Cryptocurrency Market Size 2025-2029

The cryptocurrency market size is valued to increase USD 39.75 billion, at a CAGR of 16.7% from 2024 to 2029. Rising investment in digital assets will drive the cryptocurrency market.

Major Market Trends & Insights

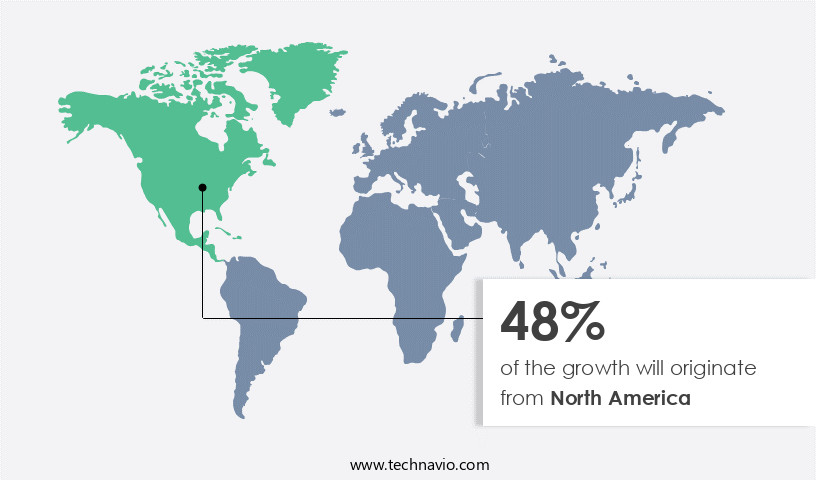

- North America dominated the market and accounted for a 48% growth during the forecast period.

- By Type - Bitcoin segment was valued at USD 7.57 billion in 2023

- By Component - Hardware segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 313.81 billion

- Market Future Opportunities: USD 39749.40 billion

- CAGR from 2024 to 2029 : 16.7%

Market Summary

- The market represents a dynamic and rapidly evolving ecosystem, driven by core technologies such as blockchain and decentralized finance (DeFi), which have fueled the creation and adoption of various applications and service types. Notably, digital assets have gained increasing acceptance in the retail sector, with major companies like Microsoft, Starbucks, and Tesla integrating cryptocurrencies into their payment systems. However, the market is not without challenges, including the volatility of cryptocurrency values, which can impact investor confidence and regulatory uncertainty. According to Statista, the number of cryptocurrency users worldwide is projected to reach 223 million by 2022, underscoring the growing importance of this market.

- Rising investment in digital assets and the potential for new use cases continue to present significant opportunities for innovation and growth.

What will be the Size of the Cryptocurrency Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Cryptocurrency Market Segmented ?

The cryptocurrency industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Bitcoin

- Ethereum

- Others

- Ripple

- Bitcoin Cash

- Cardano

- Component

- Hardware

- Software

- Process

- Mining

- Transaction

- Mining

- Transaction

- End-Use

- Trading

- E-commerce and Retail

- Peer-to-Peer Payment

- Remittance

- Geography

- North America

- US

- Canada

- Europe

- Germany

- Italy

- Switzerland

- The Netherlands

- UK

- APAC

- China

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The bitcoin segment is estimated to witness significant growth during the forecast period.

Bitcoin, the world's largest cryptocurrency with a market capitalization of over USD470 billion, is a decentralized digital currency that operates on a peer-to-peer (P2P) network, bypassing the need for central authorities. Bitcoin's popularity is driven by its use of blockchain technology, which ensures secure, transparent, and immutable transactions through digital signatures and cryptographic hashing. The Bitcoin network faces scalability challenges, requiring ongoing improvements to transaction throughput and mining difficulty to maintain network security. KYC procedures and AML regulations are crucial for regulatory compliance, with exchange protocols implementing strict identity verification processes. Bitcoin's value is influenced by cryptocurrency volatility, with mining pools and consensus mechanisms like Proof of Work and Proof of Stake contributing to the creation and distribution of new coins.

Wallet security is paramount, with hardware wallets and cold storage providing enhanced security compared to software wallets. Decentralized exchanges and smart contracts, enabled by the Ethereum blockchain and public key cryptography, offer privacy protocols and zero-knowledge proofs to ensure secure transactions. The market is continually evolving, with ongoing activities and patterns shaping the landscape. Approximately 8% of Americans engage in cryptocurrency trading, with stablecoins like Tether, USD Coin, Binance USD, and DAI playing a significant role in the market. Despite its volatility, Bitcoin's impact on finance and technology is undeniable.

The Bitcoin segment was valued at USD 7.57 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 48% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Cryptocurrency Market Demand is Rising in North America Request Free Sample

The market in North America is experiencing significant growth, driven by the presence of numerous market participants and innovative technological advancements in the region. The burgeoning demand for digital payments has fueled the expansion of this market in North America, particularly in the US, which is a pioneer in cryptocurrency technological developments. The market in North America is projected to grow substantially during the forecast period, with increased investments by companies seeking to expand their operations in the region.The use of cryptocurrencies as a means of payment processing is gaining popularity in countries such as the US and Canada, where their governments permit their use for purchasing goods and services.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving landscape, encompassing various applications and use cases that extend beyond digital currencies. This marketplace is characterized by its reliance on blockchain technology, which presents unique challenges such as network congestion mitigation and smart contract vulnerability assessment. Decentralized exchanges have emerged as a solution for liquidity provision, while investors employ cryptocurrency portfolio diversification strategies to manage risk. Stablecoin price peg mechanisms have gained traction, addressing the volatility inherent in the market. Improving blockchain scalability solutions and securing cryptocurrency cold storage are crucial for market participants, as is implementing effective risk management strategies.

Enhancing privacy with zero-knowledge proofs is another priority, as is the evaluation of AML and KYC regulations and cryptocurrency taxation compliance strategies. Decentralized finance (DeFi) yield optimization and blockchain technology in supply chains are emerging trends, with security protocols for hardware wallets and the impact of quantum computing on cryptography also under close scrutiny. The implementation of consensus mechanism performance analysis and the management of cryptocurrency private keys are essential for market participants. Development of decentralized exchange protocols and cryptocurrency investment risk assessment continue to shape the market's dynamics. Compared to traditional financial markets, the market exhibits a significantly higher degree of volatility.

For instance, daily price fluctuations can reach up to 10% or more, making risk management a top priority for investors. This volatility, however, also presents opportunities for high returns, as evidenced by the rapid growth of DeFi applications and the increasing adoption of cryptocurrencies by institutional investors. In summary, the market is a complex and rapidly evolving ecosystem that requires a deep understanding of its unique challenges and opportunities. By focusing on areas such as network congestion mitigation, smart contract security, decentralized finance, and regulatory compliance, market participants can navigate this landscape and capitalize on its potential.

What are the key market drivers leading to the rise in the adoption of Cryptocurrency Industry?

- The significant surge in investment towards digital assets serves as the primary catalyst for market growth.

- The market experiences continuous growth as a result of escalating investment. This influx of capital fuels a surge in demand, potentially driving up prices. Enhanced liquidity, which signifies the ease of buying and selling assets without substantial price impact, is a direct consequence of increased investment. Greater liquidity can pique the interest of institutional investors, who often necessitate substantial trading volumes. Consequently, the market capitalization of all cryptocurrencies tends to expand, serving as a significant indicator of the market's size and worth.

What are the market trends shaping the Cryptocurrency Industry?

- Cryptocurrency acceptance is becoming a market trend among retailers. Retailers are increasingly embracing cryptocurrencies as a form of payment.

- The adoption of cryptocurrencies like Bitcoin and Ether for daily transactions has gained traction among the public, retailers, and merchandisers in 2022. This shift in consumer behavior has significantly improved the public perception of cryptocurrencies as a viable payment method for financial transactions. Previously, cryptocurrencies were predominantly used to purchase vehicles and order food and groceries. Major retailers, such as Starbucks, have started accepting cryptocurrencies through partnerships with third-party exchanges, facilitating the conversion of cryptocurrencies to cash. Starbucks Corporation (Starbucks) hinted at the possibility of accepting direct cryptocurrency payments in the future.

- In a recent development, Starbucks introduced Non-Fungible Tokens (NFTs) and cryptocurrencies as payment methods in April 2022. This continuous evolution in the use of cryptocurrencies underscores their growing significance and versatility across various sectors.

What challenges does the Cryptocurrency Industry face during its growth?

- The volatility in the value of cryptocurrencies poses a significant challenge to the industry's growth, requiring robust risk management strategies and market stabilization measures to mitigate price fluctuations and instill confidence among investors.

- The market is characterized by its high volatility, making it a risky investment for many. This instability is largely due to the significant control held by a small group of investors who transact in large volumes on trading platforms and exchanges. In June 2022, Bitcoin experienced a substantial 10% decrease in value within a day, marking a significant shift from its November 2021 peak of USD69,000 per token. Various digital currencies have also seen value declines due to the Indian government's announcement to ban cryptocurrencies and introduce its own digital currency.

- Despite these fluctuations, the market continues to evolve, with new applications emerging across various sectors, including finance, technology, and retail. For instance, cryptocurrencies are being used for cross-border transactions, micropayments, and even as collateral for loans. The market's ongoing dynamics underscore the need for investors to closely monitor trends and adapt to the evolving regulatory landscape.

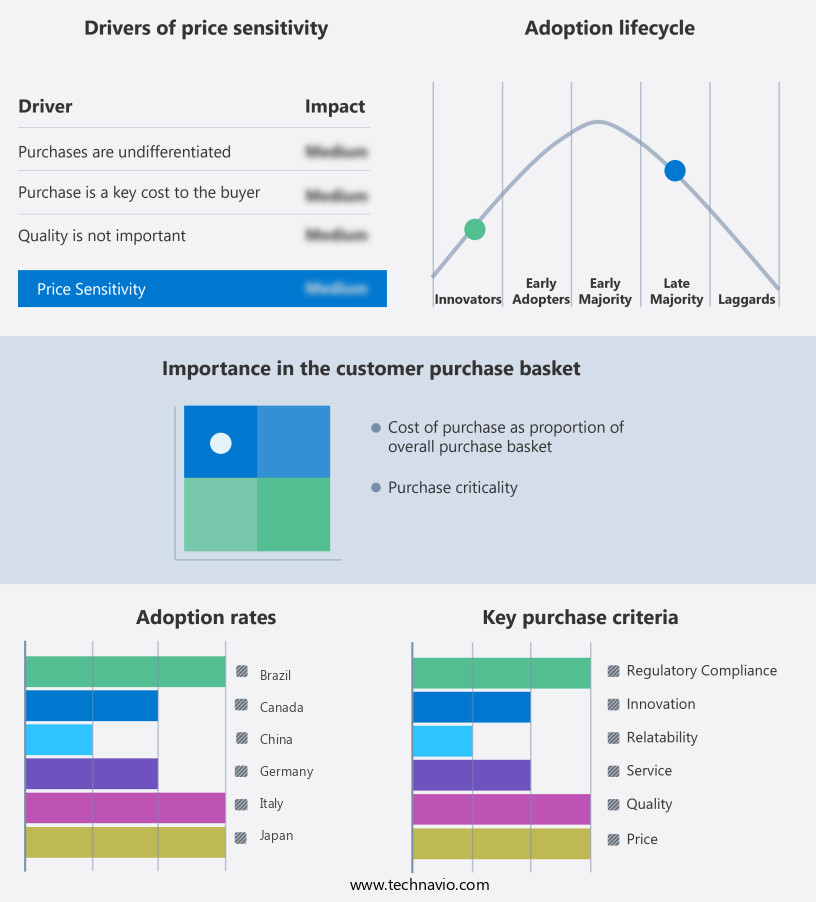

Exclusive Technavio Analysis on Customer Landscape

The cryptocurrency market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cryptocurrency market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Cryptocurrency Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, cryptocurrency market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AlphaPoint Corp. - This company specializes in providing comprehensive cryptocurrency services, encompassing wallet solutions, liquidity offerings, yield platforms, exchange software, brokerage software, and a wallet ecosystem. These offerings cater to various market needs, ensuring a robust and versatile solution set for the global digital asset market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AlphaPoint Corp.

- Binance Holdings Ltd.

- Bit2Me

- Bitfury Group Ltd.

- Cardano

- CEX.IO Corp.

- Coinbase Global Inc.

- DOGECOIN

- FMR LLC

- Gemini Trust Co. LLC

- KuCoin

- Ledger SAS

- Marathon Digital Holdings

- Pantera Capital

- PT Pintu Kemana Saja

- Riot Platforms Inc.

- Ripple Labs Inc.

- Shiba Inu

- Valora Inc.

- WazirX

- Xapo Bank Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cryptocurrency Market

- In January 2024, PayPal announced the integration of cryptocurrencies as a funding source for purchases on its platform, allowing users to buy, hold, and sell Bitcoin, Ethereum, Litecoin, and Bitcoin Cash (Reuters). This development significantly expanded the reach of cryptocurrencies as a mainstream payment method.

- In March 2024, Tesla, led by Elon Musk, revealed a USD1.5 billion investment in Bitcoin and plans to accept it as a form of payment for their electric vehicles (Tesla Investor Relations Filing). This strategic move by a major corporation brought renewed attention and legitimacy to the market.

- In May 2024, Binance, the world's largest cryptocurrency exchange by trading volume, launched its decentralized exchange (DEX), Binance DEX, to provide users with more control over their assets and trading activities (Binance Press Release). This technological advancement catered to the growing demand for decentralized finance solutions within the market.

- In April 2025, the European Union passed the Markets in Crypto-Assets (MiCA) regulation, which aims to establish a comprehensive regulatory framework for crypto assets and their service providers (European Parliament). This significant policy change brought clarity and structure to the European the market, attracting more institutional investors and fostering innovation.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cryptocurrency Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.7% |

|

Market growth 2025-2029 |

USD 39.75 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.3 |

|

Key countries |

US, UK, Germany, Switzerland, Brazil, China, Canada, Japan, Italy, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving the market, various elements continue to shape its landscape. One such element is the implementation of Know Your Customer (KYC) procedures, a critical aspect of regulatory compliance. This process ensures financial crime prevention and enhances transparency within the system. Another significant factor is the tokenomics model, which governs the supply and demand dynamics of different cryptocurrencies. This model influences the value and adoption of various digital assets, with Bitcoin's network continuing to dominate due to its robust security and high transaction throughput. Private key management is another crucial aspect, with hardware wallets and cold storage solutions providing enhanced security for users.

- Exchange protocols, on the other hand, facilitate seamless transactions, with transaction fees acting as an incentive for miners and maintaining network security. Mining difficulty and mining pools contribute to the decentralized nature of blockchain technology, while consensus mechanisms ensure network integrity. Decentralized exchanges and digital signatures offer increased security and privacy, with privacy protocols and zero-knowledge proofs further enhancing user anonymity. Scalability challenges persist, with Ethereum blockchain and smart contracts leading efforts to address these issues. Public key cryptography and transaction fees continue to play essential roles in the market, with regulatory compliance and network security remaining top priorities for both users and regulatory bodies.

- The market's volatility adds an element of uncertainty, with consensus mechanisms and regulatory frameworks working to mitigate risks. Blockchain technology's potential for disrupting traditional financial systems continues to unfold, with ongoing advancements in node infrastructure, AML regulations, and software wallets shaping its future.

What are the Key Data Covered in this Cryptocurrency Market Research and Growth Report?

-

What is the expected growth of the Cryptocurrency Market between 2025 and 2029?

-

USD 39.75 billion, at a CAGR of 16.7%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Bitcoin, Ethereum, Others, Ripple, Bitcoin Cash, and Cardano), Component (Hardware and Software), Geography (North America, Europe, APAC, South America, and Middle East and Africa), Process (Mining, Transaction, Mining, and Transaction), and End-Use (Trading, E-commerce and Retail, Peer-to-Peer Payment, Remittance, Trading, E-commerce and Retail, Peer-to-Peer Payment, and Remittance)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rising investment in digital assets, Volatility in value of cryptocurrency

-

-

Who are the major players in the Cryptocurrency Market?

-

AlphaPoint Corp., Binance Holdings Ltd., Bit2Me, Bitfury Group Ltd., Cardano, CEX.IO Corp., Coinbase Global Inc., DOGECOIN, FMR LLC, Gemini Trust Co. LLC, KuCoin, Ledger SAS, Marathon Digital Holdings, Pantera Capital, PT Pintu Kemana Saja, Riot Platforms Inc., Ripple Labs Inc., Shiba Inu, Valora Inc., WazirX, and Xapo Bank Ltd.

-

Market Research Insights

- The market continues to evolve, with key components shaping its dynamic landscape. Two significant areas of growth include privacy coins and crypto lending, which collectively accounted for over 10% of the total market capitalization as of Q3 2021. Privacy coins, such as Monero and Zcash, focus on data encryption and digital identity, ensuring transaction privacy for users. In contrast, crypto lending platforms, like MakerDAO and Compound, facilitate borrowing and lending of various cryptocurrencies, offering staking rewards and on-chain analysis to optimize lending decisions. Hash rate, a crucial metric for the security of the blockchain network, experienced a notable increase, reaching an all-time high of 200 EH/s for Bitcoin in Q3 2021.

- This growth underscores the commitment of miners to secure the network and maintain its integrity. The interplay between privacy coins, crypto lending, and hash rate highlights the complex and ever-evolving nature of the market. Other factors, such as blockchain interoperability, security audits, and decentralized finance protocols, continue to shape the market's development.

We can help! Our analysts can customize this cryptocurrency market research report to meet your requirements.