Adhesive Market Size 2025-2029

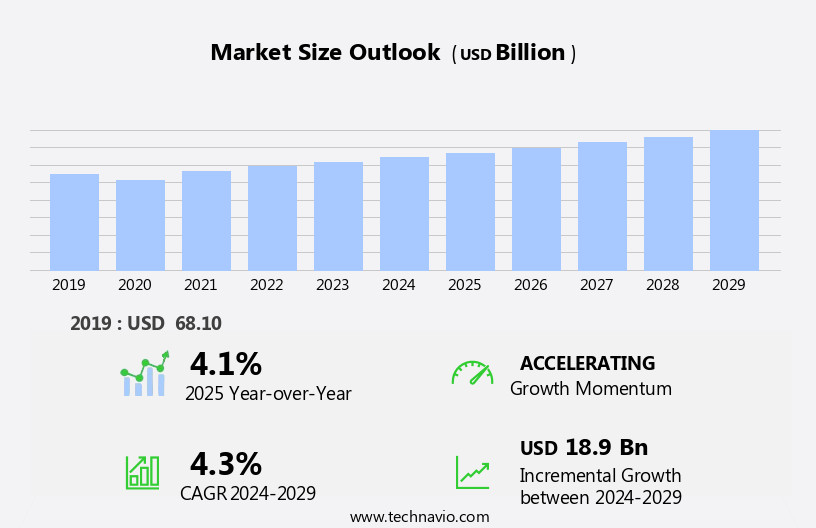

The adhesive market size is forecast to increase by USD 18.9 billion at a CAGR of 4.3% between 2024 and 2029.

- The global adhesives market is experiencing significant growth, driven by the increasing demand for adhesives in various industries, particularly in the medical sector. The medical industry's reliance on adhesives for medical devices, diagnostics, and pharmaceuticals is expected to fuel market expansion. Another key trend influencing market growth is the development of hybrid resins for manufacturing high-performance adhesives. These advanced adhesives offer superior bonding strength, flexibility, and resistance to harsh environments, making them ideal for use in automotive, construction, and electronics industries. However, the market's growth is not without challenges. Stringent environmental regulations, driven by growing concerns over the impact of adhesives on the environment, are posing significant challenges to market participants. The production of certain types of adhesives, such as solvent-borne and hot melt adhesives, contributes to high CO2 emissions.

- Regulatory bodies are imposing stricter regulations on the use of volatile organic compounds (VOCs) and other harmful chemicals in adhesives. As a result, market players are investing in research and development to create eco-friendly adhesives that meet these regulations while maintaining their performance and cost-effectiveness. Companies that can successfully navigate these regulatory challenges and offer sustainable adhesive solutions will be well-positioned to capitalize on the growing market opportunities. Adhesives are used extensively in medical devices, surgical implants, and diagnostic equipment, among other applications.

What will be the Size of the Adhesive Market during the forecast period?

- In the dynamic adhesives market, various types of adhesives cater to diverse industry requirements. These include structural adhesives for high bonding strength and tensile strength, construction adhesives for large-scale projects, and hybrid adhesives for combining properties of multiple adhesive types. Water-based adhesives offer environmental benefits, while product performance factors such as open time and aging resistance influence selection. Bonding agents, adhesion promoters, and regulatory compliance are crucial considerations for manufacturers. Surface preparation and industry regulations ensure quality control. Product innovation drives the market, with advanced materials, conductive adhesives, and automated dispensing technologies leading the way.

- Customer applications span from automotive and construction to electronics and medical industries. Adhesives play a vital role in manufacturing processes, from composite materials and thermoplastic adhesives to insulating and sealing adhesives. Lightweight materials and environmental impact are key trends, with high-strength materials and biocompatible adhesives also gaining importance. The market is a significant sector in the global industrial landscape, encompassing various industries such as footwear & leather, aerospace, building and construction, healthcare, woodworking and joinery, and others.

How is this Adhesive Industry segmented?

The adhesive industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

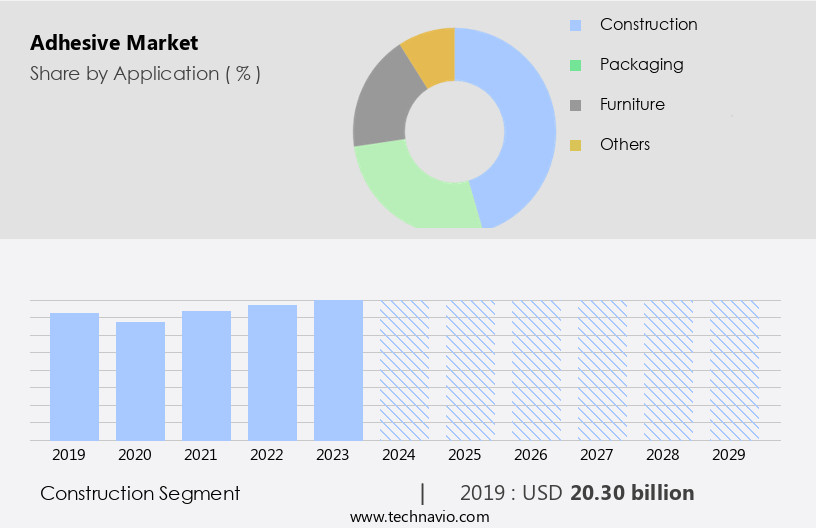

- Application

- Construction

- Packaging

- Furniture

- Others

- Type

- Water based adhesive

- Solvent based adhesive

- Others

- Resin Type

- Acrylic

- Epoxy

- Polyurethane

- Cyanoacrylate

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The construction segment is estimated to witness significant growth during the forecast period. In the expansive adhesives market, the construction segment plays a pivotal role in driving growth and innovation. Adhesives have revolutionized the way structures are built, offering architects, engineers, and builders new possibilities for bonding materials and enhancing durability. This article delves into the transformative impact of adhesives on the construction industry, examining trends, applications, challenges, and future prospects. Adhesives are increasingly utilized for structural bonding, enabling lighter construction with enhanced load-bearing capabilities. They facilitate the joining of diverse materials, including composites, metals, and polymers, fostering architectural creativity and artistic freedom. The use of adhesives streamlines the construction process, reducing the need for mechanical fasteners and welding. Sustainable adhesives, such as those based on natural rubber latex or bio-based resins, are being adopted to reduce the carbon footprint of footwear production.

Adhesive formulations offer varying properties, such as application versatility, bond strength, chemical resistance, moisture resistance, and temperature resistance. These properties cater to the unique demands of various industries, including electronics, automotive, and aerospace. Silicone adhesives, solvent-based adhesives, and UV curable adhesives are among the popular choices for their distinct advantages. Sustainability initiatives have gained momentum in the adhesives industry, with a focus on performance optimization, recycling, and reducing environmental impact. Adhesives manufacturers are investing in research and development to create eco-friendly adhesives and improve the sustainability of their production processes. Adhesives dispensing equipment is also being integrated into manufacturing systems to ensure efficiency and accuracy. Adhesives play a crucial role in various industries, including construction, packaging, and transportation, driving market growth due to increasing demand.

The adhesives market is a dynamic and evolving landscape, shaped by advancements in technology, industry trends, and customer demands. The construction segment, in particular, is at the forefront of this transformation, offering new possibilities for architects, engineers, and builders to create structures that are stronger, lighter, and more sustainable.

The Construction segment was valued at USD 20.30 billion in 2019 and showed a gradual increase during the forecast period.

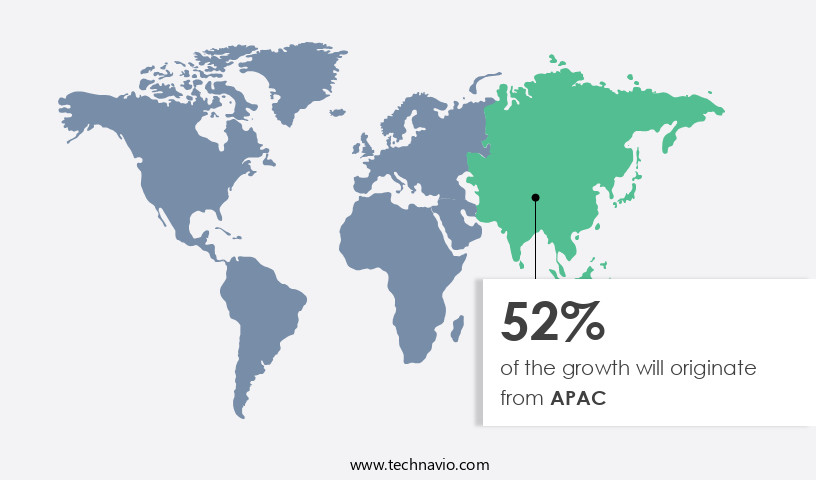

Regional Analysis

APAC is estimated to contribute 52% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Adhesives play a vital role in various industries, including construction, packaging, and transportation, due to their application versatility and ability to provide strong bonds. The chemical resistance, moisture resistance, and temperature resistance of adhesives are crucial factors driving their demand. Silicone and solvent-based adhesives are commonly used in the market, while UV curable and adhesive formulations offer performance optimization. Sustainability initiatives, such as recycling and supply chain efficiency, are increasingly important in the industry. Adhesives must meet specific standards for bond strength, tensile strength, and other properties to ensure reliable performance. In the Asia Pacific region, the construction sector's significant investments in infrastructure development are expected to fuel the demand for industrial adhesives.

Adhesives are integral components in the manufacturing process of various industries, including electronics, automotive, and aerospace. Adhesives' open time, pot life, and curing time are essential factors that impact their usability and efficiency. Adhesives' role in improving product performance, such as increasing shear strength and peel strength, is a significant market trend. Adhesives' application methods, including dispensing equipment, are also evolving to enhance productivity and reduce waste. Furthermore, in the footwear and leather goods industry, there is a growing preference for adhesives that minimize CO2 emissions and meet sustainability standards.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Adhesive market drivers leading to the rise in the adoption of Industry?

- The significant growth in the medical industry's demand for adhesives serves as the primary market driver. The medical sector's increasing spending, driven by population growth and changing lifestyles, fuels the demand for advanced adhesives. In this domain, adhesives outperform traditional fasteners, particularly in reusable medical devices. New adhesive technologies are rapidly emerging, with engineering resins like polyphenylene sulfide (PPS), polyolefins, and metals, including aluminum, titanium, nickel, and stainless steel, being utilized. Epoxy, silicones, polysulfides, and polyurethanes are among the adhesives used in medical applications. Adhesive versatility, bond strength, chemical resistance, moisture resistance, temperature resistance, and performance optimization are crucial factors driving the market's growth.

- Sustainability initiatives, such as recycling and the use of eco-friendly adhesive formulations, are also gaining importance. Adhesives' application versatility extends beyond medical applications to various industries, including packaging, construction, automotive, and electronics. Adhesives' dispensing equipment is essential for ensuring consistent application and optimal performance. Overall, the market for adhesives is dynamic and evolving, driven by technological advancements and diverse industry applications.

What are the Adhesive market trends shaping the Industry?

- The emerging market trend involves the development of advanced hybrid resins for producing high-performance adhesives. (Highlight and bold: The development of advanced hybrid resins for producing high-performance adhesives is the emerging market trend.) Hybrid adhesives, a category of structural adhesives, are revolutionizing the industry by offering superior bonding strength and adaptability. These adhesives are formulated by combining two or more different types of resins, leveraging the unique properties of each to create high-performance solutions. The resulting composite material exhibits enhanced bonding capabilities, durability, and resistance to environmental conditions. Adhesive manufacturers are focusing on product innovation to cater to diverse customer applications. Hybrid formulations provide specialized solutions for specific bonding needs, making them a preferred choice over traditional adhesives. Product performance attributes, such as tensile strength, open time, and aging resistance, are crucial factors driving the demand for these advanced adhesives.

- Bonding agents and adhesion promoters play a vital role in enhancing the performance of adhesives. Proper surface preparation is essential to ensure effective bonding. Adhesives regulations ensure product safety and compliance, further boosting consumer confidence. In the competitive adhesives market, companies are investing in research and development to introduce innovative products and maintain a competitive edge. Water-based adhesives are gaining popularity due to their eco-friendly nature and ease of use. Despite the challenges, the future of the adhesives market looks promising, with continued growth and innovation expected.

How does Adhesive market faces challenges face during its growth?

- Strict environmental regulations pose a significant challenge to the industry's growth. The market dynamics are influenced by various factors, including regulatory compliance. The Environmental Protection Agency (EPA) and the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) have set regulations to reduce the volatile organic compound (VOC) content in adhesives. These regulations, such as the US Environment Protection Act, play a significant role in the market. The emission of VOC is a concern for the EPA due to its potential hazardous effects.

- Industrial adhesives, including epoxy adhesives, hot melt adhesives, and pressure-sensitive adhesives, are subjected to various testing methods to evaluate their adhesive curing time, shear strength, and peel strength. Key adhesive types, such as epoxy adhesives, have long pot life and cure time, making them suitable for industrial applications. Consumer adhesives, like those used in electronics and household applications, have different performance requirements, including shorter curing times. Adhering to these regulations is crucial for market players to maintain supply chain efficiency and meet customer demands.

Exclusive Customer Landscape

The adhesive market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the adhesive market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, adhesive market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The Industrial and Advanced Materials division of the company provides a range of innovative adhesive solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Arkema

- Avery Dennison Corp.

- BASF SE

- DuPont de Nemours Inc.

- Evonik Industries AG

- H.B. Fuller Co.

- Henkel AG and Co. KGaA

- Huntsman Corp.

- Illinois Tool Works Inc.

- Mapei SpA

- Pidilite Industries Ltd.

- PPG Industries Inc.

- RPM International Inc.

- Sika AG

- The Dow Chemical Co.

- Wacker Chemie AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Adhesive Market

- The market has witnessed several significant developments in recent years, shaping the industry's competitive landscape and driving innovation. Here are four key developments:

- In Q1 2025, 3M Company announced the launch of its new Scotch-Weld DP8000 Series of structural adhesives, designed for the automotive industry. These high-performance adhesives offer improved bond strength, durability, and productivity, making them a popular choice for automotive manufacturers seeking to reduce vehicle weight and improve fuel efficiency (3M Press Release, 2025).

- In Q3 2024, H.B. Fuller and Sika AG entered into a strategic collaboration to develop and commercialize sustainable adhesive solutions. The partnership combines H.B. Fuller's expertise in adhesives and Sika's knowledge in specialty chemicals, aiming to create more sustainable and eco-friendly adhesive products (H.B. Fuller Press Release, 2024).

- In Q2 2024, Henkel AG & Co. KGaA acquired the adhesive business of the South African company, Adhesive Technologies. This acquisition strengthened Henkel's position in the African market and expanded its product portfolio, offering a broader range of adhesive solutions to customers in the region (Henkel AG & Co. KGaA Press Release, 2024).

- In Q4 2023, Ashland Global Holdings Inc. launched its new line of water-based pressure-sensitive adhesives, designed for the labeling industry. These adhesives offer excellent bonding performance, ease of use, and environmental sustainability, making them a preferred choice for label converters and brand owners (Ashland Global Holdings Inc. Press Release, 2023).

- These developments demonstrate the ongoing innovation and strategic maneuvers in the market, driven by companies' efforts to expand their product offerings, enhance sustainability, and strengthen their market presence.

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and the expanding requirements of various industries. One of the key trends shaping the market is the increasing adoption of process automation in the manufacturing of adhesives. This automation is leading to improved efficiency and consistency in the production of adhesives, as well as the ability to create more complex and specialized formulations. Another significant area of growth is the development of bio-based adhesives. These adhesives offer several advantages, including reduced environmental impact and improved sustainability. They are finding increasing applications in medical, automotive, and construction industries, among others.

Surface treatment is another critical aspect of the market, as proper surface preparation is essential for achieving strong bonds. Advancements in surface treatment technologies are enabling the use of adhesives in a wider range of applications, from aerospace to electronics. The raw materials used in adhesive manufacturing are also undergoing significant changes. For instance, nanotechnology is being used to create high-performance adhesives with enhanced properties, such as increased bond strength and chemical resistance. Acrylic and silicone adhesives continue to be popular choices due to their versatility and excellent product performance. Industry verticals are also driving the demand for specific types of adhesives.

The Adhesive Market is expanding rapidly, driven by innovations in adhesive tapes and specialized solutions like polyurethane adhesives, cyanoacrylate adhesives, and anaerobic adhesives. Diverse applications utilize rubber adhesives, thermosetting adhesives, and insulating adhesives, while safety-focused industries demand flame retardant adhesives and eco-friendly biodegradable adhesives. Functional products such as repair adhesives, assembly adhesives, and fastening adhesives are essential for modern assembly processes. Advanced laminating adhesives and coating adhesives enhance performance on flexible materials and engineered materials. Automation, including robotic dispensing, streamlines production, while rigorous product testing ensures quality. The market reflects growing demand for efficiency and sustainability, with innovations shaping the future of adhesives across industries.

For example, the automotive industry requires high-tensile strength adhesives for bonding various components, while the construction industry relies on structural adhesives for large-scale projects. The medical industry, on the other hand, requires adhesives with specific properties, such as moisture resistance and shear strength, for use in medical devices and implants. Adhesive application methods are also evolving, with the development of new technologies for dispensing and curing adhesives. For instance, UV curable adhesives offer faster curing times and improved bond strength, while hot melt adhesives offer the advantage of being easily dispensed and applied. Sustainability initiatives are becoming increasingly important in the adhesive industry, with a focus on reducing waste and improving the environmental impact of adhesive manufacturing.

This is leading to the development of recycling programs for adhesive waste and the use of renewable raw materials in adhesive formulations. Performance optimization is another key trend in the market, with a focus on improving the properties of adhesives, such as open time, aging resistance, and bonding strength. Adhesives are also being developed to meet specific regulations and standards, such as those related to food safety and environmental impact. Adhesives are used in a wide range of applications, from consumer products to industrial applications. Customer applications continue to drive innovation in the adhesive industry, with new uses being discovered for adhesives in various industries. Materials like polyphenylene sulfide (PPS), polyolefins, aluminum, titanium, nickel, and stainless steel are used to create devices such as disposable ECG electrodes and grounding plates. Epoxy, silicones, polysulfides, and polyurethanes are among the adhesive types utilized in medical applications.

For instance, adhesives are being used in the electronics industry to create advanced components, such as sensors and displays. Bonding agents and adhesion promoters are also playing an essential role in the market, as they help improve the bonding strength and durability of adhesives. Supply chain efficiency is another critical factor, with the development of new technologies for improving the logistics and distribution of adhesives. The market is a dynamic and evolving industry, driven by advancements in technology, changing industry requirements, and sustainability initiatives. The market is characterized by a diverse range of applications, from medical and automotive to construction and electronics. The ongoing development of new adhesive technologies and formulations is enabling the industry to meet the evolving needs of its customers and stay competitive in a global market.

Dive into Technavio's research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Adhesive Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

242 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2025-2029 |

USD 18.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.1 |

|

Key countries |

US, China, Japan, India, Germany, South Korea, Canada, UK, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Adhesive Market Research and Growth Report?

- CAGR of the Adhesive industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the adhesive market growth of industry companies

We can help! Our analysts can customize this adhesive market research report to meet your requirements.