Deep Learning Chips Market Size 2024-2028

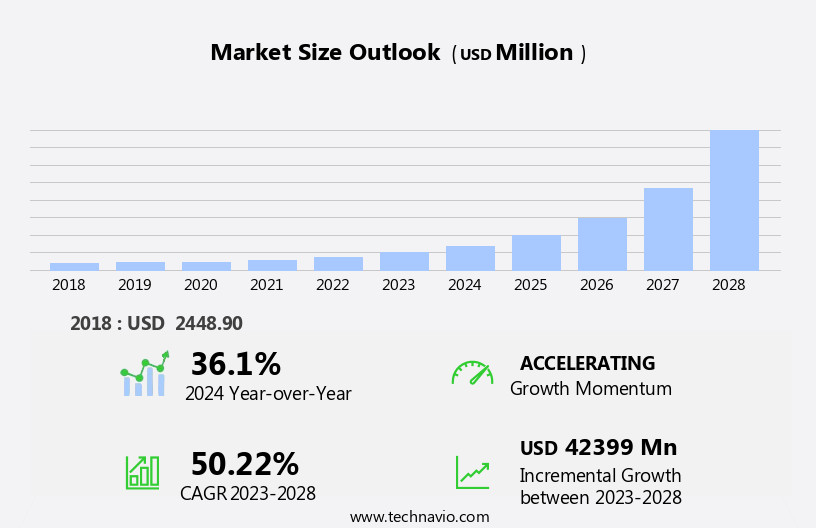

The deep learning chips market size is forecast to increase by USD 42.4 billion at a CAGR of 50.22% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing adoption of deep learning technology in various industries, particularly in autonomous vehicles. Advanced quantum computing is another driving factor, enabling faster and more efficient deep learning computations. However, the market faces challenges such as the scarcity of technically skilled workers capable of developing deep learning chips. This skilled labor shortage may hinder market growth. Moreover, the integration of deep learning chips into complex systems requires extensive research and development efforts, further increasing the market's complexity. Despite these challenges, the market's potential for innovation and growth is immense, making it an exciting area to watch for technology enthusiasts and investors alike.

What will be the Size of the Deep Learning Chips Market During the Forecast Period?

- The deep learning chip market encompasses a range of specialized hardware solutions designed to accelerate artificial intelligence (AI) workloads, including neural network processors, machine learning chips, artificial intelligence accelerators, deep learning accelerators, GPUs, CPUs, ASICs, FPGAs, high-performance computing chips, embedded AI chips, low-power AI chips, AI inference chips, AI training chips, on-device AI chips, neural processing units, AI co-processors, and AI chip integration and optimization technologies. These chips are integral to advancing AI capabilities, enabling applications such as image and speech recognition, natural language processing, predictive analytics, and autonomous systems. Market growth is driven by the increasing demand for AI solutions across various industries and the need for higher performance, efficiency, scalability, reliability, and security in AI applications. The deep learning chip market is expected to continue expanding as AI adoption accelerates and technological advancements lead to more sophisticated and integrated AI solutions.

How is this Deep Learning Chips Industry segmented and which is the largest segment?

The deep learning chips industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- System-on-Chip

- System-in-Package

- Multi-chip Module

- Others

- End-user

- BFSI

- IT and telecom

- Media and advertising

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Technology Insights

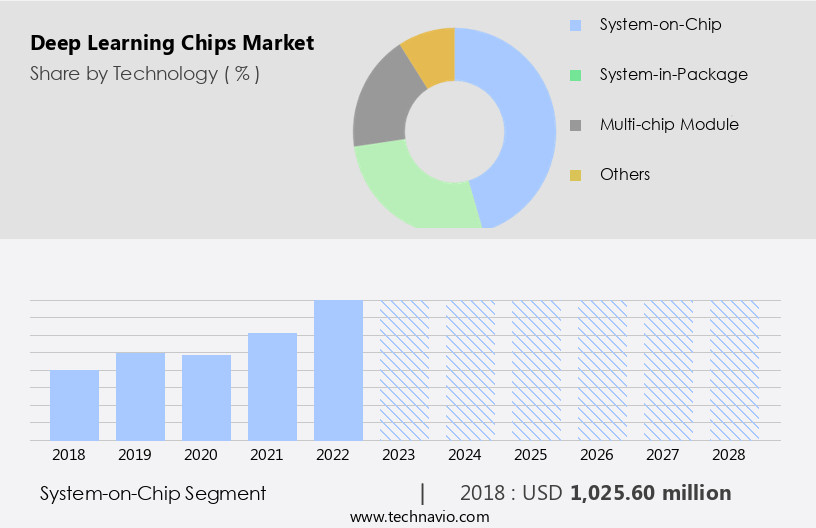

- The system-on-chip segment is estimated to witness significant growth during the forecast period.

Deep learning chips, including neural network processors, machine learning chips, artificial intelligence accelerators, and deep learning accelerators, are integral to the advancement of artificial intelligence (AI) and machine learning (ML) technologies. These chips, which include GPU chips, CPU chips, ASIC chips, FPGA chips, hardware accelerators, edge computing chips, cloud computing chips, neuromorphic computing chips, quantum computing chips, parallel processing chips, high-performance computing chips, embedded AI chips, low-power AI chips, AI inference chips, AI training chips, on-device AI chips, neural processing units, AI co-processors, and various AI chip architectures, are designed to optimize AI performance, scalability, efficiency, reliability, and security. SoCs, which integrate CPUs, microprocessor, GPUs, and necessary memory on a single chip, have gained popularity due to their versatility, power, and efficiency in performing complex computational tasks. This integration provides a higher level of performance and energy efficiency, making it an attractive option for device manufacturers to power their products across various industries, including autonomous vehicles, healthcare, retail, and manufacturing.

Get a glance at the Deep Learning Chips Industry report of share of various segments Request Free Sample

The System-on-Chip segment was valued at USD 1.03 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

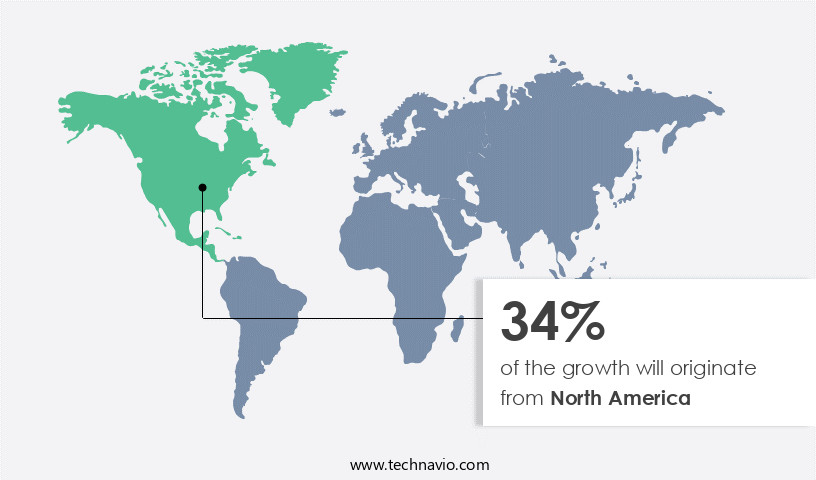

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The deep learning chip market in North America is experiencing significant growth due to the proliferation of advanced technologies in smart devices and the escalating demand for artificial intelligence (AI) solutions in various industries, including healthcare, retail, and automotive. The adoption of deep learning algorithms for enhancing the precision of image, speech, and signal recognition is a primary growth driver for the deep learning chip market in North America. For instance, tech giants like Google LLC are employing deep learning algorithms In their offerings, such as Google Assistant, Google Translate, and Google Photos, for image and speech recognition. Neural network processors, machine learning chips, artificial intelligence accelerators, and deep learning accelerators are some of the chip types gaining traction in this market.

The deep learning chip market's growth is further fueled by the increasing need for high-performance computing, low-power consumption, and real-time processing capabilities. Industry verticals like media & advertising, IT & telecom, and manufacturing are also investing in deep learning chips to enhance their offerings and gain a competitive edge.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Deep Learning Chips Industry?

Rise in adoption of deep learning chips in autonomous vehicles is the key driver of the market.

- The deep learning chip market experiences significant growth due to the increasing adoption of deep learning technologies in various industries, with a notable focus on autonomous vehicles. Automotive companies recognize the necessity of deep learning chips to attaIn the highest levels of automation, leading to a surge in demand. These processors are essential for analyzing vast amounts of data generated from sensors, cameras, radar, LIDAR, and ultrasonic instruments, enabling split-second decisions for safe and efficient driving. The need for high computational power in onboard processors to handle unstructured data and make real-time decisions is a key market driver. Deep learning chips, including neural network processors, machine learning chips, artificial intelligence accelerators, deep learning accelerators, GPUs, CPUs, ASICs, FPGAs, hardware accelerators, edge computing chips, cloud computing chips, neuromorphic computing chips, quantum computing chips, parallel processing chips, and high-performance computing chips, are crucial for achieving advanced automation levels.

- The market encompasses various chip architectures, designs, manufacturing, testing, validation, integration, optimization, performance, scalability, efficiency, reliability, security, and company landscape considerations. Applications span across machine learning, computer vision, voice recognition, speech synthesis, game playing, drug discovery, robotics, and more. The skilled workforce, bug fixing, cloud implementation, delivery, chip type, technology, and industry verticals, such as media & advertising, IT & telecom, healthcare, automotive & transportation, working from home, supply chain, stock market, and business confidence, are significant factors influencing the market dynamics.

What are the market trends shaping the Deep Learning Chips Industry?

Advances in quantum computing is the upcoming market trend.

- The explosion of data from smart devices and automation trends necessitates advanced hardware capable of processing this unstructured information. While conventional computers have made significant strides in processing speed, they fall short in meeting the demands of artificial intelligence (AI) applications. Consequently, market players worldwide are investing in quantum computing technology to unlock higher computational power. Quantum computing operates based on quantum mechanics principles, offering superior processing capabilities compared to traditional binary systems. This technology's potential applications span various industries, including media & advertising, IT & telecom, healthcare, automotive & transportation, working from home, supply chain, stock market, and business confidence.

- The development of AI hardware, such as neural network processors, machine learning chips, artificial intelligence accelerators, deep learning accelerators, GPU chips, CPU chips, ASIC chips, FPGA chips, hardware accelerators, edge computing chips, cloud computing chips, neuromorphic computing chips, quantum computing chips, parallel processing chips, high-performance computing chips, embedded AI chips, low-power AI chips, AI inference chips, AI training chips, on-device AI chips, neural processing units, AI co-processors, and AI chip architectures, is crucial to meet the growing demand for AI applications. The AI chip market encompasses various chip types, including system-on-chip, system-in-package, and multi-chip module, and is poised for significant growth as the industry continues to innovate and optimize AI chip design, manufacturing, testing, validation, integration, optimization, performance, scalability, efficiency, reliability, and security.

What challenges does the Deep Learning Chips Industry face during its growth?

Dearth of technically skilled workers for deep learning chip development is a key challenge affecting the industry growth.

- Deep learning chips, a subset of AI hardware, are experiencing significant demand due to the increasing adoption of artificial intelligence (AI) in various industries. Neural network processors, machine learning chips, artificial intelligence accelerators, and deep learning accelerators are some types of hardware accelerators used for AI applications. These chips include GPU chips, CPU chips, ASIC chips, FPGA chips, and neural processing units. The development of deep learning chips is challenging due to the lack of a skilled workforce. The field is still emerging, with limited educational programs focusing on this area of expertise. Furthermore, the complexity of deep learning chip design and manufacturing requires a high level of technical proficiency.

- To address this challenge, industry players are investing in research and development to create innovative AI chip architectures and designs. They are also collaborating with universities and technical schools to develop educational programs and recruit talented individuals. Additionally, some companies are exploring alternative chip types, such as quantum computing chips and parallel processing chips, to improve performance and efficiency. Deep learning chips have numerous applications in various industries, including media & advertising, IT & telecom, healthcare, automotive & transportation, working from home, supply chain, stock market, and business confidence. These chips are used for machine learning, computer vision, voice recognition, speech synthesis, machine translation, game playing, drug discovery, robotics, and more.

- In conclusion, the development of deep learning chips is a complex and challenging process due to the lack of a skilled workforce. However, industry players are investing in research and development, collaborating with educational institutions, and exploring alternative chip types to address this challenge and meet the growing demand for AI applications.

Exclusive Customer Landscape

The deep learning chips market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the deep learning chips market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, deep learning chips market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Achronix Semiconductor Corp. - The market encompasses advanced technologies like AMD Instinct MI200 and MI100 series accelerators, designed to optimize machine learning and artificial intelligence applications. These chips facilitate faster processing, improved accuracy, and reduced power consumption for data-intensive workloads. By leveraging innovative architectures and high-performance computing capabilities, they enable organizations to drive breakthroughs in various industries, from healthcare and finance to autonomous vehicles and gaming.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Achronix Semiconductor Corp.

- Advanced Micro Devices Inc.

- Alphabet Inc.

- Amazon.com Inc.

- Cerebras

- China Cambrian Technology Co. Ltd.

- Flex Logix Technologies Inc.

- Fujitsu Ltd.

- Graphcore Ltd.

- Groq Inc.

- Intel Corp.

- International Business Machines Corp.

- MediaTek Inc.

- NVIDIA Corp.

- Qualcomm Inc.

- Samsung Electronics Co. Ltd.

- Synopsys Inc.

- Syntiant Corp.

- Taiwan Semiconductor Manufacturing Co. Ltd.

- ThinkForce

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The deep learning chip market encompasses a range of specialized hardware solutions designed to accelerate artificial intelligence (AI) and machine learning (ML) workloads. These chips, also referred to as neural network processors, machine learning chips, or AI accelerators, are distinguished from general-purpose CPUs and GPUs by their optimized architectures and capabilities. Deep learning chips can be categorized into several types, including application-specific integrated circuits (ASICs), field-programmable gate arrays (FPGAs), and application-specific standard products (ASSPs). Each type offers unique advantages in terms of performance, power efficiency, and flexibility. ASIC chips are custom-designed for specific AI workloads, offering the highest performance and energy efficiency.

FPGAs, on the other hand, provide flexibility in terms of configurability and adaptability to various AI applications. ASSPs represent a balance between performance and versatility, offering pre-designed, integrated solutions for common AI use cases. Deep learning chips are increasingly being adopted across various industry verticals, including media & advertising, IT & telecom, healthcare, automotive & transportation, and working from home. In media & advertising, these chips enable advanced computer vision and voice recognition capabilities, enhancing user experiences and improving content recommendation. In IT & telecom, deep learning chips power network optimization, security, and customer service applications. In healthcare, they facilitate medical image analysis, disease diagnosis, and drug discovery.

In automotive & transportation, deep learning chips enable advanced driver assistance systems and autonomous driving. In the working from home sector, they support speech synthesis and natural language processing for virtual assistants and productivity tools. The deep learning chip market is driven by several factors, including the growing demand for AI and ML applications, the need for high-performance, low-power solutions, and the increasing adoption of edge computing and cloud computing. The market is also influenced by advancements in AI chip architectures, design, manufacturing, testing, optimization, and integration. Despite these opportunities, the deep learning chip market faces challenges such as the need for a skilled workforce to design, develop, and maintaIn these complex systems, as well as the ongoing competition from general-purpose CPUs and GPUs.

Additionally, the market is subject to external factors such as supply chain disruptions, stock market volatility, and business confidence. In conclusion, the deep learning chip market represents a significant growth opportunity for companies offering specialized hardware solutions for AI and ML workloads. The market is characterized by various chip types, each with its unique advantages and applications, and is driven by factors such as the increasing demand for AI, the need for high-performance, low-power solutions, and advancements in chip technologies. However, the market also faces challenges such as the need for a skilled workforce and competition from general-purpose hardware.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 50.22% |

|

Market growth 2024-2028 |

USD 42399 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

36.1 |

|

Key countries |

US, Germany, China, UK, and Taiwan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Deep Learning Chips Market Research and Growth Report?

- CAGR of the Deep Learning Chips industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the deep learning chips market growth of industry companies

We can help! Our analysts can customize this deep learning chips market research report to meet your requirements.