Cucumber And Gherkins Market Size 2025-2029

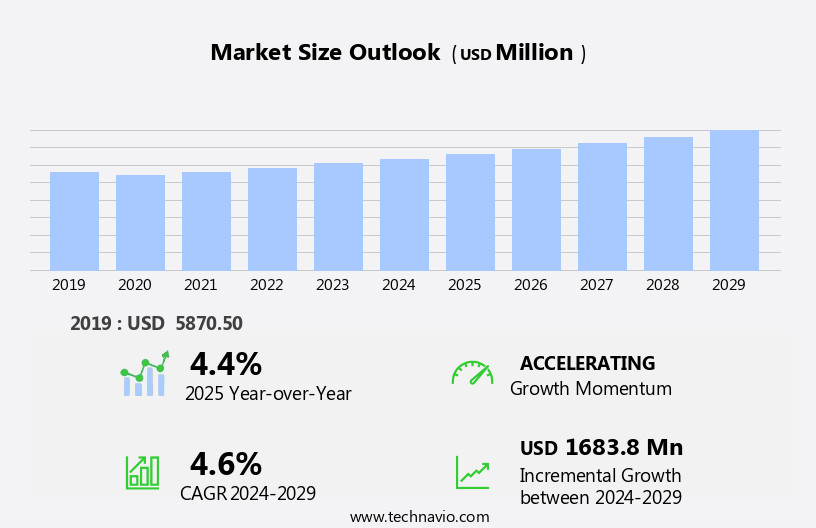

The cucumber and gherkins market size is forecast to increase by USD 1.68 billion at a CAGR of 4.6% between 2024 and 2029.

- The market is poised for significant growth, driven by the increase in global online retailing for agricultural goods. This trend is particularly notable in regions with a high consumption of pickled cucumbers and gherkins, such as Europe and North America. Additionally, technological advancements in farming practices are streamlining production processes, enhancing yields, and improving product quality. However, market expansion is not without challenges. Stringent regulations on pickled cucumbers and gherkins, particularly in relation to food safety and quality standards, necessitate compliance and add operational costs. Technological advances, including GPS, drones, and IoT devices, enable smart agriculture monitoring and farm machinery management.

- Furthermore, supply chain inconsistencies, including fluctuations in crop yields and transportation challenges, can temper growth potential. Companies seeking to capitalize on market opportunities must navigate these challenges effectively, investing in regulatory compliance and supply chain resilience strategies. Data security and privacy concerns are also critical issues that need to be addressed as the agricultural sector transitions to digital platforms. By staying abreast of market trends and regulatory requirements, and implementing innovative farming technologies, market participants can differentiate themselves and secure a competitive edge.

What will be the Size of the Cucumber And Gherkins Market during the forecast period?

- The cucumber and gherkins market is a dynamic and intricate ecosystem that encompasses various aspects of food production and consumer preferences. Market research indicates a growing consumer awareness towards vinegar types and food labeling, leading to an increased demand for pickling gherkins and pickling cucumbers. Global supply chains are optimized through advanced food processing equipment and ingredient sourcing strategies, ensuring the availability of diverse gherkin varieties and cucumber types. Food safety standards and health and wellness trends influence the market, with a focus on functional foods and food waste reduction. Brine solutions and sustainable farming practices, such as crop rotation and soil health, are essential for maintaining food security and producing high-quality produce. The integration of smart agricultural technology, such as GPS, drones, IoT devices, and AI capabilities, is transforming farming practices, offering numerous benefits while presenting challenges related to initial investment and data security.

- Import/export regulations and water management are crucial elements in the market, ensuring a stable supply of gherkins and cucumbers while adhering to food trends and culinary preferences. Packaging materials and design play a significant role in preserving the shelf-life of these products and catering to consumer insights. Flavor trends continue to evolve, with a shift towards functional foods and natural ingredients. Agricultural practices and food preservation techniques, such as pickling and fermentation, are essential in delivering innovative and sustainable products to the market. Key components include farm machinery equipped with sensors, GPS, and IoT devices, drones for aerial imaging, and monitoring systems for soil conditions, crop health, and weather patterns. Overall, the cucumber and gherkin market is a complex and ever-evolving landscape, requiring a deep understanding of consumer preferences, agricultural practices, and global supply chain dynamics.

How is this Cucumber And Gherkins Industry segmented?

The cucumber and gherkins industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Conventional

- Organic

- Material

- Fresh cucumbers

- Pickled cucumbers

- Gherkins

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. The market encompasses a range of flavor profiles, from mild to spicy, catering to diverse consumer preferences. Digestive health benefits associated with these vegetables have fueled their popularity, particularly in the health-conscious and dietary restriction sectors. Value-added ingredients, such as natural seasonings and flavor enhancers, add appeal to pickled vegetables and fermented foods, expanding their use in food service and culinary applications. Food safety regulations and cold chain logistics are crucial considerations in the supply chain management of these perishable items. Niche markets, including specialty products and low sodium or sugar content varieties, cater to specific consumer demands. Precision agriculture also incorporates AI and data analytics for site-specific crop management, field mapping, and satellite agriculture.

The Offline segment was valued at USD 4.78 billion in 2019 and showed a gradual increase during the forecast period. The precision farming industry continues to evolve, with a focus on automation, resource optimization, and eco-friendly agriculture. Vertical farming and precision agriculture techniques enhance crop yield and ensure consistent quality. Consumers increasingly seek fresh produce and healthy snacking options, driving innovation in the market. Product differentiation through natural ingredients, disease resistance, and long shelf life is essential for grocery stores to meet these demands. Quality control and meal preparation are key factors in the food industry, making cucumber and gherkins versatile ingredients. Food innovation, such as infused flavors and new pickling techniques, continues to drive growth in the market. Gut health benefits, a current gastronomic trend, further the importance of these vegetables in a balanced diet. Consumer preferences for organic and locally sourced produce, as well as pest control measures, are essential aspects of the market's evolution.

Regional Analysis

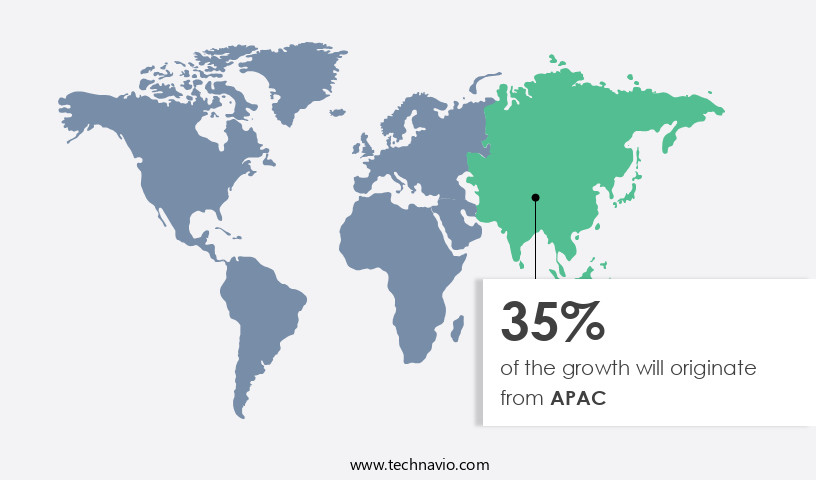

APAC is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the Asia Pacific (APAC) region, India and China are emerging markets for cucumbers and gherkins due to the rising consumer preference for natural, organic products and an increasing number of key players in these countries. Japan and Australia are also growing markets, driven by urbanization, changing lifestyles, and heightened awareness of the health benefits of fresh produce. Traditional distribution channels, including street companies and local grocery stores, remain significant due to the importance of fresh and locally sourced vegetables in the region. The market's growth is further fueled by the expanding accessibility and availability of cucumbers and gherkins to consumers.

Organized retail stores, such as hypermarkets, supermarkets, departmental stores, and e-commerce platforms, are increasingly selling these vegetables across various platforms in the region. Food safety, supply chain management, and sensory evaluation are crucial factors in maintaining the quality of these products. Fermented and pickled cucumbers and gherkins offer value-added benefits, such as improved digestive health and disease resistance. Natural ingredients, flavor enhancers, and culinary applications cater to health-conscious consumers and those with dietary restrictions. Food service establishments and meal preparation at home are significant markets for these vegetables. Vertical farming, precision agriculture, and crop yield optimization are essential for ensuring a consistent supply of fresh produce.

Shelf life, low sodium, and sugar content are key considerations for manufacturers and retailers. Consumer preferences for specialty products and fresh produce continue to evolve, driving innovation in the market. Pest control and eating habits are essential factors in the production and consumption of cucumbers and gherkins. The market is also influenced by gastronomic trends, such as the popularity of fermented foods and healthy snacking. Quality control, food innovation, and gut health are essential aspects of the market, ensuring the production and distribution of safe, nutritious, and delicious products.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Cucumber and Gherkins market drivers leading to the rise in the adoption of Industry?

- The significant expansion of global online retailing represents the primary catalyst for the agricultural market's growth. Software, including web-based and cloud-based systems, system integration, consulting, managed services, and assisted professional services, play a significant role in optimizing farm productivity. The global market for natural ingredients, including cucumbers and gherkins, is experiencing significant growth due to increasing culinary applications and the health-conscious consumer trend. With a focus on dietary restrictions and disease resistance, these ingredients have gained popularity in various industries, from food and beverage to pharmaceuticals. Effective supply chain management and cold chain logistics are crucial in maintaining the quality and freshness of these products. Sensory evaluation plays a vital role in ensuring the optimal taste and texture of cucumbers and gherkins. The market is influenced by gastronomic trends, with consumers seeking unique dining experiences.

- Online retailing is a significant channel for the sale of natural ingredients, providing convenience and accessibility to a diverse range of consumers. Through e-commerce platforms, consumers can easily purchase these ingredients and have them delivered to their doorstep or pick them up from nearby stores. The market is expected to continue growing, driven by increasing consumer awareness and the convenience of online shopping.

What are the Cucumber and Gherkins market trends shaping the Industry?

- The trend in the agricultural market is toward increasingly advanced farming practices due to technological innovations. Technological advancements are mandated in farming to stay current with industry developments. Cucumber and gherkin production have experienced significant advancements due to technological innovations in farming practices. Precision agriculture, a key trend, utilizes advanced technologies such as global positioning systems, drones, and data analytics to optimize resource usage and improve decision-making in farming. In the context of cucumber and gherkin cultivation, precision agriculture enables farmers to apply inputs like water, fertilizers, and pesticides with precision. For instance, positioning system sensor-guided tractors can follow predefined routes accurately, ensuring efficient planting and minimizing resource waste.

- Additionally, vertical farming techniques have gained popularity, offering higher crop yields and improved pest control in a controlled environment. Consumer preferences for fresh produce and healthy snacking have further fueled the demand for these specialty products. These market dynamics underscore the importance of technological advancements in farming for enhancing productivity, sustainability, and meeting evolving consumer demands.

How does Cucumber and Gherkins market faces challenges face during its growth?

- The stringent regulations governing the production and sale of pickled cucumbers and gherkins pose a significant challenge to the industry's growth. These regulations, which cover various aspects such as food safety, labeling, and quality standards, require extensive compliance efforts and resources from manufacturers and suppliers. Failure to adhere to these regulations can result in costly fines, product recalls, or even legal action. Consequently, the industry must invest heavily in research and development, as well as in training and certification programs, to ensure continued compliance and growth.

- Cucumber and gherkin production and distribution adhere to rigorous quality standards set by various government bodies. In Europe, the EU and EFTA establish regulations focusing on maintaining texture, labeling, packaging, and processing of pickled cucumbers and gherkins. These guidelines ensure the final product is free of shriveled, soft, and flabby items, and correctly labeled with a list of ingredients and net quantity. The packaging must specify the size and material used. Permitted ingredient requirements are also outlined. In the US, Good Manufacturing Practices (GMPs) are mandatory for manufacturers of pickled cucumbers and gherkins as per Federal and State Regulations. These practices prioritize precision agriculture, ensuring low sodium and sugar content in the final product. Food innovation continues to drive the market, with an emphasis on seed varieties, shelf life, and meal preparation. Quality control is paramount in the industry, with companies striving to meet and exceed consumer expectations.

Exclusive Customer Landscape

The cucumber and gherkins market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cucumber and gherkins market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cucumber and gherkins market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bayer AG - This company specializes in providing a selection of high-quality cucumber and gherkin varieties, including Malini, Padmini, and Rohini.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bayer AG

- BLOSSOM SHOWERS AGRO

- Bnazuram Agro Exports Ltd.

- Ecovinal International Pvt.Ltd

- Farm Fresh Bangalore

- Green Agro Pack Pvt Ltd.

- HENGSTENBERG GMBH and CO. KG

- Indian Tropical Agro Products Ltd.

- Johnnys Selected Seeds

- Mt Olive Pickles Co. Inc.

- REITZEL SA

- Riviana

- Sakata Seed Corp.

- satimex QUEDLINBURG GmbH

- Semillas Fito SA

- Southern Valley

- YUKSEL SEMILLAS S.A.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cucumber And Gherkins Market

- In February 2024, leading cucumber and gherkin producer, GreenVista Farms, announced the launch of its innovative, hydroponically grown, non-GMO cucumber and gherkin variety, "EcoHarvest," in partnership with Whole Foods Market (source: GreenVista Farms press release). This collaboration marked a significant shift towards sustainable farming practices and consumer demand for organic produce in the cucumber and gherkin market.

- In May 2025, Pickle-Pro, a major cucumber and gherkin processing company, entered into a strategic partnership with food tech startup, FoodMate, to integrate FoodMate's advanced food processing technology into Pickle-Pro's production facilities (source: Pickle-Pro press release). This collaboration aimed to increase efficiency and reduce processing time, providing a competitive edge in the market.

- In August 2024, global food conglomerate, Nestle, acquired a 40% stake in Cukes Unlimited, a leading cucumber and gherkin producer, marking Nestle's entry into the market (source: Bloomberg). This strategic move expanded Nestle's product portfolio and provided access to Cukes Unlimited's extensive distribution network.

Research Analyst Overview

The cucumber and gherkin market continues to evolve, driven by various factors shaping its dynamics. Precision agriculture techniques are increasingly adopted to optimize crop yield and ensure consistent quality. Consumers' growing preference for healthier options has led to an emphasis on low sodium and sugar content, driving innovation in seed varieties. In the realm of food innovation, cucumbers and gherkins find applications in diverse sectors. Their natural ingredients make them suitable for use in value-added products, such as pickled vegetables and fermented foods. The health-conscious consumer base seeks out niche markets catering to dietary restrictions, including those with digestive health concerns.

Grocery stores prioritize quality control to meet consumer expectations, ensuring fresh produce with extended shelf life. Food safety remains a critical concern, with cold chain logistics and supply chain management playing essential roles in maintaining product integrity. Cucumbers and gherkins are integral to meal preparation in various culinary applications, from salads to sandwiches and snacks. Their versatility and versatility make them a staple in food service establishments. The ongoing trend towards natural ingredients and gastronomic trends further fuels the market's growth. Disease resistance and pest control measures ensure a sustainable supply, while eating habits continue to evolve, leading to new opportunities for specialty products.

In summary, the cucumber and gherkin market is characterized by continuous dynamism, driven by consumer preferences, food innovation, and sustainable farming practices. The integration of precision agriculture, low sodium, sugar content, seed varieties, shelf life, grocery stores, quality control, meal preparation, and food safety ensures a thriving industry.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cucumber and Gherkins Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 1.68 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, Japan, India, UK, Germany, South Korea, France, Australia, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cucumber And Gherkins Market Research and Growth Report?

- CAGR of the Cucumber And Gherkins industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cucumber and gherkins market growth of industry companies

We can help! Our analysts can customize this cucumber and gherkins market research report to meet your requirements.