Information Services Market Size 2025-2029

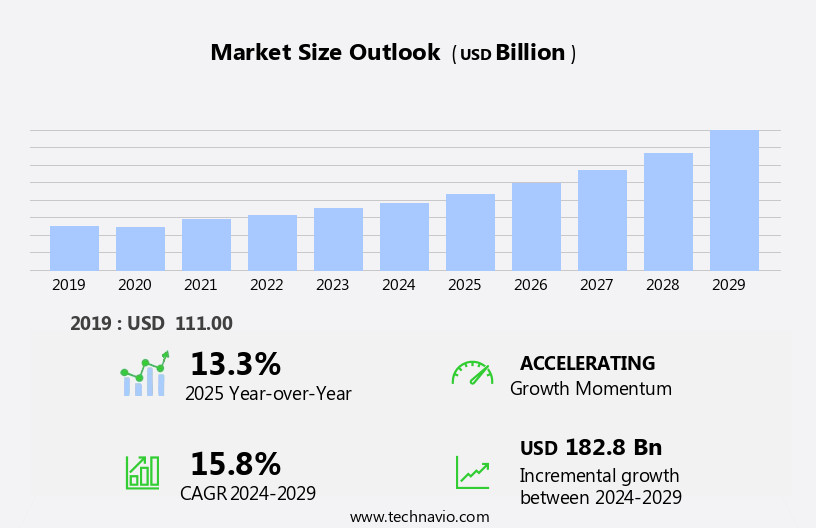

The information services market size is forecast to increase by USD 182.8 billion, at a CAGR of 15.8% between 2024 and 2029.

- The market is driven by the increasing adoption of information services for risk management, enabling organizations to mitigate potential threats and make informed decisions. This trend is further fueled by the emergence of Artificial Intelligence (AI) in information management, facilitating advanced data analysis and automation of complex processes. However, the market faces significant challenges, including the growing threat of data misappropriation, theft, and cybersecurity issues. As businesses continue to digitalize their operations, safeguarding sensitive information becomes increasingly critical. Companies must invest in robust security measures and implement strict data governance policies to protect their assets and maintain customer trust.

- Navigating these challenges while capitalizing on the opportunities presented by AI and risk management services requires a strategic approach and a deep understanding of the market's dynamics. Companies seeking to succeed in this landscape must stay abreast of emerging trends and adapt to the evolving threat landscape to effectively manage risk and secure their data.

What will be the Size of the Information Services Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping its applications across various sectors. Neural networks, data auditing, data storytelling, data mining, data transformation, data lifecycle management, prescriptive analytics, search engine optimization, business intelligence, metadata management, sentiment analysis, data ethics, text mining, data exploration, and other advanced technologies are seamlessly integrated into business processes. Data usability and information architecture are crucial considerations in today's data-driven landscape. Customer relationship management and natural language processing enable effective communication and analysis of customer interactions. Data security and archival ensure the protection and preservation of valuable information. Web analytics and data visualization provide insights into user behavior and trends.

Predictive analytics and machine learning facilitate data-driven decision making. Big data and cloud computing offer scalable solutions for managing and analyzing vast amounts of data. Data quality, reporting, and retrieval systems are essential for ensuring accurate and timely access to information. Data strategy, integration, and governance are critical for effective data management. The Internet of Things and data management platforms facilitate real-time data collection and analysis. Data discovery, modeling, and enrichment enable the creation of valuable insights from raw data. Computer vision and speech recognition offer new possibilities for data analysis and automation. Data accessibility and data-driven decision making are key drivers of business growth and innovation.

Data ethics and compliance are increasingly important considerations in the market. Ongoing market activities and evolving patterns continue to shape the landscape, with new technologies and applications emerging regularly.

How is this Information Services Industry segmented?

The information services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- News syndicates

- Libraries and archives

- End-user

- Automotive

- Healthcare

- Retail

- Manufacturing

- Others

- Function Type

- Data Backup and Recovery

- Network Monitoring and Security

- Human Resource

- System Management

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Argentina

- Brazil

- Middle East and Africa

- UAE

- Rest of World (ROW)

- North America

By Type Insights

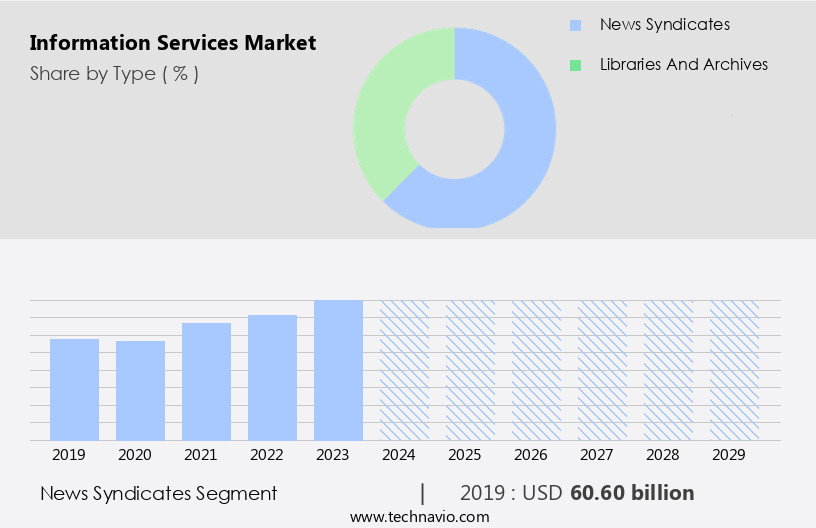

The news syndicates segment is estimated to witness significant growth during the forecast period.

In today's data-driven business landscape, the demand for advanced information services is surging. Deep learning and artificial intelligence are revolutionizing data analysis, enabling predictive insights and automating business processes. Data warehousing and archival ensure the secure storage and accessibility of vast amounts of information. Usability, information architecture, and customer relationship management optimize data utilization, while data visualization and reporting facilitate effective communication. Security, ethics, and compliance are paramount, with robust data protection measures and data governance practices. Neural networks and machine learning power data mining and transformation, uncovering valuable insights from complex datasets. Data discovery, modeling, and enrichment enhance data quality, while data integration and migration streamline operations.

Web analytics, search engine optimization, and data-driven decision making are essential for digital success. The Internet of Things and data management platforms facilitate real-time data collection and analysis. Predictive analytics and prescriptive insights guide strategic planning, while data storytelling and auditing maintain transparency and accountability. Business intelligence, metadata management, and knowledge management optimize data utilization, while data lifecycle management ensures efficient data handling. Text mining, sentiment analysis, and speech recognition expand data analysis capabilities. Data exploration, transformation, and accessibility empower users, enabling them to make informed decisions. Cloud computing and data monitoring provide scalable and cost-effective solutions, while data replication and archival ensure business continuity.

Data integration and process automation streamline operations, enhancing overall efficiency and productivity.

The News syndicates segment was valued at USD 60.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

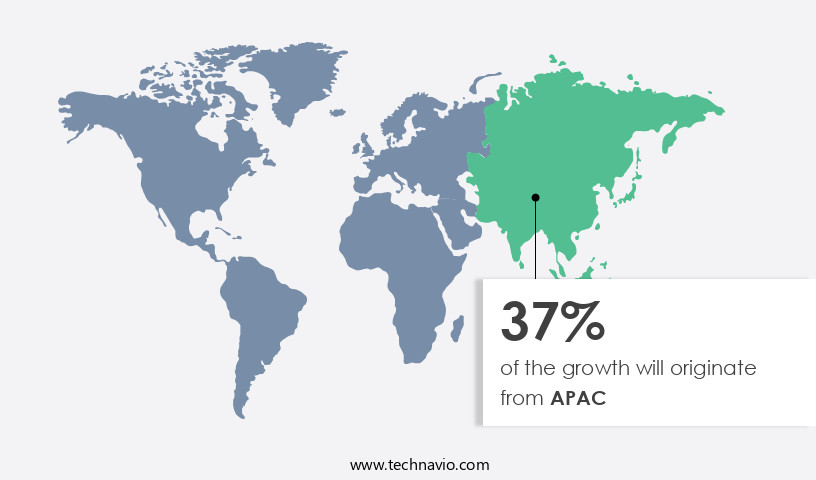

APAC is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to the increasing number of organizations catering to both Asian and Western clients. Competitive pricing and robust infrastructure are driving factors in this region. A notable trend is the rising consumption of mobile-based information services, enabling users to access data, news, and analytics from any connected device. The APAC region's digitalization is accelerating across industries, fueled by increasing Internet penetration, smartphone adoption, and the expansion of digital platforms. Deep learning and artificial intelligence are integral components of modern information services, enhancing data analysis and insights. Data warehousing and data archival ensure data security and compliance, while data transformation and data mining extract valuable information.

Predictive analytics and prescriptive analytics provide actionable insights for data-driven decision making. Neural networks and machine learning algorithms are essential for advanced data analytics and business intelligence. Natural language processing and sentiment analysis aid in understanding customer behavior and preferences. Data visualization and data reporting facilitate effective communication of insights. Data governance, data migration, and data compliance are crucial aspects of managing the data lifecycle. Metadata management and search engine optimization optimize data accessibility and discoverability. Data enrichment and data cleansing ensure data quality. Cloud computing and data monitoring enable efficient data management and real-time analysis. The Internet of Things and business process automation are transforming industries by integrating data from various sources.

Knowledge management systems facilitate the sharing and utilization of organizational knowledge. In summary, the market in APAC is witnessing substantial growth due to the adoption of advanced technologies, digitalization, and the increasing importance of data-driven decision making. Organizations are leveraging various services, including data warehousing, data analytics, and business intelligence, to gain a competitive edge.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Information Services Industry?

- The indispensable role of information services in risk management is the primary growth factor for this market.

- In today's global business landscape, enterprises face numerous risks from external and internal factors, including technological advancements, government policies, exchange rates, and credit and operational risks. Information services play a crucial role in helping organizations navigate these risks by providing up-to-date market data, competitor strategies, technology adoption trends, and other valuable insights. These services are developed by industry experts and enable businesses to make informed decisions, manage risks, and improve overall performance. Moreover, information services offer Environmental, Social, and Governance (ESG) data, which encompasses climate and energy transition, private assets and Small and Medium Enterprises (SMEs), counterparty risk management, supply chain, and trade.

- With the increasing importance of data usability, information architecture, data warehousing, and data visualization tools, businesses can gain deeper insights from their data through techniques such as natural language processing, data mining, predictive analytics, and data replication. Artificial intelligence and machine learning, including deep learning, are also transforming the market by enabling advanced data analysis, customer relationship management, and web analytics. Data security remains a top priority, with information services providers offering robust security measures to protect sensitive data from unauthorized access, theft, or loss. Additionally, data archival solutions ensure that businesses can store and access historical data for future analysis and compliance purposes.

- Overall, information services are essential for businesses seeking to stay competitive and mitigate risks in today's complex and dynamic marketplace.

What are the market trends shaping the Information Services Industry?

- The emergence of artificial intelligence (AI) in information management is a significant market trend. This development reflects the increasing demand for advanced technologies to streamline and optimize information processing and management tasks.

- In today's data-driven business landscape, enterprises worldwide are integrating advanced technologies, such as Artificial Intelligence (AI), into information services to automate processes, enhance efficiency, and optimize data utilization. AI-enabled information services streamline routine tasks, allowing employees to focus on more strategic initiatives. According to recent research, up to half of an organization's workforce spends significant time on paperwork, reducing overall ROI and increasing costs. By implementing AI in information services, businesses can automate data categorization and tagging, making it easier to locate and access critical information when needed. Moreover, AI-driven information services offer various advanced capabilities, including data mining, neural networks, sentiment analysis, text mining, and prescriptive analytics.

- These technologies enable businesses to gain valuable insights from their data, driving informed decision-making and strategic planning. Furthermore, data lifecycle management, metadata management, and search engine optimization are essential components of AI-integrated information services, ensuring data integrity, security, and accessibility. However, the adoption of AI in information services also raises ethical concerns, as businesses must ensure data privacy, security, and transparency. Therefore, data ethics plays a crucial role in the implementation and utilization of AI-driven information services. In conclusion, the integration of AI in information services is a game-changer for businesses, offering numerous benefits, from increased efficiency and data insights to improved data management and ethical considerations.

What challenges does the Information Services Industry face during its growth?

- The escalating concerns over data misappropriation, theft, and cybersecurity issues pose a significant challenge to the industry's growth and necessitate heightened efforts to safeguard sensitive information and ensure digital security.

- Information services play a crucial role in managing and protecting critical data for businesses and individuals. The handling of confidential data requires robust security measures to prevent unauthorized access, which can lead to significant financial losses. With the increasing use of cloud services and digital file sharing, the risk of data breaches and cyberattacks is heightened. Strict government regulations, particularly in the banking sector, mandate the implementation of advanced technologies to maintain data security and ensure regulatory compliance. These regulations aim to maintain the required capital adequacy ratio and protect consumers from fraudulent activities.

- To address these challenges, information service providers invest in various technologies and strategies. Data management platforms, data discovery tools, and data modeling techniques help organizations effectively manage and analyze their data. Data integration, enrichment, and reporting systems streamline business processes and improve decision-making. Advanced technologies such as computer vision, speech recognition, and business process automation enhance data processing capabilities and provide more accurate and efficient solutions. The Internet of Things (IoT) generates vast amounts of data, necessitating advanced data management and analysis tools. In conclusion, the market is dynamic and evolving, driven by the growing demand for data security, regulatory compliance, and advanced data processing capabilities.

- Organizations must invest in the right technologies and strategies to effectively manage their data and mitigate the risks associated with data breaches and cyberattacks.

Exclusive Customer Landscape

The information services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the information services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, information services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agence France Presse

- AGS Corp.

- Australian Associated Press Ltd.

- Bloomberg LP

- Clarivate PLC

- FUJIFILM Holdings Corp.

- GISP Group

- Moodys Corp.

- News Corp.

- Nexstar Media Group Inc.

- RELX Plc

- S and P Global Inc.

- The New York Times Co.

- Thomson Reuters Corp.

- United Press International Inc.

- Wolters Kluwer NV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Information Services Market

- In February 2024, IBM announced the launch of its new AI-powered data analytics platform, Watsonx, designed to help businesses make data-driven decisions more effectively (IBM Press Release, 2024). This development signifies a significant advancement in the market, as AI and machine learning technologies continue to revolutionize data analysis and interpretation.

- In June 2025, Microsoft and Google signed a multi-year partnership to expand their cloud services collaboration, with Microsoft Azure becoming the preferred choice for Google Workspace customers (Microsoft News Center, 2025). This strategic alliance represents a major shift in the cloud services landscape, potentially impacting market share and competition dynamics.

- In August 2024, Amazon Web Services (AWS) acquired Elemental Technologies, a leading provider of video processing and delivery solutions, for approximately USD500 million (AWS Press Release, 2024). This acquisition is expected to strengthen AWS's media and entertainment offerings, expanding its presence in the content delivery market.

- In November 2024, the European Union introduced the Digital Services Act, which includes new regulations on digital advertising, online marketplaces, and content moderation (European Commission, 2025). This policy change represents a significant development for the market, as it sets new standards for online content and advertising, potentially impacting business models and operations.

Research Analyst Overview

- In the dynamic the market, various players collaborate and compete to provide innovative solutions for managing and leveraging data. Data governance specialists ensure compliance with data privacy regulations and ethics guidelines, while data privacy advocates push for robust data security measures. Data brokers and data marketplaces facilitate data exchange, enabling businesses to access valuable insights. Artificial intelligence models, machine learning algorithms, and robotics software are transforming data analytics, empowering data analysts and data scientists to uncover hidden patterns and trends. Knowledge managers and data consultants provide strategic guidance on implementing data management software and business intelligence platforms.

- Cloud data storage, cybersecurity solutions, and blockchain technology are crucial components of the data landscape, ensuring data privacy, security, and integrity. Speech recognition engines and data visualization tools enhance user experience and facilitate data accessibility. Data engineers and data security experts work together to build and maintain complex data infrastructures. Deep learning frameworks and automation tools streamline data processing and analysis, enabling businesses to make data-driven decisions. Data management software and data governance frameworks provide structure and control, ensuring data accuracy and consistency. Overall, the market is characterized by continuous innovation, collaboration, and the integration of various technologies to help businesses effectively manage and leverage their data assets.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Information Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.8% |

|

Market growth 2025-2029 |

USD 182.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.3 |

|

Key countries |

US, China, Japan, UK, India, Germany, Canada, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Information Services Market Research and Growth Report?

- CAGR of the Information Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the information services market growth of industry companies

We can help! Our analysts can customize this information services market research report to meet your requirements.