Concrete Cooling Market Size 2024-2028

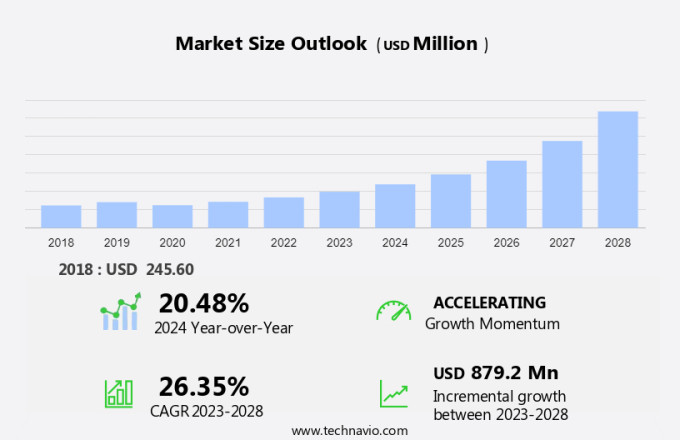

The concrete cooling market size is forecast to increase by USD 879.2 million at a CAGR of 26.35% between 2023 and 2028. The market is experiencing significant growth due to the industrialization and construction of complex buildings in rapidly urbanizing areas around the world. As cities expand into megacities, the demand for innovative solutions to maintain the desirable properties and building performance of concrete structures, particularly in warmer climates, is increasing. However, the construction market in North America and Europe may present fewer opportunities for market growth. This trend is driven by the increasing adoption of smart building technologies, which can help mitigate the time-consuming and resource-intensive process of traditional concrete cooling methods. To remain competitive, market players must stay abreast of these trends and innovate to meet the evolving needs of the construction industry.

What will be the Size of the Market During the Forecast Period?

The market is a significant sector within the construction industry, focusing on the application of various cooling techniques to ensure the production of high-quality concrete in high-temperature environments. This market plays a crucial role in infrastructure development, particularly in hot climatic regions, where the use of concrete is extensive in highway construction, and commercial, and residential projects. The concrete cooling process is essential to maintain the overall quality of poured concrete, as high temperatures can negatively impact its strength and tensile strength. Concrete cooling techniques include water cooling, ice cooling, and air cooling, each with its unique advantages.

Moreover, water cooling is a widely used method, where water is circulated through the concrete to absorb heat. This technique is effective in maintaining a consistent concrete temperature, ensuring the concrete sets well and is durable. In highway construction, for instance, water cooling is often employed to produce concrete for pavement and bridge construction in hot climates. High temperatures can significantly impact the quality of concrete used in infrastructure projects, such as dams, locks, ports, nuclear power plants, and indoor air quality applications. Proper concrete cooling is essential to ensure the concrete is well cooled down before it is transported and placed, resulting in a durable final product.

Furthermore, cement, a primary component of concrete, reacts with water to form hydrates, which strengthen the concrete. High temperatures can accelerate this process, leading to premature setting and reduced strength. Cooling the concrete slows down the hydration process, allowing the concrete to reach its full potential strength. In modern concrete construction, the demand for high-quality, durable concrete is on the rise. As a result, the market is witnessing significant growth. The market caters to various sectors, including infrastructure, commercial, and residential, ensuring the production of superior concrete in high-temperature environments. In conclusion, the market plays a vital role in the construction industry, particularly in hot climatic regions.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Ice cooling

- Water cooling

- Air cooling

- Liquid nitrogen

- Application

- Highway construction

- Power plant construction

- Port construction

- Dams and locks

- Geography

- Middle East and Africa

- APAC

- India

- South America

- Brazil

- North America

- Europe

- Middle East and Africa

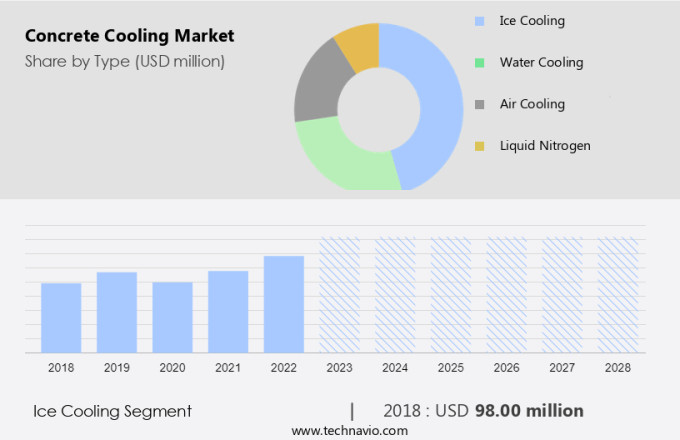

By Type Insights

The ice cooling segment is estimated to witness significant growth during the forecast period. In the construction industry, particularly for large-scale projects such as nuclear power plants and hydro dams, the use of flake ice for concrete cooling is a preferred choice. This cooling method helps mitigate the heat generated during the concrete curing process, ensuring the concrete reaches the required temperature for structural integrity. The versatility, low cost, and effectiveness of flake ice make it an ideal solution for critical low-temperature concrete specifications. Stringent governmental rules regarding carbon emissions and the lack of standardization in the market contribute to the increasing demand for efficient cooling methods like flake ice. Brand awareness and profitability are significant factors driving the growth of the ice cooling segment in The market.

However, technical difficulties in implementing and maintaining the cooling systems can pose challenges. Despite these hurdles, the benefits of using flake ice for concrete cooling are expected to outweigh the challenges, leading to continued market expansion during the forecast period.

Get a glance at the market share of various segments Request Free Sample

The ice cooling segment accounted for USD 98.00 million in 2018 and showed a gradual increase during the forecast period.

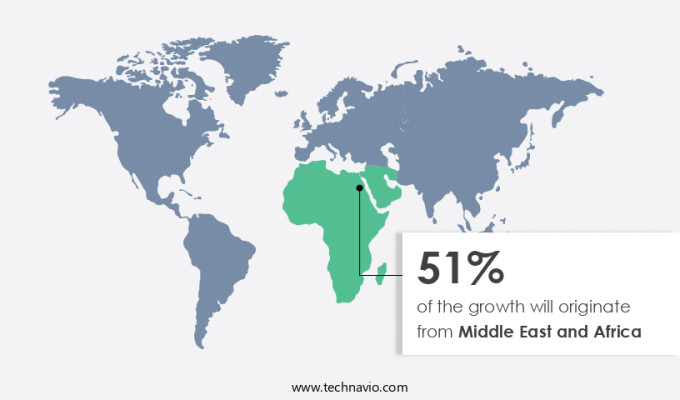

Regional Insights

Middle East and Africa is estimated to contribute 51% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is experiencing significant growth, particularly in regions with hot climates such as the Middle East and Africa. With the construction industry in these areas expanding at a rapid pace, the demand for high-quality concrete mix is increasing. Given the harsh weather conditions in these regions, the use of concrete cooling techniques, such as water cooling, is becoming increasingly important for ensuring the overall quality of poured concrete. This trend is expected to continue driving the growth of the market during the forecast period. The expansion of the construction industry in these regions is drawing in investors, making it an attractive sector for business growth.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Cities evolving into megacities is the key driver of the market. In 2023, approximately 52% of the global population resided in urban areas, a figure projected to expand by a low-single-digit percentage by 2030. By this time, one-third of the world's population will call urban areas home. Furthermore, it is estimated that 150 new cities will surpass one million inhabitants by 2030. Megacities, those with over 10 million residents, numbered around 44 in 2023, and this count is expected to rise by an additional 10 by 2030.

The ongoing urbanization trend will significantly fuel the expansion of the residential sector in the ensuing years, resulting in substantial demand for concrete cooling. This demand stems from the necessity to ensure that concrete structures in these rapidly expanding urban areas are well cooled down before they reach their full strength and tensile strength, thus producing durable infrastructure that can withstand the test of time.

Market Trends

A global platform for innovative products is the upcoming trend in the market. The concrete and masonry industry plays a significant role in the industrialization of properties and building structures in the construction market. With the increasing complexity of buildings and the need for energy efficiency and sustainability, innovations are essential to meet the demands of the current climate. companies in this industry showcase their latest technologically advanced products at the annual World of Concrete award program. This event highlights new and innovative concrete and masonry products, divided into various categories.

Furthermore, the materials for the concrete construction segment include reinforcement products, such as rebar accessories, joints, load transfers, cement, admixtures, prepacked mixes, vapor barriers, waterproofing materials, and curing/form release agents. These materials are crucial for enhancing the strength and durability of concrete structures, making them ideal for constructing smart buildings that cater to the needs of modern society. The World of Concrete award program provides a platform for companies to display their groundbreaking products and contribute to the ongoing evolution of the concrete and masonry industry.

Market Challenge

Fewer opportunities for the concrete cooling market in North America and Europe is a key challenge affecting the market growth. The construction industry in North America and Europe is currently undergoing a moderate expansion, influenced by unpredictable weather patterns, reduced construction activities, and various other challenges. In regions with temperatures below 20 degrees Celsius, such as North America and Europe, the need for concrete cooling is minimal due to the favorable conditions for concrete curing.

However, in warmer climates like the Middle East and certain parts of Asia Pacific, the use of concrete cooling becomes essential. In these regions, the extreme heat can cause concrete to crack and potentially damage structures. The markets in Europe and North America are currently facing constraints due to the decreased number of projects.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ConCool - The company offers concrete cooling products such as fluidized bed chillers and Blue Northern air chillers.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air Liquide SA

- Chirag Ice Factory Pvt. Ltd.

- Coldcrete Inc.

- Focusun Refrigeration Corp.

- Fujian Snowman Co. Ltd.

- Gulfcryo.

- Kirloskar Pneumatic Co. Ltd.

- KTI Plersch Kaltetechnik GmbH

- Linde Plc

- LINTEC Corp.

- Mellcon Engineers Pvt. Ltd.

- North Star Ice Equipment Corp.

- Penetron

- Polarmatic Oy

- Recom Ice Systems BV

- Rite-Temp Manufacturing Inc.

- SCHWING GmbH

- Tamutom ICE MACHINES

- Vogt Ice

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for concrete in infrastructure development, particularly in hot climatic regions. In these regions, the use of concrete cooling techniques such as water cooling, ice cooling, air cooling, and liquid nitrogen cooling is becoming increasingly popular. This is because well-cooled concrete ensures better overall quality, enhancing the strength and tensile strength of the concrete. The construction of complex buildings, smart buildings, highways, dams, locks, ports, and nuclear power plants is driving the demand for concrete cooling. The climate plays a crucial role in the market, as high temperatures can negatively impact the concrete curing process and result in poor concrete quality.

Furthermore, urbanization and industrialization are also contributing to the growth of the market. However, the market faces challenges such as time-consuming cooling processes, stringent governmental rules, lack of standardization, brand awareness, profitability, and technical difficulties. In the water cooling segment of dam and reservoir constructions, concrete cooling technique are essential to manage high temperature during the curing process. However, these methods can be time consuming and contribute to carbon emission, especially in large-scale projects like nuclear plant construction. Poor concrete curing can result in structural weaknesses, underscoring the need for more efficient and environmentally friendly cooling solutions to ensure durability and minimize environmental impact. Cement and water are the primary raw materials used in concrete production, and the market is expected to grow as the construction market expands. The market is also expected to be impacted by the declining effect of carbon emissions and the need for indoor air quality improvement. Despite these challenges, the market is expected to continue its growth trajectory due to the increasing demand for durable concrete structures in various sectors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 26.35% |

|

Market growth 2024-2028 |

USD 879.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

20.48 |

|

Regional analysis |

Middle East and Africa, APAC, South America, North America, and Europe |

|

Performing market contribution |

Middle East and Africa at 51% |

|

Key countries |

Saudi Arabia, United Arab Emirates, India, Brazil, and Indonesia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Air Liquide SA, Chirag Ice Factory Pvt. Ltd., Coldcrete Inc., ConCool, Focusun Refrigeration Corp., Fujian Snowman Co. Ltd., Gulfcryo., Kirloskar Pneumatic Co. Ltd., KTI Plersch Kaltetechnik GmbH, Linde Plc, LINTEC Corp., Mellcon Engineers Pvt. Ltd., North Star Ice Equipment Corp., Penetron, Polarmatic Oy, Recom Ice Systems BV, Rite-Temp Manufacturing Inc., SCHWING GmbH, Tamutom ICE MACHINES, and Vogt Ice |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Middle East and Africa, APAC, South America, North America, and Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch