Managed Services Market Size 2025-2029

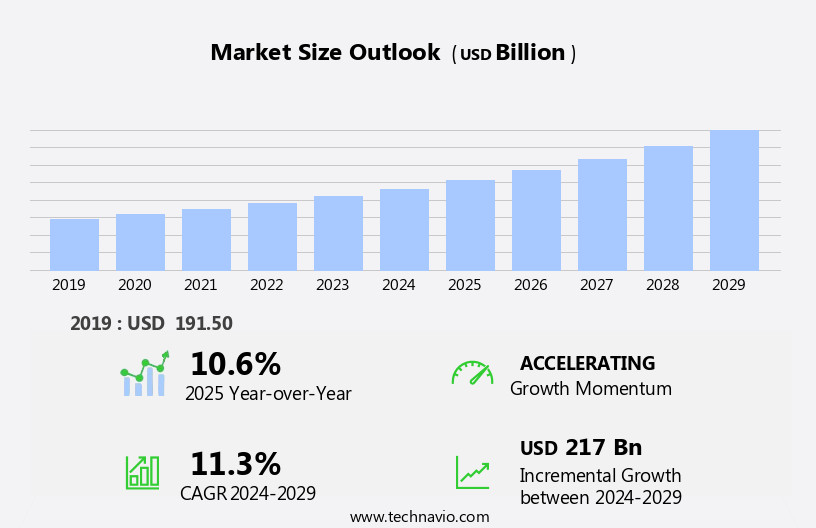

The managed services market size is forecast to increase by USD 217 billion, at a CAGR of 11.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of Internet of Things (IoT) solutions and the advent of big data and analytics services. Companies are recognizing the value of outsourcing IT management to focus on core business functions, leading to a surge in demand for managed services. However, this market landscape is not without challenges. Data privacy and security risks in cloud-based services continue to pose a significant obstacle, as more businesses move their operations to the cloud. Ensuring the confidentiality, integrity, and availability of sensitive data is a top priority for organizations, necessitating robust security measures and compliance with data protection regulations.

- Companies must navigate these challenges to effectively capitalize on the opportunities presented by the market's dynamic landscape. By investing in advanced security solutions and adhering to best practices, businesses can mitigate risks and build trust with their customers, ultimately driving growth and success in this competitive market.

What will be the Size of the Managed Services Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Entities seek to optimize their IT infrastructure through data governance, endpoint security, incident response, technical support, hybrid cloud, system administration, infrastructure management, service level agreements, performance monitoring, software licensing, big data analytics, and artificial intelligence. These solutions are integrated into comprehensive offerings, ensuring businesses maintain optimal IT performance and security. Data governance strategies enable organizations to manage and protect sensitive information, while endpoint security safeguards against cyber threats. Incident response and technical support provide swift resolution to IT issues, ensuring minimal disruption to business operations. Hybrid cloud solutions offer flexibility and cost savings, allowing businesses to leverage both on-premises and cloud resources.

System administration and infrastructure management ensure IT environments run efficiently, while service level agreements and performance monitoring enable businesses to measure and improve service quality. Software licensing solutions provide cost optimization, while big data analytics and artificial intelligence offer valuable insights for strategic decision-making. Vulnerability assessments and security audits ensure IT environments remain compliant with industry regulations, safeguarding against potential risks. Disaster recovery and business continuity plans ensure uninterrupted operations in the face of unexpected events. IT consulting and outsourcing offer expert guidance and cost savings, enabling businesses to focus on their core competencies. Remote monitoring and customer relationship management enhance IT service delivery, improving customer satisfaction and loyalty.

Cost optimization and resource optimization strategies help businesses maximize their IT investments, while digital transformation initiatives drive innovation and growth. Knowledge management solutions enable effective information sharing and collaboration, fostering a culture of continuous learning and improvement. The IT service management landscape is continually evolving, with new technologies and trends shaping the market. Managed services providers must stay abreast of these developments to deliver value to their clients and remain competitive in the marketplace.

How is this Managed Services Industry segmented?

The managed services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- MDS

- MNS

- MSS

- MMS

- Others

- Deployment

- Cloud

- On-premises

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

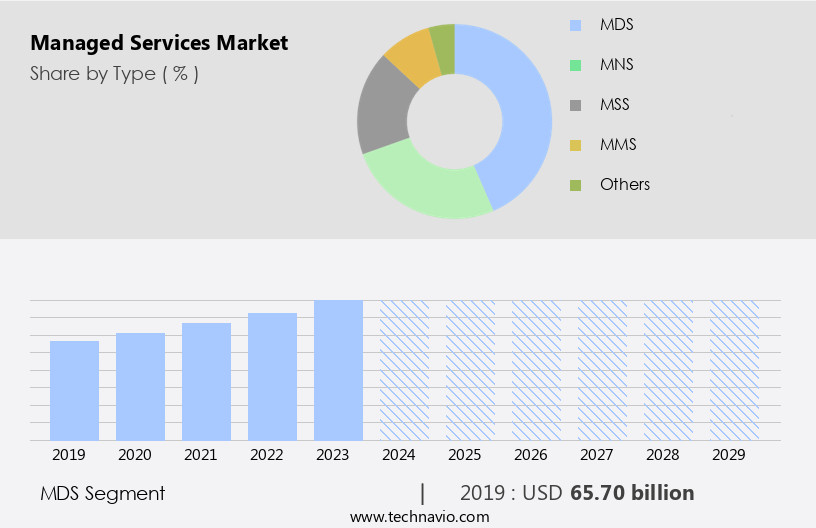

The mds segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth, particularly in sectors such as IT, banking, financial services and insurance (BFSI), education, healthcare, and retail. The demand for managed services, including capacity planning, hardware maintenance, machine learning, security audits, performance metrics, cybersecurity services, disaster recovery, compliance audits, data governance, endpoint security, incident response, technical support, hybrid cloud, system administration, infrastructure management, service level agreements, performance monitoring, software licensing, big data analytics, artificial intelligence, vulnerability assessments, managed hosting, cloud security, cloud computing platforms, help desk, application management, IT consulting, IT support services, SLA compliance, network management, resource optimization, customer satisfaction, cost optimization, IT service management, remote monitoring, customer relationship management, data loss prevention, business continuity, IT outsourcing, and digital transformation, is driven by the need for cost-effective and reliable solutions.

In emerging countries like China, India, Brazil, Indonesia, and Mexico, the number of small and medium-sized enterprises (SMEs) is increasing, leading to a higher demand for managed data center services (MDS). MDS offers pay-per-use storage infrastructure, which is deployed, monitored, and managed by the service provider, providing similar functionalities as standard data centers but through a managed service platform. Additionally, the adoption of cloud computing and the increasing importance of cybersecurity are also fueling market growth.

The MDS segment was valued at USD 65.70 billion in 2019 and showed a gradual increase during the forecast period.

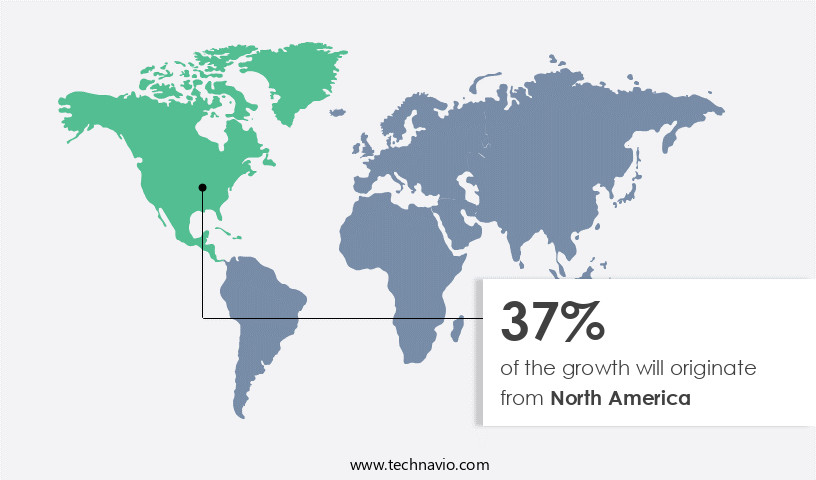

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic IT landscape of North America, managed services continue to gain traction due to the region's early adoption of advanced technologies in industries such as manufacturing, retail, and BFSI. Key companies like Accenture, Atos, Cisco, DXC, and Fujitsu, with a strong presence and penetration in the market, significantly contribute to its growth. Advanced economies in North America necessitate managed services for data processing and outsourcing, Internet services and infrastructure, and increasingly, cloud-based offerings, automation solutions, and artificial intelligence (AI) integration with operational and supply chain processes. New intelligent managed services are emerging, driven by the adoption of cloud computing platforms, help desks, application management, IT consulting, IT support services, and network management.

Performance monitoring, SLAs, and resource optimization ensure customer satisfaction and cost optimization. Security audits, disaster recovery, compliance audits, data governance, endpoint security, incident response, technical support, hybrid cloud, system administration, infrastructure management, and performance metrics are integral components of managed services. Vulnerability assessments, managed hosting, cloud security, and IT service management further bolster the market. The ITIL framework and knowledge management facilitate efficient service delivery and customer relationship management. Business continuity, data loss prevention, digital transformation, and IT outsourcing complete the spectrum of managed services in North America.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and ever-evolving business landscape, the market continues to gain momentum as an essential solution for organizations seeking to optimize their IT infrastructure, enhance security, and reduce operational costs. Managed services providers (MSPs) offer a comprehensive suite of services, including cloud management, network monitoring, IT support, and cybersecurity solutions. These services enable businesses to focus on their core competencies while experts handle the complexities of technology management. The market caters to various industries, from healthcare and finance to education and retail, ensuring customized solutions tailored to unique business needs. With the integration of advanced technologies like artificial intelligence, machine learning, and automation, MSPs deliver proactive and efficient services, ensuring business continuity and competitive edge. The market's growth is fueled by the increasing adoption of cloud computing, the need for data security, and the desire for cost savings and improved IT agility. By partnering with MSPs, businesses can leverage their expertise, gain access to the latest technologies, and achieve operational excellence.

What are the key market drivers leading to the rise in the adoption of Managed Services Industry?

- The significant growth in the implementation of Internet of Things (IoT) technologies is the primary catalyst fueling market expansion.

- The Internet of Things (IoT) is a technology that connects physical devices, embedded software, communication services, and managed services to create intelligent communication environments. This network enables smart homes, shopping, transportation, and healthcare systems, among others, through the remote control and monitoring of devices using microcontrollers and the Internet. Managed services play a crucial role in the IoT ecosystem, providing end-to-end infrastructure for IoT applications. Capacity planning, it strategy, and hardware maintenance are essential components of managed services in the IoT market. These services help optimize resource utilization, ensure system availability, and maintain hardware performance.

- Machine learning and data center operations are also integral to managed services, providing advanced analytics and automation capabilities. Cloud adoption is a significant trend in the market, with cybersecurity services and performance metrics becoming increasingly important. Security audits and compliance audits are essential for ensuring data privacy and security in IoT systems. Disaster recovery is another critical managed service, ensuring business continuity in the event of system failures or disruptions. In conclusion, managed services are an essential enabler of IoT technology, providing the communication services and infrastructure necessary for smart devices to function effectively.

- The market for managed services in the IoT ecosystem is dynamic, with a focus on capacity planning, hardware maintenance, machine learning, data center operations, cloud adoption, cybersecurity services, performance metrics, disaster recovery, and compliance audits.

What are the market trends shaping the Managed Services Industry?

- The emergence of big data and analytics services is a significant market trend. Professionals in various industries are increasingly recognizing the value of leveraging data to inform business decisions and drive growth.

- In today's digital world, businesses are generating vast amounts of data from various sources. To gain valuable insights from this data, firms are adopting managed services that offer data governance, endpoint security, incident response, technical support, system administration, infrastructure management, and performance monitoring. These services enable companies to manage and analyze their data effectively, adhering to service level agreements. Advanced analytical tools such as big data analytics, artificial intelligence, and predictive analytics are used to transform unstructured data into structured insights. Industries like finance, telecommunications, and healthcare are leveraging these tools to make informed decisions and gain a competitive edge.

- Hybrid cloud solutions are also becoming increasingly popular, as they offer flexibility and cost savings. Software licensing and system administration are essential components of managed services, ensuring that businesses have the necessary software and infrastructure to operate efficiently. Performance monitoring is crucial to maintaining optimal system functionality and preventing potential issues before they become major problems. In conclusion, managed services play a vital role in helping businesses effectively manage and utilize their data to gain valuable insights and maintain a competitive edge. By focusing on data governance, endpoint security, incident response, technical support, system administration, infrastructure management, performance monitoring, and advanced analytics, firms can make informed decisions and improve their overall operations.

What challenges does the Managed Services Industry face during its growth?

- The growth of the cloud-based services industry is significantly impacted by the challenges posed by data privacy and security risks. These risks, which are of paramount importance, must be addressed to ensure the confidentiality, integrity, and availability of data in cloud environments.

- Managed services in the realm of cloud computing have gained significant traction in the business world, with offerings such as vulnerability assessments, managed hosting, application management, IT consulting, and IT support services becoming increasingly popular. However, data privacy and security remain major concerns for organizations adopting cloud-based managed services, particularly in public cloud environments. Cloud security is a complex challenge for companies, requiring robust measures to safeguard online data from unauthorized access and potential vulnerabilities in the underlying cloud infrastructure. The open-source code base of cloud infrastructure can introduce flaws, making cloud security management a critical concern.

- Public cloud infrastructure, which supports multiple tenants and applications, is more susceptible to these vulnerabilities due to the interconnected nature of its systems. Vulnerability assessments, network management, service desk, help desk, and SLAs are essential components of managed services that can mitigate these risks and ensure compliance with security standards. Resource optimization and efficient IT support are additional benefits that organizations can derive from managed services, enhancing their overall operational efficiency.

Exclusive Customer Landscape

The managed services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the managed services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, managed services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - The company provides expert managed services, ensuring the stability, optimization, and agility of IT infrastructure.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- ALE International

- Amazon.com Inc.

- Atos SE

- BMC Software Inc.

- Capgemini Services SAS

- Cisco Systems Inc.

- Cloudticity LLC

- Cognizant Technology Solutions Corp.

- DXC Technology Co.

- Fujitsu Ltd.

- Google LLC

- HCL Technologies Ltd.

- Hewlett Packard Enterprise Co.

- Huawei Technologies Co. Ltd.

- Infosys Ltd.

- International Business Machines Corp.

- Lumen Technologies Inc.

- NEC Corp.

- NTT DATA Corp.

- Telefonaktiebolaget LM Ericsson

- Verizon Communications Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Managed Services Market

- In January 2024, IBM announced the acquisition of GreenBlue Data Centers, a leading European managed services provider, for approximately USD1.3 billion. This acquisition was aimed at expanding IBM's hybrid cloud capabilities and managed services offerings in Europe (IBM Press Release, 2024).

- In March 2024, Microsoft and Google Cloud entered into a multi-year partnership to offer joint managed services for Microsoft Teams and Google Workspace. This collaboration enabled seamless migration and management of workloads between the two platforms, enhancing their competitive edge in the unified communication market (Microsoft Press Release, 2024).

- In May 2024, Amazon Web Services (AWS) launched AWS Outposts, an extension of AWS services to on-premises data centers. This offering enabled businesses to run AWS services and applications on their own infrastructure, providing more flexibility and control in their managed services strategy (AWS Press Release, 2024).

- In February 2025, Accenture and Google Cloud formed a strategic partnership to deliver Google Cloud services and solutions to Accenture clients. This collaboration aimed to help businesses accelerate their digital transformation journeys and leverage Google Cloud's advanced technologies (Accenture Press Release, 2025).

Research Analyst Overview

- In the dynamic the market, organizations increasingly prioritize robust security measures to safeguard their digital assets. Managed security services, such as penetration testing, data encryption, access control, and DDoS protection, have gained significant traction. Security best practices, including web application firewalls, network security, and security awareness training, are essential components of this strategy. Vulnerability management through regular security audits and incident response planning is crucial for identifying and mitigating threats. Compliance frameworks like PCI DSS and disaster recovery testing ensure business continuity and regulatory adherence. Two-factor authentication, intrusion detection systems, and threat intelligence further bolster security defenses.

- Data tokenization and data masking offer enhanced data protection, while firewall management and network security maintain perimeter security. Implementing security best practices, such as data encryption and access control, is a proactive approach to risk mitigation. Regular security audits, vulnerability management, and incident response planning are integral parts of a comprehensive security strategy. Threat intelligence and disaster recovery testing enable organizations to stay informed about potential threats and minimize downtime in the event of a breach. PCI DSS compliance and business impact analysis help ensure regulatory adherence and business continuity. Incorporating managed services like intrusion detection systems and two-factor authentication into your security strategy strengthens your organization's defenses against cyber threats.

- Network security, data center security, and firewall management are essential for maintaining a secure IT infrastructure.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Managed Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.3% |

|

Market growth 2025-2029 |

USD 217 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.6 |

|

Key countries |

US, China, India, Canada, Germany, Japan, UK, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Managed Services Market Research and Growth Report?

- CAGR of the Managed Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the managed services market growth of industry companies

We can help! Our analysts can customize this managed services market research report to meet your requirements.