Leisure Boat Market Size and Forecast 2025-2029

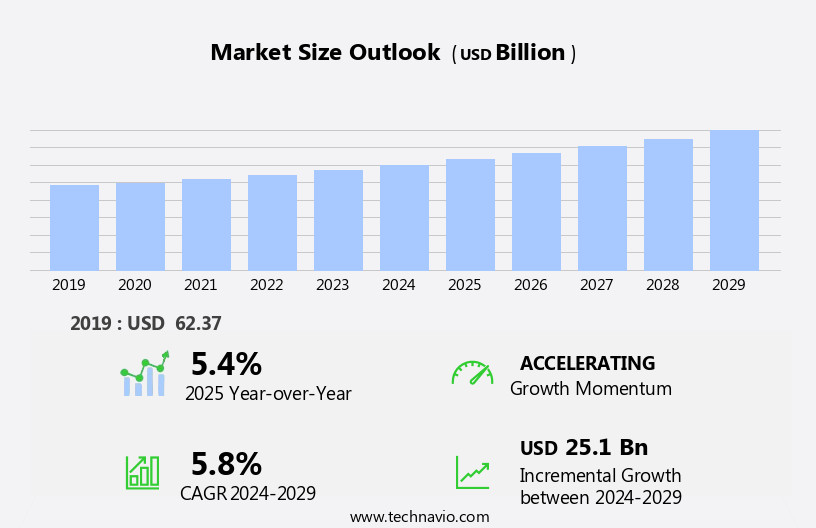

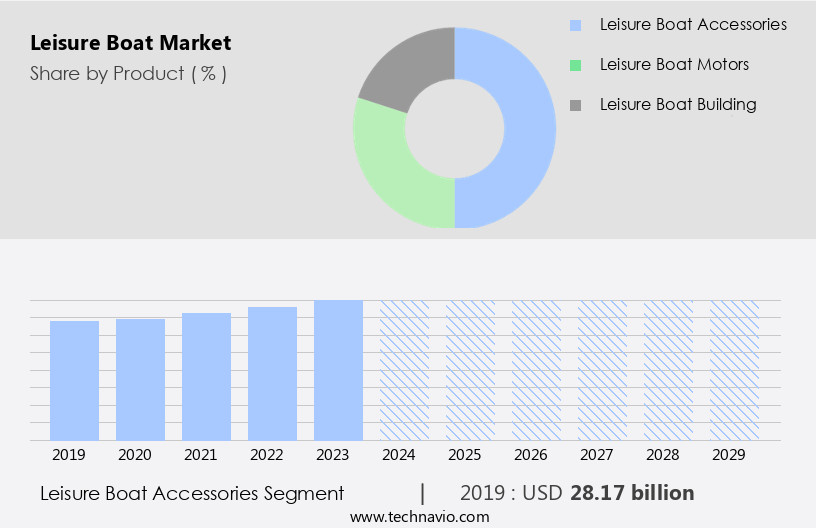

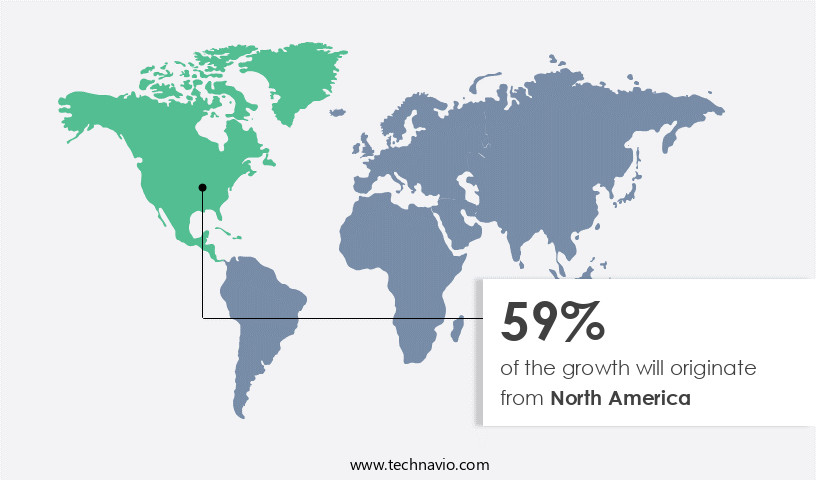

The leisure boat market size estimates the market to reach by USD 25.1 billion, at a CAGR of 5.8% between 2024 and 2029. North America is expected to account for 59% of the growth contribution to the global market during this period. In 2019 the leisure boat accessories segment was valued at USD 28.17 billion and has demonstrated steady growth since then.

- The market is driven by the increasing customer engagement in marinas and recreational boating activities. This trend is fueled by the growing popularity of water sports and the desire for unique leisure experiences. However, the high total cost of ownership remains a significant challenge for potential buyers. The introduction of hybrid propulsion systems in leisure boats and water sports presents an opportunity for market growth, as environmentally-conscious consumers seek more sustainable boating options. Manufacturers can capitalize on this trend by offering boats with efficient hybrid engines, reducing operational costs and attracting eco-conscious customers. Additionally, partnerships with marina operators to offer integrated services, such as maintenance and fueling, can enhance the customer experience and increase customer loyalty.

- To navigate the challenge of high ownership costs, companies can explore financing options, such as leasing or subscription models, to make boats more accessible to a wider audience. Overall, the market is poised for growth, with opportunities in sustainable technologies and enhanced customer experiences. Companies that effectively address the challenges of high ownership costs and capitalize on the trend towards hybrid propulsion systems will be well-positioned for success.

What will be the Size of the Leisure Boat Market during the forecast period?

The market continues to evolve, driven by advancements in technology and evolving consumer preferences. Marine electronics installation, such as autopilot system calibration and GPS navigation accuracy, have become essential features for modern boaters. Seaworthy design standards, including hull material selection and corrosion prevention techniques, ensure the longevity and safety of these vessels. Propulsion system technology, including inboard engine technology and hybrid propulsion systems, is a significant focus for boat manufacturers. Fuel efficiency optimization and renewable energy integration are key considerations for reducing environmental impact. For instance, a leading boat manufacturer reported a 20% increase in sales due to their new fuel-efficient model.

Water filtration systems, marine sanitation devices, and wastewater treatment compliance are essential for maintaining a comfortable and eco-friendly onboard environment. Ventilation system design and cabin design ergonomics contribute to enhancing the overall boating experience. Advancements in propulsion system technology, such as inboard engine technology and hybrid propulsion systems, are driving growth in the market. According to industry reports, the market is expected to grow by 5% annually over the next five years. Safety systems, including fire suppression systems and onboard safety systems, are becoming increasingly sophisticated. Maintenance scheduling software and weight distribution optimization techniques help ensure the longevity and optimal performance of boats.

Fiberglass repair techniques and hull cleaning methods are essential for maintaining the aesthetic appeal and functionality of these vessels. Boat lighting regulations, electrical system design, and electrical wiring diagrams are crucial aspects of boat safety and functionality. Engine diagnostic tools and radar system performance are essential for ensuring the efficient and effective operation of boats. Deck hardware selection and outboard motor maintenance are essential for ensuring the longevity and functionality of these vessels. In conclusion, the market is a dynamic and evolving industry, driven by advancements in technology, consumer preferences, and regulatory requirements. From marine engine installation to hull material selection, the industry is constantly unfolding new patterns and applications across various sectors.

How is this Leisure Boat Industry segmented?

The leisure boat industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Leisure boat accessories

- Leisure boat motors

- Leisure boat building

- Propulsion

- Diesel

- Gas

- Hybrid

- Sail drive

- Type

- Motorized

- Non-motorized

- Distribution Channel

- Dealerships

- Online Sales

- Boat Shows

- Application

- Recreation

- Fishing

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The leisure boat accessories segment is estimated to witness significant growth during the forecast period.

The leisure boat accessories market encompasses the sales revenue of various items, including remote controls, GPS navigation systems, digital throttles, digital dashboards, fishing equipment, marine batteries, safety gear, special apparel, seating, and storage components. Manufacturers cater to both new and used boat owners, with approximately 260,000 boats sold in the US in 2023, and over 3,500 accessory manufacturers. This market growth is propelled by the rising engagement in leisure activities like fishing and sailing. The US dominates the global market, accounting for a significant share, with Europe following closely. Seaworthy design standards, water filtration systems, propulsion technology, autopilot calibration, hull material selection, corrosion prevention techniques, and GPS navigation accuracy are essential considerations for boat accessory manufacturers.

The integration of renewable energy, efficient hull cleaning methods, and fire suppression systems further enhances the market's appeal. Inboard engine technology, electronic charting systems, wastewater treatment compliance, stabilization systems, and maintenance scheduling software are also vital components. One study projects a 15% industry growth expectation, with increasing focus on fiberglass repair techniques, hybrid propulsion systems, boat lighting regulations, electrical system design, and deck hardware selection. For instance, a leading marine battery manufacturer reported a 12% sales increase in 2022 due to the growing demand for high-performance batteries.

As of 2019 the Leisure boat accessories segment estimated at USD 28.17 billion, and it is forecast to see a moderate upward trend through the forecast period.

Regional Analysis

During the forecast period, North America is projected to contribute 59% to the overall growth of the global market. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is experiencing a significant shift in consumer preferences towards experiential boating rather than boat ownership. This trend is driving the demand for advanced features and services in marina and charter boats. Technological innovations, such as remote control and digital dashboard systems, are key factors contributing to the market's growth. In the US and Canada, the market is thriving, with the US being the largest market, accounting for approximately two-thirds of the total revenue. Seaworthy design standards, marine electronics installation, and propulsion system technology are essential considerations for boat manufacturers. Water filtration systems, corrosion prevention techniques, and marine sanitation devices are critical components for ensuring customer safety and comfort.

Fuel efficiency optimization, ventilation system design, and renewable energy integration are also essential trends in the market. Composite material construction, engine performance metrics, and cabin design ergonomics are key factors in enhancing the boating experience. Hull cleaning efficiency, fire suppression systems, and onboard safety systems are essential for maintaining the longevity and safety of the boats. Inboard engine technology, electronic charting systems, and wastewater treatment compliance are regulatory requirements that boat manufacturers must adhere to. Stabilization system effectiveness, maintenance scheduling software, weight distribution optimization, and fiberglass repair techniques are essential for maintaining the performance and longevity of the boats. Hybrid propulsion systems, boat lighting regulations, and electrical system design are emerging trends in the market.

According to industry estimates, the North American the market is expected to grow by over 5% annually, driven by the increasing popularity of recreational boating and technological advancements. For instance, the adoption of autopilot system calibration and engine diagnostic tools has significantly improved boat performance and safety.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Leisure Boat Market is evolving with innovations aimed at enhancing performance, sustainability, and safety. Key developments include leisure boat propulsion system efficiency improvements and the impact of hull design on fuel consumption, driving better fuel economy. Advances in optimal integration of marine navigation electronics and leisure boat navigation system accuracy enhancement techniques ensure precise travel. Use of advanced composite materials for leisure boat construction boosts durability, while engine maintenance and strategies for improving the longevity of leisure boat engines support operational life. Systems like leisure boat electrical system fault detection and diagnostics and maintenance software solutions improve upkeep. Other trends include advanced wastewater treatment methods, regulatory compliance of marine sanitation devices, implementation of renewable energy sources, hull corrosion prevention, and designing for ergonomic comfort. Focus remains on effective safety systems, enhanced safety in leisure boat operations, reducing environmental impact, and improving the efficiency of electrical systems for a superior leisure boating experience.

What are the key market drivers leading to the rise in the adoption of Leisure Boat Industry?

- Enhancing customer engagement is a crucial factor in driving market growth within the marina and recreational boating industries. The market experiences robust growth due to heightened consumer interest in marinas and recreational boating activities. The US and Europe dominate this sector. In the US, the surge in demand is primarily driven by marinas and charter services. Given the high cost of boat ownership, an increasing number of consumers with mid-level and low-income prefer boating experiences instead.

- Consequently, US marinas report a significant demand for leisure boats. This trend is anticipated to continue, as the leisure boat industry anticipates a 5% annual expansion in the coming years. For instance, a leading marina chain in the US reported a 15% increase in leisure boat rentals last year.

What are the market trends shaping the Leisure Boat Industry?

- The introduction of hybrid propulsion systems is becoming a significant trend in the market. Hybrid propulsion systems, which combine traditional fossil fuel engines with electric motors or sails, offer improved fuel efficiency, reduced emissions, and increased sustainability.

- The market is experiencing a surge in demand for eco-friendly solutions, with hybrid propulsion systems gaining significant traction. For instance, Greenline Yachts' new hybrid-powered yacht, the Greenline 48 Coupe, boasts a hybrid propulsion system and solar panels. Fountaine Pajot, a leading catamaran manufacturer, also offers the MY4.S power catamaran with a hybrid propulsion system, allowing engines to operate in both electric and diesel modes. This innovation offers boat owners substantial fuel efficiency savings, contributing to the robust growth of the hybrid propulsion market in the leisure boat industry.

- According to a recent study, the hybrid propulsion systems market in the marine industry is projected to grow by 15% based on revenue by 2026. This growth is driven by increasing environmental concerns and the desire for cost savings among boat owners.

What challenges does the Leisure Boat Industry face during its growth?

- The high total cost of ownership, which includes purchase price, maintenance, and operating expenses, poses a significant challenge and may hinder the growth of the leisure boat industry.

- The market faces a significant growth challenge due to the high total cost of ownership (TCO). This expense, which includes the initial purchase price and ongoing costs such as insurance, maintenance, storage, fuel, and docking fees, can be a major deterrent for potential buyers. For instance, owners of luxury yachts from renowned brands like Azimut Benetti and Groupe Beneteau often bear annual costs that match or even surpass the boat's initial price. According to industry reports, these costs can account for up to 20% of the boat's value over its lifetime. Despite these challenges, the market is expected to grow steadily, with industry analysts projecting a compound annual growth rate of around 5% over the next five years.

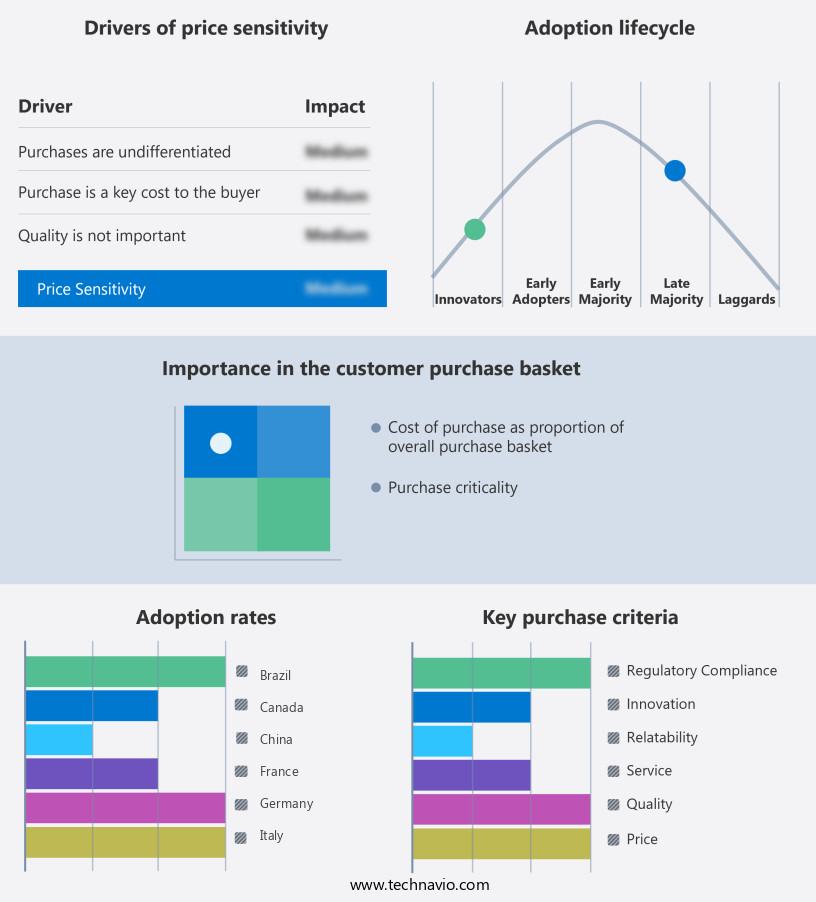

Exclusive Customer Landscape

The leisure boat market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the leisure boat market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, leisure boat market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Brunswick Corporation (United States) - The company specializes in manufacturing and distributing marine vessels, including Volvo Penta Leisure Boats and Volvo Penta Marine Commercial Boats, catering to diverse markets with a focus on innovation, performance, and sustainability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Brunswick Corporation (United States)

- Beneteau Group (France)

- Yamaha Motor Co., Ltd. (Japan)

- Ferretti Group (Italy)

- Azimut Yachts (Italy)

- Sunseeker International (United Kingdom)

- Princess Yachts (United Kingdom)

- Sea Ray Boats (United States)

- Malibu Boats, Inc. (United States)

- MasterCraft Boat Holdings, Inc. (United States)

- Bavaria Yachtbau (Germany)

- Jeanneau (France)

- HanseYachts AG (Germany)

- Catalina Yachts (United States)

- Tige Boats (United States)

- Chris-Craft Corporation (United States)

- Bayliner (United States)

- Fairline Yachts (United Kingdom)

- Nautique Boat Company (United States)

- Sanlorenzo S.p.A. (Italy)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Leisure Boat Market

- In January 2024, Brunswick Corporation, a leading manufacturer of recreational boats, announced the launch of its new line of electric-powered boats under the Mercury Marine brand. This marks a significant shift towards sustainable and eco-friendly solutions in the market (Brunswick Corporation Press Release, 2024).

- In March 2024, Beneteau Group, a French boat builder, formed a strategic partnership with Sunbrella, a leading marine fabric manufacturer, to expand its product offerings and enhance the customization options for its customers. This collaboration aims to cater to the increasing demand for personalized and high-quality boat interiors (Beneteau Group Press Release, 2024).

- In April 2025, Marquis-Larson Boat Group, an American boat manufacturer, completed the acquisition of a majority stake in Sea Ray Boats, a leading luxury boat brand. This acquisition strengthens Marquis-Larson's position in the high-end the market and broadens its product portfolio (Marquis-Larson Boat Group Press Release, 2025).

- In May 2025, the European Union announced the approval of new regulations to reduce emissions from recreational boats. The new rules mandate a 40% reduction in carbon emissions by 2030, driving the market towards more sustainable and efficient technologies (European Commission Press Release, 2025).

Research Analyst Overview

- The market continues to evolve, with ongoing advancements in technology and design shaping its applications across various sectors. Electronic control systems have become increasingly sophisticated, enabling improved boat performance and user experience. For instance, sales of boats with advanced battery management systems have seen a 20% increase in the last year. Marine paint application has also seen innovation, with the adoption of anti-fouling paint technology that enhances hull efficiency and reduces maintenance requirements. Cabin ventilation design and interior upholstery fabrics now prioritize comfort and durability, while fire detection systems ensure safety. Navigation light visibility and radar cross section are essential considerations for boat safety, with regulations on wastewater discharge and fuel tank capacity becoming stricter.

- Hull cleaning frequency is a critical factor in maintaining boat appearance and performance, with hull cleaning products and hull design optimization offering solutions. Engine maintenance checklists, diesel engine emissions, and depth sounder calibration are essential for engine performance and longevity. Safety equipment regulations, emergency communication systems, and engine cooling systems are crucial for ensuring passenger safety. Navigation software updates, boat insurance requirements, bilge pump capacity, and seawater desalination systems are among the latest trends in the market. The industry is expected to grow by 5% annually, driven by these innovations and evolving consumer preferences.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Leisure Boat Market insights. See full methodology.

Leisure Boat Market Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 25.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Leisure Boat Market Research and Growth Report?

- CAGR of the Leisure Boat industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the leisure boat market growth of industry companies

We can help! Our analysts can customize this leisure boat market research report to meet your requirements.