Compact Power Equipment Rental Market Size 2024-2028

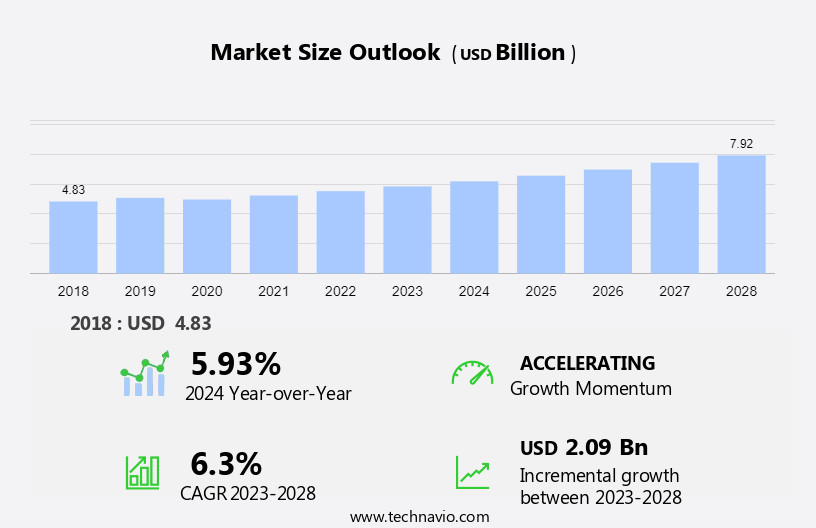

The compact power equipment rental market size is forecast to increase by USD 2.09 billion at a CAGR of 6.3% between 2023 and 2028.

- The market in North America is witnessing significant growth due to the expansion of the construction industry. The integration of advanced technologies such as telematics, fuel cells, batteries, and transformers in compact power equipment like pumps, generators, compressors, bulldozers, and power tools is driving the market growth. These technologies enhance equipment efficiency, reduce operational costs, and improve safety. However, operational challenges associated with compact power equipment rentals, including maintenance, transportation, and fuel management, continue to pose challenges for market growth. Influencers like HVAC, lighting, and HVACR industries are also adopting compact power equipment to meet their energy needs. The market is expected to witness further growth with the increasing demand for eco-friendly and cost-effective power solutions.

What will be the Size of the Market During the Forecast Period?

- The market encompasses a diverse range of machinery and tools, including engine-driven and electric power tools such as drills, polishers, woodwork routers, and screw drivers. This market plays a vital role in infrastructure development and maintenance by providing lightweight, efficient solutions for construction projects and various industries. The market's size is significant, with continuous growth driven by the increasing demand for specialized equipment that offers improved performance, lower emissions, and enhanced functionality. Rental services for generators, compressors, and other power equipment are increasingly popular due to their cost-effectiveness and convenience. Equipment tracking systems and online platforms, along with mobile applications, facilitate seamless rental processes and efficient inventory management.

- The transition towards electric equipment, such as those powered by batteries, electricity, and fuel cells, is gaining momentum due to their environmental benefits and the advancements in electric motors, transformers, and battery technology. Overall, the market is a dynamic and evolving landscape that caters to the ever-changing needs of various industries and construction projects.

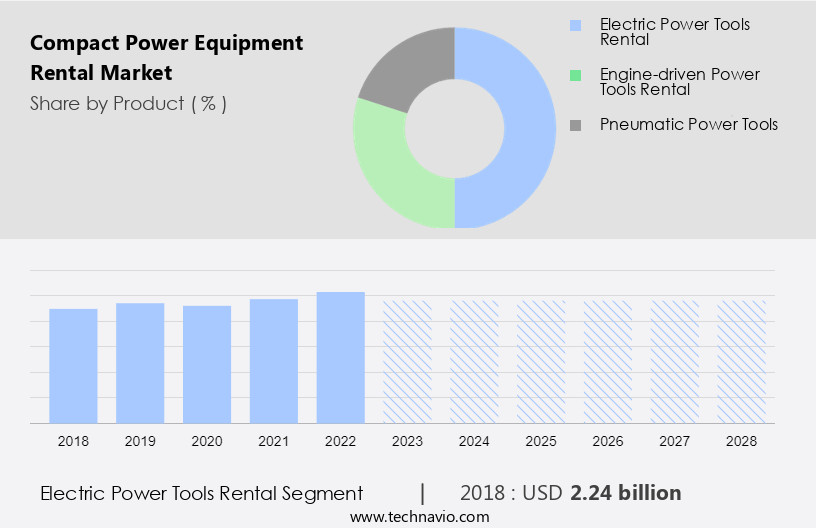

How is this Compact Power Equipment Rental Industry segmented and which is the largest segment?

The compact power equipment rental industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Electric power tools rental

- Engine-driven power tools rental

- Pneumatic power tools

- Type

- Period rental

- Rent to own

- On-demand rental

- Geography

- North America

- US

- Europe

- Germany

- France

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By Product Insights

- The electric power tools rental segment is estimated to witness significant growth during the forecast period.

The market has experienced significant growth due to the increasing focus on environmental sustainability and the reduction of carbon emissions. Electric power tools, a key segment of this market, offer lower emissions and reduced noise levels compared to engine-driven alternatives. This makes them an attractive option for urban and noise-sensitive environments, driving demand, particularly in residential and commercial settings. Electric power tools are also lighter, easier to handle, and require less maintenance, making them suitable for a wide range of users, including DIY enthusiasts, contractors, and professionals. Rental services provide an accessible solution for end-users to utilize eco-friendly equipment without the long-term commitment of ownership.

Get a glance at the Compact Power Equipment Rental Industry report of share of various segments Request Free Sample

The electric power tools rental segment was valued at USD 2.24 billion in 2018 and showed a gradual increase during the forecast period.

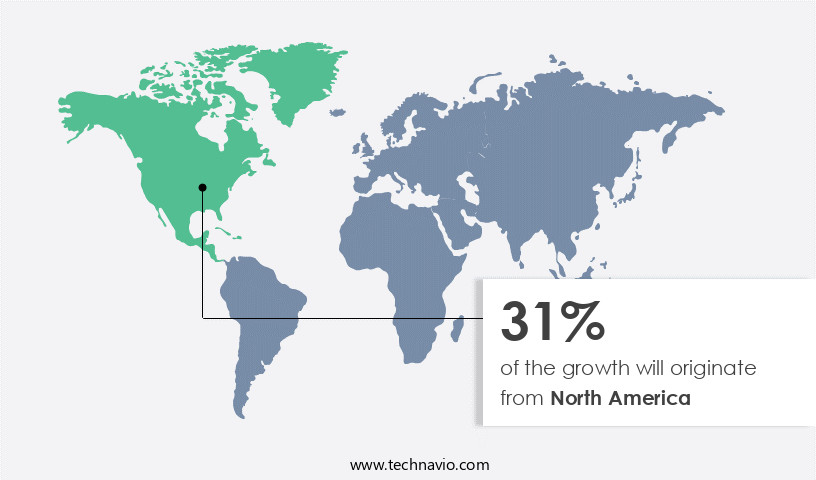

Regional Analysis

- North America is estimated to contribute 31% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is driven by the growth In the construction industry, particularly In the US. Despite federal spending cuts, the industry is projected to expand due to low housing loan interest rates and a pipeline of infrastructure projects. In Canada and Mexico, similar positive trends are anticipated. Infrastructure development is a significant growth factor, with numerous projects planned in the US during the forecast period. Compact power equipment, including generators, compressors, pumps, and various power tools, is essential for these projects. Equipment types include engine-driven, electric, pneumatic, and specialized tools for drilling, polishing, woodwork routing, screw driving, and more.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Compact Power Equipment Rental Industry?

Growth of global construction industry is the key driver of the market.

- The construction industry's evolution in developed economies, including the US and the UK, is driven by infrastructure maintenance, sustainable building practices, and investments in green technologies. Aging infrastructure necessitates significant restoration and maintenance efforts, while the shift towards sustainable building development and retrofitting contributes to the industry's growth. This expansion of the construction sector creates substantial opportunities for The market. Power tools, including engine-driven, electric, and pneumatic varieties, are essential for various construction applications such as drilling, polishing, woodwork routing, and screw driving. Lightweight and specialized equipment cater to diverse needs in infrastructure development and maintenance. The rental market offers flexibility in equipment selection through short-term, mid-term, and long-term rentals.

- In addition, online platforms and mobile applications streamline rental services, enabling contractors to efficiently manage tool wear, equipment tracking, and power sources (diesel, gasoline, electric, hydraulic, etc.) for their projects. The market also prioritizes low-emission equipment, fuel-efficient engines, telematics systems, and emission control systems to cater to the evolving industry demands. Equipment types include generators, compressors, pumps, light towers, and a wide range of machinery and tools. Batteries, fuel, electric motors, transformers, lighting, and rechargeable batteries are essential power sources. The market continues to grow, catering to the industrial, residential, utilities, and various construction sectors.

What are the market trends shaping the Compact Power Equipment Rental Industry?

Integration of advanced technologies in compact power equipment is the upcoming market trend.

- The market is driven by the integration of telematics and Internet of Things (IoT) technologies. Real-time tracking, remote monitoring, and data analytics enable proactive maintenance, reducing downtime and enhancing equipment utilization, leading to cost savings and operational efficiency. Advanced technologies, such as predictive maintenance, collect and analyze data on equipment health and performance to anticipate potential issues, schedule timely maintenance, and extend equipment life. Smart technologies also contribute to improved safety standards, with features like collision avoidance systems, operator monitoring, and real-time safety alerts enhancing on-site safety and reducing accidents and injuries. Equipment rental companies benefit from these advancements, increasing reliability and customer satisfaction.

- In addition, infrastructure development projects, including construction and infrastructure maintenance, continue to drive demand for compact power equipment. The rental market offers various equipment types, including power tools like drilling, polishing, woodwork routing, and screw driving, as well as engine-driven and electric power tools. Equipment types include generators, compressors, pumps, and emission control systems, with power sources ranging from diesel, gasoline, electric, hydraulic, and fuel-efficient engines. Rental services offer short-term, mid-term, and long-term rentals to contractors, utilities, and residential customers. Online platforms and mobile applications facilitate equipment rental and tracking. Compact power equipment includes lightweight and specialized equipment, such as chain saws, portable generators, IT equipment, HVAC systems, and heavy machinery.

What challenges does the Compact Power Equipment Rental Industry face during its growth?

Operational challenges associated with compact power equipment rentals is a key challenge affecting the industry growth.

- Compact power equipment rental plays a crucial role in various sectors, including construction projects, infrastructure development, and infrastructure maintenance. However, the rental market poses unique challenges. Equipment wear and tear, caused by varied usage histories, can lead to operational disruptions and downtime. Ensuring the availability of specific types of compact power equipment, such as power tools like drills, polishers, woodwork routers, and screw drivers, engine-driven power tools, pneumatic power tools, and specialized equipment, is essential. Logistical challenges arise when transporting compact power equipment to and from rental sites, with potential delays or damage impacting project timelines and overall efficiency. To mitigate these challenges, rental services offer a range of solutions.

- Equipment tracking systems help monitor the location and usage of rented equipment. Low-emission electric equipment and fuel-efficient engines contribute to reduced environmental impact and cost savings. Online platforms and mobile applications facilitate easy rental booking and management. Telematics systems provide real-time equipment performance data, enabling proactive maintenance and repair. Compact power equipment types include generators, compressors, pumps, emission control systems, light towers, and various power sources like diesel, gasoline, electric, hydraulic, and batteries. Rental durations vary, with short-term, mid-term, and long-term options available to cater to different project requirements. Contractors and end-users rely on rental services to provide reliable power sources and machinery for their projects, ensuring the smooth execution of their operations.

Exclusive Customer Landscape

The compact power equipment rental market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the compact power equipment rental market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, compact power equipment rental market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aggreko Plc

- Ahern Rentals

- Ashtead Group Plc

- Bierschbach Equipment and Supply

- Briggs and Stratton LLC

- Caterpillar Inc.

- Compact Power Equipment Rental

- Construction Equipment Rentals OMATA

- Cooper Equipment Rentals Ltd.

- Cummins Inc.

- Doosan Portable Power Co.

- Dynamic Equipment Rentals

- Finning International Inc.

- Herc Holdings Inc.

- Makita Power Tools India Pvt. Ltd.

- Manlift Middle East LLC

- Pioneer Power Service Pvt Ltd.

- STARK Building Materials UK Ltd.

- The Home Depot Inc.

- United Rentals Inc.

- Titan Machinery Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of machinery and tools that cater to various industries and applications. This market includes engine-driven power tools such as drills, polishers, woodwork routing machines, and screw drivers, as well as electric power tools and pneumatic power tools. The demand for compact power equipment is driven by infrastructure development projects and infrastructure maintenance, among others. One significant trend In the market is the shift towards lightweight and fuel-efficient equipment. Contractors and rental companies are increasingly seeking equipment that offers improved productivity and reduced operating costs. This has led to the development of low-emission electric equipment and specialized equipment designed for specific applications.

Moreover, another trend In the market is the integration of technology into rental services. Online platforms and mobile applications have made it easier for customers to search for and rent equipment, while telematics systems enable real-time equipment tracking and monitoring. Equipment rental companies are also investing in emission control systems and fuel-efficient engines to meet environmental regulations and reduce operating costs. The market is segmented based on equipment type, including generators, compressors, pumps, and various types of machinery and tools. The rental duration is another segmentation criterion, with short-term, mid-term, and long-term rentals available to cater to different customer needs.

In addition, the rental demand for compact power equipment is influenced by various factors, including the nature of the project, the location, and the availability of power sources. Diesel, gasoline, electric, hydraulic, and other power sources are used to operate the equipment, depending on the specific application. Equipment wear and maintenance are critical considerations In the market. Rental companies must ensure that their equipment is well-maintained to maintain customer satisfaction and prevent downtime. This involves regular inspections, repairs, and replacement of worn-out parts. The trend towards lightweight, fuel-efficient, and technologically advanced equipment is driving innovation and growth In the market. Rental companies must stay abreast of these trends and invest In the latest technology to remain competitive and meet the evolving needs of their customers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.3% |

|

Market growth 2024-2028 |

USD 2.09 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.93 |

|

Key countries |

US, China, Japan, Germany, and France |

|

Competitive landscape |

Leading Companies, market growth and forecasting Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Compact Power Equipment Rental Market Research and Growth Report?

- CAGR of the Compact Power Equipment Rental industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the compact power equipment rental market growth of industry companies

We can help! Our analysts can customize this compact power equipment rental market research report to meet your requirements.