Compound Camphor Ointment Market Size 2024-2028

The compound camphor ointment market size is forecast to increase by USD 3.81 billion at a CAGR of 11.64% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for this therapeutic product. The rising prominence of online retailing is also contributing to market expansion, as consumers increasingly turn to e-commerce platforms for convenience and accessibility. However, government regulations regarding the use of camphor and health hazards associated with its application pose challenges to market growth. Despite these challenges, the market is expected to continue its upward trajectory, driven by the proven effectiveness of compound camphor oil ointment in treating various conditions such as muscle pain, joint inflammation, and skin infections. As online sales channels continue to gain popularity and regulatory frameworks evolve, the market is poised for continued growth In the coming years.

What will be the Size of the Compound Camphor Ointment Market During the Forecast Period?

- The market caters to the demand for effective topical solutions for various consumer health conditions. Key drivers for this market include the prevalence of chest congestion, fungal infections,infectious diseases, hemorrhoids, and chronic pain. The sedentary lifestyle and aging population also contribute to the market growth, as they increase the incidence of musculoskeletal diseases, osteoporosis, and workplace-related injuries. Furthermore, spinal cord injuries, obesity, and heart disease symptoms necessitate pain relief solutions. Compound camphor ointment finds application In the prevention and treatment of itching, cold sores, toenails, warts, burns, and swelling. As a muscle relaxant, it is also used for internal use in certain cases.

- The market presents investment opportunities In the formulation development of camphor ointment for diverse applications, including anti-itching and fungal infection treatments. However, potential risks such as overdose accidents and internal use require careful consideration.

How is this Compound Camphor Ointment Industry segmented and which is the largest segment?

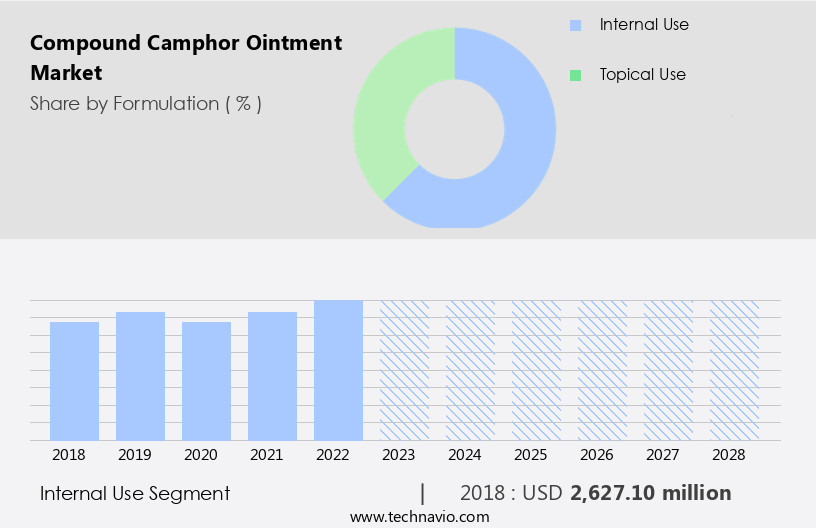

The compound camphor ointment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Formulation

- Internal use

- Topical use

- Geography

- APAC

- China

- India

- North America

- Mexico

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Formulation Insights

- The internal use segment is estimated to witness significant growth during the forecast period.

The internal use segments is estimated to witness significant growth during the forecast period. Camphor is a terpene (organic compound) that is commonly used in creams, ointments, and lotions. The internal use of compound camphor ointment includes its inhalation to relieve coughing. Inhaling the vapors of compound camphor ointment provides temporary relief to cough triggered by irritation in the throat or lungs.

Get a glance at the Compound Camphor Ointment Industry report of share of various segments Request Free Sample

The Internal use segment was valued at USD 2.63 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

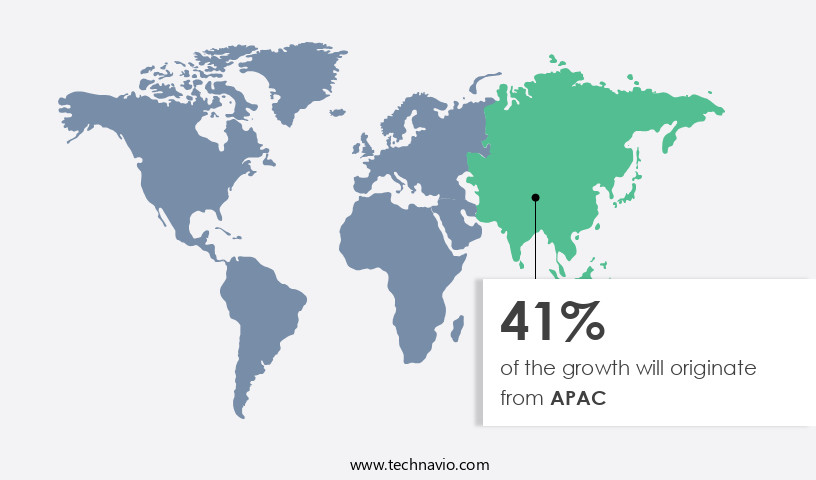

- APAC is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Asia Pacific (APAC) is experiencing consistent growth due to the rising demand for camphor oil in pharmaceutical applications, particularly in China and India. Arthritis patients are a significant consumer base In these countries, with India having a substantial population affected. Approximately 1% of India's population suffers from rheumatoid arthritis, and over 180 million people have arthritis, making it more prevalent than diabetes, AIDS, and cancer. Camphor ointment is commonly used to alleviate pain and inflammation associated with musculoskeletal diseases such as arthritis. Additionally, it is used for various other health conditions, including chest congestion, fungal infections, hemorrhoids, sedentary lifestyle, geriatric population, osteoporosis, chronic pain, workplace-related injuries, spinal cord injuries, and obesity.

Topical use of compound camphor ointment is a popular pain relief solution for various conditions, making it an essential component of preventive healthcare. The pain relief segment dominates the market, driven by the increasing healthcare expenditure and the availability of various formulations for different indications. Analgesic drugs, including compound camphor ointment, are widely used for pain relief, anti-itching, and fungal infections. The market is expected to continue growing due to the increasing prevalence of conditions requiring pain relief and the availability of various drug delivery systems.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Compound Camphor Ointment Industry?

Growing demand for compound camphor ointment is the key driver of the market.

- Compound camphor ointment holds significant value In the medical industry due to its versatile applications. This ointment is commonly used for treating various conditions, including chest congestion, fungal infections, hemorrhoids, and musculoskeletal diseases such as osteoarthritis. Its superior properties, including antibacterial, antifungal, and anti-inflammatory effects, make it an essential component in medication formulations. Topical use of compound camphor ointment is prevalent for pain relief, particularly for conditions like osteoporosis, chronic pain, workplace-related injuries, and spinal cord injuries. It is also effective in providing relief from symptoms of obesity, such as body pain and swelling. Furthermore, it acts as a muscle relaxant, making it beneficial for preventive healthcare.

- The ointment's anti-itching properties make it an ideal solution for conditions like warts, toenails, and cold sores. It can also be used to alleviate heart disease symptoms, such as pain and itching. Compound camphor ointment's widespread use is attributed to its ability to offer effective pain relief and its affordability, making it a popular choice in retail pharmacies as an over-the-counter (OTC) medication. Investment pockets In the healthcare sector, particularly In the pain relief segment, are expected to drive the demand for compound camphor ointment. Analgesic drugs, which are a significant component of compound camphor ointment, accounted for a substantial share of healthcare expenditure in 2020.

- As the geriatric population continues to grow, the demand for pain relief solutions is anticipated to increase, further boosting the market for compound camphor ointment. In summary, compound camphor ointment's multifaceted applications and benefits make it an essential component In the medical industry. Its use in treating various conditions, from pain relief to fungal infections, and its affordability make it a popular choice for consumers. The growing healthcare expenditure on pain relief solutions and the increasing geriatric population are expected to fuel the demand for compound camphor ointment In the coming years.

What are the market trends shaping the Compound Camphor Ointment Industry?

Growing prominence of online retailing is the upcoming market trend.

- The market In the US is witnessing significant growth due to various factors. Chest congestion, fungal infections, hemorrhoids, and musculoskeletal diseases are common health issues leading to the increased demand for pain relief solutions. The geriatric population, with its higher susceptibility to osteoporosis, chronic pain, and workplace-related injuries, also contributes to the market expansion. Obesity, a prevalent health concern, increases the risk of various conditions such as osteoarthritis, body pain, swelling, and itching, further driving the demand for compound camphor ointment. Topical use of analgesic drugs, including compound camphor ointment, is a popular preventive healthcare measure for various conditions.

- The pain relief segment dominates the market due to the high prevalence of pain-related conditions. The OTC availability of compound camphor ointment in retail pharmacies adds to its accessibility and affordability. Drug delivery systems, such as transdermal patches and creams, are being increasingly adopted for their effectiveness and convenience. The increasing healthcare expenditure and the availability of investment pockets In the pain relief segment provide opportunities for market growth. Compound camphor ointment is used for various conditions, including cold sores, toenails, warts, burns, and heart disease symptoms. Its anti-itching properties make it effective for fungal infections and other skin and dermatology conditions.

- However, the risk of overdose accidents due to internal use is a concern that requires caution. In conclusion, the market In the US is expected to grow due to the rising prevalence of various health conditions and the increasing popularity of topical pain relief solutions. The market dynamics, including the growing geriatric population, obesity, and workplace injuries, contribute to the market growth. The availability of various formulations, drug delivery systems, and OTC availability further support the market expansion.

What challenges does the Compound Camphor Ointment Industry face during its growth?

Government regulations for and health hazards of using camphor is a key challenge affecting the industry growth.

- The market is driven by the prevalence of various health conditions such as chest congestion, fungal infections, hemorrhoids, and musculoskeletal diseases including osteoporosis and osteoarthritis. The geriatric population, with its increased susceptibility to these conditions, represents a significant consumer base. Sedentary lifestyles and obesity further contribute to the market growth. The pain relief segment, which includes analgesic drugs for body pain, swelling, and itching, holds a substantial market share. Topical use of compound camphor ointment for conditions like cold sores, warts, burns, and heart disease symptoms is common. However, stringent government regulations and guidelines regarding the use of camphor can pose challenges to market growth.

- These regulations include restrictions on internal use and the requirement for drug delivery systems to minimize overdose accidents. The market for compound camphor ointment is expected to witness steady growth due to its role as a pain relief solution and its use in preventive healthcare for various conditions. The market size is anticipated to expand In the coming years, with investment pockets in formulation development and anti-itching and fungal infection treatments.

Exclusive Customer Landscape

The compound camphor ointment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the compound camphor ointment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, compound camphor ointment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Amrutanjan Health Care Ltd. - The market caters to the demand for topical pain relievers, delivering effective solutions for everyday stress-related discomfort and alleviating headaches and cold-related body pains. This product category is recognized for its ability to provide instantaneous warmth and relaxation, making it a popular choice among consumers seeking quick relief from various types of pain. The market offers a range of high-quality camphor ointments, formulated with essential ingredients that enhance their therapeutic properties.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amrutanjan Health Care Ltd.

- Caribe Natural LLC

- China Resources Pharmaceutical Group Ltd.

- DLC Laboratories Inc.

- DWD Pharmaceuticals Ltd.

- Emu Joy

- Focus Consumer Healthcare

- Haw Par Corp. Ltd.

- Indiana Botanic Gardens Inc.

- ROHTO Pharmaceutical Co. Ltd

- Strides Pharma Science Ltd.

- The J.R. Watkins Co.

- The Procter and Gamble Co.

- Trifecta Pharmaceuticals USA LLC

- World Perfumes Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of topical formulations utilized for various therapeutic applications. This market caters to a diverse consumer base, including individuals afflicted by conditions such as chest congestion, fungal infections, and skin irritations, among others. The prevalence of these conditions, driven by factors such as sedentary lifestyles, an aging population, and the increasing incidence of chronic diseases, has fueled the demand for effective pain relief solutions. The market for compound camphor ointment is characterized by its dynamic nature, driven by several key factors. The growing awareness of preventive healthcare and the rising healthcare expenditure have led to an increased focus on the development of innovative pain relief formulations.

Additionally, the market is witnessing significant advancements in drug delivery systems, enabling the creation of more effective and efficient topical treatments. The pain relief segment, a significant contributor to the market, is expected to maintain its dominance due to the high prevalence of pain-related conditions. These conditions can be attributed to various factors, including obesity, osteoarthritis, and workplace-related injuries. The market also caters to specific demographics, such as men and women, who experience unique pain-related issues. The market is further segmented based on formulation types, including those designed for internal use and those intended for topical application. Topical use remains the preferred method due to its convenience, ease of application, and minimal side effects.

The market also offers various formulations for specific conditions, such as analgesics for body pain, muscle relaxants for spinal cord injuries, and anti-itching solutions for fungal infections. The market is also witnessing significant growth In the OTC sector, with retail pharmacies serving as key distribution channels. This trend is driven by the increasing consumer preference for self-medication and the availability of over-the-counter pain relief solutions. The market is also witnessing a shift towards more advanced formulations, such as those incorporating advanced analgesic drugs and improved formulation compositions. Despite the numerous opportunities, the market faces several challenges. These include the risk of overdose accidents due to the potent nature of some formulations and the presence of counterfeit products In the market.

Additionally, the market is subject to regulatory scrutiny due to the potential risks associated with certain formulations and their active ingredients. In conclusion, the market is a dynamic and evolving industry, driven by the growing demand for effective pain relief solutions. The market is characterized by its diverse consumer base, innovative product development, and the increasing focus on preventive healthcare. Despite the challenges, the market offers significant growth opportunities for investors and industry participants alike.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

134 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.64% |

|

Market growth 2024-2028 |

USD 3811.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.12 |

|

Key countries |

China, US, Germany, India, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Compound Camphor Ointment Market Research and Growth Report?

- CAGR of the Compound Camphor Ointment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the compound camphor ointment market growth of industry companies

We can help! Our analysts can customize this compound camphor ointment market research report to meet your requirements.