Coated Abrasives Market Size 2025-2029

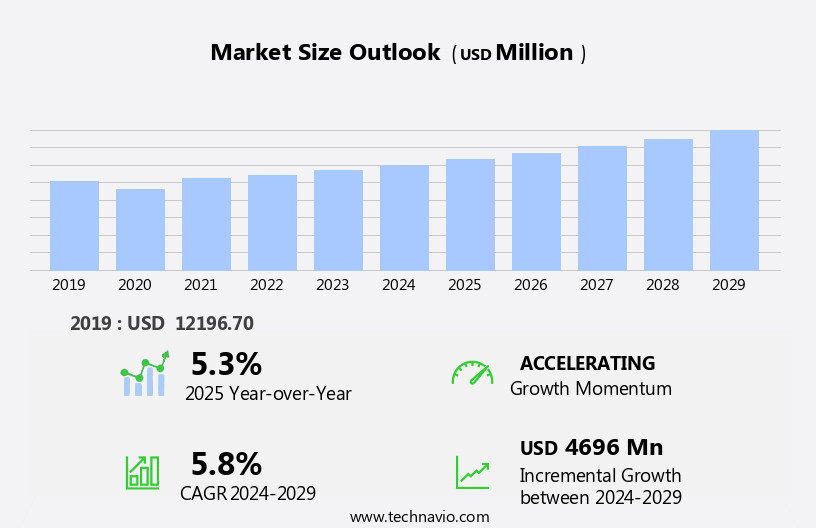

The coated abrasives market size is forecast to increase by USD 4.7 billion at a CAGR of 5.8% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for pressure-sensitive adhesive (PSA)-backed coated abrasives. This product type is gaining popularity due to its ease of use and versatility, making it a preferred choice for various applications in industries such as automotive, construction, and electronics. Another key trend influencing market growth is the emergence of China as a major consumer and producer. With its large population and rapidly developing industries, China's demand for coated abrasives is expected to continue growing. However, the market is not without challenges. Improper or inadequate storage of coated abrasives can lead to technical issues, such as product degradation and decreased performance.

- As such, companies must prioritize effective storage solutions to ensure product quality and customer satisfaction. To capitalize on the growing demand and navigate the challenges, market participants must focus on innovation and operational efficiency. Developing new, high-performance coated abrasive products and implementing storage solutions will help companies differentiate themselves and maintain a competitive edge. Additionally, expanding into emerging markets, such as China, can provide significant growth opportunities. By addressing these trends and challenges, companies can effectively capitalize on the market's strategic landscape and position themselves for long-term success.

What will be the Size of the Coated Abrasives Market during the forecast period?

- The market encompasses a wide range of products utilized in various surface finishing applications. These abrasives are characterized by their coated surfaces, which enhance their performance and versatility in material removal and polishing techniques. The market's sizeable growth is driven by the increasing demand for high-performance abrasives in industries such as automotive, construction, and aerospace. Key trends in the market include the development of advanced abrasives, such as nanotechnology-based abrasives, for improved efficiency and durability. Additionally, the market is witnessing the growing popularity of composite abrasives, which offer superior material removal rates and increased wear resistance. The manufacturing process of coated abrasives involves the application of a bonding agent to a base material, followed by the coating of abrasive particles.

- In the consumer sector, applications include fiberglass and composite material manufacturing, as well as the production of electronic component units for mobile phones and other devices. Quality control measures, such as grit size and density specifications, are crucial to ensure consistent product performance. Coated abrasives come in various forms, including sheets, belts, discs, and powders, catering to diverse applications and equipment, such as sanding machines, grinding machines, and deburring machines. The market also offers a range of accessories and slurries for specialized applications. Effective disposal and recycling of coated abrasives are essential considerations for environmental sustainability and cost efficiency. Market dynamics are influenced by factors such as technological advancements, cost-effectiveness, and the growing trend towards customization and personalization in industries like automobile repair and furniture production.

How is this Coated Abrasives Industry segmented?

The coated abrasives industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Grain Type

- Aluminum oxide

- Ceramic

- Silicon carbide

- Alumina zirconia

- Others

- Backing Material

- Fiber

- Paper

- Cloth

- Polyester

- Others

- Application

- Transportation

- Machinery

- Metal fabrication

- Consumer goods

- Others

- Product Type

- Belts

- Discs

- Rolls

- Sheets

- Others

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- North America

- US

- Canada

- South America

- Brazil

- Middle East and Africa

- APAC

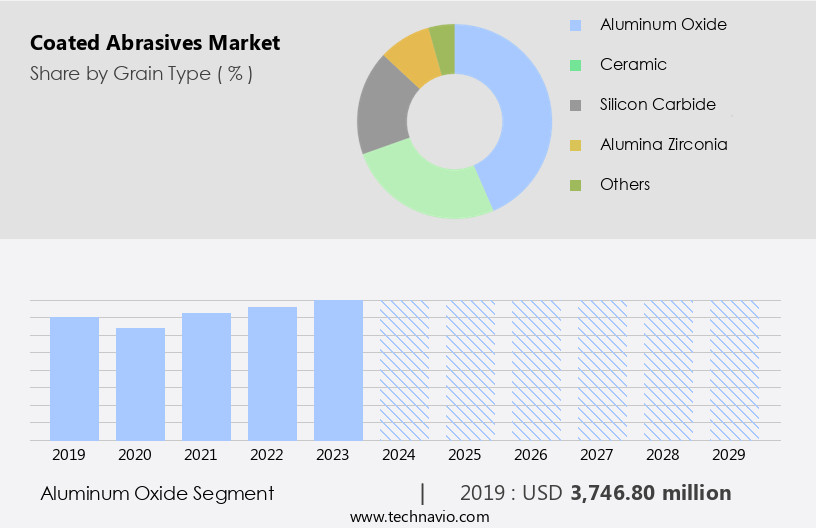

By Grain Type Insights

The aluminum oxide segment is estimated to witness significant growth during the forecast period. Coated abrasives, specifically those made with aluminum oxide grains, are essential in various industries for material removal and surface finishing applications. Aluminum oxide is a synthetic grain manufactured from bauxite through the fusing process. Its high toughness and durability make aluminum oxide-based coated abrasives popular choices for grinding, machine blasting, cutting operations, and refractory material production. However, the lack of a crystal structure in brown aluminum oxide, the most commonly used type, results in wear and the formation of rounded structures, reducing their cutting ability. To address this challenge, abrasive innovation and optimization have been key focus areas. Advanced abrasive technology, such as vitrified and resin bonds, has led to improved abrasive performance and longer abrasive life.

Precision grinding applications demand high-performance abrasives, leading to the development of eco-friendly abrasives, such as those with fiber or cloth backing, and the use of silicon carbide grains. Automated grinding processes, including robotic grinding, have streamlined industrial manufacturing and surface preparation. Abrasive selection, cutting speed, and abrasive maintenance are crucial factors in ensuring optimal abrasive application and surface finish quality. Abrasive recycling is another area of interest for sustainability-conscious businesses. The market for coated abrasives is diverse, with various abrasive materials, grains, and backing types catering to specific applications. As research and development efforts continue, the future of coated abrasives lies in advanced abrasive engineering, enhanced abrasive materials, and improved abrasive performance. Industries utilizing coated abrasives span pre-engineered buildings, agricultural, metal fabrication, electric cars and charging outlets, consumer electronics, industrial sector, paper, cloth, and more.

Get a glance at the market report of share of various segments Request Free Sample

The Aluminum oxide segment was valued at USD 3.75 billion in 2019 and showed a gradual increase during the forecast period.

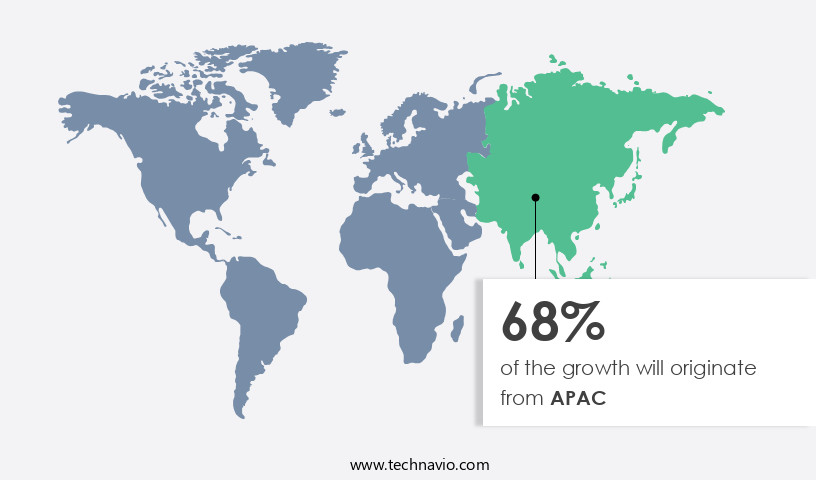

Regional Analysis

APAC is estimated to contribute 68% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is driven by the increasing demand for material removal in various industries, particularly in APAC. This region led the market in 2024 and is expected to continue leading due to economic development in the Association of Southeast Asian Nations (ASEAN) countries and rising per capita income. Major contributors to the APAC market include China, Japan, Australia, and India. The region's rapid industrialization and expansion of manufacturing sectors, especially in automotive, electronics, and metalworking industries, fuel the demand for high-performance coated abrasives. Innovation and abrasive optimization are crucial factors in the market. Advanced abrasive technology, such as precision grinding, high-speed grinding, and automated grinding, is driving the market.

Various abrasive materials, including silicon carbide, aluminum oxide, and ceramic abrasives, are used based on the specific application and required surface finish quality. Sustainable abrasives, such as eco-friendly abrasives and abrasive recycling, are gaining popularity due to environmental concerns. Abrasive selection, cutting speed, and abrasive life are essential factors in abrasive application. Different abrasive grains, such as vitrified bond and resin bond, and various backing materials, including paper backing, fiber backing, and cloth backing, are used based on the specific application and required performance. Flap discs, sanding belts, rolls, and discs are the most common types of coated abrasives. Robotic grinding and sanding sheets are also gaining popularity in industrial manufacturing and surface finishing processes. Abrasive maintenance is crucial to ensure optimal performance and longevity.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Coated Abrasives Industry?

- Growing demand for PSA-backed coated abrasives is the key driver of the market. Coated abrasives, which include sanding discs, rolls, and sheets, have become increasingly preferred due to the convenience they offer in their application. While cloth and paper continue to be widely used as backing materials, pressure-sensitive adhesives (PSA) are gaining traction. Companies like Saint Gobain and CUMI provide coated abrasives with PSA backing. These products find extensive use in various applications, such as blending welds and defects in auto body shops, removing paint and primer in auto refinish shops, and orbital sanding for finishing flat stock wood components.

- The use of PSA-backed coated abrasives simplifies mounting on disc sanders, orbital sanders, and rotary sanders. These abrasives offer significant benefits, including protection from dust and moisture, as well as extended disc life. By utilizing PSA technology, coated abrasives ensure a more efficient and productive sanding process.

What are the market trends shaping the Coated Abrasives Industry?

- Emergence of China as a major consumer and producer is the upcoming market trend. Coated abrasives have witnessed significant demand in recent years due to the economic and industrial growth in various regions, particularly China. In 2024, China accounted for over 20% of the market share, driven by its extensive raw material resources and advanced manufacturing technologies. The country's industrial sectors, such as electronics and automobile, have experienced substantial growth, leading to an increased need for coated abrasives.

- Additionally, population growth and urbanization have further fueled market expansion. China's position as a leading producer and consumer of coated abrasives is expected to continue during the forecast period, as these factors continue to influence the industry's growth trajectory.

What challenges does the Coated Abrasives Industry face during its growth?

- Improper or inadequate storage, causing technical issues, is a key challenge affecting the industry's growth. Coated abrasives are essential industrial materials that require proper handling to maintain their effectiveness. Improper storage can lead to technical challenges such as weakened bonds, curling, brittleness, and breakages. Changes in temperature and humidity significantly impact coated abrasives, causing adhesive bonds to soften or become excessively dry.

- This reduces flexibility and distorts the product, leading to defects like cupping. Two common types of cupping defects caused by humidity are concave and convex cupping. Proper material handling and storage conditions are crucial to prevent these issues and ensure the longevity and efficiency of coated abrasives.

Exclusive Customer Landscape

The coated abrasives market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the coated abrasives market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, coated abrasives market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company offers coated abrasives in various shapes such as belts, brushes, discs, sheets and rolls, wheels, and handheld abrasives.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Ammega Group BV

- Arc Abrasives Inc.

- BARTON International

- Compagnie de Saint-Gobain SA

- DEERFOS Co. Ltd.

- Fandeli International Corp.

- Gemtex Abrasives

- Hermes Schleifmittel GmbH

- Jiangsu Sanling Abrasive Co. Ltd.

- Johnson Abrasives Co. Inc.

- KLINGSPOR AG

- Mirka Ltd.

- Murugappa Group

- Napoleon Abrasives S.p.a.

- Robert Bosch GmbH

- SAK ABRASIVES Ltd.

- Swajit Abrasives Pvt. Ltd.

- VSM AG

- WEEM Abrasives

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of products utilized in various industries for material removal and surface finishing applications. These abrasives come in different forms, including grinding wheels, flap discs, sanding belts, and rolls, among others. The market is driven by the ever-evolving demands of industrial manufacturing, where precision and efficiency are paramount. Abrasive optimization and innovation continue to shape the market, as manufacturers seek to improve performance and extend abrasive life. Abrasive technology has advanced significantly, with developments in bonding materials, such as vitrified and resin, and abrasive grains, including silicon carbide and aluminum oxide.

The selection of the appropriate abrasive for a specific application is crucial for achieving optimal cutting speed and surface finish quality. Factors such as the material being ground, the required surface finish, and the grinding process itself all influence abrasive choice. Sustainability is a growing concern in the market, with eco-friendly abrasives gaining popularity. These abrasives are engineered to minimize waste and reduce environmental impact, making them an attractive option for manufacturers seeking to improve their sustainability credentials. Automated grinding processes, such as robotic grinding, have become increasingly common in industrial manufacturing. These processes offer improved consistency, increased productivity, and reduced labor costs.

However, the coated abrasives market is a significant segment of the broader abrasives industry, encompassing various types of abrasive products used in surface finishing techniques and grinding operations. These include abrasive belts for sanding applications such as abrasive belt sanding, disc sanding, and flap disc sanding, as well as sheet sanding, roll sanding, and blending operations.Coated abrasives come in various forms, including abrasive films, powders, slurries, pastes, and fluids. Abrasive grain size, density, hardness, wear resistance, durability, and efficiency are crucial factors determining their performance and application suitability.

Grinding processes, deburring, and surface finish measurement are primary applications for coated abrasives. Advanced technologies like nanotechnology abrasives and abrasive coatings have revolutionized the market, offering enhanced properties and improved efficiency. Manufacturing processes, quality control, safety standards, disposal, and certification are essential aspects of the coated abrasives industry. Abrasive equipment, polishing machines, tools, accessories, and consumables are essential components of the value chain. Stay updated with the latest news, events, training, and certification opportunities in the coated abrasives market through reputable suppliers and industry associations.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

263 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 4.69 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.3 |

|

Key countries |

China, Japan, India, US, South Korea, Australia, Germany, UK, Brazil, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Coated Abrasives Market Research and Growth Report?

- CAGR of the Coated Abrasives industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the coated abrasives market growth and forecasting

We can help! Our analysts can customize this coated abrasives market research report to meet your requirements.