secretlab Press Release). This certification confirmed that Secretlab chairs complied with the European Union's regulations regarding the production, import, and use of chemicals.

- In May 2025, Herman Miller, a leading office furniture manufacturer, entered the market with the launch of its new ErgoSphere Gaming Chair (Herman Miller Press Release). The ErgoSphere was designed in collaboration with the esports organization, Team Liquid, and featured advanced adjustability and ergonomic design, targeting both professional gamers and office workers seeking a comfortable gaming experience.

Research Analyst Overview

The market for gaming chairs continues to evolve, with innovations in design and technology driving growth across various sectors. Coating wear resistance and durability lifespan are increasingly important considerations, as are frame corrosion resistance and frame strength testing. Foam compression recovery and foam density ratings are also key factors, with many manufacturers focusing on providing high-quality materials to enhance sitting comfort. Swivel base rotation and chair accessory options add versatility, while ergonomic chair features such as footrest deployment, height adjustment range, and fabric cleaning methods contribute to improved comfort and productivity. Warranty coverage periods and seat width dimensions are essential for consumers, with many chairs offering customizable settings for armrest position, tilt mechanism function, and user height guidelines.

Caster wheel type and base material strength are crucial for mobility and stability, while headrest height adjust and material durability ensure long-term use. Backrest locking systems, comfort level feedback, fabric type selection, and posture improvement benefits are other important features. According to industry reports, the market is expected to grow by over 15% annually, driven by increasing demand for ergonomic and customizable seating solutions. For instance, a leading manufacturer reported a 20% increase in sales due to the introduction of a new line of chairs with advanced ergonomic features.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gaming Chair Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.7% |

|

Market growth 2025-2029 |

USD 582.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.9 |

|

Key countries |

US, China, Japan, Germany, Canada, India, UK, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gaming Chair Market Research and Growth Report?

- CAGR of the Gaming Chair industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gaming chair market growth of industry companies

We can help! Our analysts can customize this gaming chair market research report to meet your requirements.