Control Valves Market Size 2024-2028

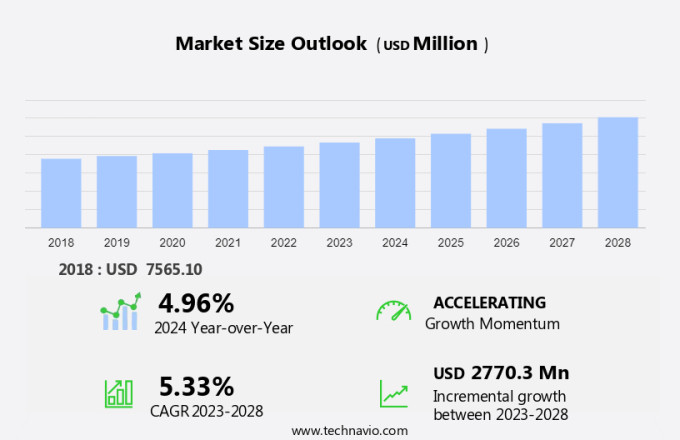

The control valves market size is forecast to increase by USD 2.77 billion at a CAGR of 5.33% between 2023 and 2028. The market is experiencing significant growth due to increasing demand in various industries, including petrochemicals, petroleum, power generation, process plants, pulp and paper, and renewable energy. In the petrochemical industry, the need for precise pressure control in production processes is driving the demand for advanced control valves. In the petroleum sector, the rising demand for oil and gas is leading to increased investments in fluid handling infrastructure, which in turn is boosting the market. In the power generation sector, the shift towards renewable energy sources is creating new opportunities for control valves in renewable energy projects. Meanwhile, in the water industry, the need for reliable valves to ensure potable water supply is a key growth factor. Developments in control valve positioners and fluctuations in raw material prices are also influencing market trends.

The market is witnessing significant growth due to the increasing automation in process plants across various industries, including pharmaceuticals, oil & gas, water and wastewater treatment, energy and power, and power generation. The integration of wireless infrastructure in control valves is a key trend driving market growth. Smart control valves, which use connected networks and automatic components like solenoid valves, are gaining popularity due to their ability to enhance process efficiency and reduce operational costs. In the pharmaceutical industry, control valves are used for chemical treatment in feed water and cooling water systems. In the oil and gas industry, they are employed in power generation plants and nuclear power plants for various applications, including process control and safety systems.

Moreover, the energy and power industry uses control valves extensively for power generation and distribution. Industry players are focusing on developing advanced control valves with improved performance and reliability. Medical devices are also incorporating control valves for fluid management applications. Overall, the market is expected to grow steadily due to the increasing demand for industrial equipment and the need for efficient and reliable process control systems.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Pneumatic

- Electrical

- Hydraulic

- Product

- Sliding shaft

- Rotating shaft

- Geography

- APAC

- China

- India

- Japan

- Europe

- North America

- US

- Middle East and Africa

- South America

- APAC

By Application Insights

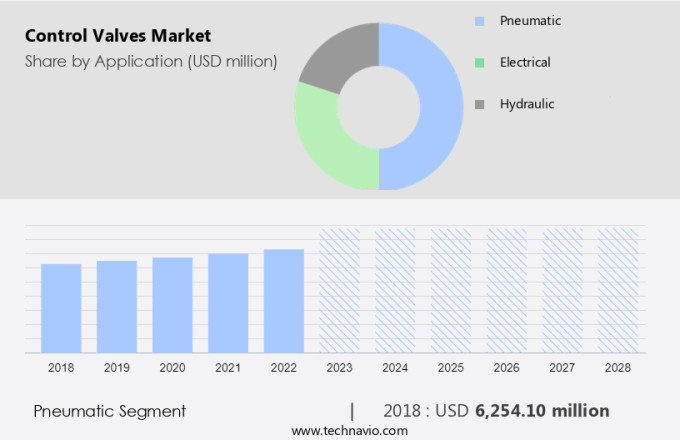

The pneumatic segment is estimated to witness significant growth during the forecast period. Control valves play a crucial role in the water and wastewater industry, particularly in applications such as water treatment, effluent treatment plants, sewage treatment plants, and water recycling. These valves, including diaphragm valves, are essential for managing fluid flow in hydraulic systems. The growing water demand, driven by population growth, industrial activities, and urbanization, has led to an increase in the construction of water and wastewater treatment plants. In addition, the shift towards energy efficiency and the exploration of alternative energy sources, such as desalination plants, cooling water systems in power generation, and crude oil refineries, further boosts the demand for control valves.

Moreover, digital intelligence and connected networks are increasingly being integrated into control valve systems to optimize performance and reduce energy consumption. The emerging economies are expected to witness significant growth in the water and wastewater treatment sector, providing opportunities for control valve market expansion.

Get a glance at the market share of various segments Request Free Sample

The pneumatic segment was valued at USD 6.25 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

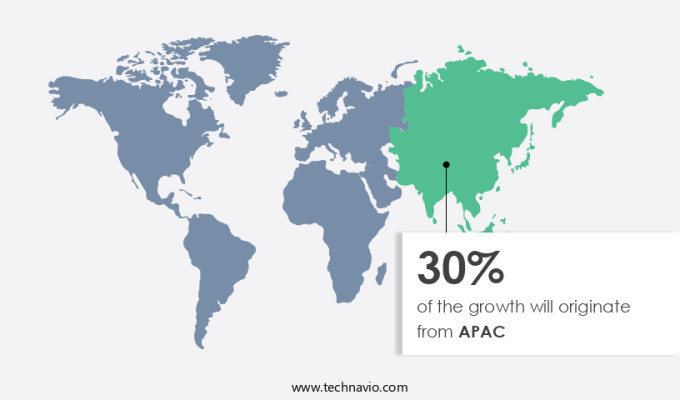

APAC is estimated to contribute 30% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the Asia Pacific (APAC) region is expected to witness significant growth during the forecast period, with China, Japan, India, and South Korea leading the charge. The expansion of industries such as food and beverages, oil refining, and desalination plants is driving the demand for control valves in APAC. In China and India, the increasing automobile market is fueling the need for crude oil refining, resulting in new capacity additions. Additionally, China's investment in natural gas pipelines for import and distribution to megacities for heating applications is also contributing to the market growth. The integration of digital intelligence and energy efficiency in control valves is further propelling the market forward, particularly in the energy & power industry as countries shift towards diverse energy sources.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rising investments in fluid handling is the key driver of the market. Control valves play a crucial role in various industries, including oil and gas and chemicals, in managing fluid flow and pressure. Actuators are integral components of control valves, enabling automatic positioning in response to process conditions. With the increasing focus on automation needs and alternative energy sources, investments in control valves have grown. In the oil and gas sector, aging infrastructure and the expansion of shale oil exploration and production projects necessitate the installation of new control valves. These valves are essential for maintaining the smooth flow of fluids during exploration, production, and transportation processes. In the chemicals industry, control valves undergo chemical treatment for optimal performance and longevity.

Overall, the demand for control valves, including ball valves and butterfly valves, is anticipated to grow significantly due to the ongoing development of new projects and the increasing importance of fluid handling technology.

Market Trends

The developments in control valve positioners are the upcoming trend in the market. Control valves have experienced notable advancements in design and functionality over the past few years. These valves are now more compact, offering enhanced shutoff capabilities and utilizing sophisticated sealing technologies. Enhanced resistance to corrosion and erosion, as well as improved anti-cavitation and noise-reducing trims, contribute to the superior performance of modern control valves.

Moreover, the introduction of advanced control valve positioners is a significant factor driving these improvements. Leveraging technology, smart and digital valve positioners have emerged, expanding their capabilities in various industries. With digital communication protocols gaining prominence, the functionalities of these intelligent and digital valves continue to evolve. In the context of aging infrastructure and the increasing adoption of alternative energy sources in industries like chemicals, the demand for automatic components, including control valves, automation, and chemical treatment, is on the rise.

Market Challenge

The fluctuations in raw material prices is a key challenge affecting the market growth. Control valves are essential automatic components in various industries, including the chemicals sector, to regulate the flow of fluids and gases. Actuators are used to automate the opening and closing of control valves, such as ball valves and butterfly valves, in response to changing process conditions. The aging infrastructure in several end-use industries necessitates the need for control valve upgrades and replacements. Alternative energy sources, such as wind and solar, are gaining popularity, leading to increased demand for control valves in power generation applications. Automation needs in these industries are driving the market growth for control valves. The manufacturing process of control valves involves the use of various raw materials, including copper, stainless steel, cast iron, aluminum, brass, and bronze.

Similarly, steel, particularly cast steel and forged steel, is widely used due to its strength and durability. High-temperature carbon steel, low-temperature carbon steel, and austenitic stainless steel are commonly used steel types in control valve manufacturing. Special metal grades, such as super austenitic stainless steel, duplex steel, and super duplex steel, are also utilized for specific applications due to their superior corrosion and chemical resistance. Raw material prices significantly impact control valve prices, making it a challenge for companies to maintain profit margins. Chemical treatment is also employed to enhance the performance and longevity of control valves.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alfa Laval AB: The company offers control valves such as LKC Non return Valve, LKC UltraPure, and LKUV 2 Air-relief Valve.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Avcon Controls Pvt. Ltd.

- AVK Holding AS

- Baker Hughes Co.

- Bray International Inc.

- Curtiss Wright Corp.

- DFT Inc.

- Emerson Electric Co.

- Flowserve Corp.

- Goodwin PLC

- Honeywell International Inc.

- IMI Hydronic Engineering Inc.

- KSB SE and Co. KGaA

- Parker Hannifin Corp.

- SAMSON AG

- Schlumberger Ltd.

- Trillium Flow Technologies

- Valmet Corp.

- Valvitalia SpA

- Watts Water Technologies Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is expected to witness significant growth due to the increasing automation needs in various industries, including energy & power and chemicals. The market is driven by the automation of fluid handling systems in power generation plants, oil & gas industry, and process plants. The aging infrastructure in emerging economies is providing financing opportunities for market growth. The market is segmented into actuator types, including pneumatic, electric, hydraulic, and others. The market includes automatic components such as ball valves, butterfly valves, diaphragm valves, gate valves, linear control valves, plug valves, rotary control valves, solenoid valves, and smart valve technology.

Furthermore, the market is influenced by factors such as energy efficiency, environmental legislation, and safety standards. High temperatures and pressure control requirements in industries such as oil & gas, petrochemicals, and pulp & paper are driving the demand for control valves. The market is also witnessing the adoption of digital intelligence, connected networks, and smart control valves in various applications. The market is further expected to grow due to the increasing demand for renewable energy and the expansion of desalination plants in water-scarce regions. The market is also witnessing the miniaturization of control valves for use in medical devices and liquid soap dispensers. A skilled workforce is essential for the installation, maintenance, and repair of control valves. The market is expected to face challenges from greenhouse gas emissions and increasing crude oil prices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.33% |

|

Market Growth 2024-2028 |

USD 2.77 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.96 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 30% |

|

Key countries |

China, US, Russia, India, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Alfa Laval AB, Avcon Controls Pvt. Ltd., AVK Holding AS, Baker Hughes Co., Bray International Inc., Curtiss Wright Corp., DFT Inc., Emerson Electric Co., Flowserve Corp., Goodwin PLC, Honeywell International Inc., IMI Hydronic Engineering Inc., KSB SE and Co. KGaA, Parker Hannifin Corp., SAMSON AG, Schlumberger Ltd., Trillium Flow Technologies, Valmet Corp., Valvitalia SpA, and Watts Water Technologies Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch