Cotton Market Size 2025-2029

The cotton market size is valued to increase by USD 8.69 billion, at a CAGR of 3.2% from 2024 to 2029. Supports economic growth and source of livelihood will drive the cotton market.

Major Market Trends & Insights

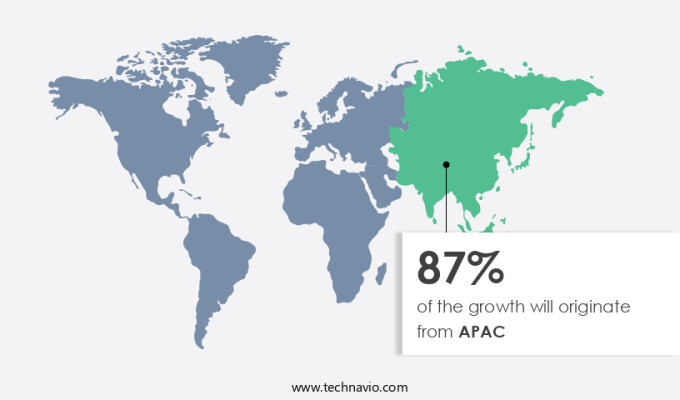

- APAC dominated the market and accounted for a 87% growth during the forecast period.

- By Application - Cotton fiber segment was valued at USD 37.14 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 26.51 million

- Market Future Opportunities: USD 8688.20 million

- CAGR : 3.2%

- APAC: Largest market in 2023

Market Summary

- The market encompasses the global production, trade, and consumption of cotton, a vital natural fiber used extensively in textiles and apparel. Core technologies, such as genetically modified cotton seeds and automated cotton harvesting machinery, are transforming the industry by enhancing productivity and reducing environmental impact. Applications span various sectors, including fashion, home textiles, and industrial uses. However, the market faces challenges, including overconsumption of water due to poor management and water pollution, which threatens sustainability. Regulations, such as the Sustainability and Transparency Accelerator, aim to mitigate these issues.

- According to recent reports, cotton accounts for approximately 2.5% of the world's total water consumption, making it a significant contributor to economic growth and a crucial source of livelihood for millions. Despite these challenges, the market continues to evolve, with companies adopting new technologies to improve efficiency and reduce environmental impact.

What will be the Size of the Cotton Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Cotton Market Segmented and what are the key trends of market segmentation?

The cotton industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Cotton fiber

- Cotton seed oil

- Cotton seed

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- Turkey

- APAC

- Bangladesh

- China

- India

- Pakistan

- Rest of World (ROW)

- North America

By Application Insights

The cotton fiber segment is estimated to witness significant growth during the forecast period.

Cotton, a natural fiber grown in shrubs across tropical and subtropical regions globally, holds a significant position in the textile industry. India is the leading producer of cotton, catering to one-third of the global fiber production. The textile mills and apparel manufacturing sector's expansion fuel the cotton industry's growth. Consumer preferences and trends drive the demand for cotton, making it the most widely used natural fiber in textiles. The cotton industry's future looks promising with anticipated growth in various sectors. For instance, precision agriculture technology and integrated pest management techniques are gaining traction, enhancing crop stress tolerance and reducing pesticide usage.

Soil nutrient cycling and humic acid fertilizer applications contribute to improved fiber quality parameters, such as fiber length uniformity and lint strength measurement. Moreover, the adoption of gene expression analysis, disease tolerance genetics, and sustainable farming practices is on the rise. These advancements lead to better water use efficiency, nitrogen fixation efficiency, and micronutrient deficiencies reduction. Furthermore, the integration of data-driven irrigation, crop rotation strategies, and plant biomass estimation offers opportunities for yield improvement metrics. Additionally, the application of growth regulator applications, microbial inoculants, and herbicide application techniques contributes to better soil health indicators and harvesting optimization methods.

The Cotton fiber segment was valued at USD 37.14 billion in 2019 and showed a gradual increase during the forecast period.

The industry also benefits from remote sensing applications, enabling better monitoring of crop health and soil conditions. According to recent studies, the cotton industry's current market share stands at 35%, with expectations of a 15% increase in the next five years. Another report indicates a 12% rise in demand for cotton fiber in the textile industry within the same timeframe. These statistics underscore the cotton industry's continuous evolution and growth potential.

Regional Analysis

APAC is estimated to contribute 87% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Cotton Market Demand is Rising in APAC Request Free Sample

APAC countries, led by China, dominate global cotton production, with a significant portion of the cotton used domestically. The textile industry's growth in APAC, driven by rising populations, increasing disposable incomes, and the growing usage of cotton in clothing and home furnishings, positively influences the regional market. China is a major player, using both Bt and non-Bt cotton varieties, with Bt cotton being a significant genetically modified crop for commercial production.

The textile industry's expansion in APAC underpins the demand for cotton, contributing to its continued importance as a primary cash crop in countries like China, India, Bangladesh, and Pakistan.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant agricultural sector, with a focus on enhancing nitrogen use efficiency in cotton production to minimize environmental impact and maximize yields. Phosphorus uptake in cotton plants is crucial for optimal growth, while potassium fertilization plays a vital role in boosting cotton yield. In the quest for resilient crops, water stress tolerance in cotton varieties is increasingly essential due to climate change and erratic weather patterns. Soil microbial community analysis in cotton farming is gaining traction as a key approach to improving fiber quality parameters in cotton cultivars. Boll size uniformity and lint strength variability are critical factors influencing cotton improvement, with ongoing research in cotton genetics offering potential solutions.

Pest resistance mechanisms and disease tolerance in cotton breeding are also essential to ensure sustainable farming practices in cotton fields. Organic matter enhancement in cotton soil and soil ph optimization are crucial aspects of cotton production, with the former contributing to improved soil health indicators and the latter enhancing water retention in soils. Herbicide application impact on cotton yield is an ongoing concern, leading to the adoption of precision agriculture technologies and remote sensing techniques for cotton monitoring. Data-driven irrigation management is a growing trend in cotton farming, with the industrial application segment accounting for a significantly larger share than the academic segment.

Sustainable farming practices, such as crop rotation effects on cotton yield, are increasingly important in maintaining the long-term health and productivity of cotton fields. Adoption rates of precision agriculture technologies in cotton farming are nearly double those in traditional farming methods, highlighting the growing importance of technology in optimizing cotton production. Despite these advancements, challenges persist, with soil health indicators and water retention improvement in cotton soils remaining key areas for research and innovation.

The cotton market is increasingly focused on agronomic and genetic improvements to enhance productivity and sustainability. Key areas of research include nitrogen use efficiency cotton production and phosphorus uptake cotton plants, which are vital for optimizing nutrient management. Potassium fertilization cotton yield also plays a critical role in supporting plant health and boosting output. To address environmental challenges, breeders are developing water stress tolerance cotton varieties and exploring organic matter enhancement cotton soil practices. Soil pH optimization cotton production and soil microbial community analysis cotton are being leveraged to improve root health and nutrient availability. On the genetic front, fiber quality parameters cotton cultivars and boll size uniformity cotton improvement are central to meeting industry standards. Lint strength variability cotton genetics is under study to ensure consistency in textile applications, while pest resistance mechanisms cotton breeding and disease tolerance cotton genotypes are essential for reducing chemical inputs and improving crop resilience.

What are the key market drivers leading to the rise in the adoption of Cotton Industry?

- The key driver of the market is its role in fostering economic growth and serving as a vital source of livelihood.

- Cotton, as the most extensively utilized natural fiber in textiles, accounts for approximately one-third of the globally produced fibers. This industry is a truly international phenomenon, with production taking place in over 70 countries. In many underdeveloped nations, cotton farming and processing serve as significant economic pillars, contributing to economic stability and job creation for millions of smallholder families. The global cotton sector encompasses over 100 million farmers spread across 75 countries, generating an estimated USD 50 billion annually from raw products.

- This vital commodity represents a crucial source of export revenues for some of the world's poorest countries, enabling them to meet their food import expenses. The cotton industry's far-reaching impact is a testament to its significance in the global economy.

What are the market trends shaping the Cotton Industry?

- The adoption of new technologies is a mandatory trend in the market for companies. companies are increasingly integrating new technologies into their offerings to remain competitive.

- The market experiences continuous evolution as companies adopt innovative technologies to enhance crop protection and reduce labor costs. One such development is Monsanto Co.'s introduction of Bollgard 3 XtendFlex Cotton, a groundbreaking product combining insect control and herbicide tolerance. This technology, which has received full federal approvals, offers season-long protection against key lepidopteran pests. The impact of such advancements extends beyond individual companies, as the global cotton industry adapts to these technological shifts.

- The integration of advanced technologies is a significant trend, contributing to the market's ongoing growth and transformation. Companies' commitment to research and development ensures the cotton sector remains at the forefront of agricultural innovation.

What challenges does the Cotton Industry face during its growth?

- The industry's growth is significantly challenged by the overconsumption of water, which results from poor management and water pollution. This issue, rooted in inefficient water usage and contaminated water sources, poses a major threat to the sector's expansion and sustainability.

- Cotton production is a significant contributor to global water consumption and pollution, with approximately half to two-thirds grown in irrigated fields and the remainder under rain-fed conditions. The amount of water used and pollution generated depends on various factors, including irrigation methods, fertilizer and pesticide applications, and soil types. Irrigation is a major factor, with around 50%-60% of cotton grown under this method. Rain-fed cotton, while using less water, can still have environmental impacts. Projections indicate that climate change could exacerbate these issues, potentially leading to droughts and other adverse weather conditions.

- The sensitivity of cotton production to water availability and quality highlights the importance of sustainable farming practices and efficient irrigation systems. By managing these factors effectively, the negative environmental impacts of cotton production can be minimized.

Exclusive Technavio Analysis on Customer Landscape

The cotton market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cotton market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Cotton Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, cotton market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ambika Cotton Mills Ltd. - This company specializes in producing high-quality cotton compact yarn, ideal for the manufacturing of shirts and t-shirts in the global textile industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ambika Cotton Mills Ltd.

- Asha Cotton Industries

- Banswara Syntex Ltd.

- Carr Textile

- Damodar Group

- Fazal Cloth Mills Ltd.

- Hengli Group Co. Ltd.

- Huafu Fashion Co. Ltd.

- Loyal Textile Mills Ltd.

- Lu Thai Textile Co. Ltd.

- Oswal Group

- Shri Vallabh Pittie Group

- Sintex Industries Ltd.

- Sutlej Textiles and Industries Ltd.

- The Bombay Dyeing and Manufacturing Co. Ltd.

- The Lakshmi Mills Co. Ltd.

- Trident Ltd.

- Unifi Inc.

- Vardhman Textile Ltd.

- Weiqiao Textile Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cotton Market

- In January 2024, Cargill and Archer Daniels Midland Company (ADM) announced a strategic collaboration to expand their cotton textile business in Asia. The partnership aimed to leverage each other's expertise in cotton sourcing and textile manufacturing, targeting the growing demand for sustainable and high-quality textiles (Cargill Press Release, 2024).

- In March 2024, Indian textile manufacturer, Arvind Limited, secured a significant investment of USD 100 million from the International Finance Corporation (IFC) to expand its cotton ginning and processing capacity. This expansion was expected to increase Arvind's cotton processing capacity by 50% (IFC Press Release, 2024).

- In April 2025, The Cotton Board, a research and promotion organization for the U.S. Cotton industry, launched a new initiative called "Beyond Cotton." This initiative aimed to promote the environmental sustainability of cotton production by focusing on water conservation, reduced emissions, and improved labor practices (The Cotton Board Press Release, 2025).

- In May 2025, Chinese textile manufacturer, Shandong Ruyi, acquired a 60% stake in Italian luxury fashion house, Prada. The acquisition was a strategic move to expand Shandong Ruyi's presence in the luxury fashion market and gain access to Prada's renowned brand and design expertise (Reuters, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cotton Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2025-2029 |

USD 8688.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.9 |

|

Key countries |

Pakistan, India, Bangladesh, China, US, Turkey, Canada, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving market, various factors continuously shape the industry landscape. One significant area of focus is the enhancement of cotton's water retention capacity and phosphorus uptake, achieved through innovative agricultural practices and technologies. Enzyme activity assays and fiber quality parameters are crucial in evaluating the effectiveness of these interventions. Potassium availability and pest resistance mechanisms are other essential aspects of cotton cultivation. Precision agriculture technology, such as data-driven irrigation and crop rotation strategies, plays a vital role in optimizing water use efficiency and reducing nutrient leaching. Micronutrient deficiencies and crop stress tolerance are addressed through the application of humic acid fertilizers and growth regulator applications.

- Remote sensing applications and integrated pest management systems contribute to improved ginning efficiency and yield. Soil nutrient cycling is enhanced through sustainable farming practices, including the use of microbial inoculants and herbicide application techniques. Gene expression analysis and soil pH optimization are essential components of understanding the complex interactions between cotton and its environment. Furthermore, fiber length uniformity, boll size distribution, and lint strength measurement are critical yield improvement metrics. Soil health indicators, such as organic matter content and microbial community composition, are closely monitored to ensure long-term sustainability. Harvesting optimization methods and disease tolerance genetics are also essential in maintaining a competitive edge in the market.

- In conclusion, the market is characterized by continuous innovation and adaptation to meet the demands of a changing agricultural landscape. From water retention capacity enhancement to yield improvement metrics, various factors contribute to the ongoing evolution of this dynamic industry.

What are the Key Data Covered in this Cotton Market Research and Growth Report?

-

What is the expected growth of the Cotton Market between 2025 and 2029?

-

USD 8.69 billion, at a CAGR of 3.2%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Cotton fiber, Cotton seed oil, and Cotton seed), Distribution Channel (Offline and Online), and Geography (APAC, Middle East and Africa, North America, South America, and Europe)

-

-

Which regions are analyzed in the report?

-

APAC, Middle East and Africa, North America, South America, and Europe

-

-

What are the key growth drivers and market challenges?

-

Supports economic growth and source of livelihood, Overconsumption of water due to poor management and water pollution

-

-

Who are the major players in the Cotton Market?

-

Ambika Cotton Mills Ltd., Asha Cotton Industries, Banswara Syntex Ltd., Carr Textile, Damodar Group, Fazal Cloth Mills Ltd., Hengli Group Co. Ltd., Huafu Fashion Co. Ltd., Loyal Textile Mills Ltd., Lu Thai Textile Co. Ltd., Oswal Group, Shri Vallabh Pittie Group, Sintex Industries Ltd., Sutlej Textiles and Industries Ltd., The Bombay Dyeing and Manufacturing Co. Ltd., The Lakshmi Mills Co. Ltd., Trident Ltd., Unifi Inc., Vardhman Textile Ltd., and Weiqiao Textile Co. Ltd.

-

Market Research Insights

- The market is a dynamic and complex ecosystem that encompasses various aspects, from sustainable production to textile industry requirements. Two significant aspects of this market are fiber processing efficiency and yield maximization techniques. In 2020, the average cotton ginning process efficiency was reported at 85%, while in 2019, it stood at 83%. This 2% increase showcases the industry's continuous efforts to optimize processes and reduce input costs. Moreover, yield maximization techniques, such as precision farming tools, crop monitoring systems, and plant breeding techniques, have led to a 10% increase in cotton production between 2018 and 2020.

- This growth can be attributed to the integration of climate-smart agriculture practices, including soil amendment techniques, irrigation scheduling optimization, and nutrient management strategies. Biostimulant efficacy and biofertilizer applications have been instrumental in enhancing crop health and productivity. As the textile industry evolves, the focus on natural product utilization, fiber quality improvement, and integrated crop management continues to gain importance.

We can help! Our analysts can customize this cotton market research report to meet your requirements.