Digital Signature Market Size 2025-2029

The digital signature market size is forecast to increase by USD 39.58 billion at a CAGR of 42.1% between 2024 and 2029.

- The market is experiencing significant growth driven by technological advances in digital signatures and authentication methods. These innovations enable secure and convenient electronic document signing, making it an attractive alternative to traditional paper-based processes. Furthermore, the increasing number of applications for digital signatures in various industries, including finance, healthcare, and education, is fueling market expansion. However, the market's growth is not without challenges. The variation in digital signature rules and regulations across regions poses complexities for businesses looking to expand globally.

- Adhering to these regulations while ensuring seamless user experience is a key consideration for market participants. Companies seeking to capitalize on this market's opportunities must stay informed of the latest regulatory developments and invest in developing user-friendly digital signature solutions that meet the diverse needs of their customers. By doing so, they will be well-positioned to navigate the challenges and thrive in this dynamic market.

What will be the Size of the Digital Signature Market during the forecast period?

- In the evolving digital landscape, the market for digital signature solutions continues to gain traction among businesses seeking secure and efficient methods for document authentication. Hashing algorithms form the foundation of this technology, ensuring data integrity and non-repudiation. E-signature regulations, such as the Electronic Signatures in Global and National Commerce Act (ESIGN) and European Union's eIDAS Regulation, provide legal frameworks for the use of digital signatures. Digital signature security is paramount, with third-party validation, cloud-based signature validation, time stamping, and digital signature trust ensuring the authenticity and reliability of electronic documents. company compliance audits and digital signature APIs facilitate seamless integration with various systems.

- Advanced encryption standards, including AES, further bolster security. Biometric signature verification and smart card readers offer additional layers of security, ensuring only authorized individuals can sign documents. Hashing algorithms, e-signature regulations, digital signature security, and advanced encryption standards all contribute to the evolving market dynamics and trends in digital signature technology.

How is this Digital Signature Industry segmented?

The digital signature industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

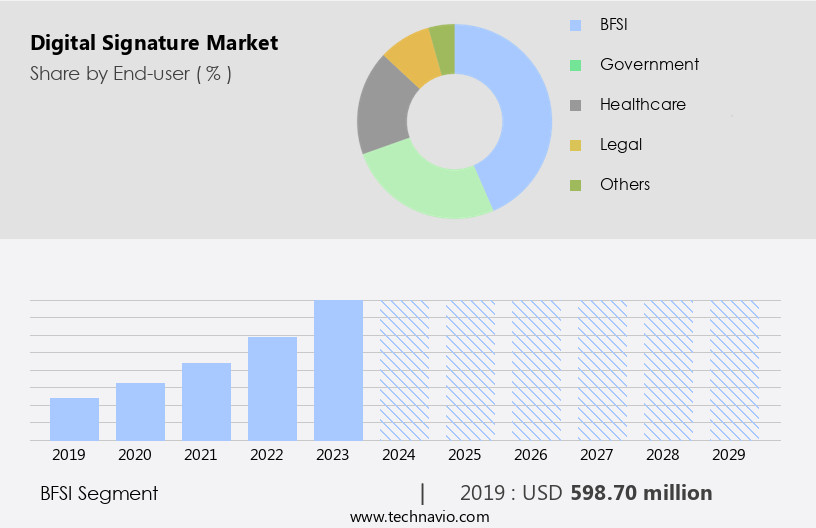

- End-user

- BFSI

- Government

- Healthcare

- Legal

- Others

- Component

- Software

- Hardware

- Service

- Type

- SES

- AES

- QES

- Deployment

- On-premises

- Cloud

- Hybrid

- Application

- Document Signing

- Authentication

- Compliance

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Middle East and Africa

- UAE

- Rest of World (ROW)

- North America

By End-user Insights

The bfsi segment is estimated to witness significant growth during the forecast period.

Government entities at the local, state, and federal levels, as well as internationally, are currently handling numerous contracts, correspondence, and reports that necessitate the signatures of various council members and external parties. The traditional process involves creating multiple hard copies, which must be signed in person, scanned, and then sent back via fax, email, or post. This lengthy, inefficient, and costly process negatively impacts business operations. To streamline these procedures, governments worldwide are investing in advanced technologies. Digital signature solutions, including encryption techniques, artificial intelligence, and public key infrastructure, are increasingly being adopted. These technologies enable secure communication, financial transactions, and identity management, among other applications.

Digital certificates, such as X.509 and digital signatures, provide legal compliance and third-party validation. E-commerce transactions, workflow automation, and electronic records management are just a few of the industry-specific solutions that digital signatures offer. Advanced electronic signatures, such as qualified electronic signatures and smart cards, ensure document security and user experience. Digital signature verification, digital signature API, and blockchain technology provide additional layers of security and compliance. Moreover, digital transformation is a critical priority for governments, and digital signature solutions are an essential component. The digital signature ecosystem, which includes digital signature providers, signature pads, and digital signature hardware, is continually evolving to meet the demands of various vertical markets.

The integration capabilities of these solutions enable seamless adoption, even in complex environments. Security audits and digital signature validation are essential to maintaining data privacy and ensuring the integrity of digital documents. Governments are increasingly turning to digital signature solutions to improve efficiency, reduce costs, and enhance security.

Get a glance at the market report of share of various segments Request Free Sample

The BFSI segment was valued at USD 598.70 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing significant growth due to the widespread adoption of cloud technology. Major players, including Adobe Inc., DocuSign, Inc., Oracle Corp., SIGNiX Inc., Entrust Corp., and OneSpan, offer cloud-based digital signature solutions in the region. These services enable organizations to access digital signature functionality through document workflow providers like Adobe, creating a comprehensive end-to-end solution. By eliminating the need for physical equipment, such as paper and printers, these cloud-based solutions reduce hardware costs and maintenance requirements. Advanced security features, such as encryption techniques, artificial intelligence, and public key infrastructure, ensure the integrity and confidentiality of digital signatures.

Biometric authentication and identity management systems add an extra layer of security, making digital signatures a reliable alternative to traditional wet signatures. Service level agreements and secure communication protocols further enhance the trustworthiness of these digital solutions. Financial services and industry-specific applications are major vertical markets for digital signatures. Advanced electronic signatures, contract management, time stamping, and smart cards are essential components of digital signature solutions. Digital signature verification, document security, and cloud-based signature solutions are also integral parts of the digital signature ecosystem. Legal compliance, third-party validation, and regulation and compliance are critical factors driving the adoption of digital signatures.

Digital signature providers offer solutions that meet various industry-specific standards and regulations, ensuring a secure and legally binding digital signature. Blockchain technology and digital signature validation further strengthen the security and trustworthiness of digital signatures. Digital transformation initiatives in various sectors, such as healthcare, education, and government, are also contributing to the growth of the market. Digital signature APIs and workflow automation tools facilitate seamless integration with existing systems, making digital signatures an attractive option for organizations looking to streamline their processes and improve efficiency.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Global Digital Signature Market 2025-2029 expands with B2B digital signature solutions and secure digital signature platforms. Digital signature market trends 2025-2029 highlight digital signatures with blockchain integration and e-signatures for legal compliance. Cost-effective digital signatures for SMEs and digital signatures for small businesses drive growth, per global digital signature market size and forecast. Scalable digital signature providers and cloud-based digital signature market insights support digital signature deployment for enterprises. Digital signatures for contract management and e-signature adoption in finance enhance security. AI-driven digital signature benefits, digital signatures for remote work, and digital signature market analysis address digital signature market challenges and solutions. Global digital signature market competitive landscape and future of digital signatures 2029 insights fuel digital signature market growth opportunities 2025.

What are the key market drivers leading to the rise in the adoption of Digital Signature Industry?

- Technological advances in digital signatures and authentication methods is the key driver of the market. The market is experiencing significant advancements driven by technological innovations in authentication methods. Two key areas of progress are biometric authentication and blockchain technology. Biometric authentication, which includes methods like fingerprint recognition, facial recognition, and iris scanning, is increasingly being adopted in digital signature solutions. These techniques offer enhanced security by verifying a user's unique biological traits, thereby reducing the risk of unauthorized access and fraud. Additionally, blockchain technology is being explored to bolster the security and immutability of digital signatures.

- By utilizing decentralized and tamper-proof distributed ledgers, blockchain-based digital signature solutions can deliver transparent and auditable records of signature transactions, ensuring the integrity and authenticity of documents. These technological developments are shaping the market, offering improved security and reliability for businesses and individuals alike.

What are the market trends shaping the Digital Signature Industry?

- Growing number of apps for digital signatures is the upcoming market trend. The market is experiencing significant growth due to the increasing preference for digital signature services through apps. These apps, accessible via desktops and mobile devices, offer convenience and mobility. Notable apps in this sector include Eversign, DocuSign, and Adobe Sign. The ease of use and accessibility of these apps are driving their adoption. Moreover, the shift towards cloud-based digital signatures and the implementation of ETSI TS 119 432 standards are expected to further boost the use of digital signatures on mobile devices.

- Another significant factor fueling the market's expansion is the integration of these apps into enterprise resource planning (ERP) and customer relationship management (CRM) software, streamlining business processes.

What challenges does the Digital Signature Industry face during its growth?

- Variation in digital signature rules and regulations across regions is a key challenge affecting the industry growth. Digital signature solutions play a crucial role in automating corporate processes, driving digital transformation, and enhancing business efficiency. Consumers expect these solutions to be user-friendly, secure, and compliant with all relevant regulations. In the context of commercial transactions, digital signatures provide an added layer of security and instill confidence in the business process. Digital signature technology is applicable to various types of documents, including those with financial information, designs, and details about goods and services. Small and medium-sized enterprises (SMEs) are increasingly adopting digital signature technologies to meet local demands and remain competitive.

- However, it is essential to note that different jurisdictions have varying laws regarding digital signatures as witnesses or evidence, and acceptance standards may differ among courts. Therefore, businesses must ensure that their digital signature solutions meet the highest security standards and comply with all relevant regulations to maintain trust and credibility.

Exclusive Customer Landscape

The digital signature market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the digital signature market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, digital signature market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

DocuSign Inc. - The company specializes in providing digital signature services, including Adobe Acrobat Sign sales and support. Our offerings streamline document workflows, ensuring secure and efficient signing processes for businesses worldwide. Adobe Acrobat Sign empowers users to send, sign, and manage documents electronically, enhancing productivity and reducing the need for physical signatures. This innovative solution aligns with our commitment to delivering advanced technology and exceptional customer experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- DocuSign Inc.

- Adobe Inc.

- OneSpan Inc.

- HelloSign

- SignNow

- PandaDoc Inc.

- SAP SE

- Atos SE

- Secunet Security Networks AG

- GlobalSign

- Zoho Corporation Pvt. Ltd.

- Kofax Inc.

- NTT Data Corporation

- Hitachi Solutions Ltd.

- Fujitsu Limited

- Tencent Holdings Ltd.

- Alibaba Cloud

- SigniFlow

- eMudhra Limited

- Ascertia Limited

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News

- In March, 2024, Signature Brands secured a Conventional Debt funding round for $75 million from Wingspire Capital, signifying continued investor confidence and capital infusion into companies with established digital signature product lines or those that leverage them heavily in their operations.

- In early 2025, advancements in Artificial Intelligence (AI) and blockchain technology continued to be integrated into digital signature solutions, aiming to enhance security, fraud detection, and workflow automation. This technological evolution allows for more robust authentication and tamper-proof records, moving beyond traditional PKI standards.

- In January, 2025, cloud-based digital signature solutions continued to gain significant traction, driven by the increasing demand for flexible, scalable, and remote access capabilities. These solutions offer reduced infrastructure expenses and seamless integration with other cloud applications, becoming a dominant deployment model.

- In March, 2025, government initiatives and regulatory mandates, such as the continued emphasis on e-governance and the legal recognition of Digital Signature Certificates (DSCs) in countries like India under the Information Technology Act of 2000, significantly propelled the adoption of digital signatures across various sectors. These regulations have made DSCs mandatory for numerous electronic filings and compliance submissions, particularly in corporate governance and financial sectors.

Research Analyst Overview

The market encompasses a range of technologies and solutions designed to ensure the authenticity and integrity of digital documents. These solutions employ various techniques such as encryption, artificial intelligence, and hashing algorithms to secure digital signatures and verify their validity. Mobile signatures have gained significant traction in recent years, enabling users to sign documents on-the-go using their smartphones or tablets. This trend is driven by the increasing adoption of remote work and the need for secure, convenient e-signature solutions. Digital signature management and digital certificates are essential components of public key infrastructure (PKI), which underpins secure communication and e-commerce transactions.

Advanced electronic signatures, such as qualified electronic signatures, provide enhanced security and legal compliance for industries like financial services and government agencies. Biometric authentication and identity management are increasingly integrated into digital signature solutions to provide an additional layer of security and convenience. Service level agreements and secure communication protocols ensure reliable and confidential document exchange between parties. Industry-specific digital signature solutions cater to the unique requirements of various sectors, including healthcare, education, and legal services. Advanced features like workflow automation, contract management, and time stamping streamline business processes and enhance operational efficiency. Cloud-based digital signature solutions offer flexibility and scalability, allowing businesses to easily integrate digital signature functionality into their existing systems.

Secure tokens and enterprise solutions provide advanced security features for large organizations. Regulation and compliance play a crucial role in the market, with various standards and regulations governing the use of digital signatures in different industries and applications. Digital signature providers offer third-party validation services to ensure compliance with these regulations and maintain data privacy. Blockchain technology is also making inroads into the market, offering enhanced security and immutability for digital signatures and transactions. Digital signature APIs and digital transformation initiatives are driving the adoption of digital signatures across various industries and applications. Digital signature ecosystem players collaborate to provide integrated solutions that cater to the evolving needs of businesses and organizations.

E-signature adoption continues to grow, driven by the need for secure, convenient, and efficient document exchange and management. Security audits and digital signature validation services ensure the security and reliability of digital signature solutions. Digital transformation initiatives and the increasing adoption of electronic records management systems are expected to further fuel the growth of the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

232 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 42.1% |

|

Market growth 2025-2029 |

USD 39582.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

40.4 |

|

Key countries |

US, China, Japan, Germany, France, Spain, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, Rest of World (ROW), and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Digital Signature Market Research and Growth Report?

- CAGR of the Digital Signature industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the digital signature market growth of industry companies

We can help! Our analysts can customize this digital signature market research report to meet your requirements.