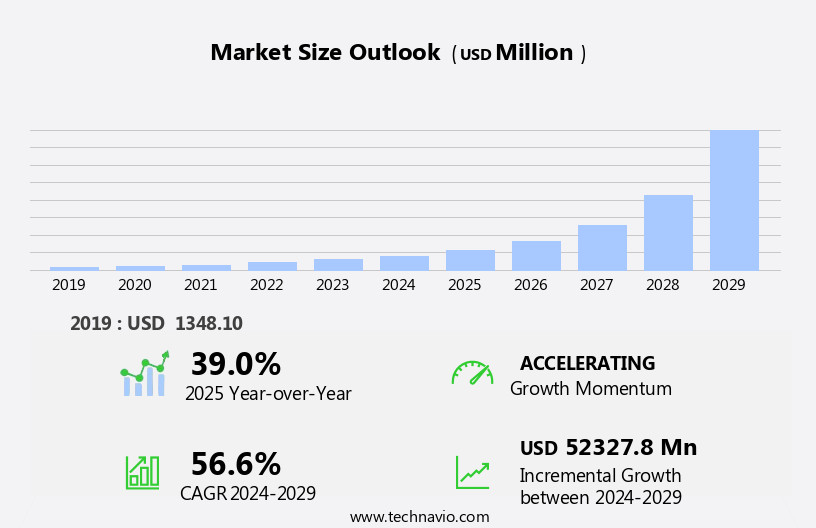

Blockchain Technology Market Size 2025-2029

The blockchain technology market size is forecast to increase by USD 52.33 billion at a CAGR of 56.6% between 2024 and 2029.

- The market is experiencing significant growth, fueled by increasing venture capital funding and investments. This financial influx is driving the development and implementation of innovative blockchain solutions, particularly in the payments sector. However, the market's expansion is not without challenges. Regulatory hurdles impact adoption, as governments and regulatory bodies grapple with defining the legal framework for blockchain technology. Additionally, security and privacy concerns persist, as the decentralized nature of blockchain transactions raises questions about data protection and potential vulnerabilities. Despite these challenges, the potential benefits of blockchain technology are substantial. Its ability to provide secure, transparent, and efficient transactions is attracting businesses across industries, from finance to supply chain management. The potential of the metaverse to create secure, great environments for healthcare applications is also being explored, enhancing patient engagement and data security. One application of blockchain technology in healthcare is the secure exchange of sensitive information, such as vaccination certificates and medical records.

- Companies seeking to capitalize on this market opportunity must navigate these challenges effectively, ensuring regulatory compliance and addressing security concerns through robust implementation and continuous improvement. By doing so, they can harness the transformative power of blockchain technology and stay ahead of the competition. Overall, the adoption of blockchain technology in healthcare is a significant trend that is expected to continue, as the industry prioritizes data security and privacy while improving workflow and patient care.

What will be the Size of the Blockchain Technology Market during the forecast period?

- In the dynamic and evolving world of technology, blockchain continues to make waves across various industries. From healthcare to voting, logistics to insurance, and identity to government, blockchain technology is revolutionizing business processes and transactions. In the finance sector, blockchain is transforming cryptocurrency trading and facilitating the issuance of tokenized securities. The arts and entertainment industry is embracing blockchain for music and education, while manufacturing and retail are leveraging it for supply chain management and transactions. Decentralized autonomous organizations are gaining traction in philanthropy and charity, providing transparency and accountability.

- Blockchain is also making inroads into energy, agriculture, and travel industries, offering potential solutions for sustainability and efficiency. Overall, the blockchain market is experiencing significant growth and innovation, with applications spanning from finance to development and beyond.

How is this Blockchain Technology Industry segmented?

The blockchain technology industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- BFSI

- Government

- Healthcare

- Others

- Type

- Private

- Public

- Hybrid

- Component

- Services

- Platform

- Hardware

- Application

- Cryptocurrency

- Financial services

- Supply chain

- Healthcare

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

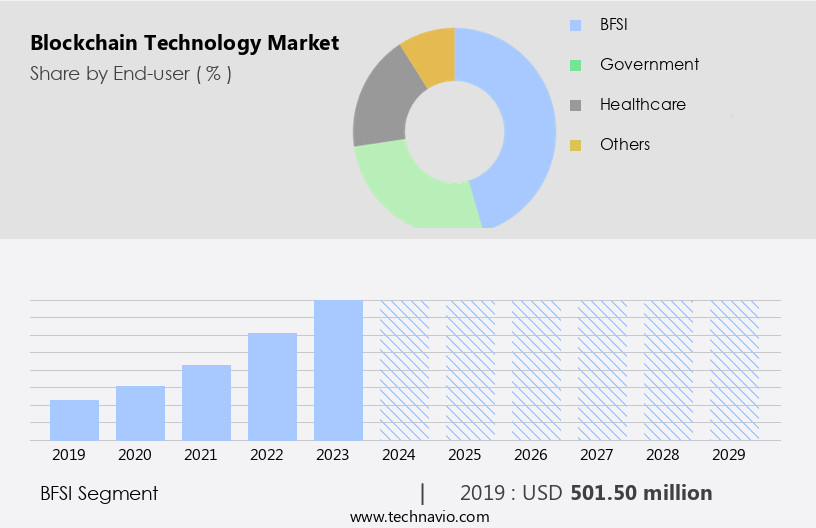

By End-user Insights

The BFSI segment is estimated to witness significant growth during the forecast period. In the business world, blockchain technology is making a significant impact, particularly in the financial services industry (BFSI). This distributed ledger technology facilitates secure, transparent, and decentralized transactions, enabling applications such as digital assets, smart contracts, and decentralized exchanges. In the BFSI sector, blockchain is utilized to mitigate fraud, execute smart contracts, process payments, and enhance KYC (know-your-customer) due diligence. Enterprises are exploring blockchain implementation in post-trade settlement, payments, reference data, and trade finance. However, challenges like trust issues and operational cost savings are driving the adoption of blockchain in the BFSI sector. KYC due diligence plays a crucial role in preventing money laundering, terrorist activities, and other illicit financial transactions.

Blockchain's decentralized nature and immutable records offer enhanced security and transparency, making it an attractive solution for KYC processes. Smart contracts, a key component of blockchain, enable automated, self-executing agreements, streamlining processes and reducing operational costs. Consortium blockchains, a collaborative approach to blockchain development, allow multiple organizations to share a single network while maintaining control over their data. This approach is gaining popularity in the BFSI sector due to its ability to provide enhanced security and privacy. Byzantine fault tolerance, a consensus mechanism, ensures the reliability and security of blockchain networks, making it suitable for high-stakes financial transactions. From preventing healthcare data breaches and drug counterfeiting to improving the management of medical devices and facilitating transactions with non-traditional suppliers, the benefits of this technology are vast.

Transaction fees, a necessary cost for executing transactions on a blockchain, are a concern for some enterprises. However, the benefits of increased security, transparency, and efficiency often outweigh the costs. Blockchain services, consulting, and development firms are offering solutions to help businesses navigate the complexities of blockchain adoption. Non-fungible tokens (NFTs) and security tokens are gaining traction in the BFSI sector, offering new opportunities for digital asset creation and investment. Cross-chain bridges enable the transfer of assets between different blockchain networks, expanding the interoperability and versatility of blockchain solutions. Crypto wallets and exchanges facilitate the secure storage and trading of digital assets.

The BFSI segment was valued at USD 501.50 billion in 2019 and showed a gradual increase during the forecast period. Blockchain infrastructure, analytics, and identity management solutions are essential components of a robust blockchain ecosystem. These solutions help businesses manage and secure their data, ensuring compliance with regulatory requirements and maintaining data privacy. Blockchain platforms, such as Ethereum and Hyperledger, provide the foundation for building decentralized applications (dApps) and custom blockchain solutions. The adoption of blockchain technology in the BFSI sector is on the rise, driven by the need for increased security, transparency, and efficiency. Despite challenges, the benefits of blockchain are compelling, and enterprises are investing in this technology to transform their operations and gain a competitive edge. The growing adoption of blockchain-based health information exchange is the upcoming trend in the market.

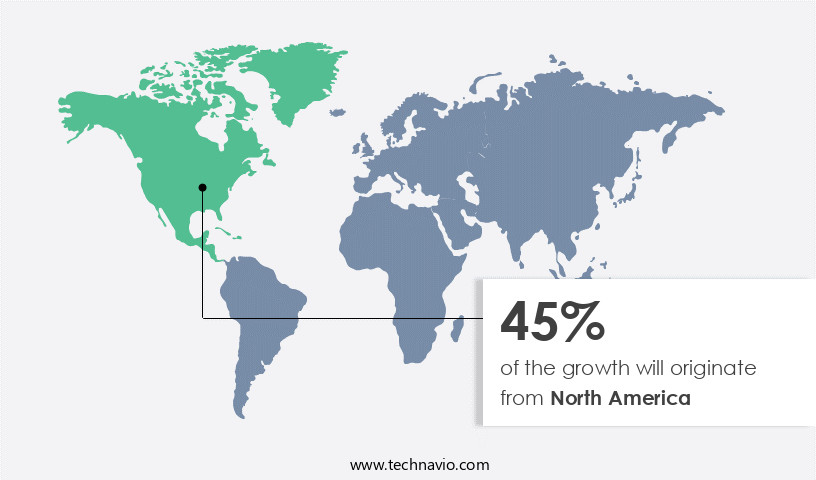

Regional Analysis

North America is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, driven by the region's technological innovation and favorable regulatory environment. Financial institutions have been early adopters of this technology, leveraging its benefits to reduce costs, enhance efficiency, and improve customer services. Blockchain technology's applications extend beyond finance, with various industries adopting it for data security, supply chain management, and decentralized applications. Consortium blockchains and permissioned blockchains are gaining traction in enterprise settings, while public blockchains continue to power decentralized exchanges and crypto investment. Smart contract development and byzantine fault tolerance are crucial components of blockchain technology, ensuring secure and reliable transactions. From patient data security and informed consent to clinical trials and approval processes, blockchain technology is poised to bring revolutionary changes to the healthcare industry.

Hashing algorithms and consensus mechanisms underpin the security and integrity of these systems. Blockchain services, including development, consulting, and analytics, are essential for businesses looking to implement this technology. Decentralized finance and decentralized governance are emerging trends, with security tokens and utility tokens shaping the token economics landscape. Crypto wallets and cross-chain bridges facilitate the transfer and management of digital assets. Identity management and data security are critical concerns, with blockchain technology offering potential solutions through distributed ledger technology and cryptographic keys. Non-fungible tokens and blockchain solutions are revolutionizing industries such as art, gaming, and collectibles.

Transaction fees and gas fees are essential considerations for users, with blockchain infrastructure and crypto exchanges playing a vital role in managing these costs. The market's evolution continues, with ongoing research and development in areas such as smart contracts, consensus mechanisms, and blockchain security.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Blockchain Technology market drivers leading to the rise in the adoption of Industry?

- Venture capital funding's continual increase and subsequent investment in blockchain technology serve as the primary catalyst for market growth. Blockchain technology is a decentralized, digital ledger system that offers enhanced security and transparency. Its adoption is on the rise due to the development of decentralized applications (dApps) and decentralized finance (DeFi) platforms. Blockchain platforms provide digital signatures for secure transactions and decentralized governance through consensus mechanisms. These mechanisms ensure the security and integrity of the data on the blockchain. Venture capital financing plays a crucial role in the growth and expansion of blockchain technology companies. With venture capital funding, businesses can access substantial resources, enabling them to scale more rapidly than with other financing methods.

- For instance, TRST01, a Hyderabad-based blockchain startup, has made significant strides in the climate technology sector. Following a USD42 million investment from Octave Ventures in 2022, TRST01 expanded its operations across ten countries, impacting over 250,000 farmers through its regenerative agriculture initiatives. Private blockchains, with their enhanced security features, are gaining popularity among businesses looking for secure data storage and transfer solutions. Blockchain consulting services are also on the rise, offering expert advice and guidance to businesses looking to implement blockchain technology. The future of blockchain technology holds immense potential for innovation and growth, making it an attractive investment opportunity for venture capitalists.

What are the Blockchain Technology market trends shaping the Industry?

- The rising adoption of blockchain technology for payment solutions represents a significant market trend. This innovative approach to transactions is gaining increasing popularity among professionals and businesses alike. Blockchain technology, underpinned by cryptographic keys and distributed ledgers, offers significant advantages for various business applications beyond cryptocurrencies. One such area is security tokens, which represent digital assets with inherent value and ownership rights. In supply chain management, blockchain infrastructure ensures transparency, traceability, and security of transactions. Crypto wallets enable users to securely store and manage their digital assets. The crypto investment sector benefits from blockchain's security and decentralization, making transactions more secure and accessible. Cross-chain bridges facilitate the transfer of assets between different blockchain networks, expanding their interoperability. Blockchain analytics tools enable businesses to monitor and gain insights into transactions, while identity management solutions provide secure and decentralized authentication.

- Public blockchains, such as Bitcoin and Ethereum, form the backbone of these applications, offering quick, affordable, and secure transaction processing. Bitcoin, as a decentralized digital currency, has gained popularity due to its fast transaction processing times and low fees. Stablecoins, another type of blockchain-based payment method, offer price stability and reduced volatility, making them an attractive alternative for businesses.

How does Blockchain Technology market faces challenges face during its growth?

- The integration of security, privacy, and blockchain transaction concerns poses a significant challenge to the growth of the industry. This issue necessitates the development and implementation of robust solutions to mitigate risks and ensure trust and confidence in the use of emerging technologies. Blockchain technology offers a secure and transparent solution for various transactions, yet concerns regarding security, privacy, and transaction validation persist. The security that blockchain provides is a significant advantage, as a network of nodes verifies and validates transactions, making it difficult for one entity to control the system. However, the decentralized nature of blockchain networks has made them vulnerable to attacks, where a single party can manipulate transactions by controlling over half of the network's computing power.

- Moreover, instances of digital asset theft highlight the importance of robust security measures to protect user data and assets. Despite these challenges, the potential benefits of blockchain technology, such as enhanced security, transparency, and efficiency, continue to attract enterprise adoption.

Exclusive Customer Landscape

The blockchain technology market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the blockchain technology market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, blockchain technology market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - This company specializes in implementing advanced blockchain technologies, including the Red String solution.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- Amazon.com Inc.

- Amcon Soft

- Ara Soft Group LLC

- Capgemini Service SAS

- Cargoledger

- ConsenSys Software Inc.

- Deloitte Touche Tohmatsu Ltd.

- HCL Technologies Ltd.

- Hewlett Packard Enterprise Co.

- Huawei Technologies Co. Ltd.

- Infosys Ltd.

- Intel Corp.

- International Business Machines Corp.

- OpenLedger

- Oracle Corp.

- PixelPlex Ltd

- SAP SE

- Tata Sons Pvt. Ltd.

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Blockchain Technology Market

- In February 2023, IBM and Maersk's joint venture, TradeLens, announced the integration of VeChain Thor Blockchain to enhance supply chain transparency and traceability. This collaboration marks a significant step forward in the adoption of blockchain technology in the logistics industry (IBM Press Release, 2023).

- In May 2024, PayPal revealed its plans to allow users to buy, hold, and sell cryptocurrencies directly on their platform, marking a major shift in the financial services industry. This move signaled growing acceptance of digital currencies and blockchain technology among traditional financial institutions (PayPal Press Release, 2024).

- In October 2024, Mastercard and ConsenSys announced a partnership to explore the use of Ethereum blockchain for cross-border payments. This strategic collaboration aimed to improve transaction speed, reduce costs, and increase security in international transactions (Mastercard Newsroom, 2024).

- In March 2025, China's central bank, the People's Bank of China, launched the Digital Currency Electronic Payment (DCEP) system, a digital version of its national currency. This initiative represented a significant milestone in the development of central bank digital currencies and the potential integration of blockchain technology into mainstream financial systems (People's Bank of China Press Release, 2025).

Research Analyst Overview

Blockchain technology continues to evolve, shaping new market dynamics and expanding its reach across various sectors. Consortium blockchains, a type of collaborative blockchain network, are gaining traction as businesses seek more control over their data and transactions. Gas fees and transaction fees remain crucial factors in the blockchain landscape, influencing the adoption of decentralized exchanges and other decentralized applications. Distributed ledger technology, the foundation of blockchain, undergoes constant refinement through smart contract development and the implementation of consensus mechanisms like Byzantine fault tolerance. Token economics and data security are key concerns, driving innovation in utility tokens, security tokens, and non-fungible tokens.

The Blockchain Technology Market is rapidly transforming industries, offering secure and decentralized solutions across various sectors. Blockchain gaming is revolutionizing digital ownership, while blockchain for healthcare enhances patient data security. In education, blockchain for education ensures credential authenticity, whereas blockchain for government fosters transparent public services. Sustainable solutions emerge with blockchain for energy, and financial security improves with blockchain for insurance and blockchain for finance. Efficiency rises in blockchain for logistics, blockchain for agriculture, and blockchain for manufacturing, while innovation drives blockchain for retail, blockchain for travel, and blockchain for media. Blockchain for art redefines digital ownership, and blockchain for voting secures elections. Identity verification strengthens with blockchain for identity, while blockchain for philanthropy, blockchain for charity, and blockchain for development promote social impact.

Blockchain services, including blockchain development, dapp development, and blockchain consulting, are in high demand as businesses explore the potential of this technology. Decentralized finance, supply chain management, and identity management are among the sectors experiencing significant growth. Crypto wallets and crypto investment platforms are essential tools for individuals and institutions navigating the complex blockchain ecosystem. Cross-chain bridges and cryptographic keys facilitate interoperability between different blockchain networks, further enhancing the versatility of this technology. Blockchain infrastructure and blockchain analytics provide crucial support for the ongoing development and adoption of blockchain technology. As the market continues to evolve, enterprise blockchain solutions will play a pivotal role in driving innovation and addressing the unique challenges of various industries.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Blockchain Technology Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

255 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 56.6% |

|

Market growth 2025-2029 |

USD 52.33 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

39.0 |

|

Key countries |

US, UK, Canada, Germany, China, Brazil, France, India, Japan, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Blockchain Technology Market Research and Growth Report?

- CAGR of the Blockchain Technology industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the blockchain technology market growth of industry companies

We can help! Our analysts can customize this blockchain technology market research report to meet your requirements.