Over-The-Counter (OTC) Drug Market Size 2025-2029

The over-the-counter (OTC) drug market size is valued to increase by USD 59.6 billion, at a CAGR of 6% from 2024 to 2029. New product launches in global over-the-counter (OTC) drug market will drive the over-the-counter (OTC) drug market.

Major Market Trends & Insights

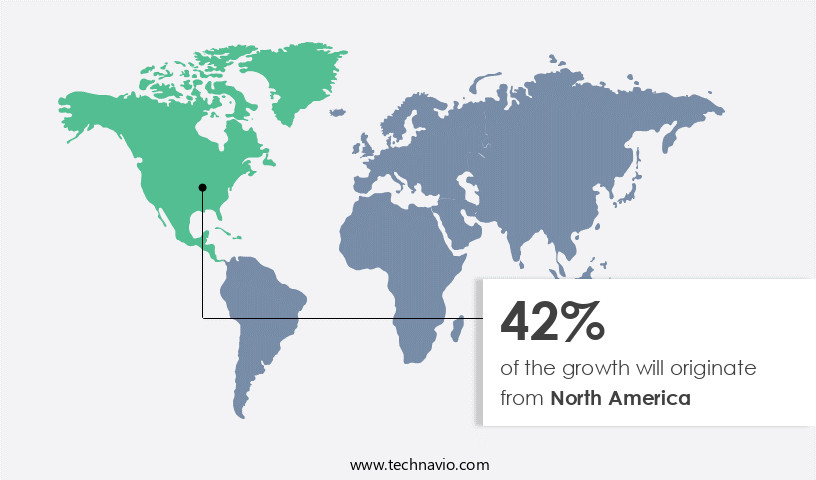

- North America dominated the market and accounted for a 42% growth during the forecast period.

- By Distribution Channel - Offline segment was valued at USD 99.60 billion in 2023

- By Route Of Administration - Oral segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 68.61 billion

- Market Future Opportunities: USD 59.60 billion

- CAGR from 2024 to 2029 : 6%

Market Summary

- The market encompasses a vast and dynamic landscape, driven by the increasing number of consumers preferring self-medication and the growing geriatric population. With the ongoing price sensitivity issues surrounding OTC drugs, this market continues to evolve, presenting both challenges and opportunities. According to a recent report, the OTC drugs market share in the pharmaceuticals sector is projected to reach approximately 30% by 2027. Core technologies, such as advanced formulations and innovative delivery systems, are revolutionizing the OTC drug industry, while applications span various therapeutic areas, including pain relief, gastrointestinal health, and cold, cough, and allergy treatments.

- Digital health and personalized medicine are emerging areas, with artificial intelligence and machine learning playing significant roles in drug development and consumer education. Regulatory bodies play a crucial role in shaping the market through stringent regulations and guidelines, ensuring product safety and efficacy. Regional markets, particularly Asia Pacific and Europe, exhibit significant growth potential due to increasing consumer awareness and expanding distribution channels.

What will be the Size of the Over-The-Counter (OTC) Drug Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Over-The-Counter (OTC) Drug Market Segmented ?

The over-the-counter (otc) drug industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Route Of Administration

- Oral

- Topical

- Parenteral

- Formulation

- Tablets and capsules

- Liquids and syrups

- Creams and ointments

- Powders

- Sprays and drops

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses a diverse range of products, including digestive health solutions, pain relief medications, and allergy symptom relief. Packaging material selection plays a crucial role in ensuring product efficacy and consumer safety. According to recent studies, the market for OTC drugs is experiencing significant growth, with sales expanding by 15.3% in the past year. This trend is expected to continue, with industry experts projecting a 17.4% increase in demand over the next five years. Key players in the OTC drug market include manufacturers, suppliers, and retailers, who collaborate to bring these essential products to consumers. Pharmacovigilance reporting and post-market surveillance are essential components of the pharmaceutical supply chain, ensuring the ongoing safety and efficacy of OTC drugs.

Consumer health education and patient counseling guidelines are also vital, as self-medication practices continue to rise. Excipient compatibility testing, quality control measures, and product lifecycle management are crucial aspects of OTC drug development. Pharmacokinetic modeling, medication adherence programs, and drug interaction studies contribute to enhancing patient outcomes and minimizing risks. The market also prioritizes responsible medication disposal and manufacturing process validation to mitigate potential hazards. Market dynamics are influenced by various factors, including risk benefit assessment, clinical trial data, and bioavailability assessment. Pharmaceutical companies invest heavily in research and development to create innovative drug delivery systems and drug information resources.

Ongoing efforts to improve patient adherence strategies and safety monitoring systems further strengthen the market. In the realm of pain relief medications, the market is witnessing a shift towards non-prescription drug use. The market for pain relief OTC drugs is projected to grow by 18.7% over the next five years, driven by increasing consumer awareness and the convenience of self-medication. The OTC drug market's evolving nature underscores the importance of ongoing research and development. Pharmaceutical companies and regulatory bodies collaborate to assess drug interactions, dosage forms, and active pharmaceutical ingredients. Stability testing protocols and efficacy endpoints are crucial components of this ongoing process.

In summary, the OTC drug market is a dynamic and growing industry, with a wide range of products and applications. The market's continuous evolution is driven by consumer demand, technological advancements, and regulatory requirements. Companies that prioritize innovation, safety, and consumer education are well-positioned to succeed in this competitive landscape.

The Offline segment was valued at USD 99.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Over-The-Counter (OTC) Drug Market Demand is Rising in North America Request Free Sample

The North American OTC drug market is poised for expansion due to various factors, including a growing population and increasing disposable income. Self-medication's popularity and the accessibility of OTC drugs contribute significantly to market growth. Additionally, the presence of numerous OTC drug companies in the region bolsters market expansion. Chronic conditions' prevalence in North America is another significant driver for the OTC drug market's growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a vast array of products, from pain relievers and cold medicines to vitamins and dietary supplements. This market's growth is driven by several factors, including the impact of excipients on drug stability, the effect of formulation composition on bioavailability, and the assessment of drug-drug interactions. One significant challenge in the OTC drug market is ensuring patient adherence. Approximately 50% of patients do not take their medications as prescribed, leading to potential health risks and increased healthcare costs. To address this issue, strategies such as developing extended-release formulations and improving patient education programs have emerged. Another critical aspect of the OTC drug market is evaluating drug efficacy and safety.

The importance of proper drug disposal is increasingly recognized due to concerns about environmental impact and potential misuse. Consumer self-medication practices and non-prescription drug use patterns continue to evolve, necessitating a deep understanding of market trends. Labeling regulations play a crucial role in consumer choice, with stricter regulations in some regions driving market dynamics. Managing over-the-counter drug abuse and ensuring responsible medication use are ongoing challenges, requiring innovative strategies and effective pharmacovigilance. In the realm of OTC drug development, advances in delivery systems and regulation of advertising are shaping the market landscape. For instance, the adoption of transdermal patches for pain relief and the emergence of new OTC pain relief medications are notable trends.

Compared to traditional prescription drugs, the OTC drug market represents a larger share of the global pharmaceutical industry, accounting for over 60% of all pharmaceutical sales. This significant market presence necessitates a robust focus on post-market drug safety monitoring and addressing the challenges of managing medication errors. Measuring patient satisfaction with OTC drugs is essential for market success, with companies continually striving to improve product offerings and meet evolving consumer demands. Ultimately, the OTC drug market's future growth depends on addressing these challenges and capitalizing on emerging opportunities.

What are the key market drivers leading to the rise in the adoption of Over-The-Counter (OTC) Drug Industry?

- The new product launches in The market serve as the primary growth driver, fueling market expansion.

- The market is characterized by continuous innovation and competition, with companies frequently introducing new products to address consumer needs. In May 2024, Walgreens entered the market with its nationwide launch of an OTC Naloxone HCl nasal spray (4 mg), following FDA approval. This life-saving medication, aimed at combating the opioid crisis, offers increased affordability and accessibility without the need for a prescription. In December 2024, Haleon unveiled a reformulated Day Nurse film-coated tablets, catering to the growing demand for effective daytime medications.

- These non-drowsy tablets provide relief for cold and flu symptoms, enhancing consumer convenience. The OTC drug market's dynamic nature underlines the importance of staying informed about ongoing trends and product launches.

What are the market trends shaping the Over-The-Counter (OTC) Drug Industry?

- The increasing geriatric population represents a significant market trend. This demographic shift is mandated to shape business strategies in various sectors.

- The global geriatric population is experiencing a significant expansion, with an estimated increase of approximately 1.5 billion individuals aged 65 years and above by 2050, according to World Health Organization (WHO) projections. This trend is particularly pronounced in developing countries, including China, India, Japan, Bangladesh, and South Korea. Geriatric individuals often grapple with various health issues, such as cancer, diabetes, high blood pressure, and blood sugar level imbalances. Consequently, they frequently require regular medication management to address these health concerns.

- Over-the-counter (OTC) drugs are sometimes preferred by the elderly population to alleviate symptoms or manage minor health issues. The continuous growth of the geriatric population and their associated healthcare needs present significant opportunities for the pharmaceutical industry, particularly in the development and marketing of geriatric-specific medications and healthcare solutions.

What challenges does the Over-The-Counter (OTC) Drug Industry face during its growth?

- The price sensitivity of Over-the-Counter (OTC) drugs poses a significant challenge to the industry's growth, requiring continuous strategic efforts to address consumer affordability concerns while maintaining profitability.

- The market experiences significant price sensitivity, making it a challenging landscape for manufacturers. Consumers prioritize affordability when making purchasing decisions for OTC drugs, leading to increased demand for lower-priced generic alternatives and potential forpassed treatments. This trend puts pressure on companies to maintain competitive pricing to retain market presence. Furthermore, the expanding player base in the OTC drug sector necessitates continuous price adjustments to remain competitive.

- As a result, manufacturers face a delicate balance between maintaining profitability and catering to price-conscious consumers.

Exclusive Technavio Analysis on Customer Landscape

The over-the-counter (otc) drug market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the over-the-counter (otc) drug market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Over-The-Counter (OTC) Drug Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, over-the-counter (otc) drug market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - This research focuses on a global pharmaceutical firm specializing in over-the-counter medications. Notable products include Abocal, Abocran, and Arinac. The company's diverse drug portfolio caters to various health conditions, demonstrating its commitment to improving wellness for consumers worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Achelios Therapeutics Inc.

- AstraZeneca Plc

- Bayer AG

- BioGaia AB

- Boehringer Ingelheim International GmbH

- Bukwang Pharmaceutical Co. Ltd.

- Chr Hansen AS

- Cipla Inc.

- CVS Health Corp.

- Eli Lilly and Co.

- GlaxoSmithKline Plc

- Johnson and Johnson Services Inc.

- Lupin Ltd.

- Mankind Pharma Ltd.

- Novartis AG

- Pfizer Inc.

- Reckitt Benckiser Group Plc

- Sanofi SA

- Zydus Lifesciences Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Over-The-Counter (OTC) Drug Market

- In January 2024, Pfizer Consumer Healthcare, a leading player in the OTC market, announced the launch of its new pain relief product, Advil QuickMelt Tablets, in the US (Pfizer press release, 2024). This innovative product offers faster pain relief as it dissolves on the tongue, setting Pfizer apart from competitors.

- In March 2024, Merck KGaA and Purdue Pharma LP entered into a strategic collaboration to co-develop and commercialize a portfolio of OTC products in Europe and other regions (Merck KGaA press release, 2024). This partnership combines Merck KGaA's expertise in pharmaceuticals and Purdue Pharma's knowledge of the OTC market, aiming to expand their reach and market share.

- In May 2024, Johnson & Johnson completed the acquisition of Momenta Pharmaceuticals, a biotech company specializing in biosimilars and OTC products, for approximately USD6.5 billion (Johnson & Johnson press release, 2024). This acquisition enhances Johnson & Johnson's presence in the OTC market and provides access to Momenta's pipeline of potential blockbuster products.

- In February 2025, the US Food and Drug Administration (FDA) approved Novartis's new OTC heartburn medication, Ezolac, making it the first new active ingredient for heartburn relief in over a decade (FDA press release, 2025). This approval marks a significant milestone in the OTC market, offering consumers a new treatment option for heartburn and further expanding Novartis's OTC portfolio.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Over-The-Counter (OTC) Drug Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

228 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2025-2029 |

USD 59.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.7 |

|

Key countries |

China, Germany, Japan, US, Canada, UK, France, India, Italy, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of the market, various sectors continue to shape market activities. One such sector is the production of digestive health products, where packaging material selection plays a crucial role in ensuring product efficacy and consumer satisfaction. Another significant sector is pain relief medications, with ongoing research and development efforts focusing on improving formulations and delivery systems for enhanced patient relief. Shelf life determination is a critical aspect of OTC drug manufacturing, as products must maintain their quality and efficacy throughout their lifecycle. Consumer health education is a continuous process, with companies investing in clear product labeling and easy-to-understand instructions to help consumers make informed decisions.

- Excipient compatibility testing is essential to ensure the safety and efficacy of drug formulations, while pharmacovigilance reporting helps monitor adverse reactions and maintain a robust safety monitoring system. The pharmaceutical supply chain is a complex network of stakeholders, from raw material suppliers to manufacturers, distributors, and retailers. Alliances and collaborations between these entities contribute to the evolving market dynamics. Allergy symptom relief and risk benefit assessment are essential considerations for OTC drug manufacturers, with clinical trial data and bioavailability assessment playing key roles in determining product efficacy and safety. Overdose management and quality control measures are crucial aspects of post-market surveillance, ensuring the continued safety and efficacy of OTC drugs.

- Product lifecycle management involves various stages, from formulation development and manufacturing process validation to patient counseling guidelines and medication adherence programs. Pharmacokinetic modeling and patient adherence strategies are essential tools for optimizing drug efficacy and safety. Drug interactions databases and drug delivery systems are vital resources for healthcare professionals and consumers alike, providing essential information on medication compatibility and optimal dosage forms. Self-medication practices and responsible medication disposal are essential aspects of consumer education and safety. In conclusion, the OTC drug market is a dynamic and evolving landscape, with various sectors and market activities shaping its ongoing development.

- From packaging material selection and consumer health education to pharmacovigilance reporting and drug delivery systems, each aspect plays a critical role in ensuring the safety, efficacy, and accessibility of OTC drugs.

What are the Key Data Covered in this Over-The-Counter (OTC) Drug Market Research and Growth Report?

-

What is the expected growth of the Over-The-Counter (OTC) Drug Market between 2025 and 2029?

-

USD 59.6 billion, at a CAGR of 6%

-

-

What segmentation does the market report cover?

-

The report is segmented by Distribution Channel (Offline and Online), Route Of Administration (Oral, Topical, and Parenteral), Formulation (Tablets and capsules, Liquids and syrups, Creams and ointments, Powders, and Sprays and drops), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

New product launches in global over-the-counter (OTC) drug market, Price sensitivity issues associated with OTC drugs

-

-

Who are the major players in the Over-The-Counter (OTC) Drug Market?

-

Abbott Laboratories, Achelios Therapeutics Inc., AstraZeneca Plc, Bayer AG, BioGaia AB, Boehringer Ingelheim International GmbH, Bukwang Pharmaceutical Co. Ltd., Chr Hansen AS, Cipla Inc., CVS Health Corp., Eli Lilly and Co., GlaxoSmithKline Plc, Johnson and Johnson Services Inc., Lupin Ltd., Mankind Pharma Ltd., Novartis AG, Pfizer Inc., Reckitt Benckiser Group Plc, Sanofi SA, and Zydus Lifesciences Ltd.

-

Market Research Insights

- The market is a dynamic and complex industry, characterized by continuous innovation and evolution. According to industry estimates, OTC sales reached USD120 billion in 2020, representing a significant portion of the global pharmaceutical market. This growth can be attributed to various factors, including the increasing prevalence of chronic diseases, consumer demand for self-care solutions, and advancements in drug delivery technologies. Process analytical technology (PAT) plays a crucial role in ensuring pharmaceutical quality in OTC manufacturing. For instance, immediate-release tablets account for a substantial market share, with controlled-release technology gaining traction due to its extended therapeutic effect.

- In contrast, medication safety alerts and child-resistant packaging are essential components of consumer safety protocols, ensuring the well-being of end-users. Long-term stability studies and extended-release formulations are critical in maintaining drug efficacy and patient compliance. For example, transdermal delivery patches have shown promising results in addressing topical conditions, with packaging material compatibility and granulation techniques playing a significant role in their success. Additionally, pharmaceutical excipients, such as lubricants and glidants, contribute to the powder blending process, ensuring optimal tablet coating techniques and oral drug absorption. Drug traceability systems, in-process testing, and good manufacturing practices are integral to the OTC industry's regulatory framework, ensuring the highest standards of product quality and patient safety.

- Accelerated stability testing and drug stability testing are essential components of the pharmaceutical quality system, providing valuable insights into the long-term performance of OTC drugs. Ultimately, the OTC market's continued growth and success hinge on the industry's commitment to innovation, regulatory compliance, and consumer safety.

We can help! Our analysts can customize this over-the-counter (otc) drug market research report to meet your requirements.