Container And Packaging Market Size 2025-2029

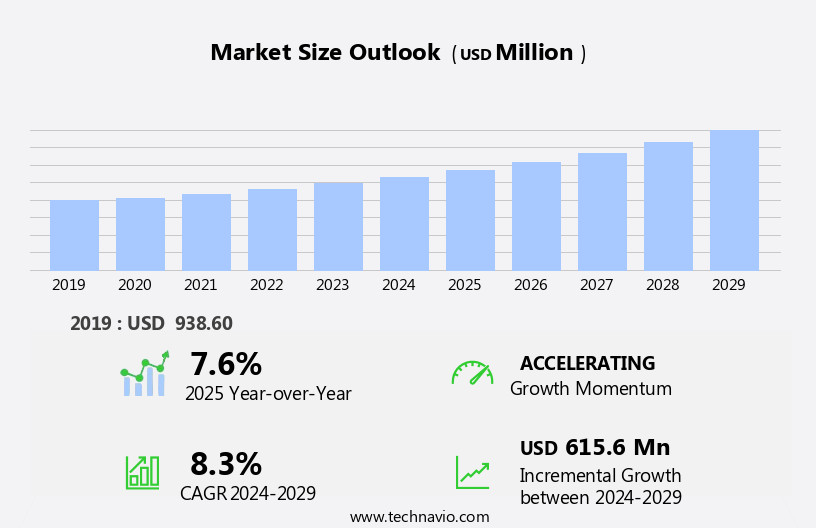

The container and packaging market size is forecast to increase by USD 615.6 million at a CAGR of 8.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing trend towards e-commerce and the resulting demand for efficient and sustainable solutions. With online sales continuing to rise, there is a heightened focus on optimizing supply chain logistics and reducing transportation costs through the use of standardized containers and efficient packaging designs. Additionally, consumer preferences are shifting towards more eco-friendly options, creating a strong demand for sustainable materials and recyclable packaging solutions. However, this market is not without challenges. The rising cost of raw materials, particularly for plastics and metals, is putting pressure on manufacturers to find cost-effective alternatives while maintaining quality and performance.

- Furthermore, stringent regulations regarding the use and disposal of certain materials, such as single-use plastics, are adding complexity to the market landscape. Companies seeking to capitalize on these opportunities must stay informed of regulatory changes and invest in research and development to bring innovative, sustainable solutions to market. By addressing these challenges and leveraging emerging trends, players in the market can position themselves for long-term success.

What will be the Size of the Container And Packaging Market during the forecast period?

- The market encompasses a diverse range of industries producing and supplying various types of containers and packaging solutions. Key market drivers include the growing demand for plastic-based packaging, particularly in sectors such as food and beverage, pharmaceuticals, and industrial chemicals. Sterile bulk containers, metal drums, and glass jars are also prominent in this market, catering to the needs of industries dealing with liquid substrates, solvents, and other hazardous materials. International borders pose challenges in the market due to the complexities of international trade and transportation. Electronic commerce and shipping routes have significantly impacted the market, leading to increased demand for efficient supply chain processes, shipment tracking, and shipment quantities.

- Industrial plants rely on a steady supply of containers and packaging to meet production demands, while the need for secure and reliable transportation remains a critical consideration. Overall, the market is a dynamic and evolving industry, adapting to the changing demands of various sectors and global markets.

How is this Container And Packaging Industry segmented?

The container and packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Paperboard

- Rigid plastic

- Metal

- Glass

- Others

- End-user

- Food and beverage

- Healthcare

- Industrial

- Personal care

- Others

- Type Of Packaging

- Rigid packaging

- Flexible packaging

- Corrugated packaging

- Cartons and boxes

- Bottles and jars

- Type

- Primary packaging

- Secondary packaging

- Tertiary packaging

- Specialty packaging

- Protective packaging

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- South America

- Brazil

- Rest of World (ROW)

- APAC

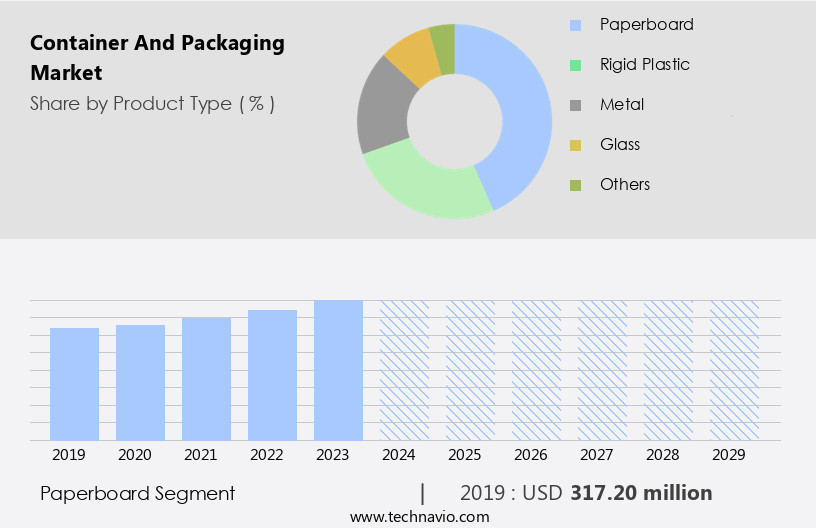

By Product Type Insights

The paperboard segment is estimated to witness significant growth during the forecast period. The market encompasses various materials, with the paperboard segment experiencing significant growth. Paperboard, an adaptable material derived from thick paper, is preferred for its lightweight and eco-friendliness. Driven by increasing consumer awareness and the expansion of e-commerce, the paperboard segment's demand increases. Paperboard's advantages, such as recyclability, biodegradability, and a reduced carbon footprint, make it an attractive choice for storing and shipping a wide range of products, including feedstock for industrial plants, sterile bulk liquids, solvents, and hazardous items. Paperboard containers are utilized for manufacturing corrugated boxes, folding cartons, tubes, and cores.

The paperboard segment's dependability is further enhanced by regulatory organizations' stringent safety standards for handling and transporting various substances, such as explosive items, radioactive materials, and toxic items. The supply chain process benefits from paperboard's durability, shipping routes' efficiency, and tracking facilities' ease of use. Additionally, the pooling networks and reconditioning infrastructure support cost savings and sustainability.

Get a glance at the market report of share of various segments Request Free Sample

The Paperboard segment was valued at USD 317.20 million in 2019 and showed a gradual increase during the forecast period.

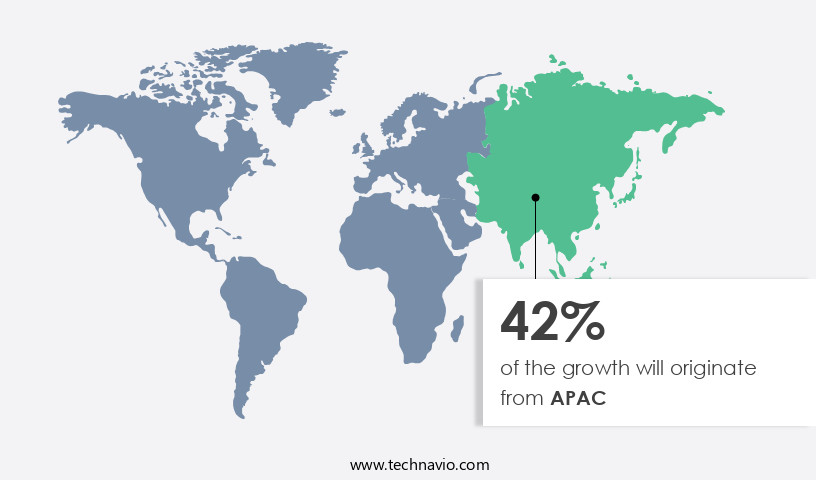

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Asia-Pacific (APAC) region is a significant player in The market, with a substantial share in both consumption and production. Industries such as electronics, automotive, pharmaceuticals, and consumer products, which have a substantial production base in APAC, drive the demand for packaging and containers due to their export-focused nature. China, Japan, India, South Korea, and Australia are the key countries contributing to the expansion of the regional market. China, in particular, is the world's largest manufacturer and consumer of packaging materials. The need for and dependable containers and packaging solutions for the transportation and distribution of various commodities is a primary market dynamic.

The market encompasses various types of containers, including Industrial Bulk Containers (IBCs), Rigid Bulk Containers, and Flexible Intermediate Bulk Containers (FIBCs), used for storing and shipping liquids, solvents, and other substances for industrial plants and shipping purposes. The supply chain process, including shipping routes and tracking facilities, is crucial in ensuring the timely and efficient delivery of these containers. The market caters to diverse industries, including those dealing with hazardous items, explosive and combustible items, radioactive substances, and toxic items. The use of biodegradable materials and reusable bulk containers is also gaining popularity due to environmental concerns.

The durability and lightness of plastic-based packaging and plastic drums are essential factors influencing the market's growth. Regulatory organizations play a crucial role in ensuring the safety and compliance of containers and packaging materials, particularly in international trade.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Container And Packaging Industry?

- The growth of e-commerce is the key driver of the market. The market has experienced significant growth due to the expansion of the e-commerce industry. With online shopping gaining popularity worldwide, the demand for packaging materials and solutions has risen. E-commerce retailers and logistics providers require innovative packaging to ensure the safe and secure transportation of products. Innovative packaging solutions, such as corrugated boxes, air-filled cushions, and protective foam, have become essential for e-commerce businesses to maintain the integrity of their products during transit.

- These packaging materials offer resistance to the rigors of long-distance transportation and protection against damage. The market's growth is driven by the increasing demand for efficient and reliable packaging solutions that cater to the unique needs of e-commerce businesses.

What are the market trends shaping the Container And Packaging Industry?

- Sustainability in containers and packaging solutions is the upcoming market trend. The market is witnessing significant attention towards sustainability as businesses strive to minimize their carbon footprint and waste generation in response to growing environmental consciousness and regulations. Consumer preference for eco-friendly packaging solutions is fueling the demand for sustainable alternatives. To achieve sustainability goals, the market is employing various strategies, including: 1. Reducing Material Waste: A crucial aspect of sustainable packaging is minimizing the production of packaging material waste.

- Techniques such as lightweighting, downsizing, and utilizing materials with a higher recycled content are being adopted by market players. By focusing on these tactics, the container and packaging industry can make a substantial contribution towards environmental sustainability while catering to evolving consumer preferences.

What challenges does the Container And Packaging Industry face during its growth?

- Rising cost of raw materials is a key challenge affecting the industry growth. The market faces significant challenges due to increasing raw material prices. Key materials, such as plastics, metals, paper, and glass, are essential for manufacturing containers and packaging solutions. However, the volatility of raw material costs can negatively impact market profitability and sustainability. Global economic conditions and geopolitical tensions are primary drivers of these price fluctuations.

- Trade disputes, embargoes, and political instability in major producing regions can disrupt supply and demand dynamics, leading to price volatility. Market players must closely monitor these factors to mitigate risks and maintain competitiveness.

Exclusive Customer Landscape

The container and packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the container and packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, container and packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ace Packaging - The company specializes in providing innovative container and packaging solutions for various industries, including food, beverage, healthcare, and home and personal care products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ace Packaging

- Amcor Plc

- Berry Global Inc.

- Buscherhoff Packaging Solutions GmbH

- BWAY Corp.

- Container and Packaging Supply Inc.

- DS Smith Plc

- Greif Inc.

- Hoover Circular Solutions

- International Paper Co.

- Mold Tek Packaging Ltd.

- Mondi Plc

- MY Flexitank Industries Sdn Bhd

- Qingdao LAF Packaging Co. Ltd.

- Jiangsu Rongtai Glass Products Co. Ltd.

- Sealed Air Corp.

- Teijin Ltd.

- The Packaging Co.

- WestRock Co.

- Winpak Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of products and applications, serving various industries and supply chain processes. At the core of this market are feedstocks, which serve as the raw materials for the production of containers and packaging solutions. These feedstocks can include a variety of liquid substrates, such as solvents, as well as rigid intermediates like metal and plastic-based materials. The demand for container and packaging solutions is driven by several factors. One significant factor is the need for efficient and reliable transportation of goods, both domestically and internationally. Containers play a crucial role in this regard, providing a secure and durable means of shipping products across shipping routes.

This is particularly important for industries that deal with hazardous or explosive items, which require specialized containers to ensure safe transport. Another factor driving the growth of the market is the increasing trend towards electronic commerce. As more businesses move towards online sales, there is a growing demand for packaging solutions that can effectively protect and transport products to customers. This has led to the development of innovative packaging solutions, such as reusable bulk containers and flexible intermediate bulk containers (FIBCs), which offer lightweight transportation and improved supply chain efficiency. Regulatory organizations play a crucial role in shaping the market.

These organizations set standards and guidelines for the production and use of containers and packaging solutions, ensuring that they meet safety and quality requirements. This is particularly important for industries dealing with toxic or radioactive substances, which require specialized containers to prevent leaks or contamination. The durability and dependability of containers and packaging solutions are also critical factors in their adoption. Containers must be able to withstand the rigors of shipping and handling, while packaging solutions must be able to protect products during transport and storage. This has led to the development of advanced materials, such as biodegradable materials and glass, which offer improved durability and sustainability.

Pooling networks have also emerged as an important trend in the market. These networks allow companies to share resources, such as reusable bulk containers and plastic drums, reducing the need for each company to maintain its own inventory. This not only saves costs but also reduces the environmental impact of the industry. The market is a dynamic and evolving industry, driven by factors such as transportation needs, electronic commerce, and regulatory requirements. Innovations in materials and technologies continue to shape the market, offering new solutions for industries dealing with a wide range of products and shipping purposes.

The focus on sustainability and efficiency is also driving the adoption of advanced packaging solutions, such as reusable and biodegradable containers, which offer improved durability and reduced environmental impact.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

252 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.3% |

|

Market growth 2025-2029 |

USD 615.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.6 |

|

Key countries |

US, China, Japan, India, Germany, Canada, France, South Korea, Brazil, UK, UAE, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Container And Packaging Market Research and Growth Report?

- CAGR of the Container And Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the container and packaging market growth of industry companies

We can help! Our analysts can customize this container and packaging market research report to meet your requirements.