Deck-Boats Market Size 2025-2029

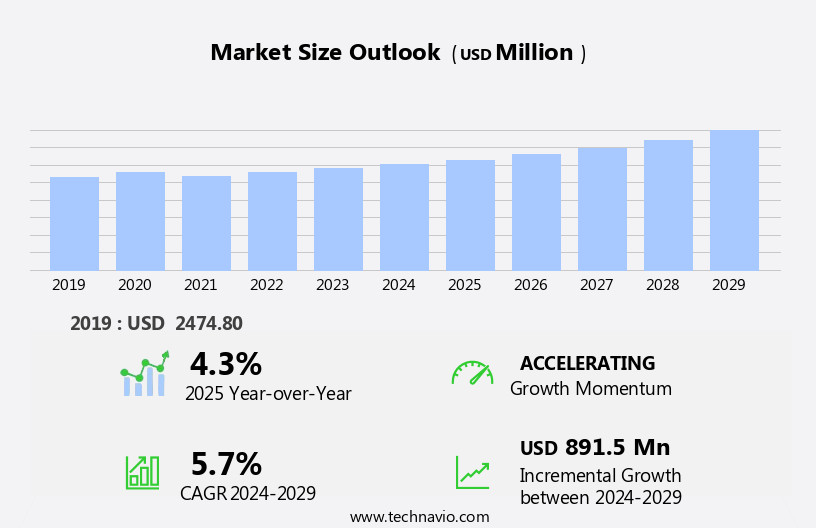

The deck-boats market size is forecast to increase by USD 891.5 million, at a CAGR of 5.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the rising household income, income levels, enabling more consumers to afford these recreational and leisure watercraft. This trend is expected to continue as disposable income increases and consumers seek cost-effective watercraft options. Strategic collaborations among industry players are another key driver, with manufacturers partnering to expand their product offerings and reach new markets. Another factor fueling market growth is the growing number of water sports enthusiasts. However, the market faces challenges as well. The increase in boat accidents has raised concerns for safety regulations and insurance costs, potentially impacting the demand for deck boats.

- Companies must address these challenges by investing in research and development for safety features and working closely with regulatory bodies to ensure compliance. To capitalize on market opportunities and navigate challenges effectively, businesses should focus on innovation, strategic partnerships, and prioritizing consumer safety.

What will be the Size of the Deck-Boats Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Deck boats continue to be a dynamic and evolving market in the recreational boating industry. These versatile watercraft offer a unique blend of features, catering to various applications, from family outings to fishing expeditions. The market's continuous unfolding is evident in several aspects, including financing solutions, environmental regulations, advanced navigation systems, and top speeds. Boat financing options have expanded, providing more accessible and flexible financing plans for consumers. Environmental regulations have become increasingly stringent, influencing hull designs, marine electronics, and engine technologies. Navigation systems have advanced, integrating GPS chartplotters and other marine electronics for improved safety and efficiency.

Top speeds remain a significant factor, with deck boats offering impressive performance while maintaining family-friendly features. Marketing and sales strategies have evolved, focusing on customer service, dealer networks, and seating arrangements to cater to diverse consumer preferences. Trailer hitches, rod holders, outboard motors, and other accessories have become essential components of the deck boat market, enhancing functionality and versatility. Supply chain management and storage solutions have gained importance, ensuring efficient distribution and maintenance of these watercraft. Fishing boats and center consoles have emerged as popular segments within the deck boat market, with features tailored to anglers, such as fish finders, storage capacity, and fishing accessories.

Luxury boating and coastal cruising have also gained traction, with demand for amenities like audio systems, safety standards, and passenger capacity. The deck boat market's ongoing dynamism is further reflected in emerging trends, such as jet drives, composite materials, and inboard motors. These innovations contribute to improved fuel efficiency, enhanced performance, and reduced environmental impact. In summary, the deck boat market's continuous evolution is shaped by various factors, including financing, regulations, technology, and consumer preferences. This ever-changing landscape offers opportunities for growth and innovation within the recreational boating industry.

How is this Deck-Boats Industry segmented?

The deck-boats industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Single decked boat

- Double decked boat

- Application

- Wakeboard

- Fishing

- Wakesurf

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- Australia

- China

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

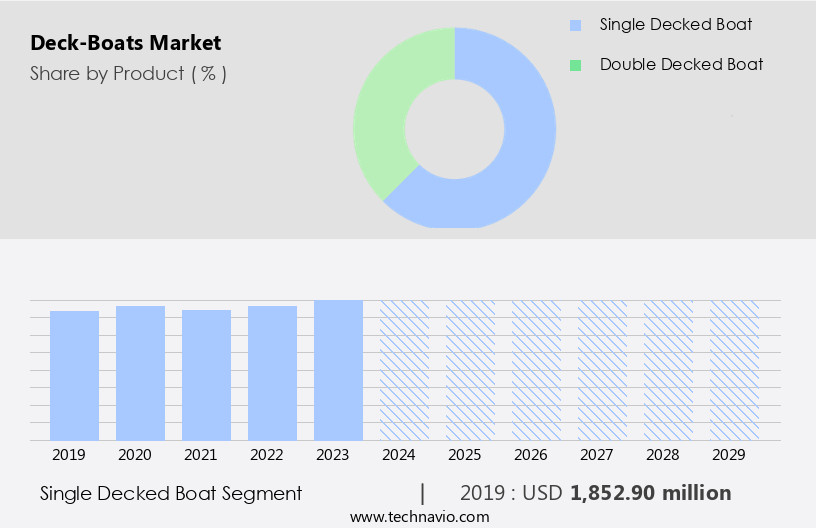

The single decked boat segment is estimated to witness significant growth during the forecast period.

The market encompasses various segments, including pontoon boats, deck boats, center consoles, fishing boats, and others. Deck boats, with their versatile design and spacious decks, continue to gain popularity for family and recreational boating. Innovations in this sector include the SunDeck 2050 by Hurricane Deck-Boats, launched in October 2024. This single decked boat offers an exhilarating ride, striking a balance between power and comfort. Equipped with advanced marine electronics, such as intuitive navigation systems and high-quality audio systems, the SunDeck 2050 delivers an immersive on-water experience. Boat maintenance, insurance, and financing are essential aspects of the market. Environmental regulations play a crucial role in shaping the industry, with an increasing focus on fuel efficiency and eco-friendly materials, such as composite materials and inboard motors.

Hull design, stern drives, and steering systems are other key factors influencing the market. Retail sales, dealer networks, and seating arrangements are crucial for customer satisfaction. Fishing boats and accessories, such as rod holders and fishing electronics, cater to the fishing enthusiasts. Luxury boating, coastal cruising, and wakeboard boats cater to diverse customer segments. Supply chain management, hull cleaning, and storage solutions ensure efficient operations. Safety standards, trailer hitches, and dock lines are essential for ensuring a safe and enjoyable boating experience. Overall, the market is dynamic, with continuous innovation and evolving trends shaping its future.

The Single decked boat segment was valued at USD 1852.90 million in 2019 and showed a gradual increase during the forecast period.

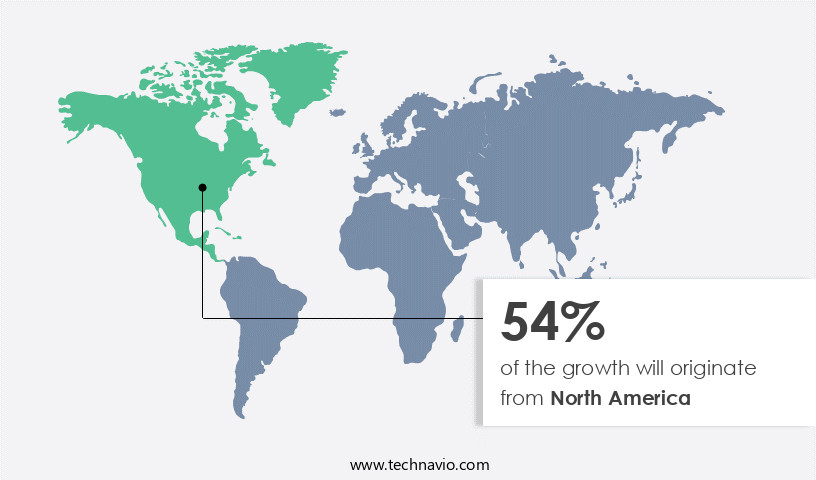

Regional Analysis

North America is estimated to contribute 54% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, particularly in the US, the market is experiencing notable growth due to the rising participation in recreational boating. Approximately 100 million Americans engaged in various boating activities in 2023, underscoring the strong affinity for outdoor and water-based leisure pursuits. This trend has significantly boosted the economic impact of the recreational boating industry, which grew from USD170 billion in 2018 to USD230 billion in 2023, a 36% increase. Deck-boats, with their versatile design and functionality, have gained popularity among consumers. These boats offer features such as cuddy cabins, fishing accessories, and ample storage capacity, making them suitable for both family boating and fishing.

The market for deck-boats is witnessing various trends, including the integration of marine electronics like fish finders and navigation systems. Boat maintenance, insurance, and financing solutions are also crucial aspects of the market. Environmental regulations continue to shape the industry, with a focus on fuel efficiency and the use of composite materials and inboard motors. Hull cleaning and safety standards are also essential considerations. Dealer networks and customer service play a significant role in the market, ensuring seamless retail sales and after-sales support. Supply chain management and trailer hitches are other critical factors. The market encompasses a diverse range of boats, including center consoles, dual console boats, and ski boats, catering to various consumer preferences and uses.

Steering systems, stern drives, and jet drives contribute to the boats' performance and maneuverability. Marketing and sales strategies are essential for businesses in the market, with a focus on reaching potential customers through various channels. Boat maintenance, repair, and upkeep are ongoing concerns, requiring expertise in engine repair and marine surveys. The market also offers a range of accessories, such as lighting systems, audio systems, and rod holders, to enhance the boating experience. In conclusion, the market in North America, particularly in the US, is experiencing robust growth due to the rising participation in recreational boating and the versatility of these boats.

The market is characterized by various trends, including the integration of marine electronics, environmental regulations, and customer service, among others. These factors contribute to the expanding demand for deck-boats, making it an exciting and dynamic industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market caters to consumers seeking versatile watercraft that offer a blend of comfort, functionality, and style. These boats, with their spacious decks, are ideal for fishing, sunbathing, and entertaining. Deck boats provide ample seating, easy access to the water, and can accommodate various water toys. Their stable hulls ensure safety and comfort, making them popular choices for families and social gatherings. Deck boats come in various sizes, from compact models to larger vessels, offering flexibility to suit diverse needs. Their robust construction, featuring durable materials and powerful engines, ensures reliable performance in different water conditions. Additionally, deck boats boast modern amenities, such as onboard sound systems, GPS navigation, and livewells for fishing enthusiasts. Overall, the market presents a wide range of options for those seeking enjoyable and practical watercraft experiences.

What are the key market drivers leading to the rise in the adoption of Deck-Boats Industry?

- Household income's continual rise serves as the primary catalyst for market growth.

- The market is experiencing notable growth due to the increasing real household income per capita in major economies. In the first quarter of 2024, OECD countries reported a 0.9% rise in household income, up from the 0.3% growth in the previous quarter. This trend is driving consumer spending on leisure activities, such as the purchase of deck-boats. All G7 economies reported an increase in real household income during this period, with Italy leading the way at 3.4%. This significant rise is attributed to higher employee compensation and social transfers, reversing the previous quarter's decline.

- As disposable income continues to grow, demand for deck-boats, featuring cuddy cabins, stern drives, and hull designs, is expected to increase. Marine electronics, such as lighting systems, fish finders, and boat maintenance tools, are also becoming increasingly popular add-ons. Wholesale distribution and marine upholstery are also seeing growth in the market, catering to the increasing demand for deck-boats.

What are the market trends shaping the Deck-Boats Industry?

- Strategic collaborations have emerged as a significant market trend. By forming alliances with complementary businesses or industry experts, companies can expand their reach, enhance their offerings, and improve their competitive position.

- The market is witnessing significant strategic collaborations to promote marine electrification. An illustrative instance is the May 2023 partnership between Mercury Marine, a Brunswick Corporation division, and JJE. This alliance aims to expand Mercury Marine's Avator electric product line by developing more powerful electric propulsion systems. This commitment to marine electrification underscores Mercury Marine's dedication to providing advanced electric systems designed for marine applications. This collaboration aligns with the broader industry trend, as consumers and regulatory bodies increasingly focus on reducing emissions and promoting eco-friendly boating solutions.

- Navigation systems, trailer hitches, rod holders, outboard motors, and other deck-boat features continue to evolve, catering to the diverse needs of family boating and recreational users. Effective supply chain management remains crucial in this market, ensuring timely delivery of boats and components while maintaining quality. Fishing boats and center consoles also benefit from these advancements, offering improved performance and enhanced user experience.

What challenges does the Deck-Boats Industry face during its growth?

- The boat industry faces significant challenges due to the rising number of boat accidents, which poses a threat to its growth.

- The market is experiencing increased demand due to its versatility and ability to cater to various boating activities, such as luxury cruising, coastal cruising, fishing, and water sports. Jet drives, a popular propulsion system in deck boats, provide smooth and efficient performance, making them a preferred choice for many consumers. Manufacturers are focusing on enhancing customer service and offering fuel efficiency through the use of composite materials and inboard motors. Hull cleaning solutions and marine surveys ensure the maintenance and safety of these boats, while storage solutions and boat trailers facilitate easy transportation and accessibility. Fishing accessories are also increasingly being integrated into deck boats to cater to the needs of anglers.

- However, the market faces challenges due to safety concerns. The rising number of boat accidents, as evidenced by the 116 reported deaths in Nigeria, West Africa, in 2023, necessitates stricter safety regulations and measures. This includes improved safety features, such as safety equipment and emergency evacuation procedures. Ensuring the safety and well-being of passengers is of utmost importance in the boating industry. In conclusion, the market is driven by consumer preferences for versatility, efficiency, and convenience, while also facing challenges related to safety and regulations. Manufacturers are responding by offering innovative solutions and focusing on customer needs to maintain competitiveness in the market.

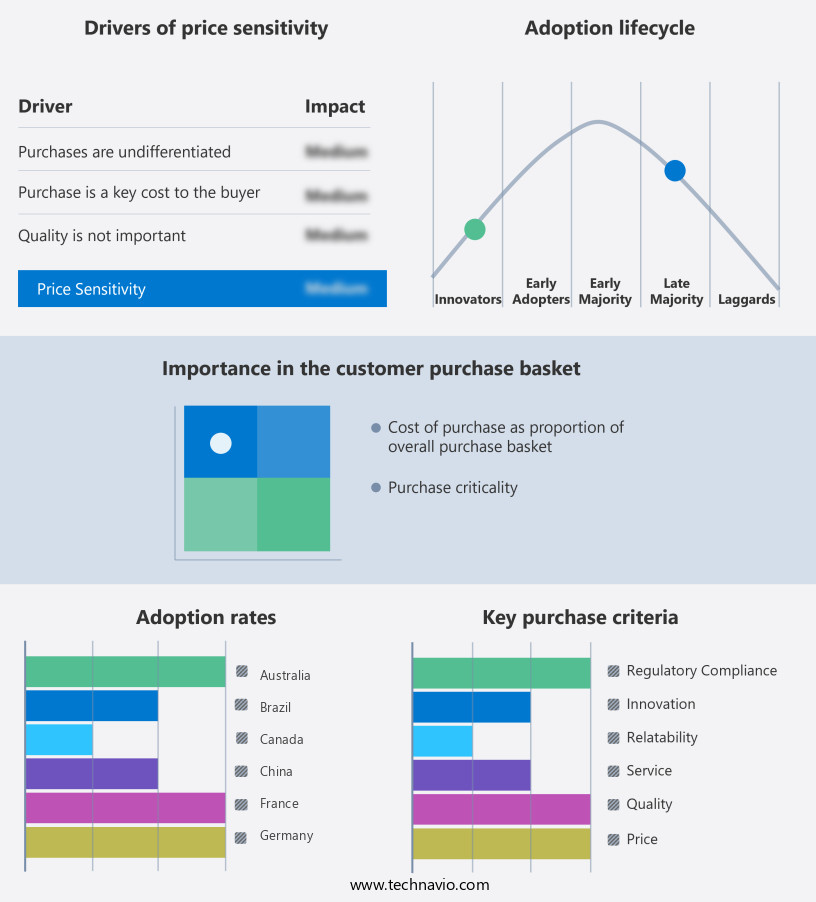

Exclusive Customer Landscape

The deck-boats market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the deck-boats market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, deck-boats market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Brunswick Corp. - This company specializes in deck boats, showcasing the Bayliner Element E21 as an exemplary model.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Brunswick Corp.

- Bullet Boats Inc.

- Crownline Boats

- Four Winns

- Glastron

- MasterCraft Boat Holdings Inc.

- Monterey Boats

- Polaris Inc.

- Regal Marine Industries Inc

- Southwind Deckboats

- White River Marine Group

- Yamaha Motor Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Deck-Boats Market

- In January 2024, Beneteau, a leading deck-boat manufacturer, introduced its new line of solar-powered deck boats, named "Solaris," at the Miami International Boat Show. This innovative product launch marked the industry's first significant step towards eco-friendly deck boats (Beneteau Press Release, 2024).

- In March 2024, Brunswick Corporation, the world's largest marine manufacturer, announced a strategic partnership with Tesla to integrate solar panels into their deck boats. This collaboration aimed to reduce the carbon footprint of recreational boating and increase the market appeal of sustainable boating solutions (Brunswick Corporation Press Release, 2024).

- In May 2024, Malibu Boats, a major deck-boat manufacturer, completed the acquisition of Crest Pontoons, a leading pontoon boat company. This acquisition expanded Malibu Boats' product portfolio and strengthened their market position in the pontoon boat segment (Malibu Boats Press Release, 2024).

- In April 2025, the European Union passed the Watercraft Directive, which mandated the installation of emission reduction systems on all new deck boats sold within the EU. This regulatory approval marked a significant shift towards greener and more sustainable deck-boat manufacturing practices (European Parliament Press Release, 2025).

Research Analyst Overview

- The market encompasses various aspects, from hull repair materials and boat design software to engine parts and marine insurance. Social media marketing and digital marketing have become essential tools for boat dealers to reach potential buyers, while boat shows provide opportunities for industry players to showcase their latest innovations. Market research and data analytics help manufacturers optimize their supply chain and implement lean manufacturing and manufacturing automation. Boat transport, boat storage, and marine safety equipment are crucial services and products for boat owners.

- Navigation software and fishing gear enhance the boating experience, while virtual prototyping and 3D modeling enable custom boat designs. Online boat sales and boat rental services cater to diverse customer needs. Boat clubs offer membership benefits, while boat financing options facilitate boat ownership. Wakeboarding equipment and waterskiing equipment cater to water sports enthusiasts. Overall, the market is dynamic, with continuous advancements in technology and design.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Deck-Boats Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

195 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market growth 2025-2029 |

USD 891.5 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

US, Canada, Australia, UK, Germany, Italy, France, Spain, China, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Deck-Boats Market Research and Growth Report?

- CAGR of the Deck-Boats industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the deck-boats market growth of industry companies

We can help! Our analysts can customize this deck-boats market research report to meet your requirements.