Dental Adhesives Market Size 2024-2028

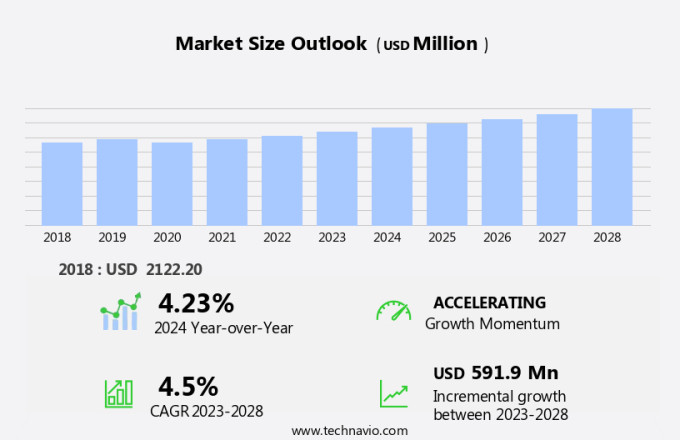

The dental adhesives market size is forecast to increase by USD 591.9 million, at a CAGR of 4.5% between 2023 and 2028.

- The market is witnessing significant growth, driven by the increasing number of patients undergoing dental procedures. This trend is fueled by rising awareness about oral health and the availability of affordable dental treatments. Furthermore, the focus on digital dental technologies at dental shows signifies the industry's shift towards advanced solutions, offering opportunities for market participants to innovate and differentiate. Additionally, regulatory policies mandating the use of antimicrobial agents in adhesives to prevent oral diseases among elderly people will further boost market growth. However, the high cost of dental restoration services may limit the market's expansion, as affordability continues to be a key concern for many patients.

- To capitalize on market opportunities and navigate challenges effectively, companies must stay abreast of technological advancements and explore cost-effective solutions to cater to the price-sensitive consumer base.

What will be the Size of the Dental Adhesives Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and research. Dental adhesives play a crucial role in the success of various dental procedures, including composite resin restorations and orthodontic treatments. The continuous pursuit of improved bonding efficacy and durability fuels market dynamics. Hydrophilic monomers and adhesive rheology are key considerations in the development of dental adhesives. These factors influence the adhesive's ability to interact with dentin and enamel, as well as its application and handling characteristics. Adhesive degradation mechanisms, such as hydrolysis and biocompatibility, are essential in assessing the long-term performance of dental adhesives. Enamel bonding durability and adhesive strength testing are critical aspects of evaluating the efficacy of dental adhesives.

Self-etching adhesives, which combine etching and bonding in a single step, have gained popularity due to their convenience and simplicity. Adhesive viscosity and polymerization are essential factors in ensuring proper application and adequate curing. Microtensile bond strength and bond failure analysis provide valuable insights into the mechanical properties of dental adhesives. Dental bonding agents, including total-etch and self-etch adhesives, exhibit varying film thicknesses and nanoleakage prevention capabilities. Post-operative sensitivity and hybrid layer formation are essential considerations in the clinical efficacy studies of dental adhesives. Dual-cure adhesives, which can be cured both chemically and photochemically, offer increased flexibility in clinical applications.

Water sorption and adhesive shelf life are essential factors in ensuring the long-term stability of dental adhesives. The ongoing research and development efforts in the market aim to address these challenges and improve the overall performance and durability of dental adhesives. Chemical bonding mechanisms and surface treatment protocols are essential in optimizing composite resin adhesion. Etching techniques and the light-curing process are critical components of the adhesive application procedure. Primer application and resin-dentin interaction are essential factors in achieving a successful bond between the adhesive and tooth structure. The ongoing research and development efforts in the market aim to address these challenges and improve the overall performance and durability of dental adhesives.

How is this Dental Adhesives Industry segmented?

The dental adhesives industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Dental repair adhesives

- Denture adhesives

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- APAC

- China

- Rest of World (ROW)

- North America

By Product Insights

The dental repair adhesives segment is estimated to witness significant growth during the forecast period.

Dental adhesives, encompassing both resins and powders, play a crucial role in dental repair procedures. Denture users primarily employ hydrophilic monomer-based powders for enhanced adhesion and stability. The choice of dental resins, including vinyl acetate, ethylene-vinyl acetate copolymer, and dimethacrylates, significantly impacts the adhesive's rheology and shear bond strength. Dentin bonding efficacy is a critical factor, ensuring a strong bond between the tooth and the adhesive. Adhesive degradation, influenced by solubility characteristics and water sorption, necessitates rigorous biocompatibility testing and clinical efficacy studies. Adhesive shelf life and degradation mechanisms are essential considerations, ensuring the longevity of the adhesive's performance.

Enamel bonding durability is another vital aspect, with microtensile bond strength and bond failure analysis providing valuable insights. Self-etching adhesives streamline the application process, while adhesive viscosity and polymerization techniques impact the overall adhesive strength. Nanoleakage prevention and post-operative sensitivity are essential concerns, with hybrid layer formation and dual-cure adhesives offering potential solutions. Chemical bonding mechanisms and surface treatment protocols are crucial factors influencing composite resin adhesion. Etching techniques and the light-curing process are integral to the adhesive application, with primer application and resin-dentin interaction significantly impacting the adhesive's overall performance. Resin composition, including the choice of monomers and fillers, plays a pivotal role in determining the adhesive's properties and efficacy.

The Dental repair adhesives segment was valued at USD 1277.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

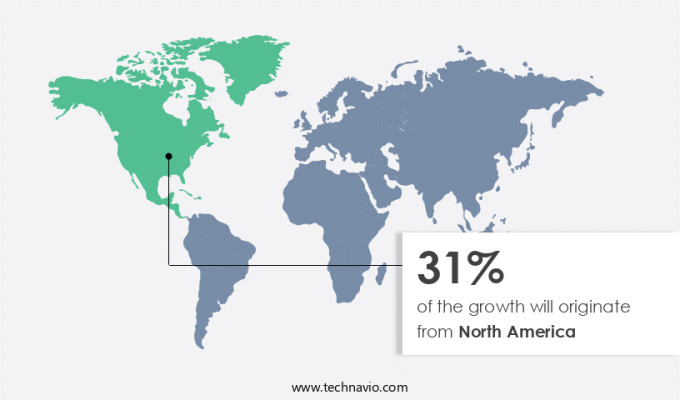

North America is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the market, various factors influence the product development and application. Shear bond strength is a critical factor in evaluating the efficacy of dental adhesives. Hydrophilic monomers, which enhance the wettability of the adhesive, are increasingly used to improve dentin bonding efficacy. Adhesive rheology, or its flow behavior, is essential for proper application and distribution of the adhesive. Adhesive degradation, primarily due to water sorption and chemical reactions, impacts the shelf life and clinical efficacy of dental adhesives. Biocompatibility testing ensures the safety and suitability of adhesives for use in dental applications. Solubility characteristics and adhesive viscosity are important considerations in the formulation of dental adhesives.

Self-etching adhesives have gained popularity due to their ease of use and improved bonding efficiency. Adhesive polymerization, either chemical or light-cured, significantly influences the adhesive's properties and performance. Microtensile bond strength testing is used to assess the bond strength between the adhesive and the tooth structure. Bond failure analysis helps identify the reasons for adhesive failure and guides the development of more durable adhesives. Dental bonding agents, available as total-etch or self-etch, differ in their surface treatment protocols and application techniques. Dual-cure adhesives offer the advantage of both chemical and light-cured polymerization. Nanoleakage prevention is a significant concern to minimize post-operative sensitivity and ensure long-term durability of the adhesive bond.

Enamel bonding durability is a crucial factor in evaluating the clinical efficacy of dental adhesives. Chemical bonding mechanisms, such as micromechanical retention and chemical bonding, contribute to the adhesive's strength and reliability. Composite resin adhesion is essential for the success of various dental restorative procedures. Etching techniques, such as phosphoric acid etching, are used to prepare the tooth surface for bonding. The light-curing process ensures the proper polymerization of the adhesive and the composite resin. Primer application plays a vital role in enhancing the bonding efficiency and durability. Resin-dentin interaction is a complex process that influences the adhesive's performance. The resin composition, including the type and concentration of monomers, affects the adhesive's properties and bonding efficiency.

Understanding these factors and their interplay is crucial for the development of high-performing dental adhesives.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is driven by the continuous research and development of advanced adhesive systems to ensure optimal bond strength and durability. One crucial aspect of dental adhesives is their ability to form a strong resin-dentin bond. However, moisture contamination during application can significantly impact adhesive strength. Therefore, various adhesive systems have been compared to assess their performance in different substrates and moisture conditions. Moreover, the clinical outcomes of different adhesive techniques vary in various clinical scenarios. For instance, adhesive effectiveness in restoring anterior and posterior teeth may differ due to distinct anatomical and functional requirements. Additionally, the influence of curing light intensity and storage conditions on adhesive properties is a critical factor in determining their longevity under occlusal forces. Market research reports evaluate adhesive degradation over time through assessment of adhesive failure mechanisms. Biocompatibility in vivo is another essential aspect of dental adhesives, which is evaluated through rigorous testing. Comparison of total-etch versus self-etch techniques and optimal adhesive application protocols for different restorations are ongoing areas of research. Furthermore, the analysis of different primer combinations with adhesives is essential to enhance the overall performance of dental adhesives in the market.

What are the key market drivers leading to the rise in the adoption of Dental Adhesives Industry?

- The expansion of the patient base is the primary growth factor for the dental procedures market.

- Dental adhesives play a crucial role in various dental procedures, including orthodontics and oral maxillofacial surgeries. The demand for these adhesives is driven by several factors. The rising prevalence of orthodontic diseases and oral maxillofacial surgeries in the population is a significant factor fueling market growth. Additionally, the increasing periodontal problems in the geriatric population contribute to the market's expansion. Periodontal diseases, such as bleeding gums, are becoming more common among both adults and children. In the geriatric population, these diseases are particularly prevalent, making it a significant market driver.

- Moreover, limited awareness about dental diseases and poor oral hygiene in certain populations, particularly in China, results in a high prevalence of periodontitis and severe tooth loss. These factors collectively contribute to the rapid growth of the market.

What are the market trends shaping the Dental Adhesives Industry?

- The focus on digital dental technologies is a significant market trend in upcoming dental shows. Dental professionals are increasingly incorporating advanced technologies, such as digital impressions, CAD/CAM systems, and teledentistry, into their practices. These innovations streamline workflows, improve patient care, and enhance overall efficiency.

- The market has seen significant advancements with the integration of digital technology in dentistry. Dental adhesives play a crucial role in ensuring shear bond strength between various dental components and the tooth structure. The use of hydrophilic monomers in adhesive formulations enhances dentin bonding efficacy. Adhesive rheology, a critical factor in determining the application and setting properties of dental adhesives, is extensively researched to optimize their performance. The degradation of adhesives over time and their biocompatibility are essential considerations in the development of new adhesive formulations. Biocompatibility testing and solubility characteristics are essential aspects of adhesive evaluation to ensure patient safety and optimal clinical performance.

- Adhesive shelf life is another critical factor influencing market dynamics, as prolonged storage can impact the physical and chemical properties of dental adhesives. Dental shows serve as platforms for global and local companies to showcase their innovative adhesive solutions, fostering growth opportunities in the dental industry. China, with its vast population and increasing dental awareness, presents significant potential for dental product manufacturers. These advancements and opportunities make the market an intriguing area of focus for stakeholders.

What challenges does the Dental Adhesives Industry face during its growth?

- The escalating costs of dental services pose a significant challenge and hinder the growth of the industry.

- Dental adhesives play a crucial role in various dental procedures, such as bonding and restorations. The market for dental adhesives in the US is driven by several factors, including the increasing prevalence of dental caries and the growing demand for minimally invasive dental treatments. The durability of enamel bonding is a significant concern in the market. Degradation mechanisms, such as hydrolysis and thermocycling, can affect the adhesive's bond strength over time. Adhesive strength testing and microtensile bond strength analysis are commonly used methods to evaluate the performance of dental adhesives. Self-etching adhesives have gained popularity due to their ease of use and improved bonding efficiency.

- Adhesive viscosity and polymerization are essential factors that influence the adhesive's performance. Proper selection and application of dental adhesives are crucial to ensure optimal bonding and prevent bond failure. Adhesive polymerization techniques, such as light-cured and self-cured, are used to improve the adhesive's properties. Understanding the mechanisms of adhesive polymerization and their impact on bond strength is essential for selecting the appropriate dental adhesive for various clinical applications. In conclusion, the market in the US is driven by the increasing demand for minimally invasive dental treatments and the need for high-performance dental adhesives. The focus on developing adhesives with improved bond strength, durability, and ease of use is expected to drive market growth.

Exclusive Customer Landscape

The dental adhesives market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dental adhesives market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, dental adhesives market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in providing dental adhesives as a fast, easy, and convenient solution for total-etch, single-component bonding.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- BISCO Inc.

- Coltene Whaledent AG

- Den Mat Holdings LLC

- Dental Technologies Inc.

- Dentsply Sirona Inc.

- Esschem Europe Ltd.

- GC America Inc.

- GlaxoSmithKline Plc

- GluStitch Inc.

- Ivoclar Vivadent AG

- Kuraray Noritake Dental Inc.

- Medicept UK Ltd.

- Mitsui Chemicals Inc.

- Pulpdent Corp.

- Queisser Pharma GmbH and Co. KG

- SHOFU Dental GmbH

- The Procter and Gamble Co.

- Tokuyama Corp.

- Ultradent Products Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Dental Adhesives Market

- In January 2024, 3M Company announced the launch of its new dental adhesive, Scotchbond Universal Adhesive, which offers universal bonding capabilities for various dental applications. This product expansion strengthened 3M's position in the market (3M Press Release, 2024).

- In March 2024, Dentsply Sirona and Ivoclar Vivadent, two leading dental companies, entered into a strategic partnership to co-develop and commercialize innovative dental adhesive solutions. This collaboration aimed to combine their expertise and resources to create advanced adhesive systems for the dental industry (Dentsply Sirona Press Release, 2024).

- In May 2024, Shin-Etsu Chemical Co., Ltd. completed the acquisition of Caulk, LLC, a leading dental adhesive manufacturer. This acquisition significantly expanded Shin-Etsu's dental business and strengthened its global market presence (Shin-Etsu Chemical Co., Ltd. Press Release, 2024).

- In February 2025, the US Food and Drug Administration (FDA) granted 3M's new dental adhesive, Scotchbond Universal Adhesive, 510(k) clearance. This regulatory approval marked a significant milestone for 3M and allowed the company to commercialize its new product in the US market (3M Press Release, 2025).

Research Analyst Overview

- The market exhibits dynamic growth, driven by advancements in adhesive technology and the increasing demand for esthetic restorations. Adhesive filler particles play a crucial role in enhancing the remineralization potential of dental restorations, while surface roughness effects influence the handling properties and compatibility with restorative materials. Adhesive failure modes, curing depth, and color stability are critical factors in ensuring adhesive longevity. Adhesion promoters and bond interface evaluation techniques contribute to improved adhesive setting time and microleakage assessment in in vivo studies.

- Monomer reactivity, polymerization shrinkage, and bioactive additives are essential considerations for the development of high-performance adhesives. In vitro studies and clinical trial results provide valuable insights into the mechanical properties, adhesive durability, and adhesive setting reaction of various dental adhesives. Adhesive application methods continue to evolve, addressing dentin demineralization and the compatibility of resin monomer types with different bonding procedures.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Dental Adhesives Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 591.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, China, Germany, France, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dental Adhesives Market Research and Growth Report?

- CAGR of the Dental Adhesives industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dental adhesives market growth of industry companies

We can help! Our analysts can customize this dental adhesives market research report to meet your requirements.