Dark Chocolate Market Size 2025-2029

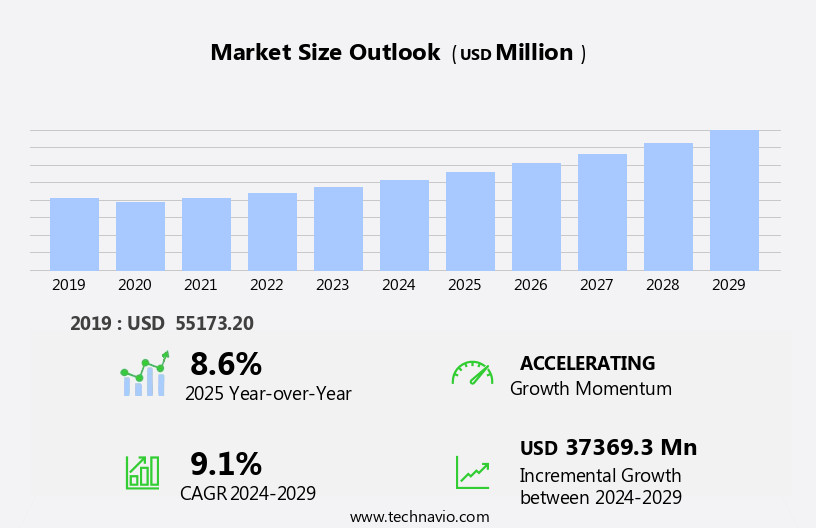

The dark chocolate market size is forecast to increase by USD 37.37 billion, at a CAGR of 9.1% between 2024 and 2029.

- The market is driven by the growing health consciousness among consumers, fueling the demand for dark chocolate due to its numerous health benefits. Dark chocolate, rich in antioxidants and minerals, is increasingly preferred over milk chocolate. Furthermore, the trend towards gourmet, artisanal, vegan, and gluten-free dark chocolate is gaining momentum, expanding the market's reach and appeal. However, the market faces challenges due to the volatility in raw material prices, primarily cocoa beans.

- Producers and manufacturers must navigate this price instability to maintain profitability and competitiveness. To capitalize on the market's growth potential, companies should focus on innovation, catering to diverse consumer preferences, and implementing effective supply chain strategies to mitigate the impact of raw material price fluctuations.

What will be the Size of the Dark Chocolate Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The dynamic nature of the market continues to unfold, driven by evolving consumer preferences and technological advancements. Health benefits associated with dark chocolate, derived from its high cocoa percentage and antioxidant properties, fuel demand across various sectors. Ingredient sourcing, from luxury chocolate to mass market varieties, influences production efficiency and sensory experience. Cocoa beans, the foundation of chocolate production, undergo rigorous quality control measures to ensure consistency and purity. Chocolate liquor, a key ingredient in chocolate bars and confections, is subject to process optimization for improved efficiency and cost savings. Consumer preferences for artisan chocolate, single origin, and fair trade options have led to product innovation and direct sales channels.

Cocoa powder, a versatile ingredient, finds applications in baking and beverages, including ice cream and chocolate cakes. Brand loyalty, driven by unique flavor profiles and sustainability practices, shapes pricing strategies for both luxury and mass market chocolate. Milk solids, cocoa mass, and cocoa butter are essential components in chocolate production, requiring ongoing process optimization to meet consumer demands and dietary restrictions. The continuous unfolding of market activities in the dark chocolate industry underscores the importance of ingredient sourcing, production efficiency, and consumer preferences. The sensory experience, from the first bite of a chocolate bar to the final luscious morsel of a chocolate truffle, remains a key differentiator for brands and manufacturers.

How is this Dark Chocolate Industry segmented?

The dark chocolate industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Conventional

- Organic

- Distribution Channel

- Supermarkets

- Online Retail

- Specialty Stores

- Product Type

- Bars

- Truffles

- Chips and Chunks

- Others

- Geography

- North America

- US

- Canada

- Europe

- Belgium

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

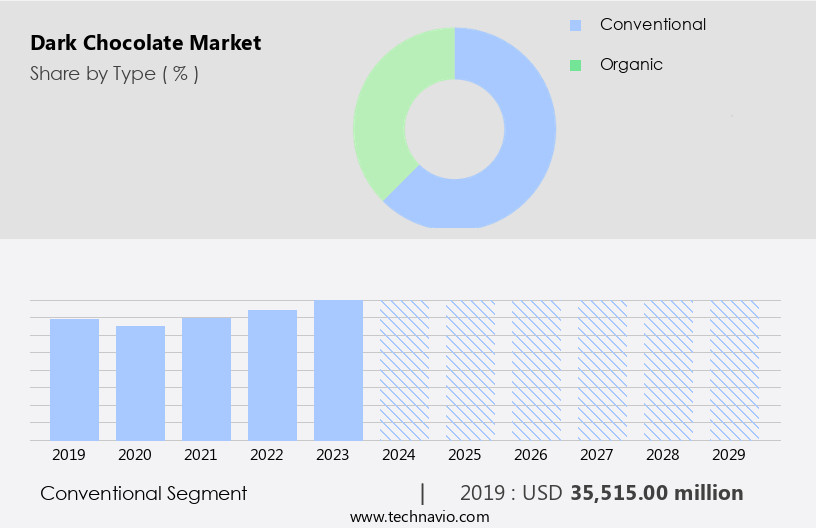

The conventional segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, various formats cater to diverse consumer tastes and preferences. Dark chocolate bars, available in varying cocoa percentages, are popular choices, offering a rich, smooth texture and intense cocoa flavor. These bars, ranging from semi-sweet to bittersweet, are favored by chocolate connoisseurs. Additionally, dark chocolate blocks are widely used in baking and confectionery applications due to their versatility. Dark chocolate pieces or chunks, convenient for snacking and recipe incorporation, are also prevalent. Furthermore, the market presents an array of flavored dark chocolate products, infused with fruits, nuts, spices, and herbs, to add complexity and depth to taste profiles.

Dark chocolate is not only consumed as standalone bars but also used in the production of chocolate liquor, chocolate chips, chocolate cakes, chocolate mousses, chocolate truffles, ice cream, and other confectionery items. Wholesale distribution and retail channels ensure easy accessibility to consumers, while quality control measures maintain consistency in product offerings. Brand loyalty is a significant factor, with artisan chocolate and fair trade options appealing to consumers seeking ethically sourced, high-quality ingredients. Production efficiency, ingredient sourcing, and process optimization are crucial aspects of the market, ensuring the delivery of premium dark chocolate products. Dietary restrictions, such as gluten-free, vegan, and sugar-free, are also considered, expanding the market's reach.

The Conventional segment was valued at USD 35.52 billion in 2019 and showed a gradual increase during the forecast period.

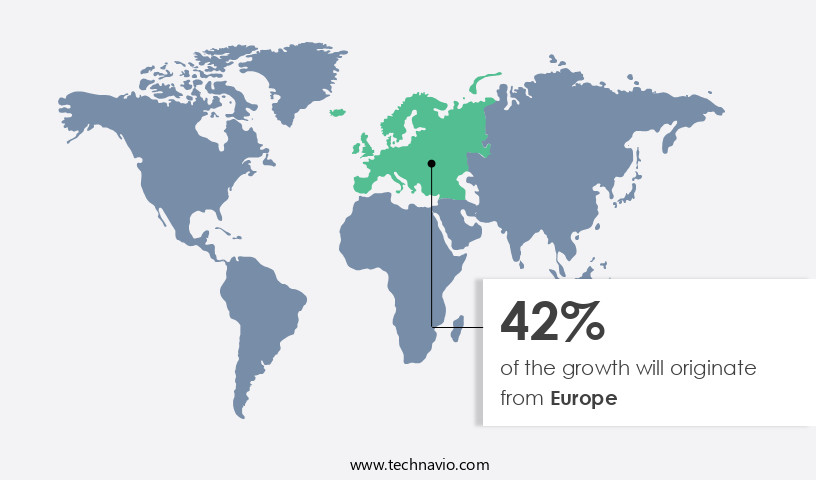

Regional Analysis

Europe is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the European market of 2024, dark chocolate continues to thrive, fueled by consumer interest in health benefits and innovative products. Dark chocolate, known for its antioxidants and potential heart health advantages, is increasingly preferred over milk chocolate. Manufacturers respond with offerings of low-calorie, sugar-free, and functional dark chocolates. Organic and naturally sourced ingredients are also in demand. Traditional retail channels, such as supermarkets and hypermarkets, dominate sales, but online retail is expanding due to customer convenience. Premiumization trends shape consumer preferences, with high-quality, single-origin, and artisanal chocolates gaining popularity. However, market growth faces challenges, including rising raw material costs due to Brexit and concerns over obesity and dietary restrictions.

Wholesale distribution and quality control remain essential, while production efficiency and process optimization are key to maintaining profitability. Cocoa beans, chocolate liquor, chocolate bonbons, chocolate chips, brand loyalty, chocolate bars, chocolate cakes, chocolate mousses, chocolate truffles, and various chocolate applications, including ice cream and chocolate cakes, continue to drive market dynamics. Ingredient sourcing, fair trade, health benefits, and sensory experience remain crucial factors in consumer decision-making

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global dark chocolate market by 2029, driven by dark chocolate market trends 2025-2029. B2B dark chocolate supply solutions leverage sustainable cocoa sourcing technologies for quality. Dark chocolate market growth opportunities 2025 include health-focused dark chocolate and dark chocolate for gifting, meeting consumer preferences. Chocolate supply chain software optimizes operations, while dark chocolate market competitive analysis showcases brands like Lindt. Sustainable dark chocolate practices align with eco-friendly chocolate trends. Dark chocolate regulations 2025-2029 shapes dark chocolate demand in Europe 2025. Organic dark chocolate offerings and premium dark chocolate insights boost appeal. Dark chocolate for baking and customized dark chocolate flavors target niches. Dark chocolate market challenges and solutions address sourcing, with direct procurement strategies for chocolate and dark chocolate pricing optimization enhancing profitability. Data-driven chocolate market analytics and vegan dark chocolate trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Dark Chocolate Industry?

- The market's growth is primarily driven by the acknowledged health benefits associated with consuming dark chocolate.

- Dark chocolate has gained significant popularity in the market due to its numerous health benefits. According to numerous studies, the antioxidant content in dark chocolate, including flavonoids and cocoa polyphenols, helps protect against disease-causing free radicals. These compounds have been linked to preventing cancer, improving heart health, and enhancing cognitive ability. Dark chocolate is also a decent source of soluble fiber and minerals, making it a powerful source of antioxidants for those following dietary restrictions. The high antioxidant capacity of dark chocolate is even greater than many superfoods. Quality control is crucial in the wholesale distribution of dark chocolate to maintain its health benefits.

- Factors such as fat bloom and sugar bloom can impact the chocolate's texture and taste, affecting its market appeal. Therefore, proper handling and storage techniques are essential to preserve the chocolate's quality. Despite these challenges, the demand for mass-market chocolate continues to grow, making it a dynamic and evolving market.

What are the market trends shaping the Dark Chocolate Industry?

- The consumption of gourmet, artisanal, vegan, and gluten-free dark chocolate is gaining popularity as the latest market trend. This segment of the chocolate industry is experiencing significant growth due to increasing consumer demand for healthier and ethically-sourced chocolate options.

- The market experiences continuous growth in 2024, fueled by the increasing preference for premium, health-conscious, and ethically sourced products. Consumers are increasingly drawn to dark chocolate due to its rich antioxidant content, which supports heart health and cognitive function. A growing number of health-conscious individuals are opting for dark chocolate with higher cacao percentages, as these varieties contain more health benefits. Moreover, the rise of veganism and plant-based diets has led to the popularity of vegan dark chocolates. Brands are responding to this trend by introducing ethically sourced, non-GMO, and dairy-free dark chocolate options. Similarly, the demand for gluten-free dark chocolate is on the rise, particularly in markets where awareness of celiac disease and digestive health concerns is increasing.

- Product innovation is a key driver in the market, with brands focusing on creating clean-label and organic products. Cocoa butter and milk solids are being replaced with healthier alternatives, such as coconut oil and almond milk. Additionally, fair trade practices and sustainable sourcing are becoming increasingly important to consumers, leading to a growing demand for dark chocolate produced using ethical and environmentally friendly methods.

What challenges does the Dark Chocolate Industry face during its growth?

- The volatility in raw material prices poses a significant challenge to the industry's growth trajectory. In order to maintain competitiveness and profitability, companies must closely monitor and adapt to fluctuations in the cost of essential inputs.

- Dark chocolate, renowned for its health benefits, is a popular indulgence worldwide. The production of this delicacy involves various ingredients, with cocoa being the primary component. Other elements, such as sugar, dairy products, nuts, and maize sweeteners, are also utilized. The prices for these raw materials are influenced by the commodity market, which is driven by demand and supply dynamics. The cost of cocoa, in particular, significantly impacts the market due to its role as a key ingredient in producing both cocoa powder and cocoa butter. Cocoa butter, which is highly desirable due to its ability to provide richness to the final product, is used extensively in the production of thin chocolate confectionery.

- To optimize production efficiency, chocolate manufacturers focus on process improvements and sensory experiences. They strive to create immersive and harmonious chocolate bars, mousses, and other chocolate products that cater to evolving consumer preferences. By prioritizing ingredient sourcing, process optimization, and maintaining high-quality standards, these companies aim to deliver delightful chocolate experiences while ensuring a sustainable and efficient production process.

Exclusive Customer Landscape

The dark chocolate market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dark chocolate market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, dark chocolate market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Barry Callebaut AG - The company showcases a diverse range of premium dark chocolate offerings, including Lindt Excellence Madagascar Cacao, Ecuador Cacao, Dark Cocoa Pure, Dark Lime Intense, and Les Grande Dark Hazelnut bars. Each selection boasts unique flavor profiles, elevating consumers' chocolate experiences.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Barry Callebaut AG

- Chocoladefabriken Lindt and Sprungli AG

- Delfi Ltd.

- Ferrero International S.A.

- Fuji Oil Holdings Inc.

- Ghirardelli Chocolate Co.

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Mars Inc.

- Meiji Holdings Co. Ltd.

- Mondelez International Inc.

- Nestle SA

- Neuhaus NV

- RITTER SPORT

- ROSHEN Corp.

- SCHMITTEN

- T Con Food Products

- The CAMPCO Ltd.

- The Hershey Co.

- Vosges Haut Chocolat Ltd.

- Yildiz Holding AS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Dark Chocolate Market

- In January 2024, Nestlé, the world's largest food and beverage company, announced the launch of a new line of premium dark chocolate products under its iconic brand, KitKat. The new line, named "KitKat Dark," was introduced to cater to the growing demand for dark chocolate and healthier snacking options (Nestlé Press Release, 2024).

- In March 2024, Ferrero, the Italian confectionery company, entered into a strategic partnership with Cargill, a leading agricultural supply chain and food ingredients company. The collaboration aimed to develop and produce sustainable cocoa beans for Ferrero's dark chocolate products, ensuring a more ethical and sustainable supply chain (Ferrero Press Release, 2024).

- In May 2024, Hershey's, the American chocolate giant, completed the acquisition of Brookside Foods, a leading producer of premium dark chocolate with fruits and nuts. The acquisition strengthened Hershey's presence in the premium chocolate market and expanded its product portfolio (Hershey's Press Release, 2024).

- In April 2025, the European Union approved a new regulation that mandated a minimum cocoa content of 30% in all dark chocolate products sold within the EU. The regulation aimed to improve the quality and authenticity of dark chocolate products, benefiting both consumers and manufacturers (European Commission Press Release, 2025).

Research Analyst Overview

- In the dynamic the market, consumer behavior significantly influences pricing dynamics. As health-conscious consumers prioritize ethical sourcing and sustainability, brands position themselves differently through various packaging materials and distribution networks. Carbon footprint reduction is a key trend, with innovation pipeline focusing on waste reduction and water usage. Regulatory compliance and food safety standards are essential for product development, while cocoa nibs offer unique product differentiation. Brand positioning in the market is shaped by sustainability initiatives and supply chain transparency. Chocolate coatings and decoration cater to various industries, driving growth potential. Energy consumption remains a concern, leading to ongoing efforts to improve manufacturing processes.

- Product development is driven by health and wellness trends, with an increasing focus on dark chocolate's antioxidant properties. Regulatory bodies play a crucial role in ensuring ethical sourcing and compliance with food safety standards. Marketing strategies emphasize product differentiation and innovation, as sales forecasts remain positive for this growing sector. Couverture chocolate continues to dominate the market, offering versatility for various applications. Overall, the market is poised for continued growth, driven by consumer preferences, innovation, and sustainability initiatives.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Dark Chocolate Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.1% |

|

Market growth 2025-2029 |

USD 37369.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.6 |

|

Key countries |

US, Germany, China, UK, Belgium, France, Canada, Italy, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dark Chocolate Market Research and Growth Report?

- CAGR of the Dark Chocolate industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dark chocolate market growth of industry companies

We can help! Our analysts can customize this dark chocolate market research report to meet your requirements.