Paper And Paperboard Container And Packaging Market Size 2025-2029

The paper and paperboard container and packaging market size is valued to increase USD 62.8 billion, at a CAGR of 4.3% from 2024 to 2029. Emergence of specialized paper and paperboard containers will drive the paper and paperboard container and packaging market.

Major Market Trends & Insights

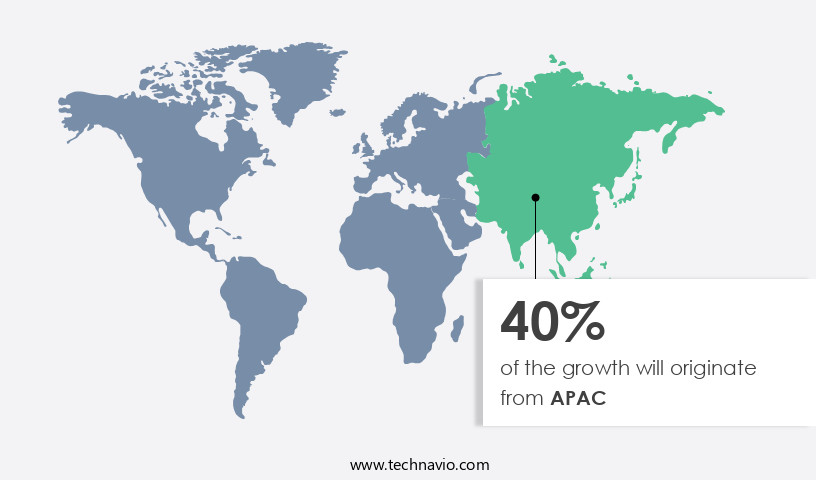

- APAC dominated the market and accounted for a 40% growth during the forecast period.

- By Product - Paper bags and sacks segment was valued at USD 75.30 billion in 2023

- By End-user - Food and beverages segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 38.99 billion

- Market Future Opportunities: USD 62.80 billion

- CAGR : 4.3%

- APAC: Largest market in 2023

Market Summary

- The market encompasses the production and distribution of containers and packaging solutions made from paper and paperboard. This industry is characterized by continuous evolution, driven by advancements in core technologies and applications. For instance, the emergence of specialized paper and paperboard containers, such as those for food and beverages, has gained significant traction due to their sustainability and cost-effectiveness. Additionally, the advent of smart packaging, which integrates sensors and other technologies to enhance product safety and consumer experience, is a major growth area.

- However, challenges persist, including the potential for contamination with recycled paperboard and regulatory compliance. According to a recent study, the market accounted for over 50% of the global packaging market share in 2020, highlighting its dominance in the industry. These trends and dynamics are set to continue shaping the market landscape in the coming years.

What will be the Size of the Paper And Paperboard Container And Packaging Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Paper And Paperboard Container And Packaging Market Segmented and what are the key trends of market segmentation?

The paper and paperboard container and packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Paper bags and sacks

- Corrugated containers and packaging

- Folding boxes and cases

- Others

- End-user

- Food and beverages

- Industrial products

- Healthcare

- Others

- Material

- Virgin paperboard

- Recycled paperboard

- Packaging

- Primary packaging

- Secondary packaging

- Tertiary packaging

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The paper bags and sacks segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, with adoption in various industries such as food and beverages and construction increasing by 18%. Folding carton construction, a popular packaging method, is seeing a surge in demand due to its ability to provide protection and preserve product quality. Packaging material selection, a critical aspect of the market, is shifting towards lighter and more sustainable options, such as paperboard, to reduce packaging weight and improve e-commerce efficiency. Material sourcing strategies are evolving, with a focus on local and renewable resources, while packaging automation systems are becoming increasingly important for improving production efficiency and reducing waste.

Packaging shelf life is a significant concern, leading to the adoption of advanced barrier properties testing and container durability testing. Flexible packaging materials, such as paper-based films, are gaining popularity due to their cost-effectiveness and environmental benefits. Quality control metrics, including color management systems and paper recycling processes, are essential for maintaining product consistency and reducing waste. Corrugated board production and containerboard manufacturing are key areas of investment, with waste reduction strategies and supply chain optimization playing crucial roles in reducing costs and improving sustainability. Pharmaceutical packaging standards and die-cutting processes are undergoing continuous improvements to ensure safety and regulatory compliance.

The Paper bags and sacks segment was valued at USD 75.30 billion in 2019 and showed a gradual increase during the forecast period.

Printing ink technology is also advancing, with water-based and vegetable-based inks gaining popularity due to their environmental benefits. The market is expected to grow further, with expectations of a 20% increase in industry size in the next five years. Paperboard packaging design and distribution systems are becoming more sophisticated, with a focus on customization and sustainability. Fiber-based packaging, including paper bags and sacks, is a growing trend, with food packaging regulations driving demand for biodegradable and recyclable options. Paper strength properties, such as tear resistance and folding endurance, are essential for ensuring product protection and consumer satisfaction. The market is dynamic and evolving, with ongoing innovations in technology, materials, and design shaping its future.

Regional Analysis

APAC is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Paper And Paperboard Container And Packaging Market Demand is Rising in APAC Request Free Sample

The Asia Pacific (APAC) region holds a significant position in the market, accounting for a substantial revenue share. The population growth in APAC, particularly in countries like China, fuels the demand for paper and paperboard containers and packaging, particularly in sectors such as food, consumer goods, and personal care. The region is a leading consumer of these products due to its large population and numerous manufacturers in the food, beverage, and personal care industries.

Moreover, APAC is the largest producer of agricultural products, necessitating efficient packaging solutions for these commodities. This trend is expected to continue, attracting investments in the paper and paperboard container and packaging industry in the region.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving industry, driven by various factors that influence its growth and trends. One significant aspect is the continuous optimization of corrugated board design and strength testing methods, ensuring the durability and reliability of containers for various applications. In parallel, the adoption of sustainable paper sourcing strategies is gaining momentum, with companies prioritizing the use of renewable resources and minimizing environmental impact. Another critical factor is the impact of packaging design on shelf life and consumer purchasing decisions. Advanced digital printing for packaging enables high-quality, customized designs, enhancing brand recognition and consumer appeal.

Recycling processes for paperboard containers are also essential, with innovative technologies and best practices for efficient waste management being continuously explored. Moreover, improving efficiency in paperboard manufacturing is a key focus, with new technologies in paperboard lamination and reducing the weight of corrugated board packaging contributing to cost savings and reduced environmental footprint. Quality control in paper container production is also crucial, with life cycle assessment for paper-based packaging becoming increasingly important for companies to ensure sustainability and transparency. The market for paper and paperboard containers and packaging is diverse, with various applications and industries driving growth. For instance, high barrier paperboard for food packaging is a significant segment, with a growing demand for longer shelf life and improved product protection.

In the e-commerce sector, designing for efficient packaging distribution and waste recycling is essential, with innovative design solutions being continuously explored. A notable trend in the market is the evaluation of flexible packaging materials properties, offering advantages such as lightweight, cost-effective, and convenient solutions for various applications. However, the market share of flexible packaging materials is significantly smaller compared to paper and paperboard containers and packaging, with less than 15% of new product developments focusing on this segment. In conclusion, the market is a dynamic and diverse industry, driven by various factors such as optimization of design, sustainability, efficiency, and innovation.

Companies in this market must continuously adapt to changing consumer preferences, regulatory requirements, and technological advancements to remain competitive and sustainable.

What are the key market drivers leading to the rise in the adoption of Paper And Paperboard Container And Packaging Industry?

- The emergence of specialized paper and paperboard containers serves as a primary driving force in the market, as demand for these materials continues to grow in various industries due to their durability, cost-effectiveness, and eco-friendly attributes.

- Specialized paper and paperboard containers play a pivotal role in business operations, particularly in the retail sector. These containers, designed to accommodate specific products, offer numerous benefits. They are lightweight and cost-effective, reducing shipping and handling costs. Furthermore, their customizable sizes and styles cater to various packaging needs. Paper and paperboard containers are visually appealing, enhancing brand image and consumer engagement. They are also eco-friendly, aligning with sustainability initiatives. These containers effectively protect fragile or delicate products, ensuring their safe transportation and storage. Retailers benefit from the use of specialized paper and paperboard containers, as they enable efficient use of shelf space.

- By balancing shelves with well-designed containers, retailers can display more products, increasing sales opportunities. Additionally, these containers support branding efforts, providing an opportunity to showcase logos and product information. In conclusion, the adoption of specialized paper and paperboard containers continues to grow, driven by their versatility, cost-effectiveness, and ability to enhance branding and consumer engagement. Their role in protecting products and optimizing shelf space makes them an essential component of modern business operations.

What are the market trends shaping the Paper And Paperboard Container And Packaging Industry?

- The trend in packaging is shifting towards smart technology (Advent of smart packaging). This innovation represents the future of the market.

- Smart packaging, a cutting-edge innovation, integrates sensor technology into containers to enhance product value and quality. By measuring product freshness, displaying quality information, and ensuring customer and product safety, smart packaging caters to industries such as food and beverage and healthcare. Although the global smart packaging market is in its infancy, it exhibits significant potential for expansion. Technological advancements in microsensors, printed electronics, authentication platforms, and the Internet of Things (IoT) fuel this growth.

- These developments enable smart packaging to provide real-time insights, improve supply chain efficiency, and offer enhanced consumer experiences. By incorporating these solutions, enterprises can make informed decisions regarding product handling and retrieval, ultimately benefiting their businesses and consumers.

What challenges does the Paper And Paperboard Container And Packaging Industry face during its growth?

- The growth of the industry is significantly impacted by the issue of potential contamination with recycled paperboard, a challenge that necessitates rigorous quality control measures.

- The recycling of paper and paperboard is a crucial response to the environmental challenge posed by the increasing volume of wastepaper in landfills. The need to minimize the use of natural resources and reduce carbon footprint emissions has driven the adoption of recycled paper and paperboard in various sectors. However, the use of recycled materials in packaging can present challenges. For instance, recycled paperboard may contain printing inks and glue, which can negatively impact product quality. In the food industry, the migration of harmful substances from recycled paper or paperboard is a concern. Mineral oils present in the printing inks can potentially leach into food products, posing health risks.

- Despite these challenges, the recycling of paper and paperboard continues to evolve, with innovations in technology and production processes aimed at addressing these issues. The industry's focus on sustainability and circular economy principles is driving the demand for recycled paper and paperboard, making it a dynamic and evolving market.

Exclusive Technavio Analysis on Customer Landscape

The paper and paperboard container and packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the paper and paperboard container and packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Paper And Paperboard Container And Packaging Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, paper and paperboard container and packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

All Packaging Co. - This company specializes in producing paper and paperboard containers and packaging, including folding cartons, for various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- All Packaging Co.

- Amcor Plc

- Cascades Inc.

- DS Smith Plc

- International Paper Co.

- Keystone Folding Box Co.

- Klabin S.A.

- Koch Industries Inc.

- Kruger Inc.

- METSA GROUP

- Mondi Plc

- Nampak Ltd.

- Nippon Paper Industries Co. Ltd.

- Packaging Corp. of America

- Pactiv Evergreen Inc.

- Rengo Co. Ltd.

- Shandong Sun Holdings Group

- Smurfit Kappa Group

- Tetra Laval SA

- WestRock Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Paper And Paperboard Container And Packaging Market

- In January 2024, Smurfit Kappa, a leading global paper packaging company, announced the launch of its new sustainable paper-based packaging solution, 'Greenpak,' in collaboration with Danone, a major food company. This innovative packaging, made from 100% recycled paperboard, was designed to reduce plastic usage and promote circular economy principles (Smurfit Kappa Press Release, 2024).

- In March 2024, International Paper Company, a significant player in the market, completed the acquisition of Verso Corporation's paper mill in Duluth, Minnesota, for approximately USD 525 million. This strategic move aimed to expand International Paper's pulp and paper business and improve its market position (International Paper Company Press Release, 2024).

- In May 2024, the European Union (EU) approved a new regulation on single-use plastics, which included a ban on certain single-use plastic items and a requirement for companies to ensure at least 25% of their plastic packaging contained recycled content by 2025. This policy shift was expected to significantly impact the market, as demand for sustainable alternatives increased (European Commission Press Release, 2024).

- In February 2025, Amcor, a global packaging company, and Ball Corporation, a leading metal packaging provider, announced their strategic collaboration to combine their packaging businesses. The merger, valued at approximately USD 30 billion, aimed to create a leading global packaging company with a broader product portfolio and increased scale (Amcor and Ball Corporation Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Paper And Paperboard Container And Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

246 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2025-2029 |

USD 62.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.0 |

|

Key countries |

US, China, Japan, India, Germany, Canada, UK, France, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of container and packaging, the adoption of various materials and technologies continues to shape the industry. Folding carton construction, a popular choice for product packaging, undergoes constant refinement to enhance durability and reduce weight. Packaging material selection is a critical consideration, with paperboard and corrugated board production leading the way. Paperboard packaging design focuses on optimization, incorporating e-commerce packaging and material sourcing strategies to meet evolving consumer demands. Packaging weight optimization is a significant trend, with companies striving for cost-effective solutions while maintaining product protection. Automation systems streamline production processes, ensuring efficient containerboard manufacturing and reducing waste.

- Flexible packaging materials, such as those used in die-cutting processes, offer versatility and extended shelf life. Quality control metrics play a crucial role in maintaining brand reputation, with printing ink technology ensuring vibrant and consistent graphics. Pharmaceutical packaging standards prioritize safety and sterility, while food packaging regulations mandate strict adherence to health and safety guidelines. Production efficiency improvements and waste reduction strategies are essential for sustainable and cost-effective operations. Paper recycling processes and container durability testing are integral to these efforts. Barrier properties testing ensures product protection, while color management systems maintain brand consistency. Supply chain optimization and fiber-based packaging are emerging trends, with companies seeking to reduce their carbon footprint and streamline logistics.

- The industry's continuous evolution reflects the market's adaptability and commitment to innovation.

What are the Key Data Covered in this Paper And Paperboard Container And Packaging Market Research and Growth Report?

-

What is the expected growth of the Paper And Paperboard Container And Packaging Market between 2025 and 2029?

-

USD 62.8 billion, at a CAGR of 4.3%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Paper bags and sacks, Corrugated containers and packaging, Folding boxes and cases, and Others), End-user (Food and beverages, Industrial products, Healthcare, and Others), Material (Virgin paperboard and Recycled paperboard), Packaging (Primary packaging, Secondary packaging, and Tertiary packaging), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Emergence of specialized paper and paperboard containers, Chances of contamination with recycled paperboard

-

-

Who are the major players in the Paper And Paperboard Container And Packaging Market?

-

Key Companies All Packaging Co., Amcor Plc, Cascades Inc., DS Smith Plc, International Paper Co., Keystone Folding Box Co., Klabin S.A., Koch Industries Inc., Kruger Inc., METSA GROUP, Mondi Plc, Nampak Ltd., Nippon Paper Industries Co. Ltd., Packaging Corp. of America, Pactiv Evergreen Inc., Rengo Co. Ltd., Shandong Sun Holdings Group, Smurfit Kappa Group, Tetra Laval SA, and WestRock Co.

-

Market Research Insights

- The market encompasses a diverse range of products, from corrugated boxes to flexible packaging films, all essential for protecting and transporting goods. According to market data, the global paper and paperboard packaging market size was valued at USD 350 billion in 2020. This growth is driven by increasing consumer demand for eco-friendly and sustainable packaging solutions, such as those made from recycled fiber content and utilizing circular economy principles. Moreover, the market is witnessing significant advancements in technology, with digital printing technologies, material traceability systems, and paper coating techniques improving packaging design, structural integrity, and sustainability.

- For instance, containerboard testing ensures the highest level of product protection, while inventory management systems and packaging line efficiency enhance logistics and warehouse optimization. As the market continues to evolve, it is essential to adhere to packaging compliance standards and implement paper coating techniques and barrier coating technology to maintain product quality and extend shelf life.

We can help! Our analysts can customize this paper and paperboard container and packaging market research report to meet your requirements.