Home Furnishings Market Size 2025-2029

The home furnishings market size is valued to increase USD 538.8 million, at a CAGR of 7.2% from 2024 to 2029. Increasing interest in interior design will drive the home furnishings market.

Major Market Trends & Insights

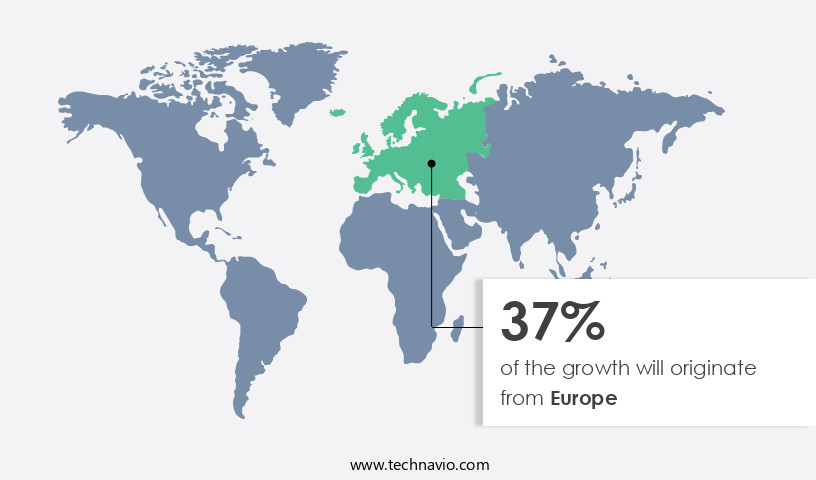

- Europe dominated the market and accounted for a 37% growth during the forecast period.

- By Product - Home furniture segment was valued at USD 419.80 million in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 95.70 million

- Market Future Opportunities: USD 538.80 million

- CAGR : 7.2%

- Europe: Largest market in 2023

Market Summary

- The market encompasses a diverse range of products and services, with core technologies and applications continually advancing to meet evolving consumer preferences. Notable trends include the increasing interest in interior design and the rise of eco-friendly home furnishings. Despite these opportunities, the market faces challenges such as uncertainty in prices of raw materials. According to recent market research, the eco-friendly segment is projected to account for over 25% of the market share by 2026, underscoring its growing significance.

- As the home furnishings landscape continues to unfold, stakeholders must navigate these dynamics to capitalize on emerging opportunities and mitigate potential risks.

What will be the Size of the Home Furnishings Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Home Furnishings Market Segmented and what are the key trends of market segmentation?

The home furnishings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Home furniture

- Home textiles

- Floor coverings

- Distribution Channel

- Offline

- Online

- Material

- Wood

- Fabric/Textile

- Metal

- Plastic

- Glass

- End-user

- Residential

- Commercial

- Decorative Accessories

- Wall Art

- Rugs and Carpets

- Lighting Fixtures

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The home furniture segment is estimated to witness significant growth during the forecast period.

The market is a significant sector, accounting for over half the market share due to its essential role in residential buildings, villas, and bungalows. Among the regions, Asia Pacific (APAC) exhibits the fastest growth, with countries like China, India, and Japan leading the charge. This expansion is attributed to the increasing average dual-household income and population growth. Multifunctional and ready-to-assemble (RTA) furniture are popular choices within this segment, catering to the evolving consumer preferences. The market is projected to witness continued growth, fueled by the rising demand for luxury furniture. Home furniture encompasses various categories, including living room, bedroom, kitchen, and bathroom furnishings.

Consumers increasingly prioritize bathroom furniture, particularly country and rustic styles. Interior design elements, such as upholstery fabrics, stain finishes, and fabric durability, significantly influence furniture selection. Spring systems, rug materials, particle board, wood treatments, plywood construction, textile blends, metal furniture, foam density ratings, ergonomic chairs, furniture design software, cushion fillings, furniture repair, glass furniture, supply chain logistics, furniture assembly, sustainable materials, window treatments, curtain fabrics, home decor styles, recycled wood, solid wood furniture, carpet fibers, cabinet hardware, laminate flooring, paint finishes, quality control furniture manufacturing processes, upholstery maintenance, wood veneer types, furniture refinishing, and lighting fixtures are all integral aspects of this market.

The living room category dominates the market, with bedroom and kitchen furniture following closely. The kitchen segment is expected to gain traction due to the ongoing trend of open-concept living spaces and the growing popularity of modern kitchen designs. In the bedroom furniture segment, ergonomic chairs and furniture design software are increasingly popular, reflecting the importance of comfort and functionality. Furniture repair and maintenance services are also gaining significance as consumers seek to extend the life of their furniture investments. The market for sustainable materials, including recycled wood and solid wood furniture, is on the rise, driven by growing environmental awareness and consumer preferences for eco-friendly products.

The furniture industry's supply chain logistics and furniture assembly processes are undergoing significant changes, with a shift towards just-in-time manufacturing and automated assembly systems. Quality control measures and furniture manufacturing processes are essential to ensure the durability and longevity of furniture products. Upholstery maintenance and furniture refinishing services are also becoming increasingly important to maintain the appearance and functionality of furniture. In conclusion, the market is a dynamic and evolving sector, with various trends and factors shaping its growth. Consumer preferences, technological advancements, and sustainability concerns are among the key drivers of market developments.

The Home furniture segment was valued at USD 419.80 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Home Furnishings Market Demand is Rising in Europe Request Free Sample

The European the market is projected to experience growth during the forecast period, fueled by the rising preference for aesthetically pleasing luxury furniture made from superior raw materials. Trends such as the emphasis on natural materials, sustainable designs, minimalist and functional furniture, and eco-friendly options continue to shape consumer preferences in Europe. Among European countries, Germany, Italy, and France are the leading markets, with France being a significant furniture importer.

These trends and market dynamics are expected to significantly contribute to the expansion of the market in Europe.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of products, including upholstery fabrics, sustainable wood furniture, modern furniture designs, ergonomic office chairs, and more. Upholstery fabric cleaning methods continue to evolve, with increasing emphasis on eco-friendly solutions that minimize water usage and chemical inputs. In the realm of sustainable wood furniture sourcing, there is a growing trend towards certified forests and responsible harvesting practices. Modern furniture design trends reflect a shift towards minimalism and functionality, with high-density foam cushions offering superior comfort and support. The impact of material choices on cost varies significantly; for instance, particle board furniture is more affordable but may lack the durability of plywood, which undergoes rigorous testing to ensure longevity.

Furniture assembly instructions must be clear and concise to minimize frustration and errors. Effective lighting plays a crucial role in showcasing furniture's true colors and textures during retail displays. Wood veneer manufacturing techniques have advanced to create realistic, cost-effective alternatives to solid wood. Cabinet hardware installation methods continue to evolve, with furniture design software comparisons providing valuable insights for manufacturers. Textile blend properties and applications are subject to ongoing research, with rug material care and maintenance a key consideration for consumers. Supply chain disruptions have become a significant challenge for the furniture industry, necessitating waste reduction strategies such as lean manufacturing and recycling initiatives.

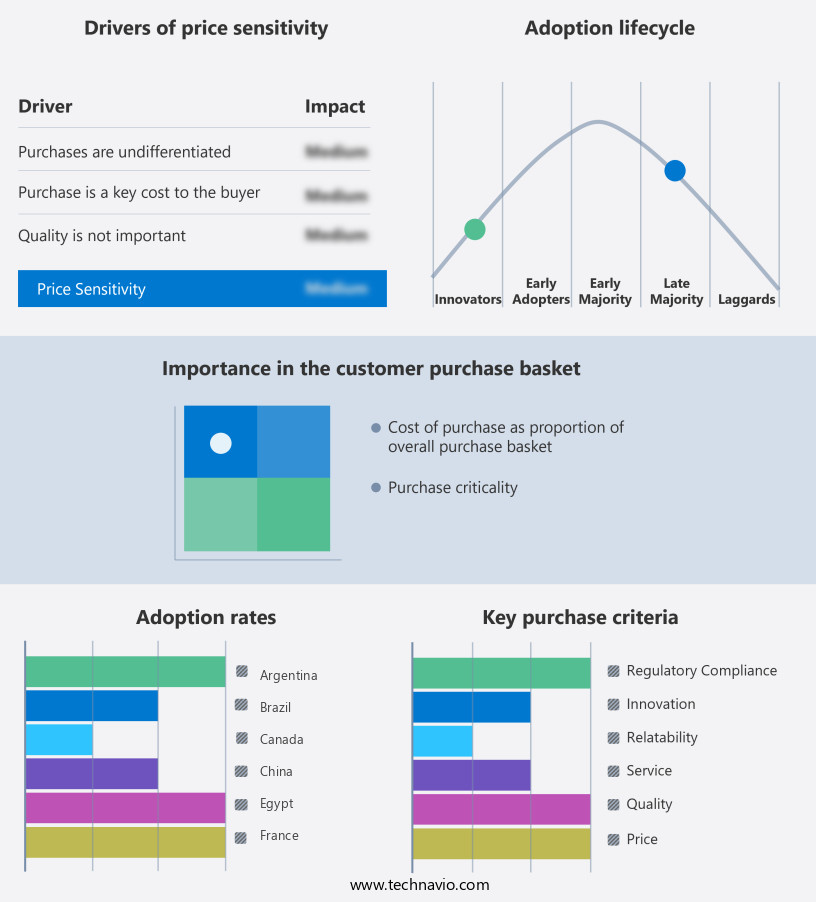

Home decor style influences furniture selection, with impactful color palettes driving sales in various markets. Furniture lifespan extension techniques, including refurbishment and repair, are gaining popularity as consumers seek to minimize replacement costs. Adoption rates for ergonomic office chairs in the commercial sector are nearly double those in residential applications, highlighting the importance of workplace comfort and productivity. This trend underscores the market's dynamic nature and the need for continuous innovation to meet evolving consumer demands.

What are the key market drivers leading to the rise in the adoption of Home Furnishings Industry?

- The surge in public interest and appreciation for interior design has significantly fueled market growth in this sector.

- Consumers globally are increasingly focusing on enhancing the interior design of their homes with high-quality products and innovative concepts. This investment extends to various sectors, including home furnishings, floor coverings, and home textiles. The escalating disposable income levels, shifting lifestyles, increased media exposure, and the influence of diverse cultures are fueling the interest in interior design. Furthermore, the growing number of working women and their involvement in home decoration decisions are driving the sales of home furnishings. The market encompasses a wide range of products, such as sofas, chairs, tables, and beds. The floor coverings segment includes carpets, rugs, and laminate flooring.

- Home textiles consist of curtains, cushion covers, bedspreads, and other fabric-based items. These categories cater to the diverse needs and preferences of consumers, offering both functional and aesthetic benefits. The interior design industry continues to evolve, with ongoing trends and innovations shaping consumer preferences. For instance, sustainable materials and eco-friendly production methods are gaining popularity. Additionally, the integration of technology, such as smart home systems and voice-activated devices, is transforming the way consumers interact with their home interiors. In conclusion, the interior design market is a dynamic and continuously evolving sector that caters to consumers' growing demand for aesthetically pleasing and functional home environments.

- The market's ongoing transformation reflects the increasing importance of home as a space for comfort, relaxation, and self-expression.

What are the market trends shaping the Home Furnishings Industry?

- The increasing demand for eco-friendly home furnishings represents a notable market trend. A growing number of consumers are prioritizing sustainable home decor solutions.

- The market is experiencing significant shifts as consumers prioritize eco-friendliness and sustainability. Driven by growing environmental consciousness, there is a rising demand for furniture made from Moso bamboo. This material, which is stronger and harder than oak, is increasingly preferred due to its aesthetic appeal and sustainable manufacturing processes. Several certifying agencies, such as the Forest Stewardship Council and the Sustainable Furnishing Council, play a crucial role in ensuring environmental sustainability within the industry.

- Consequently, the adoption of Moso bamboo furniture is poised to fuel market expansion during the forecast period. Notably, this trend transcends various sectors, reflecting the continuous evolution of consumer preferences and market dynamics.

What challenges does the Home Furnishings Industry face during its growth?

- The uncertainty surrounding the prices of raw materials poses a significant challenge to the industry's growth trajectory.

- The market is experiencing significant challenges due to escalating raw material costs. The rising prices of high-quality raw materials, such as linen, wool, silk, jute, and cotton, have led to increased manufacturing costs. These expenses are often passed on to consumers through higher product prices, potentially restricting volume sales. Recent commodity price increases and the scarcity of raw materials have intensified this issue. China, with its expanded manufacturing capacity, has contributed to a global shortage of raw materials, exacerbating the problem.

- The market has been subjected to frequent and substantial price hikes, particularly in the realm of natural floor covering fibers. This trend underscores the continuous and evolving nature of the market, where manufacturers and consumers alike must adapt to market fluctuations.

Exclusive Customer Landscape

The home furnishings market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the home furnishings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Home Furnishings Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, home furnishings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ashley Furniture Industries Inc. - This company specializes in home furnishings, providing a range of options including stationary and motion sofas, sectionals, recliners, and chairs, as well as complementary accent tables. Their product offerings cater to modern living spaces, enhancing comfort and style.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ashley Furniture Industries Inc.

- Bassett Furniture Industries Inc.

- Bed Bath & Beyond Inc.

- Ethan Allen Interiors Inc.

- Godrej Interio

- Häfele GmbH & Co KG

- Haverty Furniture Companies Inc.

- Herman Miller Inc.

- IKEA

- La-Z-Boy Inc.

- Nitori Holdings Co. Ltd.

- Oppein Home Group Inc.

- Pepperfry

- Roche Bobois

- Steelcase Inc.

- The Home Depot Inc.

- Walmart Inc.

- Wayfair Inc.

- Westwing Group GmbH

- Williams-Sonoma, Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Home Furnishings Market

- In January 2024, IKEA, the global leader in home furnishings, announced the launch of its new collection, "Sustainable Scandinavian," which includes eco-friendly and recycled materials in response to growing consumer demand for sustainable home solutions (IKEA Press Release, 2024).

- In March 2024, Crate & Barrel, an American home furnishings retailer, entered into a strategic partnership with Wayfair, the online home goods marketplace, to expand its digital presence and reach a broader customer base (Crate & Barrel Press Release, 2024).

- In May 2024, Ethan Allen Interiors, a leading North American home furnishings company, completed the acquisition of Hooker Furniture, a major furniture manufacturer, significantly expanding its manufacturing capabilities and market share (Ethan Allen Interiors Securities and Exchange Commission Filing, 2024).

- In January 2025, the European Union passed the Circular Economy Act, mandating furniture manufacturers to ensure their products are reusable, repairable, and recyclable, driving innovation and investment in sustainable home furnishings solutions (European Union Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Home Furnishings Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

195 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.2% |

|

Market growth 2025-2029 |

USD 538.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.8 |

|

Key countries |

US, China, Germany, Japan, UK, India, Canada, South Korea, Italy, France, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving industry, encompassing a vast array of elements that contribute to the comfort and aesthetic appeal of interior spaces. Upholstery fabrics, a significant segment, continue to innovate with new textile blends and advanced stain finishes, ensuring durability and resistance to wear and tear. Meanwhile, spring systems in furniture design have seen a shift towards ergonomic chairs, prioritizing user comfort and posture. Rug materials, another essential component, showcase a range of options, from natural fibers like wool and silk to synthetic alternatives. In contrast, furniture manufacturing processes have embraced technology with furniture design software and advanced assembly techniques, streamlining production and enhancing customization.

- Particle board and plywood construction remain popular choices for their cost-effectiveness, while wood treatments and veneer types cater to those seeking a more traditional, sustainable approach with solid wood furniture. The market also witnesses growing interest in eco-friendly materials, such as recycled wood and laminate flooring, reflecting the increasing importance of sustainability. Furniture repair and maintenance services continue to gain traction, ensuring the longevity of existing pieces. Additionally, the integration of metal furniture, glass furniture, and cabinet hardware adds versatility and sophistication to modern interiors. Window treatments, including curtain fabrics and home decor styles, offer a myriad of options to complement various design aesthetics.

- Furthermore, the adoption of lighting fixtures and paint finishes adds depth and character to interior spaces, creating a harmonious blend of functionality and visual appeal. Quality control measures and furniture manufacturing processes have been refined to meet the evolving demands of consumers, ensuring a high standard of craftsmanship and durability. With continuous advancements in technology and materials, the market remains an exciting and dynamic industry, offering endless possibilities for enhancing the look and feel of living spaces.

What are the Key Data Covered in this Home Furnishings Market Research and Growth Report?

-

What is the expected growth of the Home Furnishings Market between 2025 and 2029?

-

USD 538.8 million, at a CAGR of 7.2%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Home furniture, Home textiles, and Floor coverings), Distribution Channel (Offline and Online), Geography (Europe, North America, APAC, Middle East and Africa, South America, and Rest of World (ROW)), Material (Wood, Fabric/Textile, Metal, Plastic, and Glass), End-user (Residential and Commercial), and Decorative Accessories (Wall Art, Rugs and Carpets, and Lighting Fixtures)

-

-

Which regions are analyzed in the report?

-

Europe, North America, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increasing interest in interior design, Uncertainty in prices of raw materials

-

-

Who are the major players in the Home Furnishings Market?

-

Key Companies Ashley Furniture Industries Inc., Bassett Furniture Industries Inc., Bed Bath & Beyond Inc., Ethan Allen Interiors Inc., Godrej Interio, Häfele GmbH & Co KG, Haverty Furniture Companies Inc., Herman Miller Inc., IKEA, La-Z-Boy Inc., Nitori Holdings Co. Ltd., Oppein Home Group Inc., Pepperfry, Roche Bobois, Steelcase Inc., The Home Depot Inc., Walmart Inc., Wayfair Inc., Westwing Group GmbH, and Williams-Sonoma, Inc.

-

Market Research Insights

- The market is a dynamic and ever-evolving industry, shaped by shifting consumer preferences and advancements in technology. According to recent estimates, the global market size for home furnishings reached USD380 billion in 2020, representing a significant increase from USD350 billion in 2018. This growth can be attributed to several factors, including a focus on interior styling and customer experience, as well as the integration of furniture safety, production capacity, and manufacturing efficiency. Furthermore, consumer preferences for longer furniture lifespans and ergonomic designs have led to an increased emphasis on product durability and furniture ergonomics.

- In response, manufacturers have adopted various strategies to optimize their supply chains, reduce waste, and improve material sourcing. For instance, some companies have turned to sustainable materials and production methods, while others have focused on space planning and comfort features to enhance the overall customer experience. Moreover, the market has seen a growing trend towards waste reduction and environmental impact, with an increasing number of companies adopting safety standards and implementing cost optimization strategies throughout the product lifecycle. With a focus on material composition, lighting design, and texture combinations, the market continues to evolve, offering consumers a wide range of high-quality, safe, and sustainable options.

We can help! Our analysts can customize this home furnishings market research report to meet your requirements.