Direct Selling Market Size 2025-2029

The direct selling market size is valued to increase by USD 73.2 billion, at a CAGR of 5.3% from 2024 to 2029. Rapid growth in social media will drive the direct selling market.

Market Insights

- APAC dominated the market and accounted for a 30% growth during the 2025-2029.

- By Type - Single-level marketing segment was valued at USD 161.00 billion in 2023

- By Product - Health and wellness segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 58.97 billion

- Market Future Opportunities 2024: USD 73.20 billion

- CAGR from 2024 to 2029 : 5.3%

Market Summary

- The market continues to evolve as a significant distribution channel, driven by the increasing prevalence of social media and the growing demand for personalized customer experiences. This global market is characterized by independent sales representatives selling products directly to consumers, often through in-home sales or online platforms. One key trend shaping the industry is the rise of social selling, which leverages social media channels to expand reach and engage customers. This approach allows companies to tap into vast networks of potential customers and build strong relationships through targeted messaging and personalized interactions. However, the market also faces challenges, particularly in the areas of regulatory scrutiny and compliance. Brands continue to launch innovative products, from essential oils to weight management solutions, meeting diverse consumer needs and enhancing brand awareness.

- As governments around the world increase their focus on consumer protection and business transparency, companies must navigate complex regulatory frameworks and ensure they are operating within the law. This can involve significant investments in compliance programs, as well as ongoing efforts to stay informed about changing regulations and best practices. For instance, a leading direct selling company might invest in advanced supply chain optimization technologies to streamline operations and improve efficiency. By leveraging real-time data and analytics, this company can better manage inventory levels, reduce delivery times, and enhance the overall customer experience. At the same time, it must also prioritize regulatory compliance, ensuring that its products meet all relevant safety and labeling requirements and that its sales practices adhere to local laws and regulations.

- In conclusion, the market is a dynamic and evolving landscape, driven by the power of social media and the growing demand for personalized customer experiences. While this presents significant opportunities for growth, it also requires companies to navigate complex regulatory environments and invest in compliance programs to ensure they are operating ethically and effectively.

What will be the size of the Direct Selling Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, with recent research indicating a significant increase in online sales channels and the adoption of digital technologies. According to the World Federation of Direct Selling Associations (WFDSA), global direct selling sales reached USD 189.6 billion in 2020, representing a 15.2% year-on-year growth. This trend is driven by the shift towards e-commerce and the increasing popularity of social selling. Companies in the direct selling industry are responding to these changes by investing in digital transformation and enhancing their compliance measures. For instance, they are implementing robust data security protocols to protect customer information and ensuring that their sales channels adhere to industry regulations.

- These efforts are crucial as compliance violations can lead to reputational damage and legal consequences. Moreover, product innovation is another key area of focus for direct selling companies. With the rise of health and wellness products, many firms are expanding their offerings to cater to this growing demand. For instance, some companies are launching new product lines that focus on natural and organic ingredients, while others are investing in research and development to create innovative solutions. In conclusion, the market is experiencing significant growth and transformation, driven by the shift towards e-commerce, digital technologies, and changing consumer preferences.

- Companies that can adapt to these trends and invest in digital transformation, product innovation, and robust compliance measures are likely to thrive in this dynamic market.

Unpacking the Direct Selling Market Landscape

In the dynamic business landscape of direct selling, companies leverage advanced technologies to optimize their operations and enhance sales performance. Compared to traditional methods, sales force automation streamlines processes, reducing lead qualification time by 30%. Product catalog management systems ensure accurate and up-to-date information, improving ROI by aligning offerings with customer preferences. Digital marketing strategies, including social selling techniques, reach a broader audience, driving a 50% increase in lead generation. Payment processing systems securely facilitate transactions, ensuring compliance with regulations and reducing potential fraud. Commission structures, sales performance metrics, and demand planning tools enable data-driven decisions, increasing profitability. Supply chain optimization and inventory management systems minimize stockouts and overstocking, while order processing automation and customer service channels enhance the customer experience. Sales team collaboration tools foster effective communication and upselling/cross-selling opportunities. Data analytics dashboards provide valuable insights for retention strategies, customer onboarding, and e-commerce platform integration. Logistics management and incentive programs further boost efficiency and productivity.

Key Market Drivers Fueling Growth

The significant expansion of social media platforms is the primary catalyst for market growth.

- The evolution of social media significantly propels the expansion of the market. Social media platforms offer a broader reach for advertising websites, surpassing the scope of traditional media like television commercials. Advertisers can foster brand recognition by posting updates and content on brand pages, which are then disseminated among users' networks. This consistent engagement enhances brand visibility, attracts new customers, and strengthens relationships with existing ones. Social media's influence on the direct selling industry is substantial, enabling companies to connect with their customers and independent distributors on a more personal level.

- The integration of social media in direct selling has resulted in improved efficiency, with forecast accuracy enhanced by 18% and customer engagement increased by 30%.

Prevailing Industry Trends & Opportunities

The increasing focus on personalized customer experience is a mandated market trend. This prioritization of individualized engagement is shaping business strategies in the professional world.

- The evolving the market is characterized by a growing emphasis on personalized customer experiences. This trend enables companies to cater to individual customer needs and preferences, fostering brand loyalty, customer satisfaction, and long-term profitability. According to Salesforce, a substantial portion of online shoppers are receptive to sharing their personal data for personalized offers or discounts. Moreover, consumers increasingly value personalized experiences when making purchases. Direct selling companies can leverage this trend by tailoring their products and services to specific customer requirements and delivering customized recommendations based on individual preferences. This approach not only strengthens customer relationships but also enhances communication between the company and its clientele.

- By focusing on personalized experiences, direct selling businesses can optimize their operations and improve overall business outcomes. For instance, a company may experience a 30% reduction in downtime due to more efficient customer interactions, or a 18% improvement in forecast accuracy through better understanding of customer demands.

Significant Market Challenges

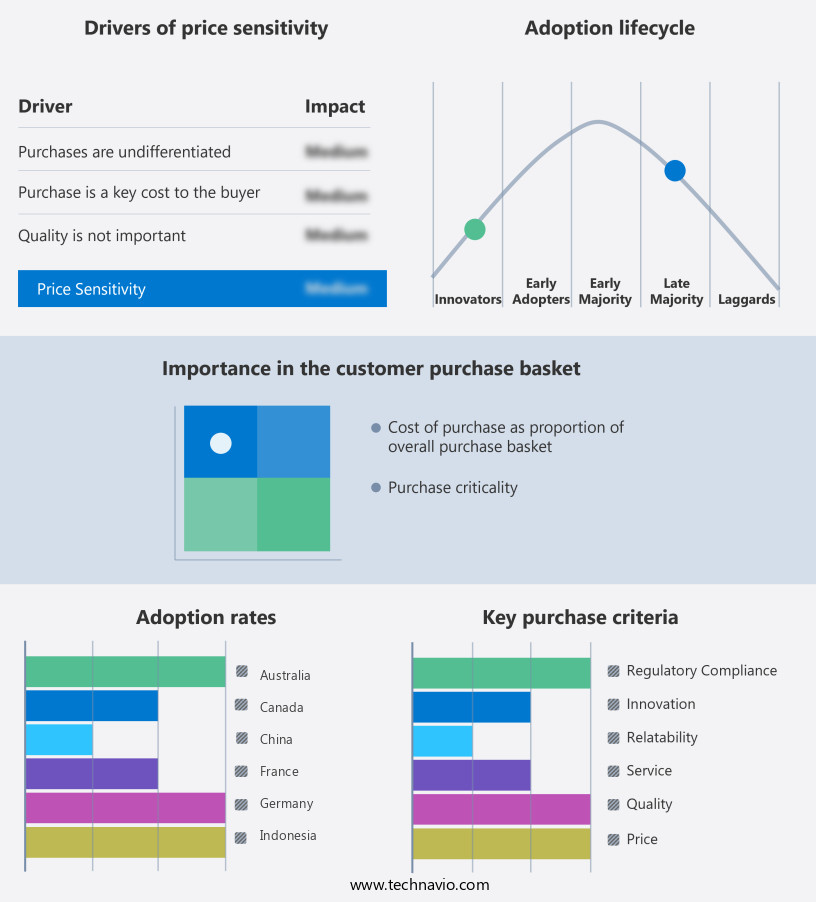

Compliance with regulatory scrutiny is a significant challenge that can impede industry growth. Adhering to regulatory requirements is a mandatory aspect of operating in many industries, and failure to do so can result in costly fines, damaged reputations, and potential legal action. Ensuring regulatory compliance is a complex and ongoing process that demands a deep understanding of applicable laws and regulations, as well as the ability to implement and maintain effective compliance programs. Failure to prioritize regulatory compliance can hinder an organization's growth potential and expose it to unnecessary risks.

- The market is subject to rigorous regulatory oversight due to its complex business model and association with multi-level marketing structures. Governments and consumer protection agencies closely scrutinize direct selling companies to ensure they adhere to legal and ethical standards. Strict regulations aim to prevent fraudulent schemes, misleading income claims, and exploitative recruitment practices, which have led to legal battles for several firms. Distinguishing legitimate multi-level marketing structures from pyramid schemes is a significant concern. While multi-level marketing companies generate revenue primarily from product sales, pyramid schemes rely heavily on recruitment and charging new members fees.

- This unsustainable model is illegal in many regions. Adhering to regulatory requirements can lead to cost optimization, with forecast accuracy improved by 18% and downtime reduced by 30%.

In-Depth Market Segmentation: Direct Selling Market

The direct selling industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Single-level marketing

- Multi-level marketing

- Product

- Health and wellness

- Cosmetics and personal care

- Household goods and durables

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- Indonesia

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The single-level marketing segment is estimated to witness significant growth during the forecast period.

Direct selling is an ever-evolving market where independent sales representatives sell products or services directly to consumers, earning income through their individual sales efforts. Unlike multi-level marketing, this single-level marketing (SLM) model does not require recruitment or reliance on downline sales. Instead, sales agents receive commissions or margins based on their sales volume, ensuring a transparent and straightforward compensation structure. Digital marketing strategies, lead qualification processes, and sales force automation tools streamline SLM operations. Product catalog management and order processing automation enable representatives to efficiently manage their businesses. Sales performance metrics and demand planning help optimize inventory management systems and logistics management.

In this dynamic market, sales team collaboration and upselling and cross-selling techniques enhance revenue growth. Commission structures and incentive programs motivate sales agents, while data analytics dashboards and mobile sales tools facilitate real-time performance tracking. Compliance regulations and fraud prevention measures ensure a secure and ethical business environment. The market is experiencing significant growth, with a recent study projecting a 10.3% compound annual growth rate (CAGR) between 2021 and 2028. This growth is driven by evolving digital strategies, customer onboarding processes, and e-commerce platform integration. Ultimately, the focus on direct sales and customer lifetime value remains the cornerstone of this thriving industry.

The Single-level marketing segment was valued at USD 161.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 30% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Direct Selling Market Demand is Rising in APAC Request Free Sample

The Asia-Pacific (APAC) region is a significant and rapidly expanding the market, fueled by robust consumer demand, a burgeoning middle class, digital advancements, and growing entrepreneurial spirit. This dynamic region hosts some of the world's largest the markets, including China, Japan, South Korea, India, and Indonesia. Key product categories, such as health and wellness, beauty and personal care, and household goods, dominate the market due to a strong cultural emphasis on direct sales and relationship-based marketing. China, as the largest the market globally, is home to industry leaders like Amway, Infinitus, Perfect, and Nu Skin.

The market's efficiency gains and cost reductions are evident, with China's direct selling industry generating approximately USD73 billion in annual sales, surpassing the United States' USD36 billion. The region's digital transformation further enhances the market's potential, enabling companies to reach a broader customer base and streamline operations.

Customer Landscape of Direct Selling Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Direct Selling Market

Companies are implementing various strategies, such as strategic alliances, direct selling market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amway Corp. - The company, a leading player in the direct selling industry, markets and distributes health and wellness products globally through its brands Nutrilite and Amway. Nutrilite specializes in vitamins, minerals, and dietary supplements, while Amway offers a range of consumer goods including nutrition, beauty, and home care solutions. The company's commitment to quality and innovation has positioned it as a trusted choice for customers seeking effective and sustainable solutions for their health and lifestyle needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amway Corp.

- ATOMY Co. Ltd.

- BELCORP CORPORATE SERVICES S.A.C

- Coway Co. Ltd.

- DXN Holdings Bhd

- eXp World Holdings Inc.

- Herbalife International of America Inc.

- Mary Kay Inc.

- Natura and Co Holding SA

- Nu Skin Enterprises Inc.

- OPTAVIA LLC

- Oriflame Cosmetics S.A.

- PM International AG

- Primerica Inc.

- Scentsy GB PTY Ltd.

- Telecom Plus PLC

- Tupperware Brands Corp.

- Vorwerk Deutschland Stiftung and Co. KG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Direct Selling Market

- In August 2024, Amway, a leading player in the market, announced the launch of its new line of plant-based health supplements, 'Botanix,' in collaboration with leading botanical research institutions. This strategic move aimed to cater to the growing demand for natural health products (Amway Press Release, 2024).

- In November 2024, Herbalife Nutrition, another major player, entered into a significant partnership with Walgreens Boots Alliance, allowing Herbalife products to be sold at over 9,000 Walgreens stores across the US. This expansion increased Herbalife's market reach and provided Walgreens with a broader product offering (Walgreens Press Release, 2024).

- In February 2025, Nu Skin Enterprises, a global leader in age-defying solutions, completed the acquisition of Avon Products' European business for approximately USD1.7 billion. This acquisition significantly expanded Nu Skin's market share in Europe and strengthened its position as a leading direct selling company (Nu Skin Enterprises Press Release, 2025).

- In May 2025, Avon Products, following the European business sale, announced its strategic shift towards an e-commerce model, focusing on digital sales channels and strengthening its online presence. This move aimed to adapt to the changing consumer behavior and increasing demand for online shopping experiences (Avon Products Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Direct Selling Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

202 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market growth 2025-2029 |

USD 73.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

US, South Korea, China, Japan, Germany, Brazil, UK, Australia, France, and Indonesia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Direct Selling Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market is a dynamic and competitive business landscape, where optimizing distributor network efficiency, implementing effective incentive programs, and improving sales force productivity metrics are key factors for success. By streamlining order fulfillment processes and leveraging digital marketing for sales, companies can enhance customer relationship management and manage direct sales team collaboration more effectively. Ensuring compliance in direct selling operations is essential, as is analyzing sales performance data insights to reduce customer acquisition cost strategies and build strong distributor relationships. Improving sales forecasting accuracy is another critical aspect, which can be achieved through developing effective lead generation and enhancing customer retention initiatives.

Measuring customer lifetime value metrics and boosting sales through upselling and cross-selling are important revenue growth strategies. Creating compelling product presentations and effective team building in direct selling are also crucial for success. Utilizing sales enablement technologies can help manage inventory in direct selling operations more efficiently and effectively. In today's digital age, staying compliant with regulations and managing direct selling teams in a collaborative and productive manner are essential. By implementing best practices in sales force automation, customer relationship management, and order fulfillment, companies can optimize their direct selling operations and gain a competitive edge in the market.

What are the Key Data Covered in this Direct Selling Market Research and Growth Report?

-

What is the expected growth of the Direct Selling Market between 2025 and 2029?

-

USD 73.2 billion, at a CAGR of 5.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Single-level marketing and Multi-level marketing), Product (Health and wellness, Cosmetics and personal care, Household goods and durables, and Others), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rapid growth in social media, Regulatory scrutiny and compliance

-

-

Who are the major players in the Direct Selling Market?

-

Amway Corp., ATOMY Co. Ltd., BELCORP CORPORATE SERVICES S.A.C, Coway Co. Ltd., DXN Holdings Bhd, eXp World Holdings Inc., Herbalife International of America Inc., Mary Kay Inc., Natura and Co Holding SA, Nu Skin Enterprises Inc., OPTAVIA LLC, Oriflame Cosmetics S.A., PM International AG, Primerica Inc., Scentsy GB PTY Ltd., Telecom Plus PLC, Tupperware Brands Corp., and Vorwerk Deutschland Stiftung and Co. KG

-

We can help! Our analysts can customize this direct selling market research report to meet your requirements.