Cylinder Deactivation System Market Size 2024-2028

The cylinder deactivation system market size is forecast to increase by USD 848.9 million at a CAGR of 3.2% between 2023 and 2028. The market's growth trajectory is contingent upon various factors, notably the stringent emission and fuel economy standards, which necessitate innovation in automotive technology. With an escalating number of vehicles on the roads, there's a pressing need to enhance vehicle performance while adhering to regulatory requirements. Additionally, the rising demand for fuel-efficient and environmentally-friendly vehicles underscores consumer preferences, further fueling market expansion. As automotive manufacturers strive to meet these evolving demands, the market is poised for robust growth, driven by a confluence of regulatory mandates and consumer expectations.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Dynamic and Customer Landscape

The market is responding to stricter emission regulations aimed at reducing CO2 emissions and environmental pollution. Automakers are adopting these systems to lower the carbon footprint of their vehicles, with electromagnetic valve actuators and advanced Engine Control Units optimizing engine type performance. Technologies such as overhead CAM design and solenoids enhance peak performance level and efficiency. Original Equipment Manufacturers (OEMs) are increasingly integrating these systems into gasoline engines to improve fuel economy and reduce emissions. With a focus on the flow of goods and operational efficiency, plants may experience shutdowns for upgrades, reflecting the industry's commitment to environmental sustainability. This shift aligns with customer expectations and regulatory demands, driving innovation in the market. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The stringent emission and fuel economy standards are key factors driving the growth of the market. Increasing levels of greenhouse gas emissions and the depleting reserves of conventional fossil fuels globally have forced legislative bodies of different countries to implement stringent standards for vehicle emissions and fuel economy. Vehicle emissions contribute significantly to air pollution in the environment. In addition, governments around the world have enacted rigorous fuel emissions and fuel economy regulations, and duty-bound automotive OEMs are required to comply with these requirements. OEMs have been attempting to build improved and efficient engine management systems to achieve these standards. The CDA system also improves fuel economy by increasing the load on the operating cylinders.

With the increased load, combustion efficiency is increased sufficiently to improve fuel consumption even when fewer cylinders are in operation. Major automotive OEMs are involved in the R and D of advanced engine management systems so that automobiles can run on minimum fuel intake and with minimum exhaust emissions. Consumers are now inclined toward purchasing environment-friendly vehicles that consume less fuel. Thus, the demand for CDA systems in vehicles will increase, which will boost the market growth and trends during the forecast period.

Significant Market Trend

Growing demand for fuel efficiency is the primary trend in the global market growth. The automotive industry has been witnessing growing demand for fuel efficiency, safety, and reduced emissions in the interest of promoting better driving and travel experience for consumers. This increases the operational efficiency of automotive engines, which, in turn, helps in reducing fuel costs. Therefore, automotive OEMs tend to favor CDA systems because customer demands are inclined toward high-performance features with low fuel usage.

For instance, in June 20222, Volvo Buses launched a new platform for premium coaches, which can save approximately 9% in fuel costs. Thus, increasing demand for fuel-efficient vehicles will augment the demand for automotive engines that can increase the efficiency of vehicles and, in turn, will drive the growth of the market in focus during the forecast period.

Major Market Challenge

Excessive oil consumption in vehicles is a major challenge to the growth of the global market. The spring tension of the rings in automobiles is insufficient to push them against the cylinder walls with adequate force to establish and maintain a positive seal between their sealing surfaces and the cylinder walls; the issue involves the fact that piston rings need both compression and combustion pressure to function. The main mechanism by which piston rings are able to, firstly, contain combustion pressure and, secondly, largely prevent the oil found on cylinder walls from penetrating past the rings and into combustion chambers depends on how pistons are designed. They must be designed such that both compression and combustion pressures can exert a significant force from behind the rings to push the rings against the cylinder walls.

Due to this issue, engines fitted with cylinder deactivation systems suffer from high oil consumption because the mechanism that ensures the effective operation of piston rings is removed when the cylinders are deactivated. Due to the lower pressure difference between the crankcase and the cylinder, the drop in pressure during cylinder deactivation may cause the oil to be transported from the crankcase into the cylinder. The oil does not just sit in the head when the engine deactivates a cylinder; instead, it is either forced out of the shaft or soaks into the rings. This then causes a loss of oil. Thus, such issues associated with CDA systems are likely to impede the growth of the market in focus during the forecast period.

Key Customer Landscape

Market Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Fev Group GmbH- The company offers cylinder deactivation system solutions such as Valve Actuation Systems.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about 15 market Companies, including:

- BorgWarner Inc.

- Continental AG

- Cummins Inc.

- Eaton Corp. Plc

- Hilite Germany GmbH

- JTEKT Corp.

- Mikuni Corp.

- Mitsubishi Motors Corp.

- Schaeffler AG

- Tula Technology Inc.

- Valeo SA

- ZF Friedrichshafen AG

- Aisin Corp.

- DENSO Corp.

Qualitative and quantitative analysis of Companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize Companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize Companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Product

The market share growth by the 4 cylinders segment will be significant during the forecast period. Engine cylinder with four cylinders was the largest segment of the global CDA segment in 2022 and will continue to remain the largest segment during the forecast period. Most cars generally have four cylinders. Four-cylinder engines are smaller than six-cylinder engines, use less fuel, and lead to fewer emissions due to reduced displacement. Four-cylinder engines have as much horsepower today as six-cylinder engines had in 2003. Four-cylinder engines accounted for more than 45% of all new car and truck sales in the US in 2021, as gas prices rose to USD4 per gallon countrywide. Because there is no lag in the firing order of the four-cylinder engine car, the power tends to be distributed more evenly, making it perform well at both low and high revolutions per minute (RPM). Such factors will in crease the segment growth during the forecast period.

Get a glance at the market contribution of various segments View the PDF Sample

The 4 cylinders segment was valued at USD 3.43 billion in 2018. In this segment, On average, a mid-size sedan with a four-cylinder engine improves its combined city-highway fuel efficiency by 10%. There is a reduction not only in fuel consumption but also in cap cost. Engines with four cylinders work continuously and are extremely refined. Major automobile manufacturing companies are increasingly launching automobiles with four cylinders. Thus, the launch of new automobile models with four-cylinder engines will drive the demand for cylinder deactivation systems to increase overall engine performance and fuel efficiency, which will boost the growth of the market in focus through the 4 cylinder segment during the forecast period.

By Region

For more insights on the market share of various regions Download PDF Sample now!

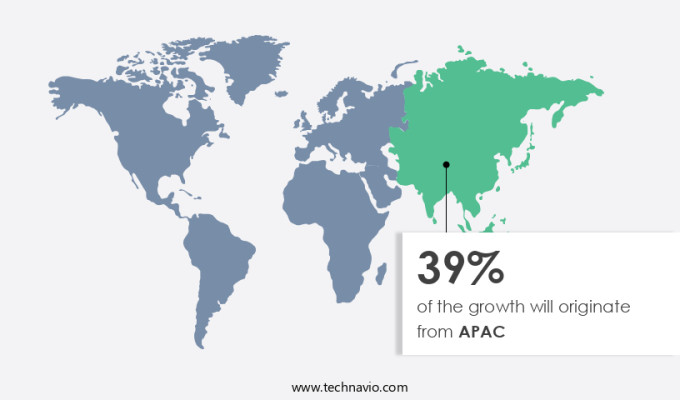

APAC is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Another region offering significant growth opportunities to companies is North America. The automotive industry in North America is expected to register moderate growth during the forecast period, owing to the considerable contribution of Mexico, which is a major player in the regional automotive industry. Mexico is also an emerging market in terms of the production of computer control vehicle systems (CVS). The country offers automotive OEMs several benefits, such as inexpensive labor and a well-qualified workforce. The country has low tariff rates for vehicles that are exported to the US. Such factors have attracted global vehicle manufacturers to shift their manufacturing bases to Mexico. For instance, in September 2020, Shaanxi Automobile Group announced the production of the X3000 and L3000 models by Shacman Mexico by November 2020, targeting the Mexico market. Hence, Mexico is a key automobile production hub for international and domestic markets. The strong presence of the automotive industry in the region will drive the demand for CDA systems, which, in turn, will spur the growth of the regional CDA system market during the forecast period.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million " for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product type Outlook

- 4 cylinders

- 6 cylinders

- above

- Vehicle type Outlook

- Passenger vehicle

- Light commercial vehicle

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in the below market reports

-

Automotive Tappets Market: Analysis APAC, North America, Europe, Middle East and Africa, South America - US, China, Japan, South Korea, Germany - Size and Forecast

-

Automotive Dual Variable Valve Timing Market: Analysis APAC, Europe, North America, Middle East and Africa, South America - China, US, Japan, Germany, France - Size and Forecast

-

US - Pickup Truck Market: Analysis by Product and Type - Forecast and Analysis

Market Analyst Overview

The market is evolving in response to stringent emission norms and the push for new mobility solutions. Global brands and Original Equipment Manufacturers (OEMs) are integrating advanced hydraulic valve systems and Engine Control Units to meet regulatory demands and enhance vehicle systems. Diesel engine cylinder deactivation technologies are gaining traction, addressing technology obsolescence and improving fuel efficiency. Solenoids and cylinder valves play key roles in optimizing these systems. As data bridge technologies advance, they support e-mobility and global vehicle engine innovations.

However, systems prone to vibration and shutdowns at assembly plants can have a ripple effect on sales channels and operational efficiency, particularly in developing economies facing challenges like the oil price crisis. The market's dynamic landscape reflects a balance between meeting engine norms and addressing evolving mobility solutions. To meet carbon dioxide emissions standards and manage power requirements, Original Equipment Manufacturer are integrating advanced engine control unit and solenoid into their vehicle system, while addressing potential shutdown issues to ensure reliable performance for customers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2024-2028 |

USD 848.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.06 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 39% |

|

Key countries |

US, China, Germany, Japan, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AISIN CORP., BorgWarner Inc., Continental AG, Cummins Inc., DENSO Corp., Eaton Corp. Plc, FEV Group GmbH, Hilite Germany GmbH, Hitachi Ltd., Hyundai Motor Co., JTEKT Corp., Magna International Inc., Mikuni Corp., Mitsubishi Motors Corp., Schaeffler AG, Tenneco Inc., Tula Technology Inc., Valeo SA, and ZF Friedrichshafen AG |

|

Market dynamics |

Parent market analysis, Market forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.