Digital Evidence Management Market Size 2024-2028

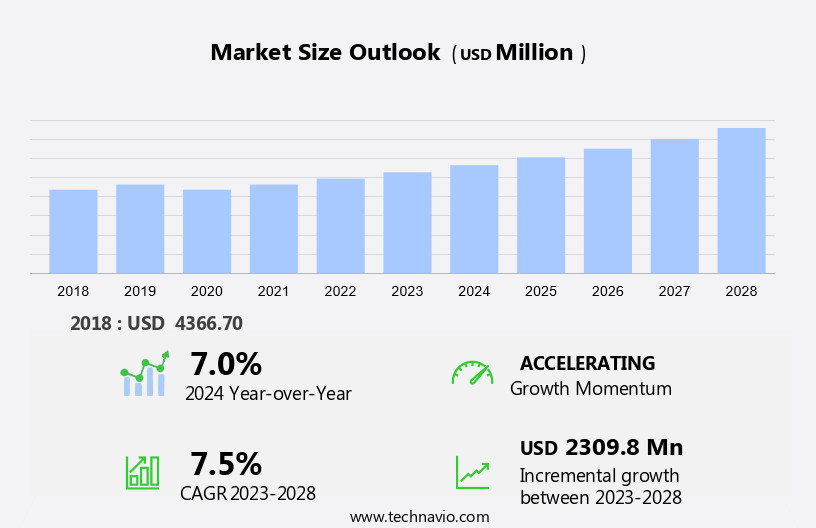

The digital evidence management market size is forecast to increase by USD 2.31 billion at a CAGR of 7.5% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. One of the primary drivers is the increasing demand for consolidated crime databases to enhance investigative efficiency. Additionally, the advent of mobile-based solutions is gaining traction, allowing law enforcement agencies to collect, store, and analyze evidence on-the-go. However, the high implementation and maintenance costs associated with these systems pose a challenge to smaller organizations and agencies.

- The integration of artificial intelligence (AI), machine learning (ML), deep learning, and blockchain technologies enhances evidence collection, analysis, and integrity. In the US and North America, these trends are shaping the landscape, with a focus on advanced technologies and integration with other law enforcement systems to streamline processes and improve overall effectiveness.

What will be the Size of the Digital Evidence Management Market During the Forecast Period?

- The market encompasses solutions and services that assist law enforcement agencies and legal officers in collecting, storing, managing, and presenting during criminal investigations and legal proceedings. With the proliferation of digital technologies, such as smartphones and internet connectivity, the volume continues to grow exponentially. This has led to challenges in managing backlogs, preventing misplacement, misuse, redundancy, data tampering, and ensuring the integrity and authenticity.

- Digital evidence management solutions address these challenges by streamlining data acquisition, data analysis, and data reporting. They provide procedural and legal guidelines to ensure the proper handling throughout the evidence lifecycle. These solutions enable forensic analysts to efficiently collect, store, and manage it, reducing the risk of misplacement or misuse. Additionally, they enable the secure presentation in legal proceedings, ensuring compliance with legal guidelines and maintaining the evidentiary chain of custody.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Software

- Services

- Hardware

- Geography

- North America

- Canada

- US

- APAC

- China

- Japan

- Europe

- UK

- South America

- Middle East and Africa

- North America

By Component Insights

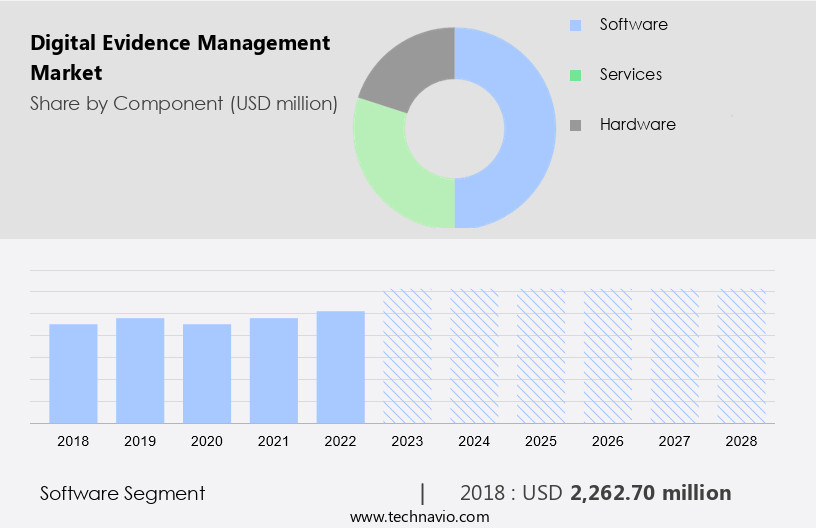

- The software segment is estimated to witness significant growth during the forecast period.

Digital evidence management software plays a crucial role in criminal investigations by facilitating the collection, storage, and analysis. This software enables law enforcement agencies to acquire, manage, and report, addressing issues of backlogs, misplacement, misuse, redundancy, data tampering, and manipulation. The software integrates with various digital investigation tools, including forensic analysis software, legal guidelines, and procedural guidelines, ensuring evidence integrity and authenticity.

AI, ML, and blockchain technologies are increasingly being adopted to enhance evidence analytics, visualization, and tracking. The software market is expected to grow due to the increasing use of digital technologies in law enforcement, the rise of cybersecurity threats, and the need for workflow streamlining and expert skills. The software supports various collection methods, including digital devices, cloud-based solutions, and IoT, and offers features such as evidence reporting, evidence tracking, and system integration.

Get a glance at the Digital Evidence Management Industry report of share of various segments Request Free Sample

The software segment was valued at USD 2.26 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

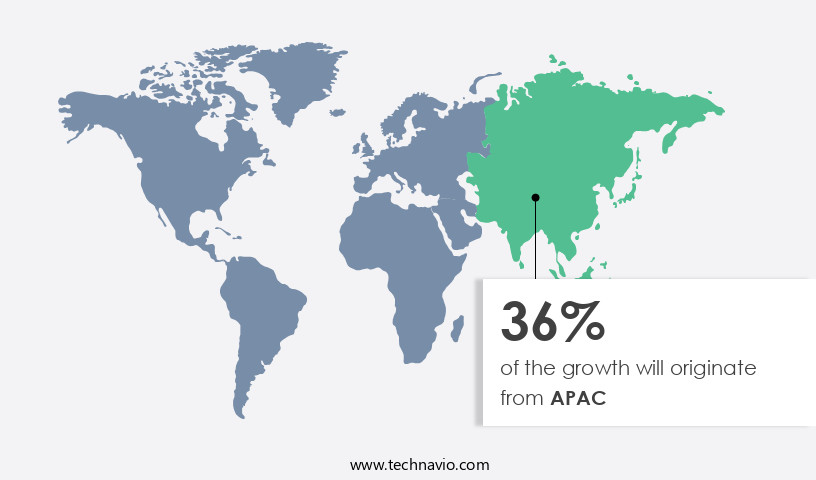

- APAC is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Digital evidence management plays a crucial role in criminal investigations, particularly in North America where the market holds a significant presence. Agencies such as the Department of Homeland Security (DHS) and Drug Enforcement Agency (DEA) have adopted management software for tasks including evidence description, storage, analysis, and reporting. The US and Canada lead in management penetration due to substantial investments in IT network infrastructure. Digital evidence encompasses various forms, including digital photographs, videos, audio recordings, and metadata from digital devices.

Criminal justice agencies, prosecutors, public defenders, and courtrooms rely on it for legal proceedings. Cybersecurity laws and surveillance cameras necessitate data integrity, authenticity, and secure data exchange. Evidence management involves collecting, storing, managing, and presenting it in a manner compliant with legal guidelines and procedural procedures. The solutions include cloud-based platforms, hardware, and software, catering to the needs of law enforcement agencies and cybersecurity solutions providers.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Digital Evidence Management Industry?

Increasing demand for consolidated crime database is the key driver of the market.

- Digital evidence management plays a crucial role in law enforcement agencies' efforts to maintain public safety by effectively managing and analyzing in criminal investigations. This involves data acquisition from various sources, such as digital devices, surveillance cameras, and cloud-based solutions, and ensuring its integrity through secure data storage and reporting. The use of management software streamlines workflows, enabling forensic analysts and legal officers to collect, store, and manage it in an efficient and secure manner. Integration of artificial intelligence (AI), machine learning (ML), deep learning, and blockchain technologies enhances the capabilities of management systems.

- These technologies facilitate data analysis, evidence visualization, and evidence analytics, enabling the identification of crime patterns and trends, and improving the accuracy and speed of investigations. Data exchange security, cross-border transfer, and data tampering and manipulation concerns are addressed through robust security protocols and legal guidelines. Procedural guidelines ensure the authenticity and integrity of digital evidence throughout the evidence lifecycle, from collection to presentation in legal proceedings. Training and education for forensic analysts and legal officers, system integration, and consulting services are essential components of digital evidence management solutions. These solutions enable law enforcement agencies to effectively respond to cyberattacks and other digital crimes, leveraging the power of digital technologies, including IoT, and the expertise of specialist skills and technical equipment.

What are the market trends shaping the Digital Evidence Management Industry?

Advent of mobile-based digital evidence management is the upcoming market trend.

- The market encompasses solutions for collecting, storing, managing, and reporting digital evidence for criminal investigations. Digital evidence, including data from digital devices such as smartphones, computers, and surveillance cameras, is crucial for investigations and legal proceedings. Data acquisition methods include forensic analysis, data exchange security, and cross-border transfer. Data reporting, analysis, and visualization are essential for evidence presentation in courtrooms. Backlogs, misplacement, misuse, redundancy, data tampering, and manipulation are common challenges in digital evidence management. Forensic analysts and legal officers require specialized skills and technical equipment to maintain data integrity and authenticity. AI, ML, and deep learning technologies are increasingly being used for evidence analytics.

- Cloud-based solutions offer scalability and flexibility for evidence storage and management. System integration with hardware, software, and IoT devices is necessary for comprehensive evidence collection. Training and education for law enforcement agencies and cybersecurity solutions are crucial for evidence security. Criminal justice agencies, prosecutors, public defenders, and courtrooms rely on digital evidence management systems to ensure compliance with legal guidelines and procedural guidelines. Cybersecurity law and internet connectivity are significant factors in digital evidence management. companies offer consulting, system integration, and digital investigation services to meet the evolving needs of the digital forensics industry.

What challenges does the Digital Evidence Management Industry face during its growth?

High implementation and maintenance cost is a key challenge affecting the industry growth.

- The market encompasses the collection, storage, management, and analysis of digital evidence for criminal investigations. Digital evidence includes data from various sources such as computers, smartphones, IoT devices, and surveillance cameras. The market dynamics include the increasing use of digital technologies in law enforcement agencies, the growing importance of data integrity and authenticity, and the need for workflow streamlining in evidence handling. However, the high cost of implementing digital evidence management solutions, which includes software licensing, system design and customization, training IT staff, maintenance, and upgrades, poses a significant challenge. Additionally, ensuring data security during exchange and cross-border transfer, preventing data tampering and manipulation, and adhering to legal guidelines and procedural procedures are critical considerations.

- The integration of artificial intelligence, machine learning, deep learning, and blockchain technologies is transforming the digital investigation landscape. Evidence analytics, visualization, and reporting are essential components of digital evidence management, benefiting criminal justice agencies, legal officers, prosecutors, public defenders, and courtrooms. Cybersecurity solutions and consulting services are also integral parts of the digital forensics industry.

Exclusive Customer Landscape

The digital evidence management market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the digital evidence management market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Capita Plc

- Cellebrite

- Digital Detective Group Ltd.

- Exterro Inc.

- FileOnQ Inc.

- Foray LLC

- Hitachi Vantara LLC

- International Business Machines Corp.

- Intrensic LLC

- Motorola Solutions Inc.

- NICE Ltd.

- Open Text Corp.

- Panasonic Holdings Corp.

- Porter Lee Corp.

- QueTel Corp.

- Safe Fleet Acquisition Corp.

- StorMagic

- Tracker Products LLC

- Vidizmo LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of solutions and services designed to assist criminal justice agencies, legal officers, and other stakeholders In the collection, storage, management, analysis, and reporting. This type of evidence, which can include data from digital devices, surveillance cameras, and other sources, plays a critical role in criminal investigations and legal proceedings. One of the primary challenges in the landscape is the vast volume of data that must be collected and processed. Backlogs, misplacement, misuse, redundancy, and other issues can hinder the efficiency and effectiveness of investigations. To address these challenges, various solutions have emerged, offering capabilities such as data acquisition, data analysis, data reporting, and evidence tracking. Forensic analysts and other experts play a crucial role in the management process, ensuring the integrity and authenticity of the data throughout the evidence lifecycle. Legal guidelines and procedural guidelines must also be strictly adhered to, making data security and data exchange security essential considerations.

Moreover, cross-border transfer can present additional complexities, as different jurisdictions may have varying legal and regulatory requirements. Artificial intelligence (AI), machine learning (ML), and deep learning technologies are increasingly being employed to streamline workflows, enhance evidence analytics, and improve evidence visualization. Blockchain technology is another emerging trend In the market, offering potential benefits in terms of data security, immutability, and transparency. Digital investigation methods continue to evolve, with system integration and consulting services playing an important role in helping organizations navigate the complex digital landscape. Training and education are also essential components of the ecosystem, as specialist skills and technical equipment are required to effectively collect, store, manage, and analyze it. Cloud-based platforms and AI-powered analytics are becoming increasingly popular solutions for managing and analyzing large volumes of data, while cybersecurity solutions are critical for maintaining data integrity and preventing data tampering and manipulation.

Thus, the market is driven by the growing reliance on digital technologies in various industries and the increasing prevalence of cyberattacks and other digital crimes. The Internet of Things (IoT) and smart devices are generating vast amounts of data, creating new opportunities and challenges for evidence management. Law enforcement agencies and other criminal justice organizations are under pressure to effectively collect, manage, and analyze this data to support investigations and ensure justice is served.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

138 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.5% |

|

Market growth 2024-2028 |

USD 2.31 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.0 |

|

Key countries |

US, China, Canada, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Digital Evidence Management Market Research and Growth Report?

- CAGR of the Digital Evidence Management industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the digital evidence management market growth of industry companies

We can help! Our analysts can customize this digital evidence management market research report to meet your requirements.