South America Chocolate Market Size and Trends

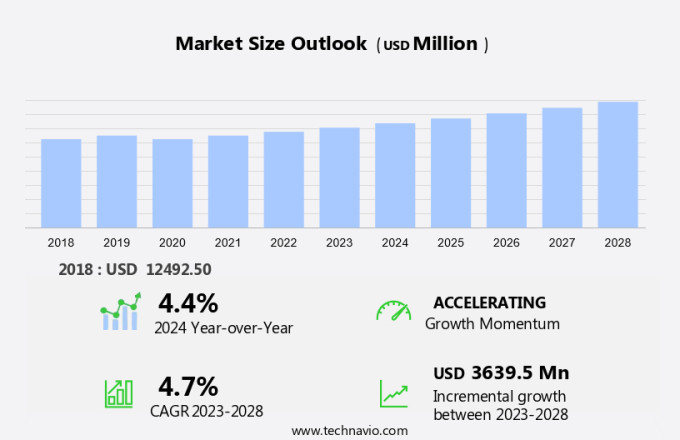

The South America chocolate market size is forecast to increase by USD 3.64 billion at a CAGR of 4.7% between 2023 and 2028. The market is experiencing significant growth, driven by rising consumer awareness of the health benefits associated with chocolate. Impulse purchasing behavior continues to fuel demand, as consumers seek indulgent treats. However, health concerns related to diabetes and obesity are prompting a shift towards healthier chocolate options. Third-party logistics (3PL) providers are essential in ensuring efficient last-mile delivery, especially in a multi-modal system that includes road, rail, and air transport. Bean-to-bar concept, where chocolate is produced from roasting and grinding the cocoa beans to making the final product, is another trend gaining traction. Trade agreements play a crucial role in shaping the competitive landscape, particularly in key producing countries. Organic chocolates, made without the use of synthetic fertilizers, pesticides, or genetically modified organisms, are increasingly preferred by health-conscious consumers. Artisanal chocolates, known for their unique flavors and healthier ingredients, are gaining popularity due to their cortisol-reducing properties. The pandemic has further fueled demand for chocolate as a comfort food, making it a resilient market despite economic uncertainties.

The market is a significant sector within the global food industry, showcasing consistent growth and innovation. This market caters to a diverse consumer base, offering a range of chocolate products to suit various dietary preferences and health concerns. High-quality chocolate continues to be a preferred choice among consumers, with an increasing focus on the origin and processing methods of cocoa beans. Single-origin chocolate, which is made from cocoa beans sourced from a specific region, has gained popularity due to its unique flavor profile. Organic, vegan, gluten-free, sugar-free, and lactose-free chocolates cater to specific consumer needs. Vegan chocolates, free from animal products, are gaining popularity among those following a plant-based diet. The mental health benefits of chocolate are a growing area of interest. Chocolate contains certain compounds, such as serotonin and endorphins, which are known to improve mood and reduce stress. Single-origin cocoa, which is rich in these compounds, is particularly beneficial. However, it is essential to note that excessive consumption of chocolate, especially milk and white chocolate, can lead to health issues such as cholesterol concerns. Cocoa supply plays a crucial role in the market. Fair-trade chocolate, which ensures farmers are paid a fair price for their produce, is gaining traction among socially-conscious consumers. Handmade chocolates, artisan chocolates, and gourmet chocolates offer an affordable luxury experience to consumers, with unique flavors and textures. Chocolate products come in various forms, including bars, truffles, and liquid chocolate.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Product

- Dark chocolate

- Milk and white chocolate

- Geography

- South America

- Brazil

- Chile

- South America

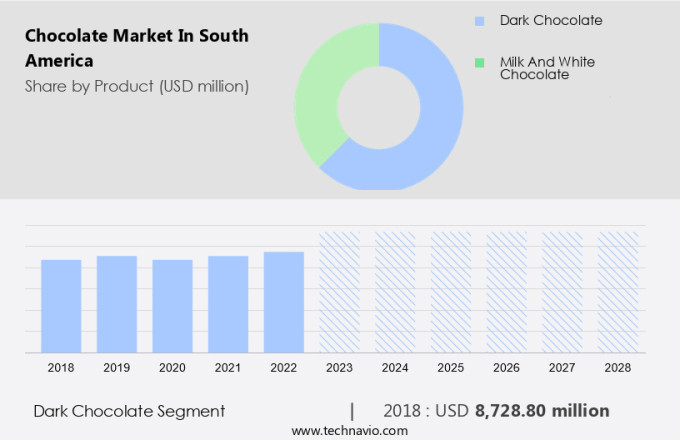

By Product Insights

The dark chocolate segment is estimated to witness significant growth during the forecast period. Dark chocolate, renowned for its rich antioxidant properties, has gained popularity among health-conscious consumers due to its numerous health benefits. These benefits include mood enhancement, heart disease prevention, and cognitive function improvement.

Get a glance at the market share of various segments Download the PDF Sample

The dark chocolate segment was the largest segment and was valued at USD 8.73 billion in 2018. Dark chocolate's ability to combat oxidative stress and reduce heart disease risk, as well as its potential to lower cholesterol levels, further enhances its appeal. With an increasing focus on premiumization and wellness, the demand for dark chocolate continues to grow steadfastly. Hence, such factors are fuelling the growth of this segment during the forecast period.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

South America Chocolate Market Driver

Rising awareness regarding health benefits offered by chocolate is notably driving market growth. In South America, the market is experiencing growth due to the increasing recognition of chocolate's health benefits. Consumers are becoming more conscious of their health and are turning to high-quality chocolate options, such as dark chocolate, for potential health advantages.

Dark chocolate is known to contain antioxidants, which may aid in lowering cholesterol levels, reducing blood pressure, and minimizing the risk of heart disease and stroke. These potential health benefits have led consumers to view chocolate as a healthier alternative to processed snacks, rather than just a treat. Furthermore, the belief that chocolate can help alleviate stress and contribute to anti-aging effects has added to its allure. Thus, such factors are driving the growth of the market during the forecast period.

South America Chocolate Market Trends

Impulse purchasing behavior of consumers is the key trend in the market. Chocolate sales experience a significant increase due to unplanned purchases by consumers. Impulse buying refers to the sudden decision to acquire a product or service without prior planning. While shopping for essentials, individuals typically do not intend to buy chocolate or other confectioneries.

However, strategically placed displays at retail outlets can capture consumers' attention, leading to impulse purchases. Factors such as rising disposable income and evolving lifestyles contribute to this trend. Chocolate, a treat for both children and adults, is often associated with rewards and happiness, making it an irresistible temptation. In the context of third-party logistics (3PL), last-mile delivery plays a crucial role in ensuring timely and efficient delivery of chocolate products to consumers. Thus, such trends will shape the growth of the market during the forecast period.

South America Chocolate Market Challenge

Growing health concerns about diabetes and obesity is the major challenge that affects the growth of the market. The market has experienced a deceleration in growth due to increasing health awareness among consumers. Concerns regarding the potential health risks associated with chocolate consumption have led some individuals to limit their intake. Dark chocolate, a premium and specialty chocolate variety, has gained popularity due to its potential health benefits, such as the release of endorphins and improvement in blood circulation.

However, the high sugar content in most chocolate products poses risks to dental health and insulin resistance, leading to conditions like tooth decay and type 2 diabetes. As e-commerce continues to dominate the retail landscape, online chocolate sales have become increasingly common. Logistics markets play a crucial role in ensuring the timely delivery of these products to consumers. Despite these challenges, the market continues to evolve, with innovations in chocolate production and distribution driving growth. Hence, the above factors will impede the growth of the market during the forecast period

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Arcor Group: The company offers chocolate product brands such as aguila, cofler, and rumba.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Barry Callebaut AG

- Blommer Chocolate Co.

- Cacau Show

- Cargill Inc.

- Chocoladefabriken Lindt and Sprungli AG

- Colombina

- Corporativo Bimbo SA de CV

- Dori Alimentos SA

- Empresas Carozzi S.A.

- Ferrero International S.A.

- Grupo Nutresa

- Mars Inc.

- Mondelez International Inc.

- Nestle SA

- Puratos

- The Hershey Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

The market is witnessing significant growth due to the increasing demand for high-quality chocolate variants. Consumers are increasingly preferring vegan, organic, gluten-free, sugar-free, and lactose-free chocolate options, driving market growth. The bean-to-bar concept and single-origin chocolate are gaining popularity due to their unique flavors and health benefits. Chocolate is known to have mental health benefits, as it contains serotonin and endorphins that help improve mood and reduce stress. Dark chocolate, in particular, is known to improve blood circulation and has been linked to heart disease prevention. Premium and specialty chocolates are gaining traction in the market, with consumers willing to pay a premium for high-quality products.

The online retail and e-commerce sectors are driving the growth of the market, with third-party logistics (3PL) providers ensuring last-mile delivery through a multi-modal system. Trade agreements and fair-trade certifications are also influencing the market, ensuring ethical sourcing and sustainable production. Artisanal chocolates are gaining popularity due to their unique flavors and health benefits. Health awareness and the desire for mood enhancement and heart disease prevention are driving the demand for chocolate products and chocolate-flavored products. Antioxidants in chocolate help reduce oxidative stress and improve overall health. The market for cocoa powder, chocolate bars, liquid chocolate, truffles, and conventional chocolate is also growing steadily.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2024-2028 |

USD 3.64 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.4 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Arcor Group, Barry Callebaut AG, Blommer Chocolate Co., Cacau Show, Cargill Inc., Chocoladefabriken Lindt and Sprungli AG, Colombina, Corporativo Bimbo SA de CV, Dori Alimentos SA, Empresas Carozzi S.A., Ferrero International S.A., Grupo Nutresa, Mars Inc., Mondelez International Inc., Nestle SA, Puratos, and The Hershey Co. |

|

Market dynamics |

Parent market analysis, market report , market forecast , Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch