Cold Plunge Tub Market Size 2025-2029

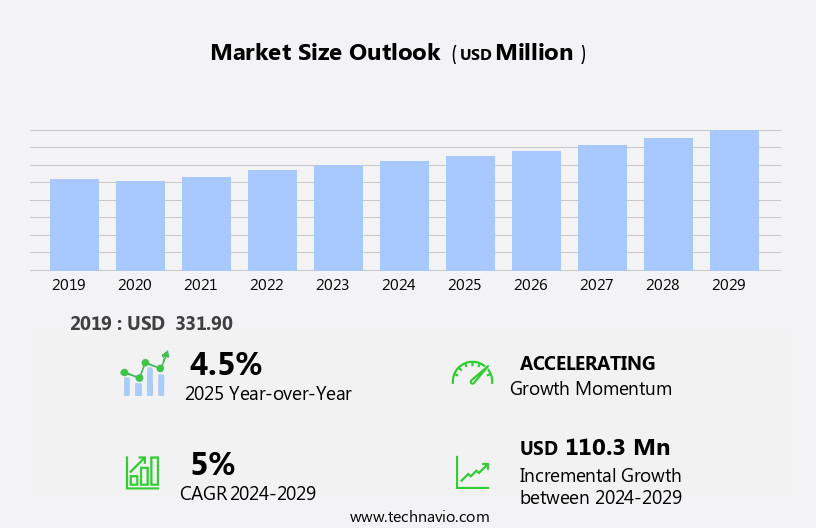

The cold plunge tub market size is forecast to increase by USD 110.3 million at a CAGR of 5% between 2024 and 2029.

- The market is experiencing significant growth driven by the increasing focus on health and wellness and the rising trend of creating luxurious home spa environments. This market caters to consumers seeking the benefits of cold water immersion, such as improved circulation, reduced inflammation, and enhanced mental clarity. These tubs have gained popularity in public spaces such as gyms & health clubs, spas, hotels, and fitness facilities. However, the high initial investment associated with cold plunge tubs may act as a barrier to entry for some consumers. Key market trends include the integration of advanced technologies, such as smart temperature control systems and energy efficiency features, to enhance the user experience and reduce operational costs. Additionally, the market is witnessing a shift towards sustainable and eco-friendly materials in the production of cold plunge tubs, catering to the growing environmental consciousness among consumers.

- Companies seeking to capitalize on these opportunities must navigate challenges such as increasing competition and maintaining regulatory compliance. By staying informed of these market dynamics and trends, businesses can effectively position themselves to meet consumer demands and capitalize on the growing potential of the market.

What will be the Size of the Cold Plunge Tub Market during the forecast period?

- The market encompasses the production, sales, and distribution of cold plunge pools and tubs used for cold water therapy. This therapeutic practice, also known as cold water immersion, offers numerous health benefits, including improved blood circulation, reduced muscle soreness, and enhanced overall wellness. Cold plunge tubs are increasingly popular in various sectors, including fitness centers, public facilities, sports training centers, and public spaces. Cold water therapy is gaining traction as a complementary treatment for athletes and fitness enthusiasts seeking to accelerate recovery and enhance performance.

- The market is poised for growth, driven by the rising trend of health and wellness and the increasing recognition of cold water therapy as an effective treatment for various ailments. The market is expanding in luxury hotels, where these high-end wellness features are often paired with premium hot tub covers to enhance the guest experience. Cold plunge tubs provide a refreshing and invigorating experience, making them an attractive addition to any facility or personal wellness routine. Cold plunge pool is becoming popular for relieving sore muscles, as cold-water therapy is known to reduce inflammation, with increased product availability making it easier for individuals to incorporate this healing method into their wellness routines.

How is the Cold Plunge Tub Industry segmented?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Commercial

- Residential

- Product Type

- In-ground cold plunge tubs

- Above-ground cold plunge tubs

- Type

- Small

- Medium

- Product

- Indoor

- Outdoor

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Application Insights

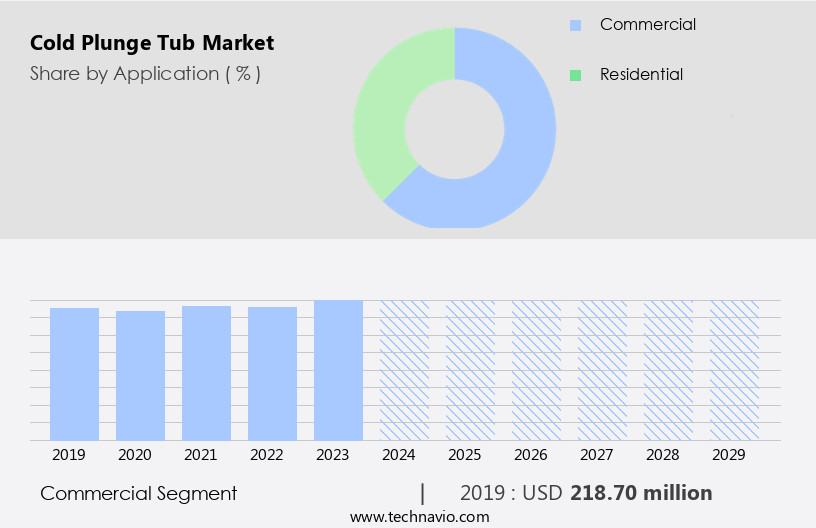

The commercial segment is estimated to witness significant growth during the forecast period. The market witnessed significant growth in the commercial sector in 2024. Upscale resorts integrate cold plunge tubs into their spa offerings for alternative hydrotherapy experiences. High-end training facilities install these tubs to aid in muscle recovery after intense workouts. Commercial cold plunge tubs are a crucial component of post-workout recovery protocols in gyms, catering to fitness enthusiasts seeking relief from muscle soreness. Wellness centers incorporate these tubs into their services, aligning with their focus on relaxation and rejuvenation.

The therapeutic benefits of cold water therapy, including improved blood circulation, muscle recovery, and inflammation reduction, make cold plunge tubs an attractive addition to these facilities. Intelligent technologies and monitoring devices enable tracking of health metrics like heart rate, body temperature, and recovery indicators, enhancing the overall wellness experience. Cold plunge tubs are increasingly becoming a staple in the wellness industry, appealing to health-conscious consumers and sports persons in the fitness sector.

Get a glance at the market report of share of various segments Request Free Sample

The Commercial segment was valued at USD 218.70 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

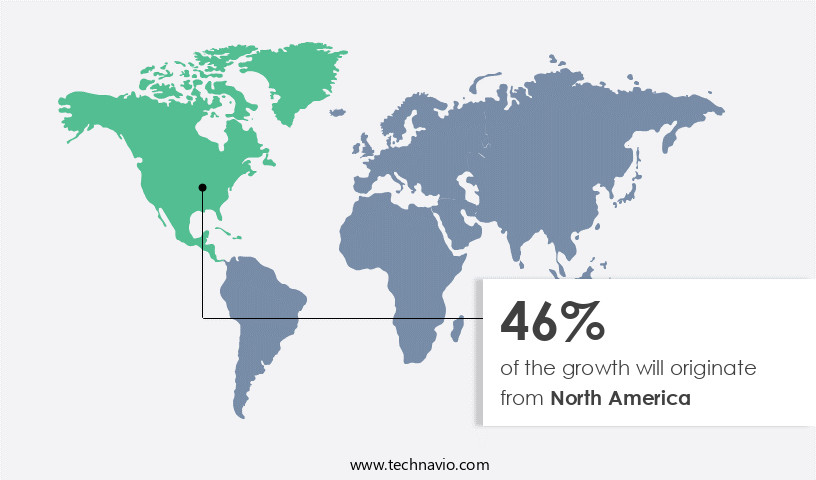

North America is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market is experiencing growth due to the rising demand for wellness and hydrotherapy products. Cold plunge tubs, a type of cold water therapy, offer various therapeutic advantages such as muscle soreness relief, improved blood circulation, and stress reduction. These tubs are popular among fitness enthusiasts, professional sports teams, and rehabilitation programs as part of holistic wellness practices. Cold plunge tubs are available in various forms, including in-ground and above-ground models, and are used in fitness centers, wellness resorts, and premium wellness facilities. Intelligent technologies and monitoring devices enable users to track health metrics like heart rate, body temperature, and recovery indicators. The US dominates the market due to its wellness culture and high disposable incomes, while Canada exhibits steady growth in urban areas with health-conscious populations. Cold plunge tubs are considered a luxury item in the fitness sector and are available through various channels, including eCommerce platforms and wellness retreats.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Cold Plunge Tub Industry?

- Growing focus on health and wellness is the key driver of the market. The market experiences growth due to the rising trend of prioritizing health and wellness. Hydrotherapy, including cold plunge baths, is gaining popularity as individuals value holistic health and self-care. Cold plunge tubs align with these goals, offering stress relief, muscle repair, and improved circulation. Notably, cold-water immersion stimulates white blood cell production, which is essential for maintaining a strong immune system.

- As health-conscious consumers seek natural methods to bolster their body's defense mechanisms, cold plunge therapy becomes increasingly attractive. Moreover, the change in customers' perspective is reflected by an increasing tendency for the inclusion of cold baths at both business and residential wellness facilities. As a result, the fusion of health consciousness and the attractiveness of hydrotherapy is expected to drive the growth of the global market during the forecast period.

What are the market trends shaping the Cold Plunge Tub Industry?

- Increasing interest in creating luxurious home spa environments is the upcoming market trend. The market is experiencing growth due to the increasing popularity of creating luxurious home spas. Homeowners are seeking improved relaxation and wellness experiences in their residences, leading to a demand for visually appealing, compact cold plunge tubs. These tubs not only enhance interior aesthetics but also maximize space utilization, seamlessly blending functionality and decor. The market is shifting towards offering high-end, in-home hydrotherapy solutions, with manufacturers focusing on stylish, customizable alternatives that cater to homeowners' discerning tastes. This trend is transforming homes into personal wellness havens, redefining their role as sanctuaries for self-care.

- However, more importance is given to aesthetic considerations complementing interior aesthetics, ensuring compact designs maximize space utilization, and seamlessly fusing functionality and decor. As a result, the market is becoming more focused on providing high-end in-home hydrotherapy solutions, with manufacturers focusing on stylish, individualized alternatives that appeal to homeowners' discriminating tastes. This is expected to drive the growth of the market in focus during the forecast period.

What challenges does the Cold Plunge Tub Industry face during its growth?

- High initial investment associated with cold plunge tubs is a key challenge affecting the industry's growth. The market faces a substantial hurdle due to the high initial investment required. This financial barrier deters potential buyers from adopting cold plunge therapy, particularly in cost-conscious markets. The expense extends beyond the tub's purchase price, encompassing installation costs, potential structural modifications, and ongoing maintenance fees. This challenge is particularly acute in regions where budget constraints are prevalent, limiting the accessibility of cold plunge baths to a select demographic and corporate sector.

- Moreover, the expensive up-front costs include not only the cost of the tub itself but also those associated with installation, potential structural alterations, and ongoing maintenance costs. In areas with a high incidence of budgetary constraints, this challenge is particularly severe, making these only available to a select group of customers and enterprises. This is expected to hinder the growth in focus during the forecast period. Consequently, this obstacle is anticipated to impede the market's expansion during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arctic Cold Tubs- The company offers 1 4HP active aqua chiller, 1HP active aqua chiller, and 1HP eco plus chiller.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arctic Cold Tubs

- Brass Monkey Health LTD

- Chill Tubs

- Cold Tribe Wellness

- COLDTUB

- Diamond Spas Inc.

- Edge Theory Labs Inc.

- Ice Barrel Inc.

- iCool Australia Pty Ltd

- INERGIZE HEALTH

- NordicWave

- Odin Ice Baths USA

- PLUNGE

- Polar Monkeys

- Red Rock Outdoors Co.

- RENU Therapy

- Sun Home Saunas

- The Pod Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of therapeutic solutions that leverage the benefits of cold water therapy. This holistic wellness practice, which involves immersing the body in cold water, has gained significant traction in various sectors, including health and fitness. Cold water therapy is renowned for its therapeutic advantages, which include muscle soreness relief, improved blood circulation, and stress reduction. Fitness enthusiasts, professional sports persons, and individuals undergoing rehabilitation programs have long utilized cold water immersion as part of their training regimens and recovery processes. The integration of intelligent technologies and monitoring devices into cold plunge tubs has further enhanced the user experience.

Moreover, these advanced features enable users to track essential health metrics such as heart rate, body temperature, and recovery indicators, offering valuable insights into their wellbeing. The wellness industry's growing emphasis on holistic health practices has fueled the demand for cold plunge tubs. Scientific validation of cold water therapy's health benefits has solidified its position as an integral component of fitness centers, wellness resorts, premium wellness facilities, and sports training centers. The availability of cold plunge tubs extends beyond commercial use, with increasing popularity in residential applications. These tubs can be found in urban neighborhoods, sports persons' homes, and fitness sectors, further expanding the market's reach.

Furthermore, ecommerce platforms and online sales channels have made these tubs more accessible to a broader audience. Wellness retreats and health tourism destinations have also incorporated cold-water treatment into their offerings, catering to consumers seeking a luxurious and rejuvenating experience. The market is diverse, with offerings ranging from in-ground tubs to above-ground models and hydrotherapy equipment. Product innovation continues to drive the market, with temperature control features and smart technology integration becoming increasingly common. These tubs cater to various user groups, including fitness enthusiasts, sports persons, and individuals seeking stress reduction and muscle recovery.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5% |

|

Market growth 2025-2029 |

USD 110.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.5 |

|

Key countries |

US, Canada, China, UK, Japan, Germany, India, France, Italy, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.