Ductless HVAC System Market Size 2024-2028

The ductless HVAC system market size is forecast to increase by USD 14.2 billion at a CAGR of 7.1% between 2023 and 2028. The market is experiencing significant growth due to several key drivers. The global construction sector is witnessing growth, leading to increased demand for energy-efficient heating and cooling solutions. The integration of Internet of Things (IoT) technology in HVAC systems is another major trend, enabling real-time performance data analysis and improved energy savings. Additionally, governments worldwide are implementing stringent regulations to phase out high-global-warming-potential (GWP) refrigerants such as hydrofluorocarbons (HFCs) and hydrochlorofluorocarbons (HCFCs), driving the adoption of eco-friendly, low GWP alternatives. Sensors and control valves are essential components of ductless HVAC systems, ensuring optimal performance and energy efficiency. These factors collectively contribute to the market's growth and innovation.

What will be the Size of the Market During the Forecast Period?

The market is witnessing significant growth due to the increasing demand for energy-efficient and eco-friendly cooling solutions. These systems, also known as mini-split systems, have gained popularity in both residential and non-residential infrastructure due to their energy savings and sustainability benefits. The integration of the Internet of Things (IoT) in HVAC systems is a major trend driving the market's growth. Smart homes and commercial buildings are increasingly adopting ductless HVAC systems equipped with sensors, control valves, and smart thermostats to optimize energy consumption and enhance overall performance.

Additionally, real-time performance data from these systems allows users to monitor and manage energy usage efficiently, leading to power savings and reduced environmental impact. The use of low global warming potential (GWP) refrigerants, such as hydrofluorocarbons (HFCs) and hydrochlorofluorocarbons (HCFCs), is another factor contributing to the market's growth. The demand for energy-efficient technologies and sustainable buildings is on the rise, with climate change concerns becoming a significant factor. Ductless HVAC systems offer a viable solution to these concerns, as they provide cooling without contributing to greenhouse gas emissions. The market is expected to experience continued growth due to the increasing focus on energy efficiency and the adoption of IoT in HVAC systems.

Moreover, HVAC professionals play a crucial role in the market's growth, as they are responsible for installing and maintaining these systems. In conclusion, the market in the United States is poised for growth due to the increasing demand for energy-efficient and eco-friendly cooling solutions, the integration of IoT, and the focus on sustainability and energy savings. The market offers significant opportunities for businesses involved in the manufacturing, installation, and maintenance of these systems.

Market Segmentation

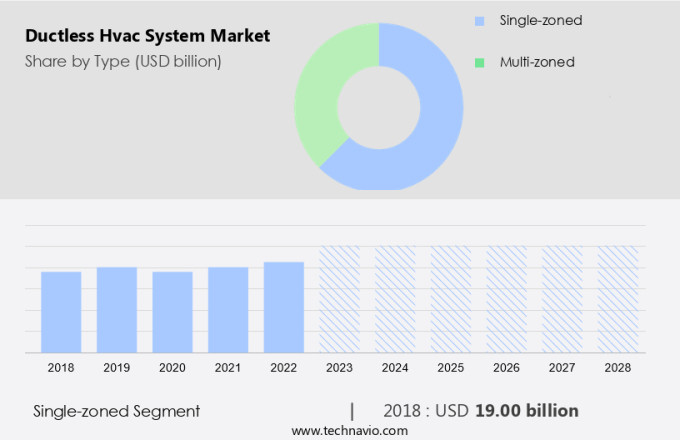

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Single-zoned

- Multi-zoned

- Geography

- APAC

- China

- Japan

- South Korea

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By Type Insights

The single-zoned segment is estimated to witness significant growth during the forecast period. Ductless single zone heating and cooling systems consist of an outdoor compressor unit connected to an indoor air handling unit via a small pipe. This setup allows for easy installation with minimal disruption to a building's aesthetic. These systems are widely used in various sectors, including education, retail, and commercial spaces, due to their cost-effective initial investment and simplified installation process. The energy efficiency of ductless single zone HVAC systems is a significant advantage, making them an eco-friendly cooling solution. Moreover, the increasing focus on energy savings and reducing carbon footprints is driving the demand for these systems. Hydrofluorocarbons (HFCs) and Hydrochlorofluorocarbons (HCFCs) are commonly used refrigerants in these systems, but the shift towards low Global Warming Potential (GWP) refrigerants is gaining momentum.

Also, the Internet of Things (IoT) is transforming the HVAC industry, allowing for real-time performance data collection and analysis. This data can be used to optimize system performance and reduce energy consumption. As the world continues to construct new buildings, the need for energy-efficient and cost-effective cooling solutions like single zone ductless HVAC systems will only increase. In conclusion, ductless single zone HVAC systems offer numerous benefits, including easy installation, energy efficiency, and cost-effectiveness. The integration of IoT technology further enhances their capabilities, making them an attractive option for various sectors. The demand for these systems is expected to grow as the world focuses on energy savings and reducing carbon emissions.

Get a glance at the market share of various segments Request Free Sample

The single-zoned segment was valued at USD 19.00 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the US and North America is experiencing significant growth due to increasing environmental concerns and the push for sustainable buildings. Mini-split systems, a type of ductless HVAC, have gained popularity due to their energy-efficient technologies and power savings. The residential infrastructure sector is a major contributor to the market's growth, with a growing demand for smart homes and temperature management solutions. Japan, South Korea, and China are leading the way in the Asia Pacific region for ductless HVAC system adoption. This trend is driven by urbanization, industrialization, and increasing population.

Additionally, regulatory programs such as the Commercial Building Disclosure (CBD) Program in Australia and Energy Conservation Building Codes in India are also promoting the use of HVAC systems, including ductless HVAC systems. The LEED-India project and the Indian Society of Heating, Refrigerating, and Air-Conditioning Engineers (ISHRAE) are further supporting the adoption of HVAC systems in the region. The enforcement of these regulations and initiatives is expected to continue driving the growth of the market in the Asia Pacific region. Overall, the market is poised for continued growth as the world focuses on reducing energy consumption and mitigating climate change.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rapid-rising commercial and residential construction globally is the key driver of the market. The global construction market, valued at USD 9.5 trillion in 2023, is projected to expand by approximately USD 4.5 trillion from 2020 to 2030, reaching a total value of USD 15.2 trillion. Emerging markets are anticipated to contribute significantly to this growth, accounting for around USD 8.9 trillion by 2030. Notably, Sub-Saharan Africa is expected to witness the highest growth rate among regions. In 2023, China, India, the US, and Indonesia collectively accounted for 58.3% of the global construction sector's growth. Urbanization is a key driver of this expansion in emerging markets. Regarding HVAC systems, the ductless market is gaining traction due to its eco-friendly use of refrigerants, product innovation, and easy installation.

Additionally, commercial sectors are increasingly adopting these systems due to their smart features, sustainability, and energy efficiency. As a result, carbon emissions from traditional HVAC systems are decreasing, contributing to a more sustainable future. Moreover, the HVAC industry is focusing on innovation, with a shift towards energy-efficient and intelligent systems. These advancements cater to the growing demand for comfort and convenience in commercial buildings. The adoption of these systems is expected to continue, driven by the need for temperature control and indoor air quality improvements.

Market Trends

The rapid transformation of IoT within the HVAC industry is an upcoming trend in the market. Ductless HVAC systems are increasingly integrating with the Internet of Things (IoT) to enhance cooling performance and efficiency. IoT technology enables these systems to collect and store data in the cloud, facilitating remote monitoring, control, and diagnostics. This results in improved HVAC operations, predictive maintenance, and cost savings.

For instance, HVAC professionals can access real-time performance data and interpret it correctly, reducing operational expenses. In nonresidential construction, IoT-enabled HVAC systems can be integrated into smart homes and buildings, allowing end-users to manage temperature settings and energy consumption effectively. Overall, IoT technology plays a significant role in optimizing HVAC system performance and reducing operational costs.

Market Challenge

Stringent government regulations are key challenges affecting market growth. The United States government enacted the National Appliance Energy Conservation Act (NAECA) in 1987, setting the foundation for minimum energy efficiency standards for residential central air-conditioning and heat pump equipment. These regulations took effect in 1992, with subsequent updates, such as the New Efficiency Standard for Residential Heating and Cooling in the US and the NAECA, being implemented in 2006 and 2015, respectively. The upcoming standards effective in 2023 mandate a seasonal energy efficiency ratio (SEER) of 14 for northern states and a SEER of 15 for southern states, where cooling demands represent a more significant portion of home energy consumption. In the residential application, ductless systems offer easy installation, temperature management, Transport, and power saving features, making them an attractive option for homeowners.

Additionally, strategic partnerships and advancements in indoor air quality, energy conservation, smart home automation, and product offerings are driving the market in the US. Indoor air quality concerns and the need for energy efficiency have become increasingly important, particularly as energy prices rise and consumers seek to reduce their carbon footprint. Ductless HVAC systems offer an attractive solution, providing zoned temperature control and improved energy efficiency compared to traditional central systems. With the increasing focus on reducing Carbon Emissions and promoting Indoor Air Quality, ductless systems have become a popular choice for retrofitting existing buildings and new construction projects. Additionally, smart home automation and advanced product offerings are enhancing user experience and convenience.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Carrier Global Corp: The company offers Performance Cassette Indoor Unit that blends into over-head space to deliver quiet comfort Ductless HVAC system.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Daikin Industries Ltd.

- Electrolux group

- Fujitsu General Ltd.

- Haier Smart Home Co. Ltd.

- Hanon Systems

- Hitachi Ltd.

- Lennox International Inc.

- LG Electronics Inc.

- MAHLE GmbH

- MIDEA Group Co. Ltd.

- Mitsubishi Electric Corp.

- Panasonic Holdings Corp.

- Rheem Manufacturing Co.

- Samsung Electronics Co. Ltd.

- Sanden Corp.

- Sharp Corp.

- Subros Ltd.

- Trane Technologies plc

- Valeo SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Ductless HVAC systems, also known as mini-split systems, have gained significant traction in the global cooling market due to their energy-saving and eco-friendly features. These systems are increasingly being adopted in both residential and commercial sectors, driven by the growing demand for sustainable buildings and concerns over climate change. The Internet of Things (IoT) is revolutionizing the HVAC industry by enabling real-time performance data, smart thermostats, sensors, control valves, and energy-efficient technologies. HVAC professionals are leveraging these smart features to optimize temperature management and energy consumption in buildings. Ductless systems use low global warming potential (GWP) refrigerants, such as hydrofluorocarbons (HFCs) and hydrochlorofluorocarbons (HCFCs), to minimize carbon emissions.

In summary, leading brands like Carrier, LG Electronics, and Reznor offer a range of energy-efficient devices and product innovations, including touchscreen controllers and mini-split, multi-split, and VRF systems. Easy installation and retrofit capabilities make ductless HVAC systems an attractive option for both new construction and infrastructure upgrades. Strategic partnerships between HVAC manufacturers and smart home automation companies are further enhancing the appeal of these systems by integrating them into smart homes and commercial buildings. Indoor air quality and energy conservation are key benefits of ductless HVAC systems, making them a popular choice for temperature management in eco-conscious homes and businesses.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2024-2028 |

USD 14.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.63 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 47% |

|

Key countries |

China, US, Germany, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Carrier Global Corp., Daikin Industries Ltd., Electrolux group, Fujitsu General Ltd., Haier Smart Home Co. Ltd., Hanon Systems, Hitachi Ltd., Lennox International Inc., LG Electronics Inc., MAHLE GmbH, MIDEA Group Co. Ltd., Mitsubishi Electric Corp., Panasonic Holdings Corp., Rheem Manufacturing Co., Samsung Electronics Co. Ltd., Sanden Corp., Sharp Corp., Subros Ltd., Trane Technologies plc, and Valeo SA |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch