Consumer Healthcare Market Size 2025-2029

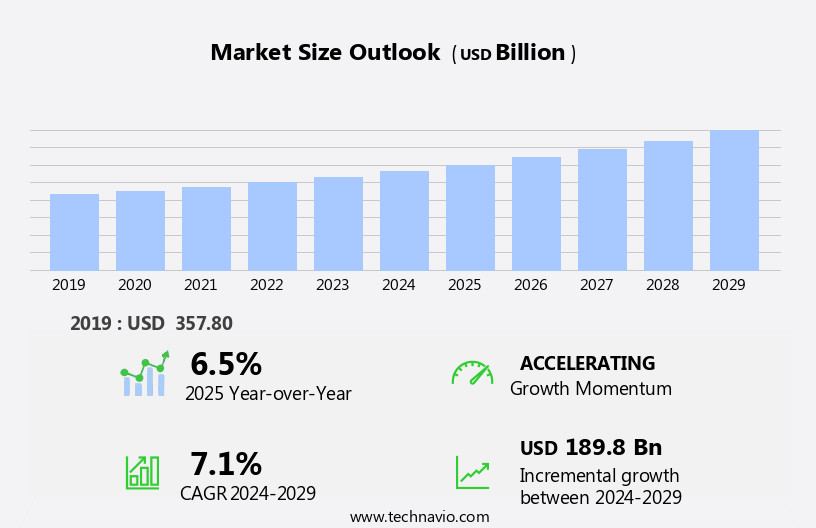

The consumer healthcare market size is forecast to increase by USD 189.8 billion at a CAGR of 7.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by increasing awareness about lifestyle diseases and the accelerated use of online resources. According to recent studies, non-communicable diseases such as diabetes, cardiovascular diseases, and cancer are on the rise, leading consumers to seek proactive healthcare solutions. The market is responding to this trend with an expanding range of products and services, including dietary supplements, over-the-counter medicines, and digital health solutions. However, the market is not without challenges. One major issue is the lack of corroborative studies on the efficacy and safety of dietary supplements, leading to regulatory scrutiny and consumer skepticism. Digital health innovations, such as telemedicine, health apps, and wearables, offer convenience and accessibility to consumers. Additionally, the digitalization of healthcare presents opportunities but also brings challenges such as data privacy concerns and the need for standardization. Companies seeking to capitalize on market opportunities and navigate these challenges effectively must prioritize transparency, evidence-based innovation, and regulatory compliance. By staying abreast of these trends and addressing consumer needs, they can position themselves for long-term success in the dynamic market.

What will be the Size of the Consumer Healthcare Market during the forecast period?

- The market encompasses a broad range of products and services designed to meet the healthcare needs of individuals outside of traditional medical settings. Key categories include wellness, oral health, nutrition, skin health, medicines, healthcare professional engagement, personal healthcare products, health supplements, cosmetics, disinfectants, consumer medical devices, nutraceuticals, digital health, OTC goods, preventative medicine, and drug distribution. This market is characterized by strong growth, driven by increasing consumer awareness and demand for self-care solutions. Trends include the rise of personalized and digital health offerings, the integration of healthcare professionals into consumer product offerings, and the increasing importance of preventative medicine.

- Counterfeit drugs and safety concerns remain challenges, while the growing popularity of OTC medicines and weight loss products adds to the market's complexity. Overall, the market is a dynamic and evolving landscape, presenting both opportunities and challenges for stakeholders.

How is this Consumer Healthcare Industry segmented?

The consumer healthcare industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- OTC pharmaceuticals

- Dietary supplements

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Asia

- Europe

- France

- Germany

- UK

- Rest of World (ROW)

- North America

By Product Insights

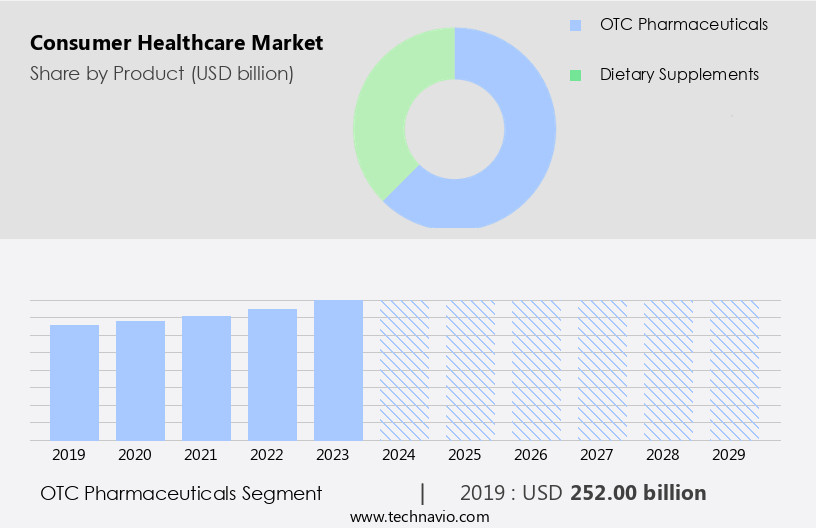

The OTC pharmaceuticals segment is estimated to witness significant growth during the forecast period. Over-the-counter (OTC) drugs, also known as self-medications, are non-prescription medicines approved by regulatory bodies like the US Food and Drug Administration (FDA) for individual purchase and use. These medications cater to various health concerns, encompassing pain relief, skin conditions, respiratory symptoms, sleep disorders, smoking cessation, weight management, and gastrointestinal issues. OTC drugs are accessible through multiple channels, including pharmacies, grocery stores, and online retail pharmacies. These products are readily available on the shelves, catering to consumers' convenience and accessibility. OTC drugs encompass a wide range of therapeutic areas, including analgesics, weight loss products, gastrointestinal products, skin products, mineral supplements, vitamin supplements, sleeping aids, ophthalmic products, sports nutrition, sports supplements, vitamins, minerals, amino acids, probiotics, omega-3 fatty acids, carbohydrates, and botanicals.

Get a glance at the market report of share of various segments Request Free Sample

The OTC pharmaceuticals segment was valued at USD 252.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

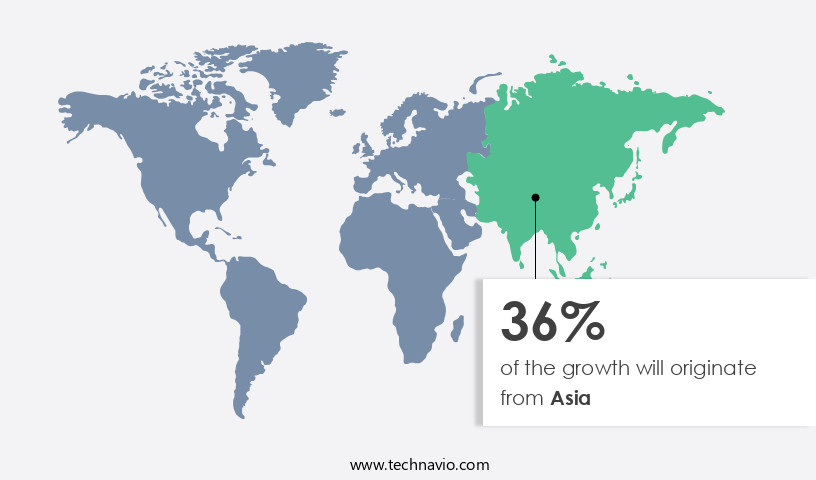

Asia is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American region leads the market, accounting for a significant market share. Factors driving this growth include the increasing prevalence of skin diseases, technological advancements in pharmaceuticals, and the aging population. In the US, consumer interest in healthy diets is on the rise due to increased awareness of food nutritional content and extensive promotional efforts by dietary supplement manufacturers, trade organizations, and healthcare institutions. Key product categories include OTC pharmaceuticals, nutraceuticals, cosmetics, and consumer medical devices. Digital health solutions, such as telemedicine, health apps, and wearables, are gaining popularity for their convenience and accessibility.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Consumer Healthcare Industry?

- Awareness about lifestyle diseases is the key driver of the market. The market has experienced significant growth in recent years due to changing lifestyle and dietary habits. Urbanization and consumerism have led to an increase in the consumption of artificial and synthetic food, contributing to the rise of lifestyle diseases such as obesity, Type 2 diabetes, heart disease, stroke, and atherosclerosis.

- In response, people are turning to dietary supplements, sports nutrition, and weight management products to maintain their health. The market is expanding, with numerous players entering the market to offer value-added solutions in segments like allergy, digestive health, feminine care, cough and cold, flu, pain, and dietary supplements. This trend is expected to continue as consumers become more health-conscious and seek effective solutions to manage their health concerns.

What are the market trends shaping the Consumer Healthcare Industry?

- Accelerated use of online resources in global consumer healthcare market is the upcoming market trend. The market is witnessing significant growth as individuals increasingly turn to the Internet for easy access to health information, leading to the popularity of self-medication with over-the-counter (OTC) medicines. Manufacturers and retailers of consumer healthcare products are capitalizing on this trend by expanding their online presence.

- E-commerce websites, such as healthkart.Com, vitacost.Com, and vivavitamins.Com, offer a wide range of vitamin health drinks, protein shakes, and supplements, among other products. These sites provide added convenience to customers through features like live chats, ensuring instant support during the purchasing process. The shift to online platforms is driven by the convenience and visibility benefits they offer to both manufacturers and consumers.

What challenges does the Consumer Healthcare Industry face during its growth?

- Lack of corroborative studies on dietary supplements is a key challenge affecting the industry growth. The nutraceutical market faces challenges due to conflicting exaggerated claims from manufacturers. Pharmaceutical companies and health agencies often disagree on the effects and benefits of nutraceuticals, leading to consumer confusion.

- The wide circulation of invalidated literature on side effects further complicates the issue. However, the publications and mandates of reputable organizations, such as the US Food and Drug Administration (FDA) and the World Health Organization (WHO), can help clarify misunderstandings in developed markets. Ensuring accurate and evidence-based information is crucial for the growth and trustworthiness of the nutraceutical industry.

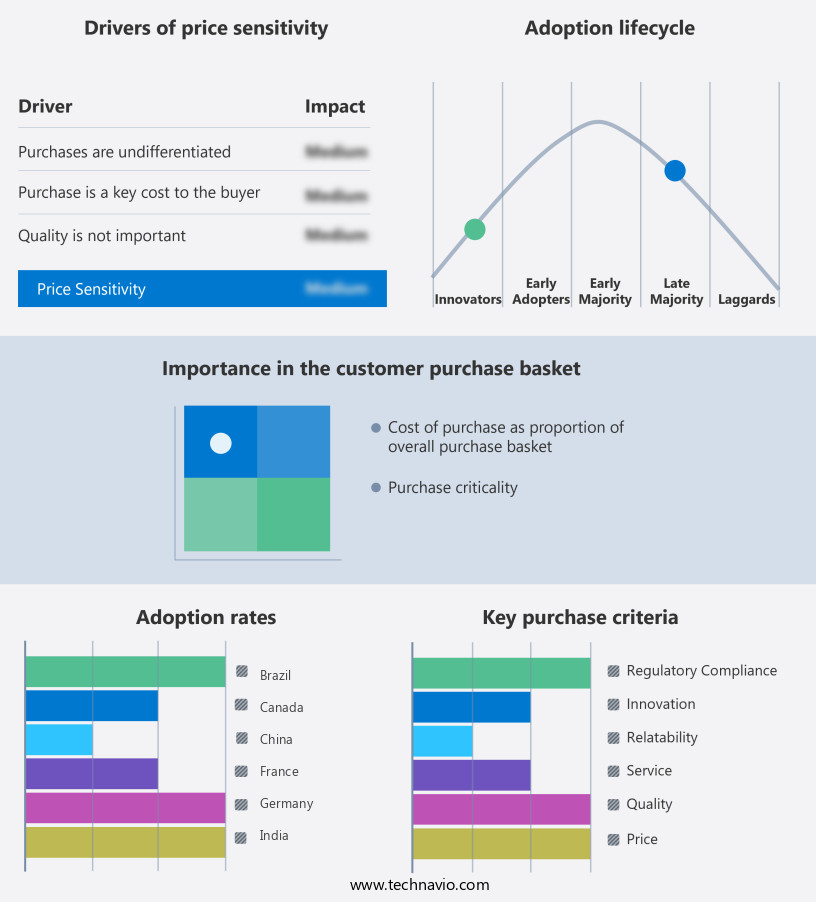

Exclusive Customer Landscape

The consumer healthcare market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the consumer healthcare market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, consumer healthcare market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Amway Corp.

- BASF SE

- Bayer AG

- BioGaia AB

- Boehringer Ingelheim International GmbH

- Chr Hansen AS

- Danone SA

- Eisai Co. Ltd.

- Glanbia plc

- GSK Plc

- Herbalife International of America Inc.

- Himalaya Global Holdings Ltd.

- Johnson and Johnson Inc.

- Kellogg Co.

- Koninklijke DSM NV

- Nestle SA

- Pfizer Inc.

- Reckitt Benckiser Group Plc

- Sanofi SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad range of products and services designed to promote wellness and prevent or manage various health conditions. This market includes sectors such as oral health, nutrition, skin health, and medicines. Oral health solutions cater to maintaining optimal hygiene and addressing dental issues, while nutrition-related offerings focus on providing essential nutrients for overall health and disease prevention. Skin health is another significant area within the market. Products in this sector range from creams and sprays to nutritional supplements, addressing various concerns such as aging, acne, and sun damage. OTC pharmaceuticals and dietary supplements are popular choices for self-medication, providing affordable alternatives to prescription treatments.

In addition, healthcare costs remain a critical factor influencing consumer behavior in the healthcare market. The geriatric population, with its increased healthcare needs, presents a substantial market opportunity. Prevalence rates for various diseases, including cardiovascular diseases, mental health issues, and age-related diseases, continue to rise, driving demand for patient-centric treatments. These solutions enable on-demand diagnosis, behavioral coaching, and treatments, making healthcare more accessible and personalized. The market is diverse and dynamic, with various players offering branded products, private labels, OTC generics, and customized products.

Moreover, startups and established companies alike are investing in product approval, branding, and estimations to gain a competitive edge. Counterfeit pharmaceuticals pose a significant challenge to the market, with online sources being a primary distribution channel. Consumers must be educated about the risks associated with purchasing counterfeit products and the importance of purchasing from reputable sources. Healthcare expenditures continue to rise, driven by an aging population and increasing disease prevalence. As a result, there is a growing emphasis on preventative medicine and early diagnosis, leading to increased demand for OTC goods, nutraceuticals, and digital health solutions.

Furthermore, drug distribution channels, including wholesalers, retailers, and online pharmacies, play a crucial role in ensuring consumers have access to a wide range of healthcare products. Competition among these channels is fierce, with each offering unique benefits and advantages to consumers. Innovations in digital health, personalized products, and self-medication are transforming the way consumers access and manage their healthcare needs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 189.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, China, Japan, Germany, India, Canada, Brazil, UK, France, and South Korea |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Consumer Healthcare Market Research and Growth Report?

- CAGR of the Consumer Healthcare industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Asia, Europe, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the consumer healthcare market growth of industry companies

We can help! Our analysts can customize this consumer healthcare market research report to meet your requirements.