Driver Drill Market Size 2025-2029

The driver drill market size is forecast to increase by USD 1.54 billion at a CAGR of 7.4% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing penetration of e-commerce channels. This trend is transforming the way consumers purchase drills, leading to increased market accessibility and convenience. Additionally, product development continues to be a key driver, with manufacturers investing in innovative technologies and features to differentiate their offerings. However, the market also faces challenges, most notably the prevalence of counterfeit products. These imitations not only undermine brand reputation but also pose safety risks to consumers. Companies must prioritize strategies to mitigate counterfeit sales, such as implementing robust authentication systems and collaborating with e-commerce platforms to remove fraudulent listings.

- By staying abreast of these market dynamics and addressing challenges effectively, businesses can capitalize on the growing demand for driver drills and maintain a competitive edge.

What will be the Size of the Driver Drill Market during the forecast period?

- The market continues to evolve, driven by advancements in technology and expanding applications across various sectors. Motor power and torque settings are critical specifications for these versatile Power Tools, with brushless motors and lithium-ion batteries offering increased efficiency and performance. Ergonomic designs cater to DIY enthusiasts and professionals alike, while safety features such as drill chucks and clutch settings ensure precise driving and prevent accidents. Torque adjustment and driving depth are essential considerations for drilling applications, with impact wrenches and rotary hammers excelling in heavy-duty tasks. Precision driving is a priority for automotive repair and home improvement projects, necessitating variable speed control and depth adjustment.

- Driver drill brands compete on features such as driving accuracy, battery life, and charging time, with cordless driver drills and magnetic drills leading the charge. Warranty offerings and impact technology further differentiate products in the market. Drill bit size and chuck capacity are crucial factors for concrete drilling and other demanding applications, while drilling tips and accessories expand the tool's capabilities. Troubleshooting and maintenance are ongoing concerns, with precision driving techniques and drilling practices playing a significant role in optimizing tool performance. The power tools industry continues to innovate, with new driver drill models and features emerging regularly.

- Brands strive to meet the evolving needs of their customers, ensuring that these essential tools remain indispensable in various industries and applications.

How is this Driver Drill Industry segmented?

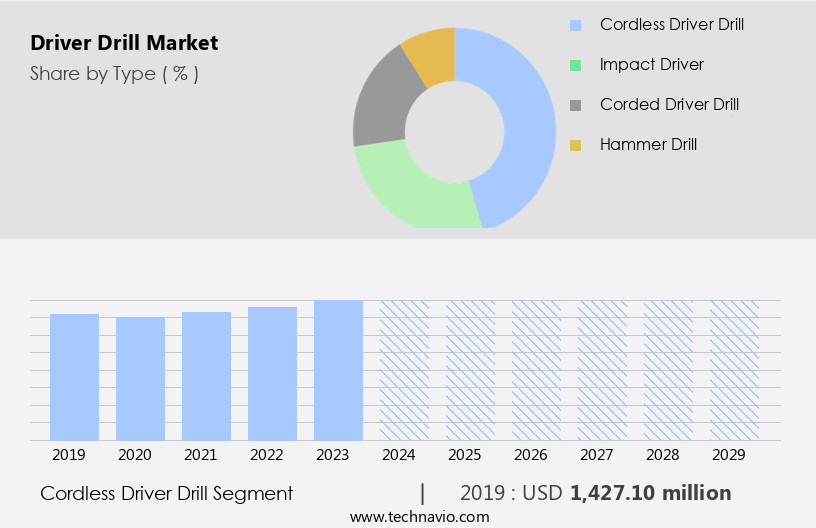

The driver drill industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Cordless driver drill

- Impact driver

- Corded driver drill

- Hammer drill

- Application

- Residential

- Construction and infrastructure

- Commercial

- Industrial

- Others

- Power Source

- Battery-Powered

- Electric

- Pneumatic

- End-User

- DIY Enthusiasts

- Professional Contractors

- Distribution Channel

- Online Retail

- Hardware Stores

- Specialty Stores

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The cordless driver drill segment is estimated to witness significant growth during the forecast period.

The cordless the market is a significant segment within the power tools industry, recognized for its continuous innovation and increasing demand for versatile, user-friendly tools. This analysis explores various cordless driver drill types, showcasing their unique features and applications. Standard cordless driver drills are the most prevalent choice, engineered for general-purpose drilling and driving tasks. Their portability, ease of use, and adaptability to various materials, such as wood, metal, and plastic, make them popular among professionals and DIY enthusiasts. These tools often include adjustable speed settings and torque control, catering to diverse applications. Impact cordless driver drills, another category, employ impact technology to deliver higher torque and faster driving speeds, making them ideal for heavy-duty automotive repair and construction projects.

These tools' ergonomic design, lithium-ion batteries, and variable speed control enhance user comfort and efficiency. Rotary hammer cordless driver drills, designed for concrete drilling, offer the power and versatility required for masonry applications. Brushless motors and clutch settings enable precise drilling and longer battery life. Cordless driver drill brands prioritize safety features, such as drill chuck security and depth adjustment mechanisms, ensuring accurate and safe drilling practices. Driver drill troubleshooting guides and accessories, like magnetic drill attachments and driver drill bits, expand the tools' functionality and ease of use. Incorporating driver drill specifications, such as motor power, drill bit size, chuck capacity, charging time, and driving accuracy, allows users to make informed purchasing decisions based on their specific requirements.

Proper driver drill maintenance ensures optimal performance and longevity.

The Cordless driver drill segment was valued at USD 1.43 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the Asia-Pacific (APAC) region, the market is experiencing significant growth due to the rapid industrialization and urbanization driving substantial investments in infrastructure. With a focus on this market segment, key factors fueling the demand for driver drill tools include infrastructure development, such as the construction of approximately 20,000 km of National Highways in India, which received an 11.1% increase in capital investment outlay to USD133.86 billion in the Interim Budget 2024-25. This investment represents 3.4% of the country's GDP and underscores the region's commitment to enhancing infrastructure. Driver drills are essential tools for various applications, including automotive repair, home improvement projects, and concrete drilling.

Ergonomic designs, lithium-ion batteries, and brushless motors are becoming increasingly popular features for driver drills, providing greater efficiency and convenience. Precision driving and torque settings are crucial considerations for both professionals and DIY enthusiasts. Driver drill brands offer a range of specifications, including motor power, drilling depth adjustment, and clutch settings, catering to diverse user needs. Cordless driver drills, impact drivers, rotary hammers, and magnetic drills are popular choices, each with their unique advantages. Driver drill troubleshooting and maintenance are essential for ensuring optimal performance and longevity. Accessories like drill bits, driver drill kits, and variable speed controls further expand the functionality of these versatile tools.

Safety features, such as driver drill safety, are also essential considerations. With the increasing popularity of driver drills, understanding their features, benefits, and applications is vital for both professionals and homeowners.

Market Dynamics

The Driver Drill Market offers a wide array of tools, from versatile cordless driver drills to powerful power drills catering to various needs. Finding the best cordless drill is a common goal for both DIY enthusiasts and professionals seeking a reliable drill/driver combo or a dedicated impact driver for demanding tasks. Brushless drills are gaining popularity for their efficiency, while traditional corded drills still offer consistent power. For tougher materials, hammer drills are essential. Users often search for drills for wood, drills for metal, and drills for concrete, seeking the ideal cordless drill for home use or heavy-duty drills for construction. Features like variable speed drills and keyless chuck drills enhance usability, and consumers look for an affordable cordless drill or invest in professional power drills. Specialized tools like right angle drills and compact driver drills address specific applications, and the selection of appropriate drill bits is crucial for any drilling task.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Driver Drill Industry?

- The significant expansion of e-commerce platforms is the primary catalyst for market growth.

- The market is witnessing notable growth due to the increasing popularity of e-commerce platforms. This trend is transforming market dynamics, offering manufacturers and retailers new avenues to expand their customer base and refine sales strategies. E-commerce's rise enables consumers to explore a multitude of driver drill options, read reviews, and make informed decisions without leaving their homes. This convenience is especially attractive to DIY enthusiasts and professionals, who prioritize time efficiency and convenience. Driver drill features, such as speed control, battery life, and compatibility with various driver drill bits, are essential considerations for consumers. Comparing these features across different brands is now more accessible than ever, thanks to e-commerce's convenience.

- Drilling practices and techniques also influence the choice of driver drills, and understanding these factors is crucial for making informed purchasing decisions. Proper driver drill maintenance is essential to ensure optimal performance and longevity. With the ease of access to information and products provided by e-commerce, consumers can now make well-informed decisions regarding their driver drill needs.

What are the market trends shaping the Driver Drill Industry?

- Product development is currently a significant market trend. This refers to the creation and improvement of new products to meet evolving consumer needs and preferences.

- The market is experiencing notable progress, fueled by the rising demand for effective and multifunctional tools. In 2024, there is a growing trend towards advanced cordless driver drills and impact wrenches, catering to both professionals and DIY enthusiasts. These innovations offer increased power, user-friendly designs, and versatility for various working conditions. For instance, in February 2024, Bosch introduced the 18V-80 QuickSnap series, which includes the AdvancedDrill and AdvancedImpact models.

- These models deliver superior performance for both driving and drilling applications. Additionally, ergonomic designs, lithium-ion batteries, and driver drill accessories contribute to the market's growth.

What challenges does the Driver Drill Industry face during its growth?

- Counterfeit products pose a significant challenge to the industry's growth and expansion, threatening the integrity of brands and undermining consumer trust.

- The market experiences a pressing concern with the emergence of counterfeit products. These imitations, while resembling authentic drills in appearance, fail to meet the mark in terms of quality, performance, and safety standards. This issue erodes consumer trust and poses potential risks to users. Counterfeit drills are often manufactured using substandard materials and production processes, leading to reduced durability, reliability, and efficiency. Users may encounter frequent breakdowns and poor performance, resulting in frustration and additional costs for repairs or replacements.

- Motor power, torque settings, and drilling depth adjustment are essential features in driver drills. Safety is paramount, especially during home improvement projects and automotive repair. Brushless motors and clutch settings are critical for concrete drilling. Driver drill weight and driving depth are also significant factors in selecting the right tool for the job. Ensuring the authenticity of driver drills is crucial to maintain safety, efficiency, and performance standards.

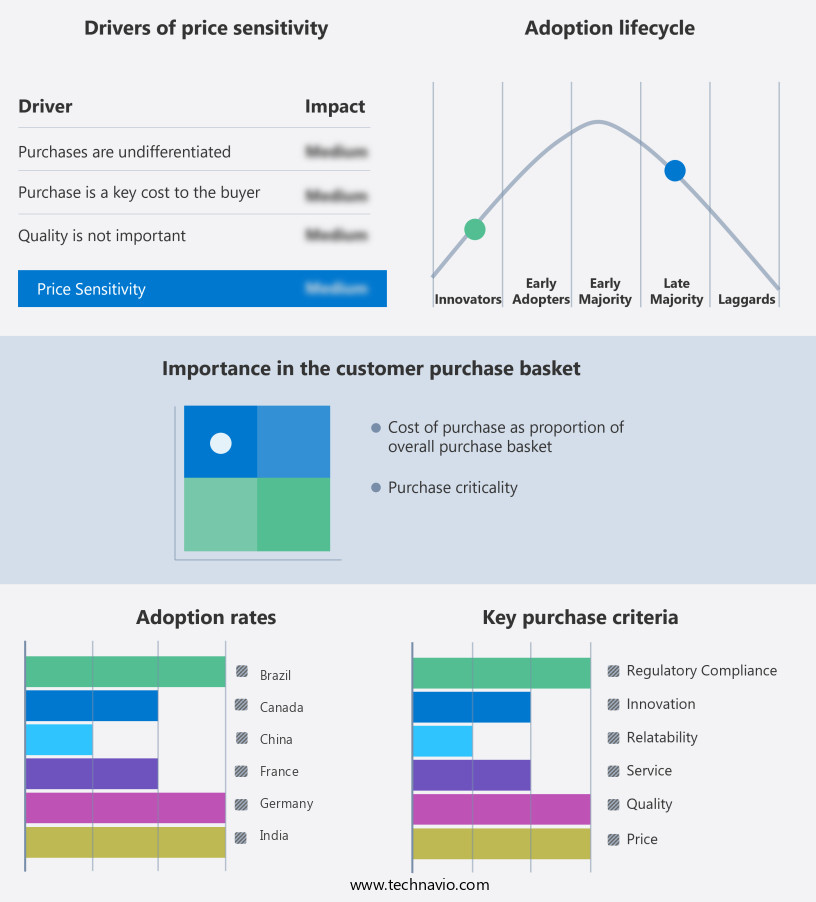

Exclusive Customer Landscape

The driver drill market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the driver drill market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, driver drill market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Black & Decker - The company specializes in providing a range of high-performance drill drivers, including 18V compact and standard models, as well as 12V 2-speed variants.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Black & Decker

- Bosch Power Tools

- Chervon Holdings Ltd.

- DeWalt

- Einhell Germany AG

- Emerson Electric Co.

- Festool GmbH

- Hilti Corp.

- Hitachi Power Tools

- Ingersoll Rand Inc.

- Koki Holdings Co. Ltd.

- Makita Corp.

- Metabo

- Milwaukee Tool

- Panasonic Corp.

- Positec Tool Corp.

- Robert Bosch GmbH

- Stanley Black & Decker Inc.

- Techtronic Industries Co. Ltd.

- TTI Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Driver Drill Market

- In February 2024, Bosch Rexroth, a leading industrial technology provider, introduced its new Hydro-Mechanical Driver Drill System, which combines hydraulic power with mechanical drilling technology. This innovation aims to increase drilling efficiency and reduce overall operating costs (Bosch Rexroth Press Release, 2024).

- In July 2024, Sandvik and Epiroc, two major players in the mining equipment industry, announced a strategic partnership to develop and commercialize integrated drilling systems. This collaboration is expected to strengthen their positions in the market and provide customers with more comprehensive drilling solutions (Sandvik Press Release, 2025).

- In September 2024, Caterpillar, a global leader in construction and mining equipment, completed the acquisition of Wirtgen Group's mining business, including its driver drill product line. This acquisition significantly expanded Caterpillar's mining portfolio and increased its market share in the driver drill segment (Caterpillar Press Release, 2024).

- In December 2024, the European Union passed new regulations on emissions from non-road mobile machinery, including driver drills. The regulations set strict limits on emissions and require manufacturers to invest in cleaner technologies, leading to increased demand for electric and hybrid driver drills (European Parliament Press Release, 2025).

Research Analyst Overview

The market encompasses the production, sales, and usage of driver drills, which are essential tools in various industries for drilling performance enhancement. Driver drills, known for their versatility and power, offer numerous applications, from construction to mining and manufacturing. Safety and maintenance are crucial aspects of the driver drill industry, with ongoing research focusing on improving safety features and reducing maintenance requirements. Innovations in driver drill design have led to advancements in functionality, such as increased torque and improved ergonomics. Despite these advancements, driver drill limitations persist, including high pricing and accessibility challenges. Brands compete in the market by offering diverse solutions, each with unique benefits and features.

Comparisons between different driver drill models are common, with trends favoring those that offer superior drilling technology and performance. The market continues to evolve, driven by development in technology and opportunities for increased efficiency and productivity. Accessories and pricing remain key factors in the decision-making process for businesses. Ultimately, the future of driver drills lies in continuous innovation and addressing the challenges faced by the industry.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Driver Drill Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 1541.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.1 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Driver Drill Market Research and Growth Report?

- CAGR of the Driver Drill industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the driver drill market growth of industry companies

We can help! Our analysts can customize this driver drill market research report to meet your requirements.