Dimension Stone Market Size 2025-2029

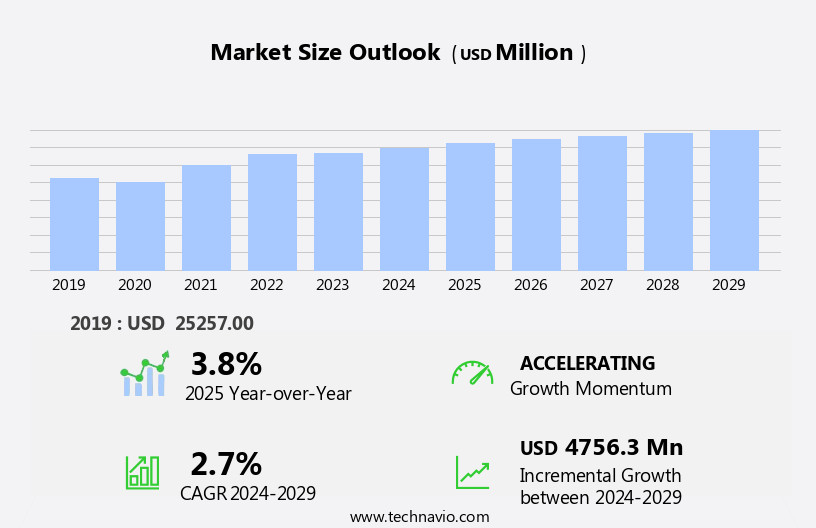

The dimension stone market size is forecast to increase by USD 4.76 billion, at a CAGR of 2.7% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the expanding construction sector. The industry's momentum is further fueled by advancements in stone-cutting and processing technologies, enabling increased efficiency and versatility in the production and application of dimension stone. Key applications of dimension stone include jewelry, furniture, flooring, residential roofing, and decorative laminate. However, the market faces a substantial challenge in the form of a shortage of skilled construction labor. This labor scarcity can potentially hinder the industry's growth trajectory and increase operational costs for companies. To capitalize on market opportunities and navigate this challenge effectively, businesses must focus on investing in automation and training programs to address the labor shortage and maintain competitiveness.

- Additionally, collaborating with educational institutions and industry organizations to promote the value and opportunities within the dimension stone sector could help attract a new generation of skilled workers. Overall, the market's dynamic landscape presents both opportunities and challenges, requiring strategic planning and innovative solutions from industry players.

What will be the Size of the Dimension Stone Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by dynamic market trends and applications across various sectors. Natural cleft finishes remain popular for their unique textures, while surface treatments offer enhanced durability and aesthetic appeal. Material selection is influenced by digital fabrication technologies, enabling precise cuts and customized designs. Retail channels, including e-commerce platforms, expand the reach of dimension stone, offering customers a wider range of options. Safety standards, such as ISO certifications, ensure the industry's commitment to ethical sourcing, environmental impact, and quality control. Water absorption and color consistency are crucial factors in exterior applications, including wall cladding and tile manufacturing.

In commercial projects, compressive and flexural strength, abrasion resistance, and stain resistance are essential considerations. Inventory management and supply chain optimization are essential for wholesale markets, where price points and design trends influence sales. Flamed finishes, honed finishes, and polished finishes cater to diverse customer preferences. The ongoing integration of technology, such as 3D scanning and CAD/CAM software, streamlines production and enhances efficiency. Waste management and reduction practices are increasingly important, as is the implementation of ANSI standards for installation techniques. Restoration methods preserve historical buildings and extend the life cycle of dimension stone. Sustainable sourcing and ethical practices are essential for maintaining the industry's reputation and long-term success.

How is this Dimension Stone Industry segmented?

The dimension stone industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Limestone

- Granite

- Sandstone

- Marble and slate

- Others

- Application

- Structural use

- Decorative use

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

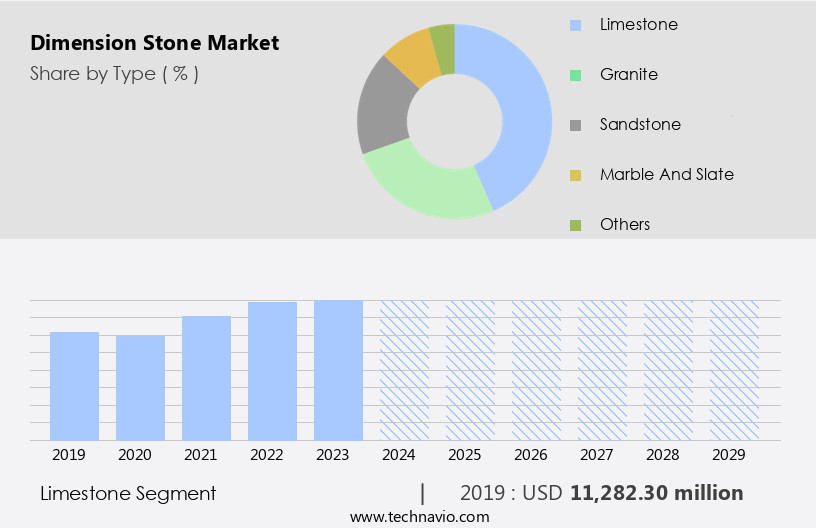

The limestone segment is estimated to witness significant growth during the forecast period.

In the dynamic market, limestone holds a significant position due to its versatile uses and natural appeal. Known for its durability and resistance to weather conditions, limestone is a preferred choice for various construction applications. Its applications span from building facades and flooring to paving and wall cladding. For instance, the iconic Great Pyramid of Giza, a testament to ancient engineering, is primarily constructed of limestone, highlighting its enduring quality. Material selection in the market is influenced by factors such as water absorption, color consistency, and texture variation. To cater to diverse customer preferences, manufacturers employ various surface treatments like polished, flamed, honed, and sandblasted finishes.

Digital fabrication technologies like 3D scanning and CAD/CAM software enable precise slab processing and seam optimization. Safety standards and ethical sourcing are essential considerations in the market. ISO certifications and ANSI standards ensure adherence to quality control and safety guidelines. The supply chain is streamlined through inventory management, wholesale markets, and distribution networks. E-commerce platforms and retail channels expand market reach, while waste reduction and environmental impact are crucial trends shaping the industry. Commercial projects and restoration methods drive demand for large dimension stone slabs, while residential projects favor cut-to-size tiles. The market's evolving landscape includes advancements in compressive and flexural strength, abrasion resistance, and stain resistance.

These properties enhance the functionality and longevity of dimension stone products. In the realm of design, color palettes and pattern matching play a vital role in creating harmonious and immersive spaces. Edge profiling and tile manufacturing techniques ensure seamless installation. Maintenance practices and import/export regulations also impact market dynamics. Overall, the market is a thriving industry that continues to innovate and adapt to the ever-changing construction landscape.

The Limestone segment was valued at USD 11.28 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing steady growth, driven by the construction industry's moderate expansion. China is a significant contributor to this growth, with an increasing number of skyscrapers being built. In 2023, 56 new skyscrapers were constructed, primarily due to China's rapid urbanization and substantial investments in infrastructure. The Belt and Road Initiative, also known as the One Belt, One Road program, is encouraging infrastructure development by linking China with Europe through central and Western Asia. Material selection, surface treatments, and finish types continue to influence design trends in the market. Natural cleft finishes, polished finishes, flamed finishes, and sandblasted finishes are popular choices for their unique textures and durability.

Digital fabrication technologies, such as 3D scanning and CAD/CAM software, enable precise slab processing and pattern matching. Tile manufacturing techniques, including cut-to-size tiles and wall cladding, cater to various applications. Safety standards and environmental impact are essential considerations in the market, with ISO certifications and ethical sourcing playing a crucial role. Inventory management and supply chain optimization are essential for wholesale markets and retail channels, ensuring seamless distribution networks and customer satisfaction. Installation techniques, such as quality control systems and seam optimization, ensure proper installation and longevity of dimension stone products. Exterior applications, including building facades and water absorption, require specific considerations.

Flexural strength, compressive strength, and abrasion resistance are essential properties for commercial projects, while customer preferences influence residential projects. E-commerce platforms and waste management practices are shaping the future of the market. Price points, color consistency, edge profiling, and color palettes are essential factors for both manufacturers and customers. ANSI standards and restoration methods are crucial for maintaining the longevity of existing dimension stone installations. Import/export regulations and maintenance practices are essential for global trade, ensuring ethical sourcing and sustainable practices.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses the production, distribution, and application of natural stones used for architectural, decorative, and landscaping purposes. These stones, sourced from quarries worldwide, include granite, marble, limestone, travertine, onyx, sandstone, slate, and quartzite. Producers employ advanced techniques like CNC machining, polishing, and finishing to create high-quality dimension stones. Architects, builders, and designers utilize these stones for their durability, aesthetic appeal, and versatility in various projects, such as cladding, flooring, countertops, and sculptures. The market caters to diverse industries, including construction, interior design, and landscaping, with applications ranging from residential to commercial and public sectors. Sustainability, customization, and technological innovation continue to shape the market's trends and growth.

What are the key market drivers leading to the rise in the adoption of Dimension Stone Industry?

- The construction sector's robust expansion serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to the increasing demand for commercial, industrial, and residential spaces. This trend is driven by the construction sector's rapid expansion, as evidenced by numerous notable projects initiated in 2024 and 2025. For instance, the Royal Academy of Arts in London unveiled a 3D truss made from cored, tensioned cylinders of limestone and steel joints at its Summer Exhibition in June 2024. This innovative architectural application highlights the versatility of dimension stone in modern design. Material selection, surface treatments, and digital fabrication are crucial factors influencing market growth.

- Natural cleft finishes remain popular due to their unique aesthetic appeal, while color consistency, edge profiling, pattern matching, and color palettes are essential for ensuring high-quality tile manufacturing. Safety standards and water absorption are also critical considerations for exterior applications. Retail channels continue to evolve, with online sales and direct-to-consumer models gaining traction. Installation techniques continue to advance, with a focus on sustainability and efficiency. Global trade plays a significant role in market dynamics, with imports and exports influencing pricing and availability. Overall, the market is poised for continued growth as it meets the increasing demand for durable, visually appealing, and sustainable building materials.

What are the market trends shaping the Dimension Stone Industry?

- Advances in stone-cutting and processing technologies are currently shaping market trends. The use of innovative techniques and technologies in the extraction, cutting, and finishing of natural stone is increasingly popular in the construction and design industries.

- The market has experienced significant advancements in stone-cutting and processing technologies, leading to enhanced efficiency, improved product quality, and increased diversity. One such innovation is the adoption of diamond wire saw technology. This technology, consisting of a thin diamond-embedded wire, enables precise cutting through even the hardest stones. It offers design flexibility, allowing for intricate shapes and curves. Moreover, diamond wire saws minimize stone waste during the cutting process, boosting productivity and cost-effectiveness. E-commerce platforms have also transformed the market, enabling businesses to expand their reach and cater to diverse customer preferences. Texture variation, from leather finishes to flamed and polished, is a key trend driving demand.

- Inventory management and supply chain optimization are crucial for wholesale markets, ensuring timely delivery and customer satisfaction. ISO certifications are essential for maintaining quality and sustainability standards. 3D scanning and design software have streamlined the process of creating custom dimension stone slabs for wall cladding and other applications. Price points cater to various market segments, ensuring affordability while maintaining the integrity of the stone's natural beauty. The market continues to evolve, with technology playing a pivotal role in shaping its future.

What challenges does the Dimension Stone Industry face during its growth?

- The construction industry faces significant growth impediments due to the scarcity of skilled labor, a critical challenge that necessitates urgent attention.

- The market faces a notable challenge due to the scarcity of skilled labor for installing stone products in commercial and residential projects. This issue affects both developed and emerging markets, including the US and APAC regions, such as China, India, and Southeast Asia. The current workforce lacks the necessary expertise in stone masonry, resulting in elevated installation and labor expenses for customers. To mitigate this challenge, the industry emphasizes ethical sourcing, waste reduction, and the implementation of ANSI standards for slab processing and raw material sourcing. Commercial and residential projects prioritize compressive strength, abrasion resistance, sandblasted finishes, stain resistance, and quality control.

- Adherence to these standards ensures the production of high-quality stone products and enhances customer satisfaction. Moreover, restoration methods using dimension stone have gained popularity due to their environmental impact and cost-effectiveness. As the demand for sustainable and durable building materials grows, the market is poised to continue its growth trajectory. By focusing on workforce development, adherence to industry standards, and sustainable practices, the market can address the labor shortage issue and cater to the increasing requirements of the construction sector.

Exclusive Customer Landscape

The dimension stone market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dimension stone market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, dimension stone market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3 Rivers Stone Ltd. - The company provides a diverse range of natural stones - granite, marble, limestone, sandstone - for various applications, enhancing architectural designs with timeless elegance and durability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3 Rivers Stone Ltd.

- Aditya Stonex

- Aro Granite Industries Ltd.

- Artgo Holdings Ltd.

- Asian Granito India Ltd.

- Avid Marbles and Granites Pvt. Ltd.

- Caesarstone Ltd

- FHL Kiriakidis Group

- Fox Marble

- Haique

- HMG Stones

- Levantina and Mineral Associates SA

- MGT STONE CO.

- Mohawk Industries Inc.

- Pokarna Ltd.

- Prem Marbles

- Regatta Granites India

- Rk Marbles India

- Shubh Marbles and Granite

- Sonnet Stone

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Dimension Stone Market

- In January 2024, leading dimension stone producer, Marble Corporation, announced the launch of its new product line, "Eco-Stone," a sustainable and recycled stone alternative, in response to growing consumer demand for eco-friendly construction materials (Marble Corporation Press Release).

- In March 2024, global the market leaders, Granite Industries, and Quarry Tech, joined forces to develop advanced automation solutions for quarries, aiming to increase operational efficiency and reduce costs (Granite Industries & Quarry Tech Press Release).

- In May 2024, the European Union passed the new Construction Products Regulation (CPR), mandating stricter safety, environmental, and energy performance standards for dimension stone products, effective from January 2025 (European Commission Press Release).

- In April 2025, Dimension Stone Inc. completed the acquisition of leading Middle Eastern dimension stone producer, Al-Khaleej Marble, expanding its global footprint and market share in the region (Dimension Stone Inc. Press Release).

Research Analyst Overview

- In the dynamic market, transparency in supply chains is a growing trend, with companies implementing traceability systems to ensure ethical sourcing and sustainable mining practices. Augmented and virtual reality technologies are revolutionizing the industry, enabling customers to visualize projects with onyx lighting and travertine mosaics in real-time. Color enhancement and sealing techniques are also popular, enhancing the natural beauty of quartzite backsplashes and soapstone sinks. Safety equipment and specialized tools, such as grinding wheels and diamond saws, are essential for stone fabrication. Training programs and sales automation help businesses improve efficiency and productivity. Sustainability is a key concern, with companies focusing on reducing energy consumption and carbon footprint through predictive modeling and warranty programs.

- Marketing strategies are evolving, with budget-friendly options and community engagement becoming important. Crack repair and stain removal are common issues addressed by stone cleaning products. High-end finishes, such as polishing pads and custom designs, cater to the luxury market. 3D printing and artificial intelligence are emerging technologies, offering innovative solutions for bespoke projects and custom designs. Slate roofing and basalt paving stones are popular choices for outdoor projects, while granite countertops remain a staple for interior applications. Global sourcing and safety standards continue to shape the market landscape.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Dimension Stone Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.7% |

|

Market growth 2025-2029 |

USD 4.76 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.8 |

|

Key countries |

US, China, Japan, India, Germany, South Korea, UK, Brazil, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dimension Stone Market Research and Growth Report?

- CAGR of the Dimension Stone industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dimension stone market growth of industry companies

We can help! Our analysts can customize this dimension stone market research report to meet your requirements.