US Corrugated Box Market Size 2024-2028

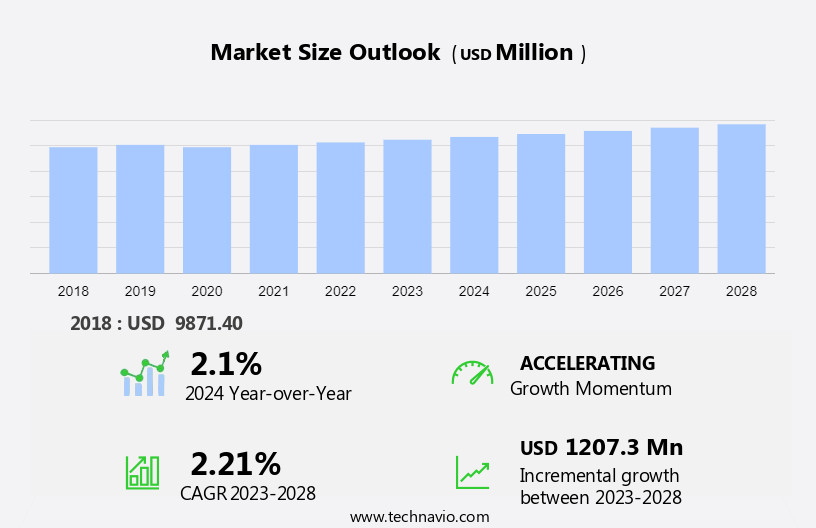

The US corrugated box market size is forecast to increase by USD 1.21 billion, at a CAGR of 2.21% between 2023 and 2028.

- The market is experiencing significant growth, driven by the rise in e-commerce retail sales and the demand for customizable packaging solutions tailored to online buyers. Raw materials, such as multi-purpose paper and sustainable products, are trending in response to increasing environmental concerns. Manufacturing methods, including digital printing and flexible plastic packaging, are advancing to meet the needs of online businesses for portability and warehousing cost efficiency. The market is also witnessing the emergence of slotted boxes and telescope boxes, which offer enhanced protection and versatility. However, challenges persist, including the environmental impact of deforestation and CO2 emissions, as well as the need to balance sustainability with cost-effectiveness. The report also highlights the impact of rapid advances in printing technology and the increasing importance of just-in-time inventory models on market growth.

What will be the size of the US Corrugated Box Market during the forecast period?

- The market is witnessing significant growth due to the increasing demand for a sustainable approach and eco-friendly material in packaging solutions. With the rise of online shopping, corrugated packaging solutions have become a preferred choice for e-commerce retailers in various sectors, including consumer goods, electronic industry, and aluminum industry. The e-commerce sector's growth is driving the demand for corrugated boxes in various sizes, colors, and designs, as they offer lightweight and durable options.

- Moreover, the trend towards paper-based packaging is gaining momentum as online buyers prefer packaging that is easy to recycle and has a minimal carbon footprint. Graphic design plays a crucial role in the market, as customized text, graphics, and logos are essential for brand recognition. The raw materials used in manufacturing corrugated boxes, such as recycled paper, are also subject to market fluctuations, impacting the pricing and availability of these packaging solutions.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Food and beverage products

- Non-durable products

- Durables and others

- Material

- Virgin corrugates

- Recycled corrugates

- Geography

- US

By End-user Insights

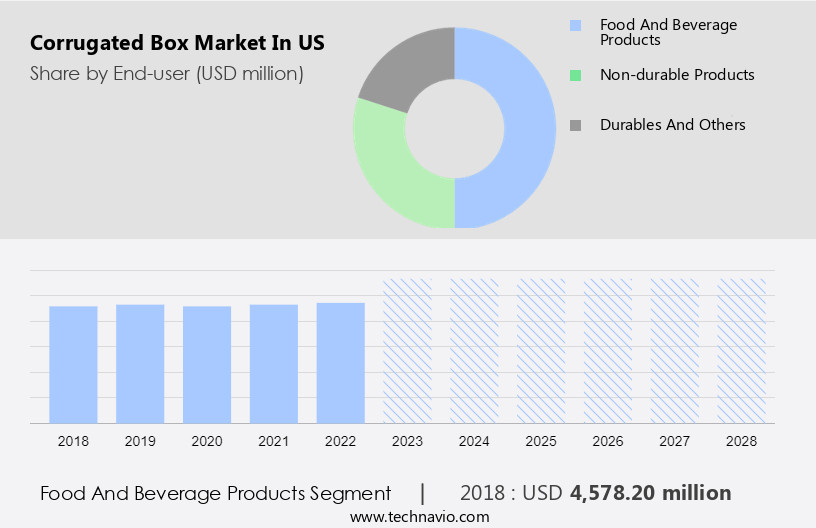

- The food and beverage products segment is estimated to witness significant growth during the forecast period.

The market, particularly in the food and beverage sector, is experiencing consistent growth due to the increasing demand for processed foods and the shift towards e-commerce platforms. With a high per capita income, the US population has a strong affinity for affordable consumer goods, making corrugated boxes a preferred choice for packaging. The food and beverage segment dominates the corrugated box market, accounting for over 50%, with applications ranging from fresh produce and processed foods to non-perishables. In addition, the personal care industry and e-commerce business development have also contributed significantly to the market's growth.

Corrugated boxes are widely used in the electronics sector and consumer goods industries as well. Kraft liner and various flute sizes are commonly used in the production of corrugated boxes to ensure product protection and durability. The use of both recycled and virgin materials in the virgin material segment and the virgin category segment caters to the diverse needs of various industries. Aluminum industry players also contribute to the market by providing aluminum foil for use as a liner or barrier in corrugated boxes, enhancing the product's shelf life and preserving the quality of sensitive goods.

Get a glance at the market share of various segments Request Free Sample

The food and beverage products segment was valued at USD 4.59 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of the US Corrugated Box Market?

Increased market consolidation is the key driver of the market.

- The market is witnessing significant growth due to the increasing demand for sustainable and eco-friendly packaging solutions. Manufacturers are focusing on using paper-based packaging materials to reduce landfill waste and minimize greenhouse gas emissions. The shift towards flexible packaging systems, such as slotted boxes, is gaining popularity due to their lightweight nature and health benefits. Graphic design plays a crucial role in the corrugated packaging industry, with customized designs enhancing brand recognition and consumer appeal.

- Packaging solution manufacturers are continuously innovating to meet the evolving needs of online shopping and e-commerce industries. Consolidation among companies in the corrugated box market is leading to increased production capacity and efficiency. This trend facilitates companies to adopt advanced technology and implement sustainable practices, aligning with environmental standards and reducing energy consumption. By acquiring or merging with appropriate companies, large companies can also expand their product offerings and cater to a wider customer base.

What are the market trends shaping the US Corrugated Box Market?

Rapid advances in printing is the upcoming trend In the market.

- The market is witnessing significant growth due to the increasing preference for sustainable and eco-friendly packaging solutions. Corrugated packaging solutions, made from paper-based materials, are a popular choice for businesses seeking to reduce their environmental footprint. Online shopping has further fueled the demand for corrugated boxes, as they provide reliable protection during transit. Graphic design plays a crucial role in enhancing the visual appeal of corrugated boxes. Advanced printing technologies, such as flexography and digital printing, enable the creation of photorealistic images, adding value to brand visibility. Flexographic printing is cost-effective, while digital printing offers greater flexibility and customization.

- Premium consumer products, including cosmetics and household items, are driving the demand for advanced corrugated packaging solutions. These products require rigid and flexible packaging materials that meet stringent environmental standards. Sustainable approaches, such as the use of recycled paper and biodegradable inks, are gaining popularity. Corrugated boxes offer health benefits, as they are free from harmful chemicals and are recyclable. The flexible packaging system reduces the amount of landfill waste and minimizes greenhouse gas emissions. Energy consumption during the manufacturing process is also a concern, and companies are investing in energy-efficient technologies to minimize environmental impacts. Packaging solution manufacturers are focusing on developing innovative designs, such as slotted boxes, to cater to diverse customer needs.

What challenges does the US Corrugated Box Market face during the growth?

Impact of just-in-time inventory model is a key challenge affecting market growth.

- The market is witnessing significant growth due to the increasing preference for sustainable and eco-friendly packaging solutions. End-users of corrugated boxes are shifting towards just-in-time inventory models to save inventory space and reduce costs. This trend is particularly prevalent In the online shopping sector, where corrugated packaging solutions offer flexibility in graphic design and paper-based materials. Manufacturers of corrugated boxes are focusing on reducing environmental impacts by using renewable resources and minimizing landfill waste. They are also working to reduce greenhouse gas emissions and energy consumption in their production processes to meet environmental standards.

- Corrugated boxes are available in both rigid and flexible packaging materials, each offering unique benefits. Rigid boxes provide superior protection and are ideal for heavy products, while flexible packaging systems offer cost savings and convenience for lighter items. Moreover, the health benefits of paper-based packaging materials are driving demand, particularly in the food and pharmaceutical industries. The slotted boxes segment is expected to dominate the market due to its versatility and cost-effectiveness. Despite these opportunities, challenges remain, including the unpredictability of demand and the need for efficient inventory management. Many manufacturers are addressing these challenges by outsourcing inventory control to third-party providers for streamlined operations and cost savings.

Exclusive US Corrugated Box Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acme Corrugated Box Co. Inc.

- Amcor Plc

- Associated Bag

- Buckeye Corrugated Inc.

- Cascades Inc.

- DS Smith Plc

- Georgia Pacific

- Great Little Box Co. Ltd.

- Hood Container Corp.

- International Paper Co.

- Kruger Inc.

- Mondi Plc

- Neway Packaging Corp.

- Packaging Bee

- Packaging Corp. of America

- Shillington Box Co LLC

- Stora Enso Oyj

- VPK Group

- Wertheimer Box Corp.

- WestRock Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for sustainable packaging solutions in various industries. The shift towards eco-friendly materials, such as paper-based packaging, is gaining popularity, especially in the online shopping sector. The use of sustainable approaches, like recycled material in corrugated boards, is reducing landfill waste and greenhouse gas emissions. The corrugated packaging solutions market caters to various industries, including food & beverages, personal care, electronics, and consumer goods. The food & beverages segment is a major contributor, with fresh produce and processed foods driving the demand for customizable packaging solutions.

Further, the e-commerce business development and the growth of the e-commerce sector are also fueling the market growth. The corrugated box market offers various types of packaging solutions, such as slotted boxes, telescope boxes, rigid boxes, and folder boxes. These packaging solutions are lightweight, durable, safe, and secure, offering protection against shock, moisture, and other environmental impacts. They are also cost-effective and versatile, available in various sizes, colors, designs, and text. The manufacturing methods, such as digital printing, hot melt-based inks, and lithography printing, are continually evolving to meet the changing consumer preferences and environmental standards. The use of biodegradable and recyclable materials is becoming increasingly important to reduce waste and minimize environmental impact.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

121 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.21% |

|

Market growth 2024-2028 |

USD 1.21 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.1 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch