Dental Equipment Market Size 2025-2029

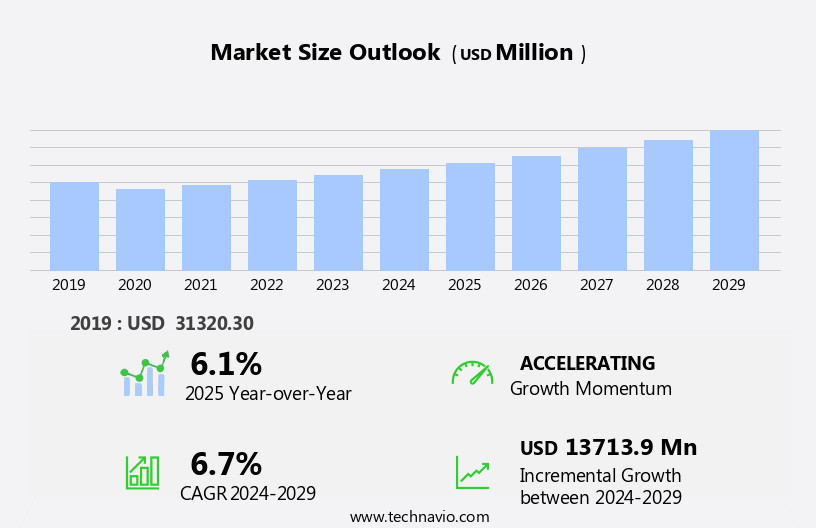

The dental equipment market size is forecast to increase by USD 13.71 billion, at a CAGR of 6.7% between 2024 and 2029.

- The market is driven by the increasing prevalence of dental diseases and related risk factors, fueling the demand for advanced diagnostic and treatment solutions. Technological innovations continue to shape the market landscape, with developments in areas such as digital dentistry, 3D printing, and robotics, offering enhanced precision, efficiency, and patient comfort. However, the high cost of dental equipment remains a significant challenge for both dental practitioners and patients, potentially limiting market growth. Dental equipment manufacturers must navigate this pricing pressure while continuing to invest in research and development to stay competitive and meet evolving customer needs. Strategic partnerships, collaborations, and mergers and acquisitions may also prove crucial for companies seeking to expand their product offerings and reach new customer segments.

- Overall, the market presents significant opportunities for growth, driven by the growing prevalence of dental diseases and the ongoing technological advancements in the industry. Companies that can effectively address the cost challenge and innovate to meet customer needs will be best positioned to capitalize on these opportunities.

What will be the Size of the Dental Equipment Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is a dynamic and ever-evolving landscape, characterized by continuous innovation and advancements in technology. Entities such as guided surgery systems, preventative dentistry solutions, dental tourism providers, digital radiography systems, operatory equipment, oral surgery equipment, dental anesthesia devices, cone beam CT scanners, dental materials, and dental technology continue to unfold, shaping the industry's future. Preventative dentistry and oral health education are at the forefront of this evolution, with an increasing emphasis on early intervention and patient-centered care. Guided surgery systems enable precise implant placement, improving patient outcomes and reducing procedural time. Dental tourism offers affordable options for patients seeking high-quality dental care, driving competition and innovation.

Digital radiography and imaging systems have revolutionized diagnostics, providing clearer, more accurate images for faster and more effective treatment planning. Operatory equipment, including dental chairs and dental units, have evolved to offer enhanced comfort and functionality. Oral surgery and dental anesthesia equipment have seen significant advancements, ensuring safer and more efficient procedures. Cone beam CT scanners offer three-dimensional imaging, enabling more accurate diagnosis and treatment planning for complex cases. Dental materials, including biocompatible and restorative options, continue to improve, offering better durability and esthetics. Dental technology, including machine learning and artificial intelligence, is transforming practice management and diagnostics, streamlining workflows and enhancing patient care.

Dental software, including practice management systems and dental lab equipment, streamline operations and improve communication between dental professionals and their teams. Intraoral cameras and dental lasers offer minimally invasive treatments, enhancing patient comfort and reducing recovery time. Pain management solutions and dental aesthetics are also gaining popularity, addressing patient needs and driving growth in the market. The market is a dynamic and evolving landscape, with ongoing advancements and innovations shaping its future. From preventative dentistry to oral surgery, dental technology continues to transform the industry, offering better patient outcomes and enhanced functionality for dental professionals.

How is this Dental Equipment Industry segmented?

The dental equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Laboratories

- Hospitals

- Clinics

- Product

- Dental diagnostics and surgical equipment

- Dental consumables

- Dental laser

- Application

- Solo practices

- DSO or group practices

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

.

By End-user Insights

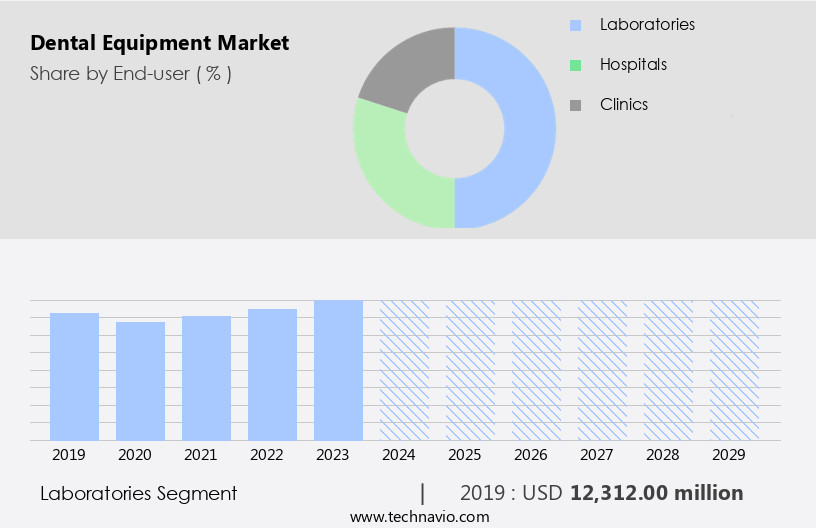

The laboratories segment is estimated to witness significant growth during the forecast period.

The market encompasses a variety of tools and technologies essential for oral health care. Dental laboratories play a crucial role in manufacturing and customizing dental products such as ceramic crowns, bridges, and dentures. Technicians in these labs adhere to prescriptions from licensed dentists while fabricating prosthetic and therapeutic devices. Basic equipment in dental labs includes workbenches and lighting, while advanced systems like articulation systems and CAD/CAM systems facilitate precision and efficiency. The increasing demand for dental consumables, including implants, crowns, and bridges, fuels the growth of the dental laboratories segment. Infection control measures are stringently implemented in dental settings, necessitating the use of advanced equipment like dental units, dental chairs, and autoclaves.

Oral health education is emphasized through the integration of multimedia tools like dental software and intraoral cameras. Dental technology continues to evolve, with innovations in areas like dental aesthetics, pain management, and digital radiography. Machine learning and artificial intelligence are increasingly being integrated into dental equipment, improving diagnostic accuracy and enhancing patient care. Biocompatible materials and dental lab equipment ensure the production of safe and effective dental restorations. Periodontal treatment, oral surgery, and dental implants require specialized equipment like scaling and root planing instruments, surgical microscopes, and guided surgery systems. Dental tourism and preventative dentistry have boosted the demand for dental equipment, leading to a thriving market.

Dental technology continues to advance, with the integration of electronic health records, cone beam CT, and dental anesthesia, offering improved patient care and streamlined operations. Dental technology also includes advanced imaging systems like 3D printing and X-ray equipment, enabling accurate diagnosis and customized treatment plans.

The Laboratories segment was valued at USD 12.31 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

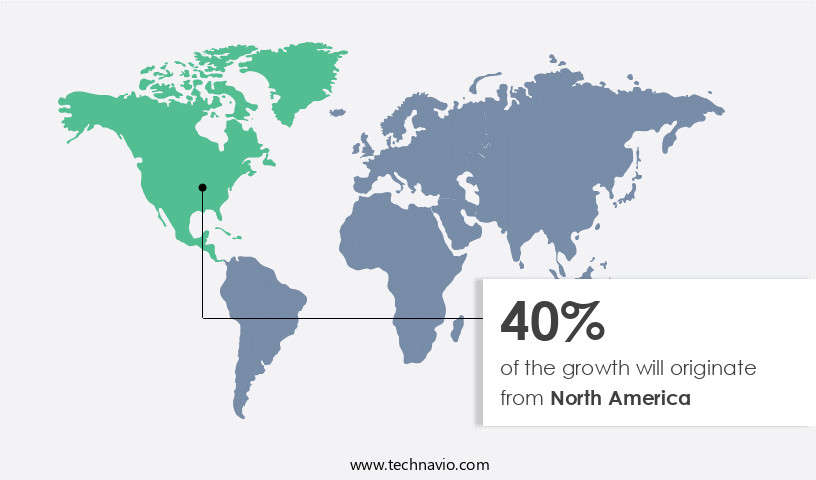

North America is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America, encompassing ceramic crowns, infection control, dental chairs, scaling & root planing, oral health education, artificial intelligence, dental software, bone grafting, intraoral cameras, dental lasers, restorative materials, dental lab equipment, biocompatible materials, CAD/CAM systems, practice management software, dental hygiene, dental aesthetics, pain management, dental units, dental implants, guided surgery, preventative dentistry, dental tourism, digital radiography, operatory equipment, oral surgery, dental anesthesia, cone beam CT, dental materials, dental technology, machine learning, electronic health records, local anesthetics, composite resins, periodontal treatment, imaging systems, 3D printing, x-ray equipment, and surgical microscopes, experiences significant growth in the US and Canada.

This expansion is fueled by increasing product approvals, a growing number of established companies, rising healthcare spending, and the increasing prevalence of dental diseases and related risk factors. The Centers for Disease Control and Prevention (CDC) reported that approximately 46% of US adults exhibit signs of gum disease, underscoring the need for advanced dental solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Dental Equipment Industry?

- The escalating incidence of dental diseases and associated risk factors serves as the primary catalyst for market growth in this sector.

- The market is driven by the rising prevalence of dental diseases, such as periodontal diseases, dental caries, and oral cancer. According to recent research, tooth decay affects an average of seven out of ten school children and nearly all adults worldwide. Oral cancer cases are also on the rise, with an estimated increase of approximately 54% in individuals worldwide during 2018-2040. The aging population is another significant factor contributing to the growth of this market, as dental diseases become more prevalent with age. To address these dental health concerns, the market for dental equipment is witnessing significant advancements in restorative materials, dental lab equipment, biocompatible materials, CAD/CAM systems, practice management software, dental hygiene, dental aesthetics, pain management, dental units, and dental implants.

- These technologies enable dental professionals to provide efficient, precise, and patient-friendly dental treatments. Dental equipment manufacturers are focusing on developing innovative solutions that cater to the evolving needs of dental practices. For instance, CAD/CAM systems offer digital impressions, reducing the need for traditional impression materials, and improving the overall patient experience. Similarly, pain management solutions are becoming increasingly important, with a focus on minimally invasive procedures and patient comfort. In conclusion, the increasing prevalence of dental diseases and the growing geriatric population are key factors driving the growth of the market. The market is witnessing significant advancements in various dental equipment categories, including restorative materials, dental lab equipment, biocompatible materials, CAD/CAM systems, practice management software, dental hygiene, dental aesthetics, pain management, dental units, and dental implants.

- These innovations are helping dental professionals provide efficient, precise, and patient-friendly dental treatments.

What are the market trends shaping the Dental Equipment Industry?

- The current market landscape is shaped by technological advances, which are increasingly becoming the norm and trending in various industries. As a professional and knowledgeable virtual assistant, I can help you navigate this dynamic business environment by staying informed about the latest technological innovations and their potential impact on your industry.

- The market is witnessing significant advancements, driven by investments in research and development to enhance the functionality and efficiency of existing products and introduce innovative solutions. For instance, new-generation intra-oral scanners, such as Planmeca Emerald, are smaller, lighter, and offer superior scanning speeds with enhanced accuracy. At the International Dental Show (IDS) 2023, Planmeca introduced the Imprex Scanning Cart, a mobile station designed to improve ergonomics and patient visualization during scans. Guided surgery, preventative dentistry, and oral surgery are key applications driving the demand for advanced dental equipment. Digital radiography, dental anesthesia, cone beam CT, and dental materials are some of the essential dental technologies undergoing continuous innovation.

- Dental technology, including digital radiography and intra-oral scanners, is increasingly being adopted for preventative dentistry, reducing the need for invasive procedures and improving patient comfort. Dental tourism is another factor fueling the growth of the market, as patients travel to countries with lower costs and advanced dental facilities. Companies are focusing on developing harmonious and immersive dental equipment to provide a more comfortable experience for patients. For example, dental anesthesia systems offer painless and precise anesthesia administration, while cone beam CT provides 3D imaging for more accurate diagnoses and treatment planning. In conclusion, the market is experiencing significant growth, driven by technological innovations, increasing demand for preventative dentistry, and the growing dental tourism industry.

- Companies are investing in research and development to introduce more advanced and efficient dental equipment, making treatments less invasive and more comfortable for patients.

What challenges does the Dental Equipment Industry face during its growth?

- The high cost of dental equipment poses a significant challenge to the growth of the dental industry. With advanced technology continually advancing and prices for equipment increasing, dental practices face substantial financial hurdles in staying competitive and providing top-tier care.

- The market in the US is influenced by several factors. The high cost of dental equipment is a significant barrier to adoption for dental professionals, particularly in light of declining dentist earnings and increasing clinic setup costs. Estimated at over USD250,000, starting a dental practice in the US is a substantial investment, with median overheads hovering around 75%. Advanced dental chairs, priced above USD7,000, and digital intra-oral scanners, ranging from USD15,000 to USD40,000, represent significant investments for dental practices. However, entry-level 3D printers, such as stereolithography (SLA) or digital light projector (DLP) models, priced below USD5,000, offer a more affordable alternative for producing molds using composite resins.

- The integration of advanced technologies like machine learning, electronic health records, and imaging systems in dental equipment is driving innovation in the market. Periodontal treatment, local anesthetics, and surgical microscopes are other essential dental equipment categories experiencing growth. The adoption of these technologies is expected to enhance the overall efficiency and quality of dental care.

Exclusive Customer Landscape

The dental equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dental equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, dental equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in providing a range of dental equipment solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- 3Shape AS

- A dec Inc.

- Align Technology Inc.

- Alpha Bio Tec. Ltd.

- BEGO GmbH and Co. KG

- BIOLASE Inc.

- Carestream Dental LLC

- DentalEZ Inc.

- Dentsply Sirona Inc.

- GC Corp.

- Institut Straumann AG

- J. Morita Corp.

- Midmark Corp.

- Nakanishi Inc.

- Planmeca Oy

- PreXion Inc.

- TAKARA BELMONT Corp.

- The Yoshida Dental Mfg. Co. Ltd.

- Ultradent Products Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Dental Equipment Market

- In March 2024, Dentsply Sirona, a leading dental solutions provider, introduced the next-generation digital impression system, the ScanBody CS3, offering improved accuracy and efficiency (Dentsply Sirona Press Release, 2024). This technological advancement is expected to significantly impact the market by enhancing the digitalization trend.

- In June 2024, 3M and Planmeca, two major dental industry players, announced a strategic partnership to integrate 3M's innovative dental materials with Planmeca's advanced imaging systems. This collaboration aims to deliver enhanced diagnostic and treatment solutions to dental professionals (3M Press Release, 2024).

- In January 2025, Danaher Corporation completed the acquisition of Envista Holdings Corporation, a leading dental solutions provider, for approximately USD2.9 billion. This acquisition strengthened Danaher's dental business and expanded its product offerings, making it a formidable competitor in the market (Danaher Corporation Press Release, 2025).

- In April 2025, the European Commission approved the use of 3D-printed dental implants, marking a significant regulatory milestone for the dental equipment industry. This approval is expected to accelerate the adoption of 3D-printed dental implants and drive market growth (European Commission Press Release, 2025).

Research Analyst Overview

- The market encompasses a range of technologies and tools essential for delivering optimal oral healthcare. Key trends include the integration of advanced technologies such as laser therapy for periodontal treatments and oral cancer screening, high-speed handpieces for enhanced precision during dental procedures, and digital imaging for improved diagnostics. Patient communication and dental practice management systems are also gaining prominence, ensuring informed consent and streamlining financial management. Zirconia crowns, dental sealants, and dental bridges continue to be popular restorative solutions, while root canal treatment remains a staple in endodontics. Dental pharmacology and dental microbiology play crucial roles in understanding the biological basis of oral diseases and developing effective treatments.

- Marketing & advertising and dental ethics are increasingly important considerations for dental practices. Hard tissue lasers and soft tissue lasers enable minimally invasive treatments, while antimicrobial agents and endodontic motors contribute to infection control and efficient root canal treatments. Partial dentures and full dentures remain viable options for tooth replacement, while dental bonding and oral pathology cater to cosmetic and diagnostic needs. Snoring appliances and dental sleep medicine address sleep disorders, expanding the scope of dental care. Impression materials and occlusal analysis ensure accurate diagnosis and treatment planning. CBCT analysis and bite registration tools facilitate precise diagnosis and treatment planning, enhancing overall patient care.

- Biocompatible ceramics and rotary instruments contribute to minimally invasive procedures and improved patient comfort. Dental ethics and financial management systems ensure the delivery of high-quality, affordable care.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Dental Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.7% |

|

Market growth 2025-2029 |

USD 13713.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.1 |

|

Key countries |

US, France, Canada, Japan, China, Germany, UK, Brazil, Italy, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dental Equipment Market Research and Growth Report?

- CAGR of the Dental Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dental equipment market growth of industry companies

We can help! Our analysts can customize this dental equipment market research report to meet your requirements.