Community Banking Market Size 2025-2029

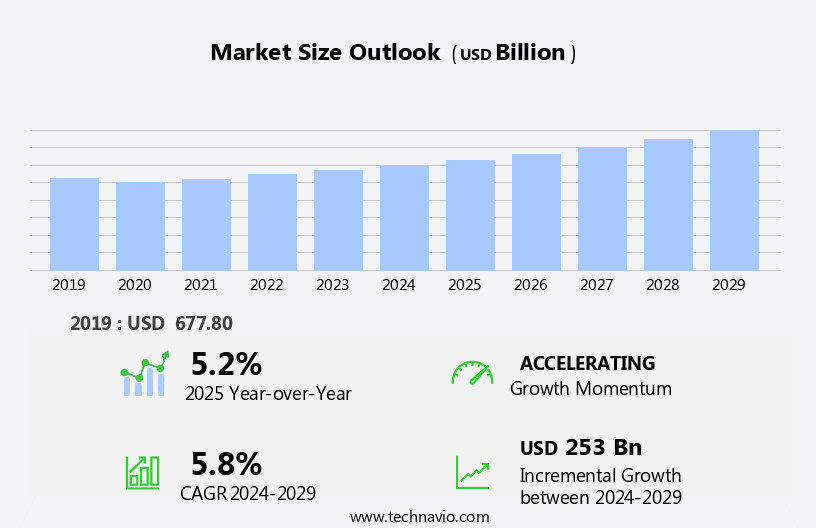

The community banking market size is forecast to increase by USD 253 billion at a CAGR of 5.8% between 2024 and 2029.

- The market is experiencing significant shifts driven by the increasing adoption of microlending in developing nations and the rising preference for digital platforms. The microlending, a segment of community banking, is gaining traction in developing economies due to its ability to provide small loans to individuals and small businesses who lack access to traditional banking services. This trend is expected to continue, fueled by the growing financial inclusion efforts and increasing economic activity in these regions. Simultaneously, the community banking sector is witnessing a surge in the adoption of digital platforms.

- The digital community banking services, such as mobile banking and online lending, are becoming increasingly popular due to their convenience and accessibility. This trend is particularly noticeable among younger demographics, who are more likely to use digital channels for banking. However, the market also faces challenges. One of the most significant obstacles is the lack of awareness about community banking services. Many potential customers, particularly in rural and underserved areas, are unaware of the benefits and availability of community banking services. Addressing this challenge will require targeted marketing efforts and community outreach programs.

What will be the Size of the Community Banking Market during the forecast period?

- The market continues to evolve, with advanced technology playing a pivotal role in shaping the landscape. Financial institutions, both large and small, are integrating microfinance, mobile banking, and remote deposit capture to cater to diverse customer needs. In the micropolitan areas, community banks have gained prominence, offering personalized services to rural and agricultural sectors. The economic recession led to a surge in digital adoption, with mobile banking becoming increasingly popular. However, the competition remains fierce, with big banks also investing heavily in technology to retain their customer base. The ongoing market dynamics underscore the need for continuous innovation and adaptation to stay competitive.

- Community banks, with their focus on local markets and relationships, are well-positioned to leverage these trends and offer competitive rates and fees to attract and retain customers. The integration of advanced technology enables seamless transactions and enhanced customer experience, further bolstering their position in the market. The future of community banking lies in its ability to balance tradition and innovation, offering personalized services while embracing digital transformation.

How is this Community Banking Industry segmented?

The community banking industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Area

- Metropolitan

- Rural and micropolitan

- Sector

- Small business

- CRE

- Agriculture

- Service Type

- Retail banking

- Commercial banking

- Wealth management and financial advisory

- Others

- Delivery Model

- Branch Banking

- Online Banking

- Mobile Banking

- Institution Type

- Credit Unions

- Local Banks

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Area Insights

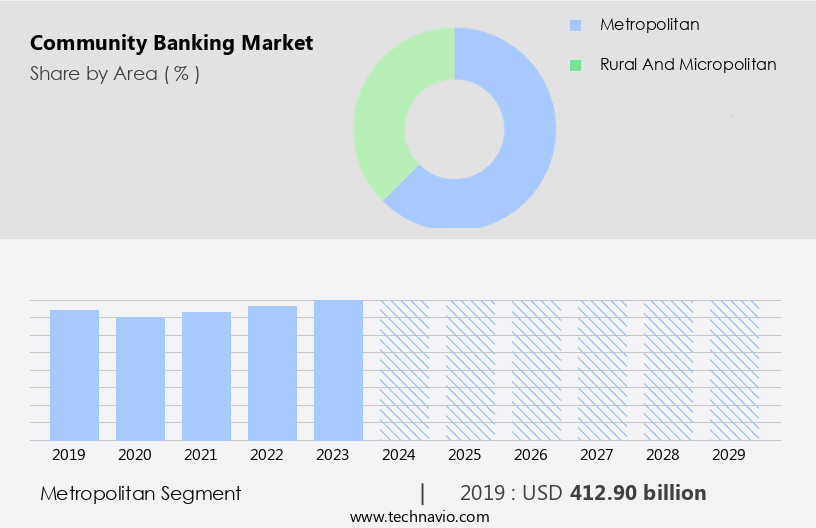

The metropolitan segment is estimated to witness significant growth during the forecast period.

In the dynamic world of financial services, community banks in the US continue to gain traction among consumers, particularly in rural and micropolitan areas where Big Banks may have a limited presence. While Big Banks dominate the market with their vast resources and broad reach, Community FIs cater to the unique needs of their local clientele. With the rise of advanced technology, Community banks have embraced digital banking solutions, including Internet banking, mobile banking, and remote deposit capture. Small businesses and agricultural sectors, integral to rural economies, benefit significantly from Community banks' personalized services and expertise. Despite the economic recession, these institutions have managed to maintain deposits through their strong relationships with customers.

Microlending, a niche offering, further distinguishes Community banks from their larger counterparts. Rates and fees remain crucial factors for customers, especially in a competitive market. Community banks often offer more competitive rates and lower fees compared to Big Banks, making them an attractive alternative. In the era of advanced technology, Community banks are investing in security measures to ensure a harmonious and secure banking experience for their customers. In metropolitan areas, where time is a valuable commodity, the convenience of digital banking offerings has led to a surge in online transactions. Community banks, recognizing this trend, are adapting to meet the demands of their urban clientele.

By focusing on security, accessibility, and a comprehensive range of services, these institutions are positioning themselves to thrive in the evolving financial landscape.

The Metropolitan segment was valued at USD 412.90 billion in 2019 and showed a gradual increase during the forecast period.

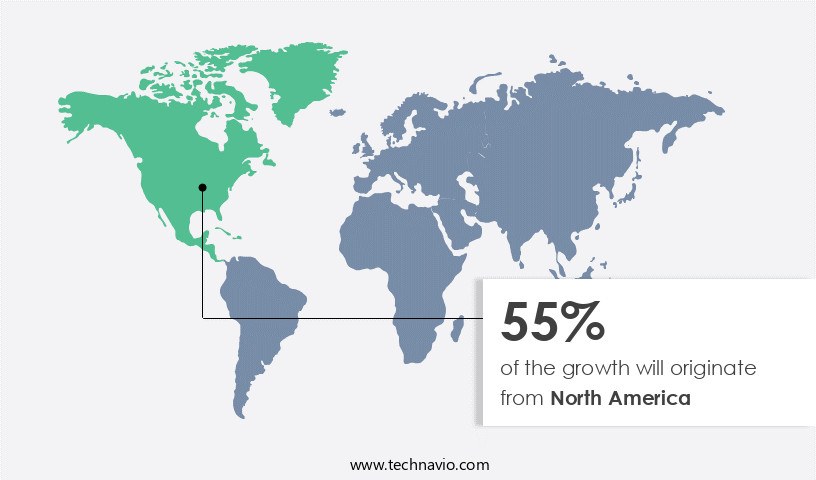

Regional Analysis

North America is estimated to contribute 55% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic world of community banking, North America leads the global market in 2024. Factors fueling this growth include the low-interest environment, with depositors and businesses turning to community banks for higher returns on their funds. Advanced technology, such as mobile banking and remote deposit capture, has made banking more accessible in rural and micropolitan areas, broadening the customer base. Agriculture, a significant sector in the region, benefits from community banks' expertise and personalized services. The economic recession has underscored the importance of local financial institutions, as they continue to support small businesses through challenging times.

The integration of advanced technology in community banking has been a game-changer, enabling microlending and other innovative services. Despite the dominance of big banks, community banks' nimble approach to business and commitment to their communities make them a vital part of the financial landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Community Banking Industry?

- In developing nations, the increasing acceptance of microlending is the primary catalyst fueling market growth. Microlending, a financial solution that provides small loans to individuals or groups who lack access to traditional banking services, is gaining significant traction in these regions. This trend is driving the expansion of the market, offering economic opportunities to underserved populations and promoting financial inclusion.

- The global microlending market is experiencing significant growth due to various factors. In developing nations, microlending is transforming lives by providing financial assistance to individuals in APAC, South America, and MEA. Government initiatives encouraging microlending in numerous countries are fueling market expansion. Furthermore, the increasing number of microlenders enables poverty reduction and enhances the living standards of underprivileged communities. In African countries, farmers are adopting microlending to purchase crops, contributing to market growth.

- Additionally, rural residents are utilizing microlending to establish businesses and improve their livelihoods, further propelling market expansion. Microlending plays a crucial role in promoting financial inclusion and economic development.

What are the market trends shaping the Community Banking Industry?

- The increasing prevalence of digital platforms represents a significant market trend. This shift towards digital solutions is mandatory for businesses seeking to remain competitive and connect with consumers in today's technological landscape.

- The market is experiencing a notable transition towards digital platforms due to the increasing use of technology such as smartphones, computers, and the Internet. IoT devices and AI are further propelling this evolution. This shift offers numerous advantages to Financial Institutions (FIs), including heightened productivity, cost savings, and expanded revenue opportunities. A primary factor fueling this trend is the escalating demand for digital banking services.

- Modern customers seek effortless and flexible access to their financial data and transactions via digital channels. Mobile banking apps and online platforms cater to this need, enabling users to manage their finances at their convenience.

What challenges does the Community Banking Industry face during its growth?

- The growth of the community banking industry is hindered by a significant lack of awareness among the public regarding the services and benefits that these institutions offer.

- Community banking plays a crucial role in serving the financial needs of underbanked populations. However, the growth of the market faces significant challenges due to insufficient awareness among potential customers. Many individuals lack a comprehensive understanding of community banking services and the loan application process. Moreover, field representatives may not be well-versed in the regulations, including pricing guidelines. Consequently, this lack of awareness poses a significant hurdle to the expansion of community banking services, potentially hindering market growth during the forecast period.

- To address this challenge, advanced technology solutions such as mobile banking and remote deposit capture can be employed to increase accessibility and educate customers about community banking services. By leveraging these technologies, financial institutions can bridge the awareness gap and provide a more seamless banking experience, ultimately contributing to the growth of the market.

Exclusive Customer Landscape

The community banking market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the community banking market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, community banking market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bay Community Bancorp - This company specializes in offering community banking services, focusing on extending financial loans for construction projects. By providing tailored financing solutions, we facilitate the growth and development of various infrastructure initiatives.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bay Community Bancorp

- BCB Bank

- Bendigo and Adelaide Bank Ltd.

- Beyond Bank Australia Ltd

- Coastal Financial Corp.

- CSBS

- Dime Community Bancshares inc.

- First Community Bankshares Inc.

- Fiserv Inc.

- Flint Community Bank

- Holland and Knight LLP

- HSBC Holdings Plc

- JPMorgan Chase and Co.

- Morton Community Bank

- PRIDE MICROFINANCE LTD.

- Sound Financial Bancorp Inc

- Summit Community Bank

- The Co-operative Bank Plc

- West Central Georgia Bank

- Wintrust Financial Corp

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Community Banking Market

- In February 2024, Fidelity National Information Services (FIS) announced the launch of its new digital banking platform, FIS Modern Banking, designed specifically for community banks. This innovative solution aims to help smaller financial institutions compete with larger competitors by offering advanced digital capabilities (FIS Press Release, 2024).

- In May 2025, BB&T Corporation and SunTrust Banks, Inc. Completed their merger, creating Truist Financial Corporation, the sixth-largest commercial bank in the US. This strategic combination brought together two major community banking players, expanding their collective market reach and enhancing their product offerings (BB&T and SunTrust Merger Press Release, 2025).

- In August 2024, the Federal Deposit Insurance Corporation (FDIC) approved the application of Ally Financial Inc. To become a bank holding company. This significant regulatory approval allowed Ally to expand its services beyond auto loans, mortgages, and investments, enabling it to offer traditional banking services as a community bank (FDIC Press Release, 2024).

- In December 2025, JPMorgan Chase & Co. And Finastra, a leading provider of financial software, announced a strategic partnership to offer JPMorgan's Chase Business Complete Banking to Finastra's banking clients. This collaboration aimed to provide small businesses with easier access to JPMorgan's digital banking services, enhancing the community banking experience for these customers (JPMorgan Chase & Co. And Finastra Press Release, 2025).

Research Analyst Overview

In the current market landscape, micropolitan financial institutions face stiff competition from big banks in the realm of rates, deposits, and fees. Small businesses and rural communities, however, continue to favor the personalized services and niche expertise of community banks. Advanced technology, including remote deposit capture and mobile banking, has leveled the playing field, enabling smaller institutions to offer comparable digital services.

The economic recession highlighted the importance of microlending, a niche area where community banks excel. Despite these challenges, micropolitan financial institutions remain a vital part of the economic fabric, providing essential services to their local communities. Internet banking and metropolitan branches expand their reach, ensuring these institutions remain competitive in an increasingly digital world.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Community Banking Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 253 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.2 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, Canada, Brazil, UAE, Australia, Rest of World (ROW), Saudi Arabia, France, South Korea, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Community Banking Market Research and Growth Report?

- CAGR of the Community Banking industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the community banking market growth of industry companies

We can help! Our analysts can customize this community banking market research report to meet your requirements.