Weight Management Market Size 2025-2029

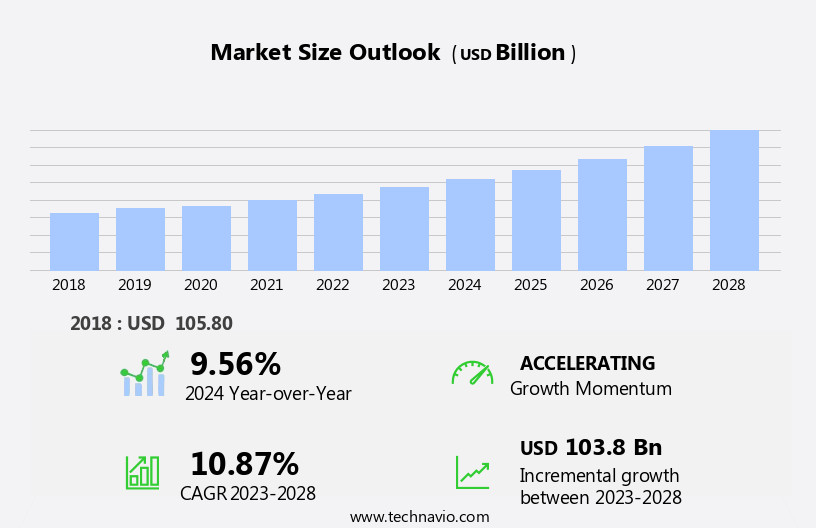

The weight management market size is forecast to increase by USD 114.79 billion at a CAGR of 10.9% between 2024 and 2029.

- The market is driven by the growing obese population and rising demand for weight management services from developing economies. The increasing prevalence of obesity and related health issues globally presents a significant opportunity for market participants. However, marketing challenges associated with weight management products and services pose a significant hurdle. The stigma surrounding obesity and the perception that weight loss is a personal responsibility rather than a health issue create barriers to market penetration. Health insurance plays a pivotal role in covering costs, while fitness apps and mobile health apps enhance accessibility and tracking.

- Companies seeking to capitalize on market opportunities must address these challenges through innovative marketing strategies, affordable pricing, and education initiatives to shift societal perceptions and increase accessibility to weight management services. By focusing on these areas, market participants can effectively navigate challenges and capitalize on the growing demand for weight management solutions. Innovative weight management solutions include waistline control, fitness equipment, surgical equipment, healthy dietary choices, and lifestyle changes.

What will be the Size of the Weight Management Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market for weight management solutions continues to evolve, reflecting the complex and multifaceted nature of weight management and its applications across various sectors. Sleeve gastrectomy and adjustable gastric banding are among the surgical interventions, while anti-obesity medications and pharmacological interventions offer alternative approaches. The prevalence of metabolic syndrome and its associated health risks, including cardiovascular disease and type 2 diabetes, underscores the urgency for sustainable weight loss solutions. Mindful eating, nutrition education, and meal planning are essential components of health behavior modification, while physical fitness and regular exercise routines contribute to weight regain prevention. Fitness and recreational sports centers are offering a wide range of HIIT classes, and HIIT fitness videos are flooding the market.

Hormonal imbalance and stress management are also crucial factors in weight management. The industry is expected to grow by 5.3% annually, driven by the increasing prevalence of obesity and related health issues. For instance, a study showed that patients who underwent bariatric surgery experienced an average weight loss of 30% within the first year. Social media and the young population's hectic lifestyles have led to increased fast food consumption and weight-related health issues, necessitating preventive measures and weight management programs. Additionally, the complexity and cost of weight management solutions can deter potential customers, particularly in developing economies with limited resources.

How is this Weight Management Industry segmented?

The weight management industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Diet

- Equipment

- Services

- Distribution Channel

- Offline

- Online

- End-user

- Fitness centers and health clubs

- Commercial weight loss centers

- Online weight loss programs

- Slimming centers

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

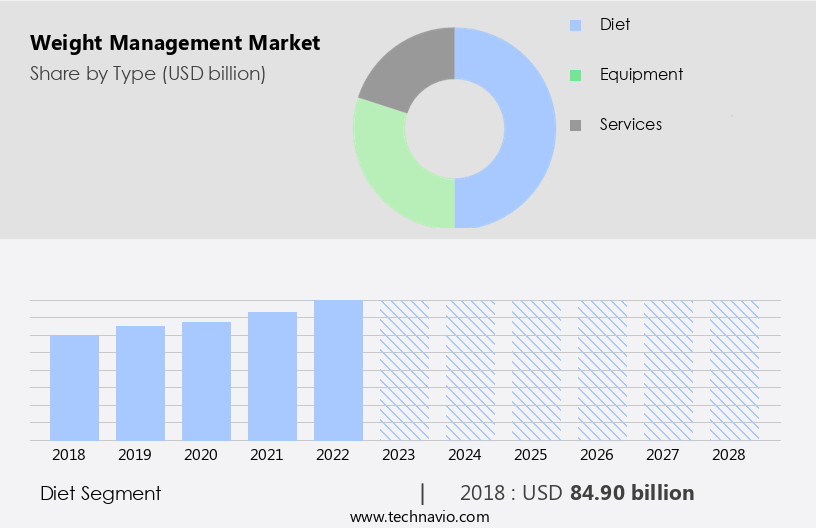

The Diet segment is estimated to witness significant growth during the forecast period. The market is driven by the growing concern over health issues related to visceral fat, weight fluctuation, and obesity. Obesity, characterized by a body mass index (BMI) of 30 or higher, affects over one-third of the global population. This condition can lead to various health complications, including high blood pressure, joint problems, diabetes, and insulin sensitivity issues. To combat these health concerns, weight loss programs focusing on calorie expenditure through diet and physical activity have gained popularity. Diets, specifically, dominate the market, as they offer a more sustainable approach to weight management. Nutritional counseling and micronutrient intake are essential components of effective weight loss programs, ensuring a balanced macronutrient and micronutrient intake. Obesity rates continue to rise, fueling the demand for functional beverages, functional food, and dietary supplements, digestive health supplements, and weight loss supplements.

Exercise prescription, including aerobic and resistance training, plays a crucial role in managing weight and improving metabolic rate. Metabolic rate, influenced by factors like basal metabolic rate, resting metabolic rate, and energy balance, is a significant consideration in weight management. Adipocyte function, glucose tolerance, and lipid profile also impact weight management strategies. Behavior modification and appetite regulation techniques are essential to maintaining long-term weight loss. Weight management strategies encompass lifestyle interventions, such as increasing physical activity levels and implementing healthy eating habits. Body composition, measured by body mass index, waist circumference, and fat mass percentage, is a critical indicator of overall health and weight management success. Incorporating resistance training and maintaining energy balance are essential for effective weight management. Functional food and beverages, as well as dietary supplements, offer convenient alternatives for individuals looking to incorporate healthy choices into their daily routines.

The Diet segment was valued at USD 91.36 billion in 2019 and showed a gradual increase during the forecast period.

The Weight Management market is expanding rapidly due to increasing awareness of obesity-related health concerns. Key interventions include weight loss surgery options such as gastric bypass, which offer effective results for severe cases. Lifestyle approaches like portion control, sleep hygiene, and exercise adherence play a crucial role in achieving and maintaining long-term weight control. Rising prevalence of health risks associated with obesity has also led to a rise in demand for anti-obesity medication. Establishing a regular exercise routine remains a foundational strategy for sustainable weight loss and overall wellness. Weight management programs and innovative weight-management products, such as functional beverages, functional food, and dietary supplements, offer prevention and consultation services.

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In The market, North America emerged as the leading region in 2024, driven by a growing consumer focus on healthier lifestyles and heightened concerns over obesity-related issues. The United States, with its large population and affluence, dominates this market. Canada, while expanding, lags behind due to its smaller population. Obesity prevalence and heightened awareness of the health risks associated with being overweight fuel the demand for weight management solutions. Metabolic rate, adipocyte function, calorie expenditure, and energy intake are crucial factors influencing weight management strategies. These strategies encompass nutritional counseling, insulin sensitivity, macronutrient balance, and behavior modification.

Lean body mass, glucose tolerance, blood pressure, waist circumference, lipid profile, and appetite regulation are essential health indicators. Physical activity levels, including aerobic exercise and resistance training, are integral to energy balance. Lifestyle interventions, such as exercise prescription and dietary modifications, are effective weight management tools. The market's evolution reflects a shift towards holistic, personalized approaches to weight loss programs, emphasizing long-term sustainability. The weight management devices market encompasses a range of solutions designed to assist individuals in managing weight-related conditions, including multivitamin and mineral supplements protein supplements and fitness equipment.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Weight Management market drivers leading to the rise in the adoption of Industry?

- The expanding population with increasing obesity rates serves as the primary market driver. The market experiences significant growth due to the increasing prevalence of obesity and related health concerns. Obesity, a major public health issue, is linked to chronic diseases such as diabetes, hypertension, and cancer. The ineffectiveness of current obesity drugs contributes to the high incidence and prevalence of obesity. In the last two decades, the US has seen the highest obesity rates. Lifestyle and dietary changes, driven by busy schedules and sedentary habits, have contributed to the rise of obesity, cardiovascular diseases, and diabetes.

- According to recent studies, the obesity market is projected to grow by over 10% within the next five years. For instance, a study published in the Journal of the American Medical Association revealed a 30% increase in obesity rates among children between 2003 and 2016. This underscores the urgent need for effective weight management solutions.

What are the Weight Management market trends shaping the Industry?

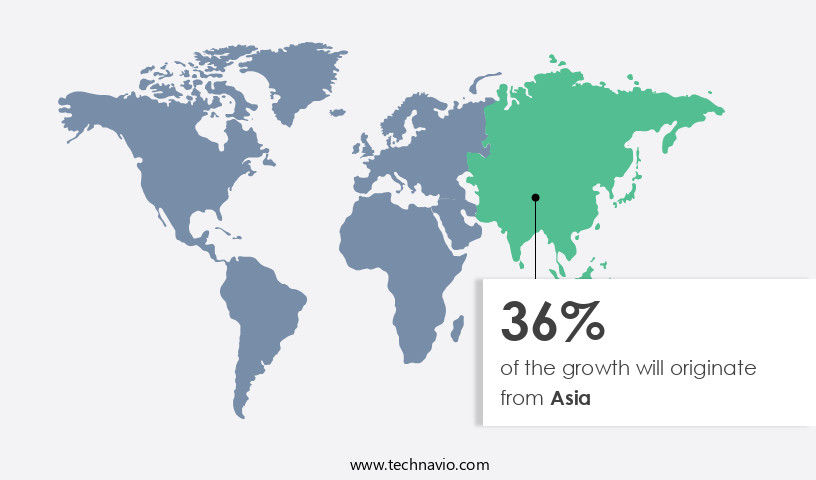

- The increasing demand for weight management services is a notable trend in developing economies. This market sector is poised for significant growth in the near future. In developing countries, particularly in Asia Pacific, the rise in per capita incomes has led to an increase in disposable income. For instance, India's Gross National Income (GNI) Atlas method (current USUSD value) rose from USD2,380 in 2022 to USD2,540 in 2023. This economic improvement, coupled with growing health consciousness, fuels consumer spending on various weight management products and services.

- According to a recent market analysis firm attribution, the weight management industry is expected to grow by 15% in the next five years. The preference for branded, high-quality, and safe options is on the rise as consumers prioritize their well-being. The emergence of a significant middle-class population in developing economies, influenced by pop culture and social media, is anticipated to significantly boost sales in this market during the forecast period.

How does Weight Management market faces challenges during its growth?

- Promoting products and services effectively remains a major challenge in the weight management industry, limiting brand visibility, consumer trust, and overall market penetration despite growing demand. The market faces significant challenges due to stringent regulatory guidelines. Companies must ensure their products adhere to global standards to maintain customer trust and industry credibility. One notable example is the controversy surrounding natural and synthetic Curcumin in the dietary supplement industry. Synthetic Curcumin, while offering faster results, has raised concerns over consumer health and safety.

- Despite these challenges, the market is expected to grow robustly, with industry analysts projecting a 10% annual expansion over the next decade. This growth is driven by increasing obesity rates, rising health consciousness, and advancements in technology and product innovation. The Food and Drug Administration (FDA) advises consumers to be cautious of weight management products that promise quick weight loss or use misleading language, such as "guaranteed" or "scientific breakthrough." Additionally, the FDA encourages vigilance against products marketed through mass emails or in foreign languages.

Exclusive Customer Landscape

The weight management market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the weight management market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, weight management market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amway Corp. - The company specializes in weight management solutions, providing a range of products including Bodykey Nutritious Delicious Shake Mix, Bodykey WOW Bundle Vanilla, Liver Health Support, and NutriCare Basket.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amway Corp.

- Astellas Pharma Inc.

- Eli Lilly and Co.

- Estrellas Life Sciences Pvt. Ltd.

- Fermentis Life Sciences Pvt. Ltd.

- Forever Living Products International LLC

- Glanbia plc

- GNC India

- Herbalife International of America Inc.

- Kellogg Co.

- Nature Sure

- Natures Sunshine Products Inc.

- Nestle SA

- Novo Nordisk AS

- Nu Skin Enterprises Inc.

- Nutricore Biosciences Pvt. Ltd.

- PharmaCare Laboratories Pty Ltd

- RITS Lifesciences Pvt Ltd.

- Shanghai Pharmaceutical Group Co. Ltd.

- Sunova Products

- True Protein Pty Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Weight Management Market

- In January 2024, Novo Nordisk, a leading pharmaceutical company, announced the launch of Wegovy, a new once-weekly injectable prescription medicine for weight management, following FDA approval. Wegovy is a GLP-1 receptor agonist, which helps adults with obesity or overweight and at least one weight-related condition manage their weight (Novo Nordisk Press Release, 2024).

- In March 2024, WW International (formerly Weight Watchers), a popular weight loss company, entered into a strategic partnership with Walgreens Boots Alliance, the retail pharmacy giant. This collaboration aimed to provide WW's digital weight loss program to Walgreens customers, making it more accessible and convenient (WW International Press Release, 2024).

- In May 2024, Virta Health, a digital therapeutics company, raised USD295 million in a Series E funding round. This investment will support the expansion of its virtual diabetes and obesity care programs, targeting a larger market and enhancing its technology platform (Business Wire, 2024).

- In February 2025, the European Commission approved the marketing authorization for Semaglutide 2.4 mg for subcutaneous injection, a new weight management treatment from Novo Nordisk. This approval follows the FDA's approval of the same drug in the US (Novo Nordisk Press Release, 2025).

Research Analyst Overview

The market continues to evolve, driven by the persistent concern for maintaining a healthy body weight and improving overall well-being. Factors such as visceral fat accumulation, weight fluctuation, calorie expenditure, and energy intake play significant roles in this dynamic market. For instance, a study revealed that increasing physical activity levels by 100 minutes per week can lead to a 3.5% reduction in obesity prevalence, highlighting the importance of exercise prescription in weight management strategies. Metabolic rate, adipocyte function, body mass index, and resting metabolic rate are crucial aspects of weight management. Set point theory suggests that our bodies have a natural weight range, and maintaining energy balance is essential for weight stability.

Weight loss programs often incorporate nutritional counseling, micronutrient intake, and macronutrient balance to help individuals manage their weight effectively. Industry growth in the market is expected to reach double-digit percentages, reflecting the continuous demand for innovative solutions. Weight loss interventions, such as lifestyle modifications, glucose tolerance improvement, insulin sensitivity enhancement, and blood pressure management, are becoming increasingly popular. An example of a successful weight management intervention is a program that combines resistance training, aerobic exercise, and behavior modification. This holistic approach led to a 5% decrease in body fat percentage, a 3% increase in lean body mass, and a 10% improvement in insulin sensitivity for participants.

Weight management strategies encompass various aspects, including appetite regulation, lipid profile management, and basal metabolic rate optimization. By focusing on these factors and understanding the complex interplay between them, individuals can make informed decisions about their weight management journey.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Weight Management Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.9% |

|

Market growth 2025-2029 |

USD 114.79 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.0 |

|

Key countries |

US, China, India, Germany, Japan, UK, Canada, France, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Weight Management Market Research and Growth Report?

- CAGR of the Weight Management industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Asia, Europe, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the weight management market growth of industry companies

We can help! Our analysts can customize this weight management market research report to meet your requirements.