Adhesives And Sealants Market Size 2025-2029

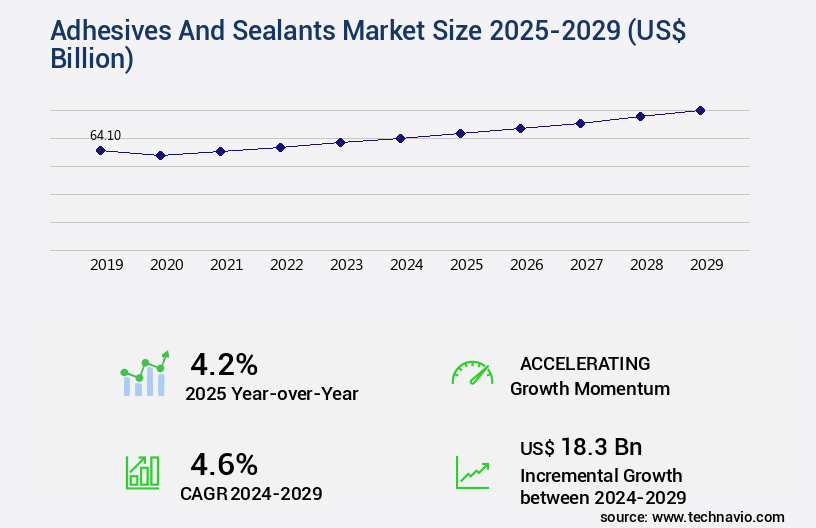

The adhesives and sealants market size is valued to increase USD 18.3 billion, at a CAGR of 4.6% from 2024 to 2029. Growing demand from construction and food packaging applications will drive the adhesives and sealants market.

Major Market Trends & Insights

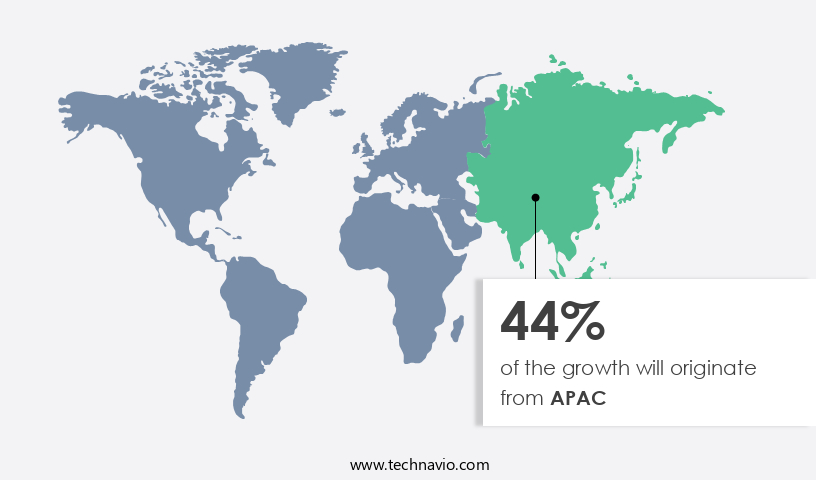

- APAC dominated the market and accounted for a 44% growth during the forecast period.

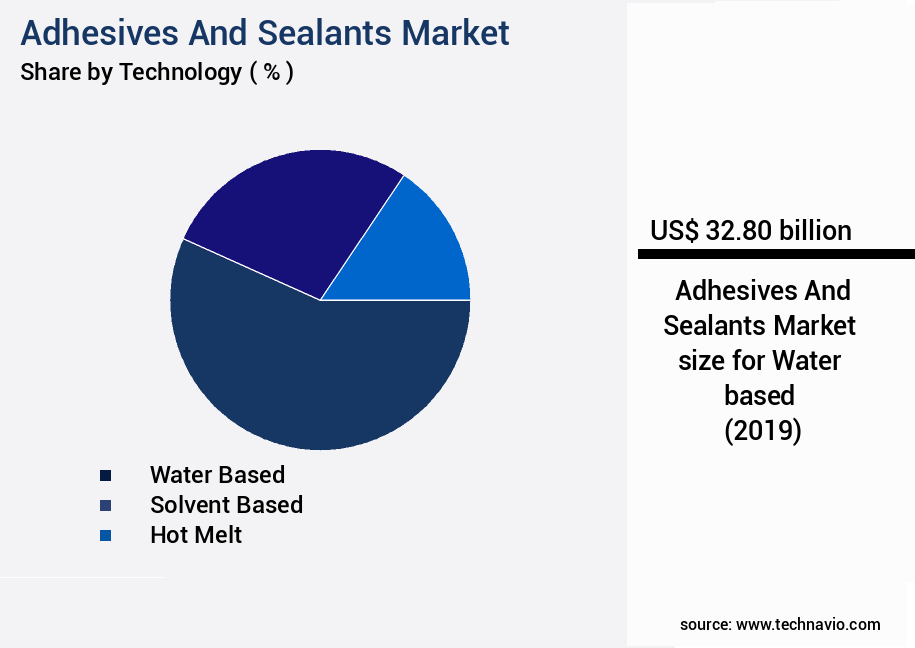

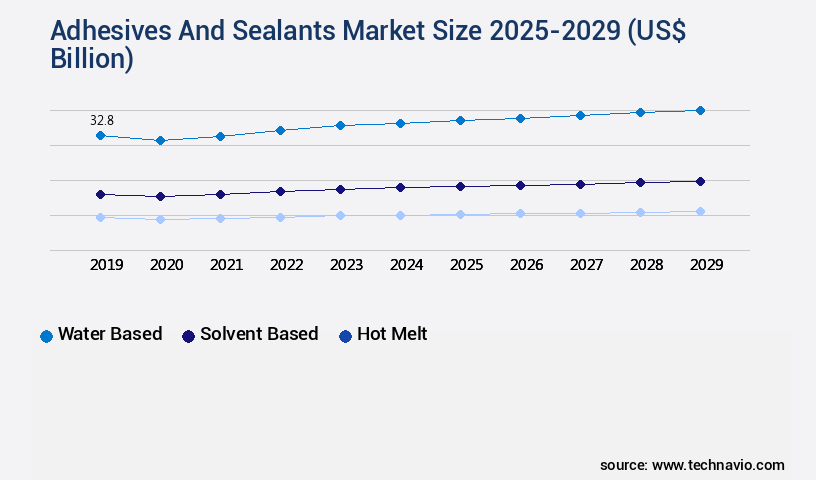

- By Technology - Water based segment was valued at USD 32.80 billion in 2023

- By End-user - Building and construction segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 41.03 billion

- Market Future Opportunities: USD 18.30 billion

- CAGR : 4.6%

- APAC: Largest market in 2023

Market Summary

- The market encompasses a diverse range of products and technologies, essential in various industries for bonding, sealing, and protecting surfaces. Core technologies include solvent-based, water-based, hot melt, and radiation-cured adhesives, each with unique advantages and applications. In recent years, this market has experienced significant growth, driven by expanding demand from core applications such as construction and food packaging.

- Simultaneously, the food packaging sector's shift towards sustainable and convenient solutions has fueled the use of adhesives. However, market growth faces challenges, including volatile raw material prices and increasing regulations. Despite these hurdles, opportunities abound, particularly in emerging markets and innovative applications, such as growing use in medical devices, which account for a 10% market share.

What will be the Size of the Adhesives And Sealants Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Adhesives And Sealants Market Segmented and what are the key trends of market segmentation?

The adhesives and sealants industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Water based

- Solvent based

- Hot melt

- Others

- End-user

- Building and construction

- Paper and packaging

- Transportation

- Leather and footwear

- Others

- Product Type

- Acrylic

- Polyurethanes

- Silicone-based adhesives and sealants

- Epoxy

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Technology Insights

The water based segment is estimated to witness significant growth during the forecast period.

Water-based adhesives and sealants, comprising primarily water as the solvent or carrier, have gained significant traction in the market due to their numerous advantages. These formulations account for a substantial market share, driven by their reduced environmental impact, lower volatile organic compound (VOC) emissions, and enhanced safety during handling and application. Among the various types of water-based adhesives, polyvinyl acetate emulsions are the most common. These adhesives utilize water as a carrier medium to disperse the resin, resulting in a low VOC content. The hazards and environmental impact of water-based adhesives are significantly less compared to their solvent-based counterparts.

Water-based adhesives exhibit impressive resistance to humidity, UV radiation, and discoloration. Structural adhesive bonding applications, such as bonding composites, laminates, and glass, greatly benefit from the water-based adhesive technology. Hot-melt adhesive applications, including packaging and labeling, also employ water-based adhesives due to their excellent performance. In terms of chemical resistance, water-based adhesives demonstrate notable strength in peel adhesion, particularly in applications like tape manufacturing. Adhesive failure analysis and surface preparation techniques play crucial roles in ensuring the optimal performance of water-based adhesives. Sealants, too, have adopted water-based technology, with water-based sealants accounting for a considerable market share.

The Water based segment was valued at USD 32.80 billion in 2019 and showed a gradual increase during the forecast period.

These sealants exhibit viscoelasticity, which allows them to maintain their shape while accommodating movement in structures. Water absorption and hydrogen bonding are essential factors in the selection of water-based sealants. Moisture-cure polyurethane sealants, a popular type of water-based sealant, offer excellent durability and elastic modulus. Their properties, such as water absorption, hydrogen bonding, and cohesive failure modes, make them suitable for various applications, including construction, automotive, and industrial. The adhesive and sealant industry anticipates a steady growth in the adoption of water-based technologies. According to recent industry reports, the market for water-based adhesives and sealants is projected to expand by 12%, while the market for water-based sealants is expected to grow by 15%.

These figures underscore the increasing demand for water-based technologies in various industries. In conclusion, the water-based the market is driven by their numerous advantages, including reduced environmental impact, lower VOC emissions, and enhanced safety. These technologies are increasingly being adopted across various industries, with significant growth expected in the coming years.

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Adhesives And Sealants Market Demand is Rising in APAC Request Free Sample

The market experiences continuous expansion due to their increasing utilization in sectors like construction, packaging, transportation, and others. The burgeoning infrastructure and construction activities in nations such as India, China, Japan, Thailand, and the Philippines contribute significantly to the market's growth. In APAC, the construction industry witnesses substantial investments from both public and private sectors, leading to a strong demand for adhesives and sealants.

These investments are primarily aimed at the construction and modernization of public infrastructure, further fueling market growth. The market's expansion is expected to remain steady, with numerous opportunities arising from the increasing demand for reliable bonding solutions in various industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of products, including epoxy resin adhesives with intricate curing kinetics, polyurethane sealants exhibiting superior thermal stability, acrylate adhesives undergoing rigorous bond strength testing methods, and silicone sealants susceptible to UV degradation mechanisms. These materials cater to various industries, each with unique requirements. Polyurethane adhesives and sealants, for instance, showcase notable adoption due to their moisture-cure properties and anaerobic curing conditions. In contrast, cyanoacrylate adhesives, known for their fast curing and high viscosity, command a distinct niche in the market. The market landscape is marked by a significant focus on developing advanced adhesive systems, such as UV curable adhesives, which offer design flexibility and improved performance.

Structural adhesive failure analysis methods and sealant viscoelasticity characterization techniques are critical in ensuring product reliability and longevity. Pressure-sensitive adhesives (PSAs) represent a substantial segment, with tack measurement techniques and contact angle analysis methods playing a crucial role in their production and application. PSAs exhibit diverse applications, from labeling and packaging to medical devices and automotive components. Hot-melt adhesive application equipment and bond strength testing standards are essential tools for manufacturers, ensuring consistent product quality and performance. Adhesive surface energy influence and rheological modeling are key considerations in adhesive formulation and application. Compared to traditional solvent-based adhesives, water-based adhesives and sealants account for a growing share, driven by environmental concerns and increasing demand for eco-friendly alternatives.

Additionally, the market is witnessing a surge in peel adhesion strength testing protocols and shear adhesion strength measurement procedures to ensure product performance under various stress conditions. In summary, the market is a dynamic and evolving landscape, driven by technological advancements, changing consumer preferences, and regulatory requirements. Manufacturers are continually innovating to meet the diverse needs of industries, ensuring the market's continued growth and relevance. More than 60% of new product developments focus on enhancing adhesive and sealant performance, with a particular emphasis on improving environmental sustainability and ease of application. This trend underscores the industry's commitment to delivering high-performance, eco-friendly solutions that cater to the evolving needs of various industries.

What are the key market drivers leading to the rise in the adoption of Adhesives And Sealants Industry?

- The construction and food packaging industries' increasing demand is the primary growth driver for the market.

- The market experiences significant growth, driven by the increasing demand in the construction and packaging industries. In the building and construction sector, adhesives play a pivotal role, serving functions such as fixing drywall lamination, prefabricated housing, adhesion of ceramic tiles, and cement joint anchoring. For instance, 3M's Polyurethane Construction Sealant 525, Gray, is a versatile bonding and long-lasting seal, enhancing the stability, durability, and strength of building components.

- In the packaging industry, adhesives ensure the secure bonding of various materials, contributing to the market's expansion. The evolving nature of these industries and the continuous demand for innovative adhesive solutions underscore the market's ongoing dynamism.

What are the market trends shaping the Adhesives And Sealants Industry?

- The increasing prevalence of adhesives in medical devices represents a significant market trend. This trend is driven by the advantages offered by adhesives, including improved patient outcomes and enhanced device functionality.

- The medical sector's increasing reliance on adhesives and sealants is driving market growth in this domain. Adhesives offer advantages over traditional fasteners in medical applications. New technologies are emerging for the reusable medical device market, including devices like disposable ECG electrodes, grounding plates, and others. These devices are manufactured using engineering resins, such as polyphenylene sulfide (PPS), polyolefins, and metals, including aluminum, titanium, nickel, and stainless steel.

- The medical adhesives market encompasses various types, such as epoxy, silicone, polysulfides, and polyurethanes. For example, Panacol's Structalit 701 is a medical-grade adhesive used for bonding surgical instruments. The continuous development of innovative adhesive solutions underscores the market's dynamism in the medical sector.

What challenges does the Adhesives And Sealants Industry face during its growth?

- The volatility in raw material prices poses a significant challenge to the industry's growth trajectory. In order to maintain competitiveness and profitability, businesses must closely monitor and adapt to fluctuations in the cost of essential inputs. This market instability can hinder long-term planning and strategic decision-making, making it a critical issue for industry professionals to address.

- The market faces considerable volatility due to the sensitivity of raw materials to price fluctuations and geopolitical tensions. Crude oil prices, a primary determinant of petrochemical derivatives, resins, and synthetic rubbers, significantly impact market dynamics. Unpredictable cost swings disrupt supply chains, compress profit margins, and complicate long-term planning for manufacturers. SMEs, in particular, are vulnerable due to their financial constraints and limited procurement leverage. Moreover, the industry's transition to sustainable and bio-based alternatives adds complexity and cost variability. While these alternatives offer environmental benefits, their limited scalability and inconsistent supply pose challenges. Adopting these alternatives requires substantial investment and strategic planning to mitigate risks.

- Despite these challenges, the market continues to evolve, with ongoing research and development efforts focusing on improving product performance, reducing environmental impact, and increasing efficiency. As the market landscape shifts, manufacturers must adapt to remain competitive and resilient in the face of price volatility and emerging trends.

Exclusive Technavio Analysis on Customer Landscape

The adhesives and sealants market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the adhesives and sealants market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Adhesives And Sealants Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, adhesives and sealants market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in providing a range of adhesives and sealants, including the 3M Scotch-Weld Acrylic Adhesive DP8410NS, 3M Scotch-Weld Epoxy Adhesive DP100 Plus, 3M Aerospace Sealant AC-251, and 3M Marine Adhesive Sealant Fast Cure 4200FC.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- AdCo UK Ltd.

- Arkema

- Avery Dennison Corp.

- BASF SE

- DELO Industrie Klebstoffe GmbH and Co. KGaA

- Dymax Corp.

- H.B. Fuller Co.

- Henkel AG and Co. KGaA

- Huntsman Corp.

- Indumarsan

- LG Chem Ltd.

- RPM International Inc.

- Sika AG

- Synthomer Plc

- Ter Group

- The Dow Chemical Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Adhesives And Sealants Market

- In January 2024, H.B. Fuller Company, a leading global adhesives provider, announced the launch of its new hot melt pressure-sensitive adhesive (HMPSA) product line, Fas-Tac Elite, designed for the labeling industry (Company Press Release). This innovation addresses the growing demand for high-performance adhesives in the labeling market.

- In March 2024, Sika AG, a Swiss specialty chemicals company, entered into a strategic partnership with 3M to expand its presence in the automotive industry. The collaboration focuses on the development and production of advanced adhesive and sealant systems for electric vehicles (Bloomberg). This partnership aims to leverage both companies' expertise and broaden their market reach.

- In April 2025, Henkel AG & Co. KGaA, a German adhesives and specialty chemicals company, completed the acquisition of the US-based Loctite Corporation from American multinational corporation, H.B. Fuller Company. The acquisition strengthened Henkel's position in the adhesives market, providing it with a broader product portfolio and increased market share (Company Press Release).

- In May 2025, the European Union's REACH regulation approved the use of a new bio-based raw material, derived from renewable sources, for the production of certain adhesives and sealants. This approval supports the growing trend towards sustainable and eco-friendly adhesive solutions, addressing the increasing demand for environmentally friendly alternatives (European Chemicals Agency Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Adhesives And Sealants Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

245 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 18.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, China, Canada, India, Japan, Germany, South Korea, UK, Australia, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The dynamic and evolving market encompasses a range of technologies, including pressure-sensitive adhesives, structural adhesive bonding, and sealants. One significant aspect of this market is the continuous advancements in adhesive properties, such as cyanoacrylate adhesive strength and tack strength measurement. Adhesive rheology plays a crucial role in determining the performance of various adhesive types. For instance, elongation at break and tensile strength are essential factors in pressure-sensitive adhesives, ensuring their ability to conform to surfaces and maintain bond strength. In contrast, structural adhesive bonding relies on high tensile adhesion strength and temperature resistance for robust bonding between different materials.

- Hot-melt adhesive application offers advantages in terms of chemical resistance and ease of use, making it a popular choice in various industries. Peel adhesion strength and adhesive failure analysis are critical considerations in evaluating the effectiveness of adhesive bonds, while surface preparation techniques ensure optimal bonding results. Sealants exhibit unique properties, such as viscoelasticity, water absorption, and durability. Silicone sealants, for example, are renowned for their high durability and resistance to UV degradation. Adhesive wetting behavior and contact angle analysis are essential in understanding sealant performance and compatibility with different substrates. The market also includes various adhesive types, such as epoxy resin adhesives and polyurethane sealants.

- Each type offers unique advantages, including moisture-cure polyurethane's flexibility and chemical resistance, and epoxy resin adhesives' high bond strength and temperature resistance. Adhesive primer selection, anaerobic adhesive mechanism, and cohesive failure modes are essential aspects of adhesive technology, ensuring optimal bonding performance and longevity. Additionally, understanding adhesive curing processes, such as acrylate adhesive curing and covalent bonding, is vital for manufacturers and users alike. The market is characterized by ongoing research and development, with a focus on enhancing adhesive properties, improving application techniques, and expanding the range of applications for various adhesive types.

What are the Key Data Covered in this Adhesives And Sealants Market Research and Growth Report?

-

What is the expected growth of the Adhesives And Sealants Market between 2025 and 2029?

-

USD 18.3 billion, at a CAGR of 4.6%

-

-

What segmentation does the market report cover?

-

The report segmented by Technology (Water based, Solvent based, Hot melt, and Others), End-user (Building and construction, Paper and packaging, Transportation, Leather and footwear, and Others), Product Type (Acrylic, Polyurethanes, Silicone-based adhesives and sealants, Epoxy, and Others), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing demand from construction and food packaging applications, Volatility in raw material prices

-

-

Who are the major players in the Adhesives And Sealants Market?

-

Key Companies 3M Co., AdCo UK Ltd., Arkema, Avery Dennison Corp., BASF SE, DELO Industrie Klebstoffe GmbH and Co. KGaA, Dymax Corp., H.B. Fuller Co., Henkel AG and Co. KGaA, Huntsman Corp., Indumarsan, LG Chem Ltd., RPM International Inc., Sika AG, Synthomer Plc, Ter Group, and The Dow Chemical Co.

-

Market Research Insights

- The market encompasses a diverse range of products, each engineered to meet specific performance criteria. Two key aspects of this industry are the continuous advancements in polymer chemistry and the stringent testing methods employed to ensure durability and regulatory compliance. For instance, industrial adhesives require high bond line thickness and excellent viscosity measurement for optimal cure time, while food contact adhesives necessitate microbial resistance and surface treatment for safe application. Moreover, the importance of fire resistance is evident in both industrial and construction applications. For example, construction sealants must exhibit gap filling capacity, creep resistance, and fatigue resistance, while automotive adhesives require thermal cycling and elasticity measurement for optimal performance.

- In contrast, medical grade adhesives necessitate strength testing methods and adherence to stringent regulatory standards. The market for adhesives and sealants is characterized by a focus on improving rheological properties, crosslinking density, and molecular weight distribution to meet evolving industry demands. For instance, adhesive dispensing systems have become increasingly sophisticated to ensure precise application and minimize waste. Similarly, advancements in polymer chemistry have led to the development of sealants with enhanced fire resistance and durability assessment. In summary, the market is a dynamic and evolving industry, driven by advancements in polymer chemistry, testing methods, and application technologies.

- The importance of durability, fire resistance, and regulatory compliance is paramount across various sectors, from industrial and construction to automotive and medical applications.

We can help! Our analysts can customize this adhesives and sealants market research report to meet your requirements.