Construction Machinery Market Size 2025-2029

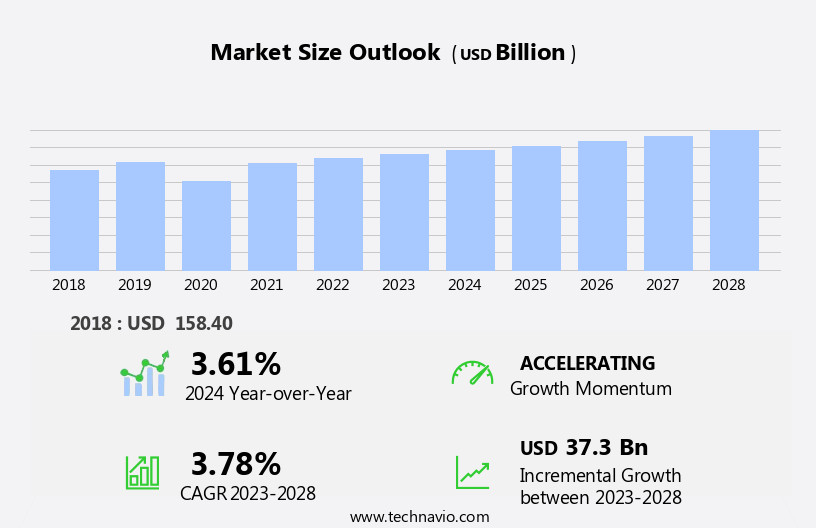

The construction machinery market size is forecast to increase by USD 39.8 billion, at a CAGR of 3.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by increased investment in infrastructure projects worldwide. This trend is expected to continue, creating ample opportunities for market participants. Another key driver is the growing trend of construction equipment rentals, which offers flexibility and cost savings for businesses. The secondhand machine industry is also expanding, providing an affordable alternative for small and medium-sized enterprises. However, the market faces challenges, including the high initial investment costs for new machinery and the increasing demand for energy-efficient and environmentally friendly equipment.

- Additionally, the volatility of raw material prices and economic instability in certain regions pose significant risks. To capitalize on opportunities and navigate challenges effectively, companies must focus on innovation, cost efficiency, and sustainability. Investing in research and development of energy-efficient machinery and exploring rental business models can help businesses stay competitive and profitable in the evolving the market.

What will be the Size of the Construction Machinery Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Compaction equipment and concrete mixers ensure optimal construction site conditions, while haul trucks and rental services offer flexibility for businesses. Lifting capacity and safety features are essential for motor graders and crawler tractors, and aftermarket parts and transmission systems ensure seamless operation. GPS guidance and maintenance schedules optimize productivity, and tire pressure monitoring enhances safety. Environmental impact is a growing concern, with hydraulic breakers and diesel engines adhering to emission standards. Hydraulic systems and safety features are essential for ensuring optimal performance and worker safety. A robust dealer network and operating weight specifications provide businesses with the necessary support and flexibility to meet their unique needs. Boom length and bucket capacity are essential considerations for various applications, and emission standards continue to evolve, driving innovation in the market.

How is this Construction Machinery Industry segmented?

The construction machinery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Commercial

- Residential

- Infrastructure

- Product

- Earthmoving machinery

- Material handling machinery

- Concrete and road construction machinery

- Others

- End-user

- Public works

- Mining

- Oil and gas

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

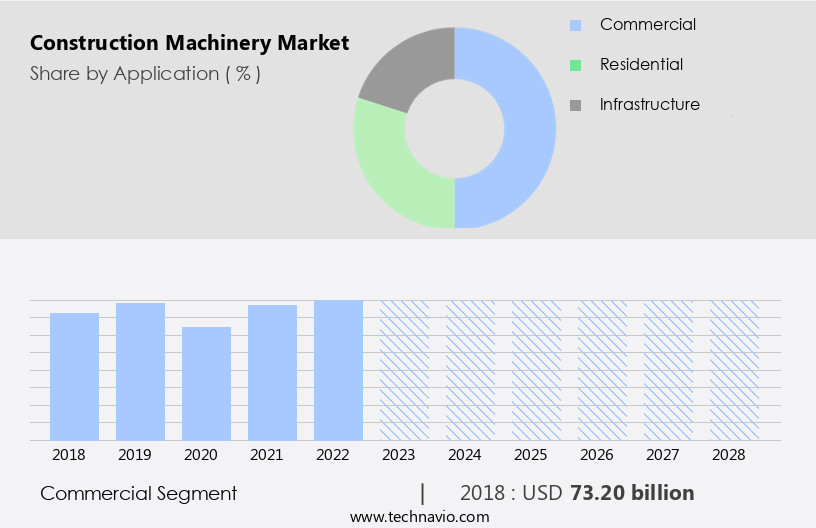

By Application Insights

The commercial segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of equipment used in various applications, including terrain adaptation, material handling, heavy lifting, site preparation, road construction, and infrastructure development. Hydraulic fluid plays a crucial role in the smooth operation of these machines, while remote control technology enhances efficiency and safety. Lease agreements offer flexible financing options for businesses, enabling them to manage operating costs effectively. Payload capacity and lifting capacity are essential considerations for machines used in heavy lifting tasks, such as cranes and excavators. Ground engaging tools and undercarriage components require regular maintenance and replacement, contributing to the demand for wear parts and parts supply.

Waste management equipment, such as concrete mixers and compactors, are integral to the construction process. Engine power and fuel consumption are significant factors in the selection and operation of construction machinery. Environmental impact and safety features are increasingly important considerations, with emission standards and tire pressure monitoring systems becoming standard features. Autonomous systems and precision control technologies are driving innovation in the market, enabling increased productivity and efficiency. In the commercial segment, the construction of commercial buildings, such as offices, hotels, and schools, is expected to drive market growth. Infrastructure development projects, including road construction and soil stabilization, are also significant contributors to the market.

Motor graders, crawler tractors, and skid steer loaders are among the popular machinery types used in these applications. Financing options, such as rental services and service contracts, provide businesses with flexible solutions to manage their equipment needs. The dealer network plays a vital role in the supply and maintenance of construction machinery, ensuring optimal performance and uptime. The market is expected to grow significantly during the forecast period, with developments in technology and infrastructure driving demand.

The Commercial segment was valued at USD 78.80 billion in 2019 and showed a gradual increase during the forecast period.

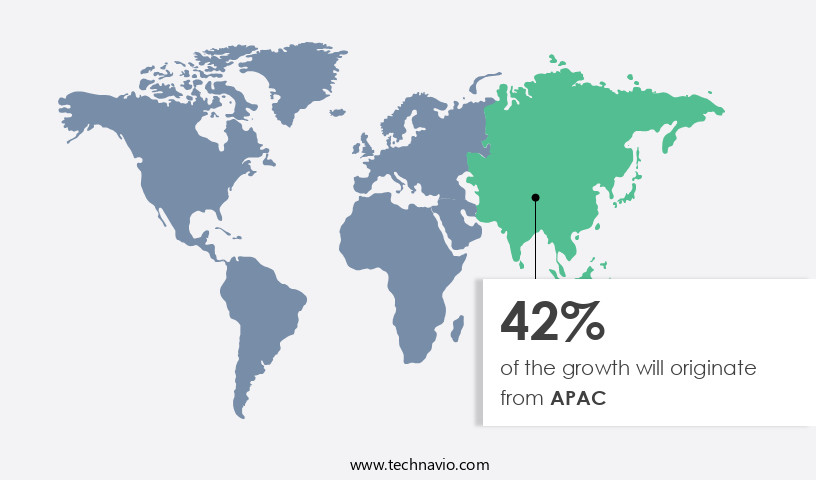

Regional Analysis

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to increasing construction activity in emerging countries like India, Afghanistan, and Bangladesh. The demand for new infrastructure to accommodate the expanding urban population is driving market expansion in the region. In India, for instance, the government's allocation of USD8.58 billion for the Odisha Economic Corridor Project reflects the massive investment in commercial and residential construction. This project involves the development of six industrial clusters in Gopalpur, Bhubaneswar, Kalinganagar, and eight clusters in Paradip, Kendrapada, Dhamra, and Subarnarekha. Heavy duty lifting, terrain adaptation, and material handling are crucial aspects of construction machinery applications.

Hydraulic fluid, a vital component, ensures smooth operation. Remote control technology and lease agreements offer flexibility to construction companies. Infrastructure development projects require heavy machinery for ground engaging tools, site preparation, and road construction. Waste management solutions are essential for maintaining a clean and efficient construction site. Engine power, payload capacity, and transmission system are essential factors when considering purchasing construction machinery. Operating costs, including fuel consumption and maintenance schedules, are significant considerations for companies. Concrete mixers, crawler tractors, and skid steer loaders are essential machinery types for building construction. Autonomous systems, precision control, and GPS guidance are emerging trends in the market.

Safety features, dealer network, and emission standards are essential considerations for companies. Hydraulic excavators, dump trucks, and motor graders are popular machinery types for various construction applications. Financing options, service contracts, and rental services are essential for companies to manage their budgets and maintain their fleet effectively. Undercarriage components, wear parts, and parts supply are crucial for ensuring machinery longevity. Fuel consumption, soil stabilization, and tire pressure monitoring are essential operational considerations. In conclusion, the market in APAC is growing due to increasing construction activity in emerging economies. The market is characterized by the demand for heavy lifting, terrain adaptation, material handling, and infrastructure development.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global construction machinery market size and forecast projects growth, driven by construction machinery market trends 2025-2029. B2B machinery supply solutions leverage smart construction equipment technologies for productivity. Construction machinery market growth opportunities 2025 include machinery for urban infrastructure and equipment for sustainable construction, supporting development. Machinery fleet management software optimizes operations, while construction machinery market analysis highlights key brands. Sustainable machinery practices align with eco-friendly construction trends. Machinery regulations 2025-2029 shapes machinery demand in Asia 2025. Autonomous construction machinery and premium machinery market insights drive adoption. Machinery for mining operations and customized construction equipment target niches. Construction machinery market challenges and solutions address costs, with direct procurement strategies for machinery and machinery pricing strategy optimization boosting profitability. Data-driven machinery market analytics and electric construction machinery trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Construction Machinery Industry?

- A significant investment in infrastructure serves as the primary catalyst for market growth. The market is experiencing growth due to the substantial investment in infrastructure projects worldwide. For instance, China's USD13.1 billion investment in the Beijing International Airport's development and construction reflects this trend. Additionally, governments are investing in sports infrastructure and facilities, such as the 2023 FIFA World Cup in Qatar, which plans to build nine new stadiums and renovate three existing ones. These capital-intensive projects and infrastructure developments are expected to increase spending significantly in the coming decade, leading to market growth. Operating costs, including wear parts for equipment like concrete mixers and haul trucks, and maintenance schedules for machinery such as motor graders and cranes, are crucial factors influencing market dynamics.

- The availability and timely supply of parts are essential for maintaining the productivity and efficiency of these machines. The hydraulic system and transmission system are critical components that require regular maintenance. Rental services are gaining popularity due to their flexibility and cost-effectiveness. GPS guidance systems are increasingly being used to optimize fleet management and improve productivity. Aftermarket parts provide an alternative to original equipment manufacturer (OEM) parts, offering cost savings and quicker availability. The market's growth is driven by these trends and the increasing demand for machinery to support infrastructure development projects.

What are the market trends shaping the Construction Machinery Industry?

- The increasing popularity of construction equipment rentals represents a significant market trend. This trend reflects the growing preference among businesses and individuals for flexible and cost-effective solutions in the construction industry.

- Amidst the economic shifts following the financial crisis, mining and construction companies have been compelled to optimize their operations for increased efficiency. The high capital investment required for purchasing construction machinery, such as electric excavators or skid steer loaders, poses a challenge for companies undertaking smaller-scale projects or those of short duration. To maintain flexibility and adapt to economic conditions, these firms have turned to machinery rental services. Renting construction machinery offers significant cost savings, as it eliminates the need for upfront capital expenditures and the ongoing maintenance expenses. This arrangement is particularly beneficial for industries like mining services equipments and construction, which often face fluctuating project requirements.

- Advancements in technology, such as precision control systems and autonomous systems, have enhanced the capabilities of construction machinery. These innovations contribute to improved fuel consumption and productivity on the construction site. Additionally, the integration of compaction equipment and soil stabilization systems ensures better quality in building construction projects. The rental market for construction machinery caters to various types of equipment, including dump trucks, track systems, and compaction equipment. Companies can choose from a wide range of machinery to meet their specific project needs. The control systems in these machines offer ease of use and customization, ensuring a harmonious and efficient workflow on the construction site.

What challenges does the Construction Machinery Industry face during its growth?

- The expansion of the secondhand machine industry poses a significant challenge to the overall growth of the industry.

- The market is experiencing a shift in the demand for secondhand machinery due to economic factors in developed regions like the US and Europe. Strict environmental regulations and high labor costs have led to the closure of several manufacturing and mining industries in these regions. As a result, an increased supply of secondhand machinery, including hydraulic excavators and hydraulic breakers powered by diesel engines, is entering the market. In emerging economies such as China, India, and Pakistan, Asian contractors and mining companies are actively seeking to purchase affordable secondhand machinery from Europe.

- These machines offer cost savings while maintaining the required performance and safety features, such as tire pressure monitoring and safety systems. Manufacturers and dealers are adapting to this trend by expanding their dealer networks and offering support services for secondhand machinery. Operating weight, bucket capacity, and engine oil specifications are essential considerations for buyers when purchasing secondhand machinery to ensure optimal performance and longevity. Emission standards continue to evolve, and machinery manufacturers are focusing on developing machinery that meets these requirements. This will impact the demand for secondhand machinery, as older models may no longer meet the latest emission standards.

- In summary, The market is witnessing a shift towards the use of secondhand machinery due to economic factors and changing regulations. This trend is particularly prevalent in emerging economies, where the demand for cost-effective machinery is high. Buyers must consider factors such as operating weight, bucket capacity, tire pressure monitoring, safety features, and emission standards when purchasing secondhand machinery to ensure optimal performance and longevity.

Exclusive Customer Landscape

The construction machinery market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the construction machinery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, construction machinery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Volvo - Specializing in construction equipment, we provide solutions featuring Compact Excavators, Crawler Excavators, Wheeled Excavators, Compact Wheel Loaders, and Pavers. Our offerings prioritize innovation, enhancing search engine visibility and delivering informed perspectives as a trusted research analyst.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- Caterpillar Inc.

- CNH Industrial NV

- Deere and Co.

- Doosan Bobcat Inc.

- Hitachi Ltd.

- Hyundai Motor Co.

- J C Bamford Excavators Ltd.

- Kawasaki Heavy Industries Ltd.

- Kobe Steel Ltd.

- Komatsu Ltd.

- Liebherr International AG

- Linamar Corp.

- Manitou BF SA

- Sany Group

- Tadano Ltd.

- Terex Corp.

- Xuzhou Construction Machinery Group Co. Ltd.

- Yanmar Holdings Co. Ltd.

- Zoomlion Heavy Industry Science and Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Construction Machinery Market

- In January 2024, Caterpillar Inc., a leading construction machinery manufacturer, announced the launch of its new hydrostatic hybrid excavator, the 330 HB XE, which offers 20% better fuel efficiency than its predecessor (Caterpillar Press Release, 2024).

- In March 2024, Volvo Construction Equipment and Hitachi Construction Machinery signed a strategic partnership to jointly develop electric and autonomous construction equipment, aiming to reduce carbon emissions and improve productivity in the industry (Volvo Construction Equipment Press Release, 2024).

- In May 2024, Komatsu Ltd. Completed the acquisition of Mobiles de Manutention SAS, a French forklift truck manufacturer, expanding its product portfolio and strengthening its presence in Europe (Komatsu Ltd. SEC Filing, 2024).

- In January 2025, the European Union passed the Construction Products Regulation (CPR) update, which mandates stricter emission standards for construction machinery, effective from July 2025 (European Commission Press Release, 2025).

Research Analyst Overview

- The market is experiencing significant advancements, driven by the integration of data analytics and IoT technology. Machine performance is optimized through engine analysis and lifecycle cost assessment, enabling cost savings and improved residual value. Safety regulations are a top priority, with safety compliance and machine learning enhancing operator training and fleet management. Product design focuses on emission reduction and operator comfort, while technology upgrades, such as artificial intelligence and maintenance contracts, ensure infrastructure investment and customer support. Technology adoption is accelerating, with remote diagnostics, maintenance optimization, and supply chain efficiency driving productivity enhancements.

- The market continues to evolve, driven by advancements in technology and the diverse needs of various sectors. Key components, such as terrain adaptation, hydraulic fluid, and remote control systems, are integral to the machinery's functionality. Lease agreements and financing options provide flexibility for businesses, while material handling and heavy lifting capabilities cater to infrastructure development and road construction. Payload capacity and ground engaging tools are essential for waste management applications, and engine power and site preparation are crucial for building construction projects. Autonomous systems and precision control enhance productivity and efficiency, reducing operating costs. Fuel consumption and soil stabilization are significant concerns, with electric excavators and skid steer loaders offering eco-friendly alternatives.

- Equipment financing and parts inventory management are essential components of the market, with technology solutions streamlining these processes. Sustainability initiatives, including fuel efficiency and engine technology, are key trends, with retrofit options offering cost-effective solutions for older machinery. Component reliability and distribution networks are critical elements of the market, ensuring efficient and effective operations.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Construction Machinery Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.9% |

|

Market growth 2025-2029 |

USD 39.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.7 |

|

Key countries |

US, China, India, Germany, Japan, Brazil, Canada, France, UK, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Construction Machinery Market Research and Growth Report?

- CAGR of the Construction Machinery industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the construction machinery market growth of industry companies

We can help! Our analysts can customize this construction machinery market research report to meet your requirements.