Edge Analytics Market Size 2024-2028

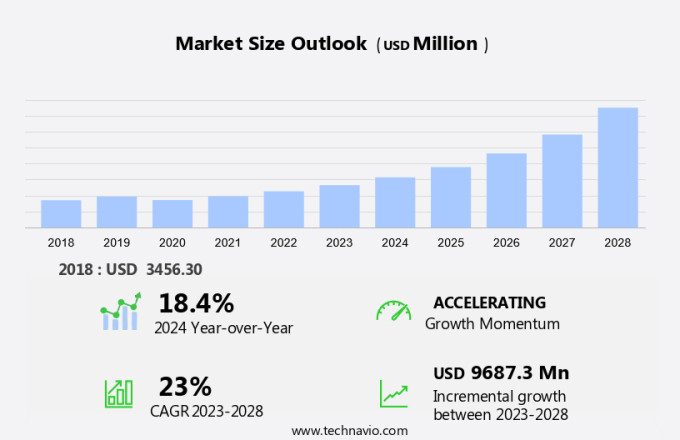

The edge analytics market size is forecast to increase by USD 9.69 billion, at a CAGR of 23% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing availability and complexity of data. The proliferation of Internet of Things (IoT) devices is leading to an unprecedented volume of data being generated at the edge. This data is too large and complex to be transmitted to the cloud for processing in real-time, necessitating the deployment of edge analytics solutions. However, the market is not without challenges. Data privacy and security concerns are becoming increasingly pressing as more data is generated and processed at the edge. With the decentralized nature of edge analytics, ensuring data security and privacy becomes more challenging than in traditional cloud-based solutions.

- Companies must invest in robust security measures to mitigate these risks and maintain customer trust. Additionally, the complexity of edge analytics solutions can pose implementation challenges, requiring significant resources and expertise to deploy and manage effectively. Despite these challenges, the potential rewards for companies that can successfully navigate them are substantial, with the ability to gain real-time insights from data and make informed decisions quickly.

What will be the Size of the Edge Analytics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the increasing demand for real-time data processing and analysis across various sectors. Seamlessly integrated solutions, such as scalability solutions, data governance frameworks, time series forecasting, data deduplication methods, anomaly detection algorithms, power consumption optimization, data visualization dashboards, network bandwidth optimization, and more, are essential in addressing the dynamic nature of data generation and processing at the edge. Edge analytics is critical for low-latency analytics and remote monitoring systems, enabling quick decision-making and improved operational efficiency. IoT device integration and distributed computing systems are key components, ensuring data quality metrics are maintained while hardware acceleration techniques and parallel processing enhance performance.

Time series forecasting and anomaly detection algorithms help organizations identify trends and potential issues, while power consumption optimization and data visualization dashboards provide valuable insights into resource utilization and system health. Network bandwidth optimization and software defined networking enable efficient data transfer and processing, further enhancing the edge analytics ecosystem. Additionally, machine learning pipelines, data compression techniques, and API integration strategies contribute to the continuous evolution of edge analytics, ensuring it remains a scalable and adaptable solution for businesses. Predictive maintenance models and real-time data processing are essential for optimizing performance and maintaining system reliability. Compliance standards and cloud connectivity solutions ensure data security and seamless integration with centralized systems, while sensor data aggregation and high-frequency data analysis provide actionable insights for businesses.

Thermal management solutions and fault tolerance mechanisms further enhance the robustness and resilience of edge analytics infrastructure. In summary, the market is characterized by continuous innovation and evolution, with a focus on delivering real-time data processing and analysis across various sectors. Integrated solutions, such as those mentioned above, are essential in addressing the dynamic nature of data generation and processing at the edge, ensuring businesses can make informed decisions and optimize their operations in real-time.

How is this Edge Analytics Industry segmented?

The edge analytics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Solutions

- Services

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Component Insights

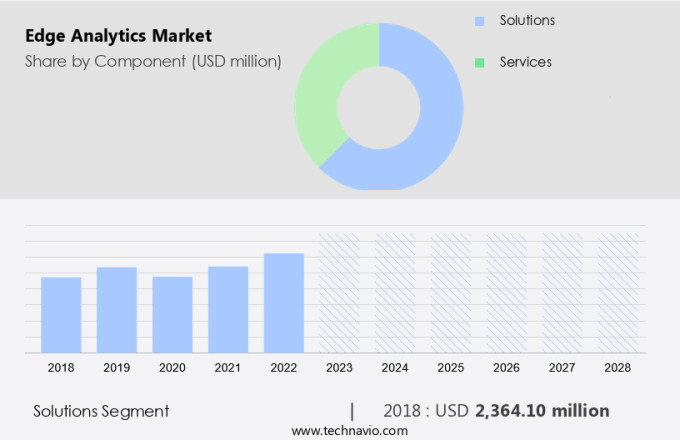

The solutions segment is estimated to witness significant growth during the forecast period.

Edge analytics solutions enable real-time data processing by performing automated computational analysis at the source, be it a sensor, network switch, or IoT device. This approach is increasingly popular in organizations dealing with vast amounts of operational data generated from remote devices. The complexity and cost of managing such data make it essential to apply analytics algorithms at the edge of the corporate network. Companies can set criteria for valuable information, either for storage in a cloud or on-premises data center. The market for edge analytics is influenced by several factors. Enterprise data privacy concerns drive the adoption of edge analytics services.

Low-latency analytics and remote monitoring systems are integral to ensuring data accuracy and timeliness. IoT device integration and hardware acceleration techniques improve efficiency and reduce power consumption. Distributed computing systems and parallel processing techniques enhance scalability, while data governance frameworks ensure compliance with industry standards. Time series forecasting and anomaly detection algorithms help identify trends and potential issues in real-time. Data deduplication methods and compression techniques minimize data redundancy and optimize network bandwidth. Thermal management solutions and power consumption optimization are crucial for maintaining system performance and longevity. Machine learning pipelines and API integration strategies enable seamless data processing and analysis.

Fault tolerance mechanisms and system architecture design ensure the reliability and resilience of edge analytics infrastructure. Predictive maintenance models and real-time data processing provide valuable insights for proactive decision-making. Performance benchmarking and cloud connectivity solutions enable continuous improvement and integration with other systems. Sensor data aggregation and high-frequency data analysis offer actionable insights for optimizing operations. Data visualization dashboards and network bandwidth optimization provide real-time insights into system performance and data usage. Software-defined networking and data stream management ensure efficient data processing and analysis. Data encryption methods protect sensitive information, while data compression techniques minimize storage requirements.

Overall, the market is a dynamic and evolving landscape that offers significant benefits for organizations dealing with complex operational data.

The Solutions segment was valued at USD 2.36 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

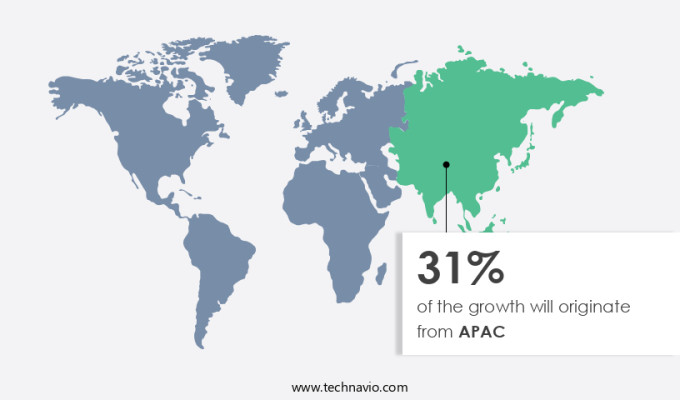

APAC is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

North American businesses are at the forefront of implementing advanced edge analytics infrastructure to analyze vast amounts of customer data in real-time. Edge analytics, an approach that processes and stores data through automated analytical computation, is gaining popularity due to the increasing velocity of data generation in industries such as telecommunications, manufacturing, and energy. Initially adopted by small and mid-size enterprises (SMEs), this technology is now being embraced by larger companies to ensure efficient and secure data management. Edge analytics offers several advantages, including low-latency analytics, remote monitoring systems, data quality metrics, IoT device integration, hardware acceleration techniques, distributed computing systems, parallel processing techniques, scalability solutions, data governance frameworks, time series forecasting, data deduplication methods, anomaly detection algorithms, power consumption optimization, data visualization dashboards, network bandwidth optimization, software defined networking, data stream management, API integration strategies, thermal management solutions, machine learning pipelines, data compression techniques, edge computing infrastructure, compliance standards, predictive maintenance models, real-time data processing, performance benchmarking, cloud connectivity solutions, sensor data aggregation, high-frequency data analysis, data encryption methods, fault tolerance mechanisms, and system architecture design.

These advanced capabilities enable businesses to optimize network bandwidth, power consumption, and improve overall system performance. Furthermore, edge analytics offers enhanced cybersecurity protocols, ensuring data security and privacy. With the growing demand for real-time data processing and analysis, edge analytics is expected to continue its influence in the business landscape.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Edge Analytics Industry?

- The increasing abundance and intricacy of data serves as the primary catalyst for market growth.

- Edge analytics is gaining momentum as organizations grapple with the increasing volume and complexity of data. The ability to analyze data in real-time at the source, rather than sending it to a centralized data center, offers numerous advantages. Intelligent techniques, such as machine learning (ML) and artificial intelligence (AI), play a crucial role in extracting valuable insights from this data. These insights can then be used to improve services and business processes, creating a competitive edge. Enterprises generate vast amounts of data daily, yet much of it goes untapped due to a lack of knowledge on how to access and utilize it effectively.

- Edge analytics addresses this challenge by enabling data analysis at the source, providing actionable insights in real-time. This market trend is driven by the growing need to make the most of the data available and gain a competitive edge.

What are the market trends shaping the Edge Analytics Industry?

- The increasing implementation of Internet of Things (IoT) data in edge analytics is a significant market trend. This approach allows for real-time data processing and analysis at the source, enhancing operational efficiency and decision-making capabilities.

- The proliferation of IoT devices and the subsequent surge in data generation necessitates real-time data processing and analysis. Edge analytics applications address this challenge by performing data processing and analysis at the source, closer to where data is generated. This approach reduces latency and enables quicker insights. Cybersecurity protocols are crucial in edge analytics to ensure data security. Remote monitoring systems, distributed computing systems, parallel processing techniques, and hardware acceleration are essential components of edge analytics. IoT device integration is another key feature, enabling seamless data flow between devices and analytics applications.

- Data quality metrics ensure accurate and reliable insights. Retail is a significant end-user industry benefiting from edge analytics, transforming in-store experiences through smart cameras and other IoT devices. Companies in various sectors, including BFSI and telecom, also leverage edge analytics for real-time data analysis.

What challenges does the Edge Analytics Industry face during its growth?

- Data privacy and security concerns represent a significant challenge to the industry's growth, as organizations must balance the need to collect and use data to drive innovation and business growth with the requirement to protect sensitive information from unauthorized access or misuse.

- The digitalization trend across industries generates vast amounts of customer, business, and operational data, posing significant data privacy and security challenges. Cybercriminals primarily target customer data, including names, email addresses, and phone numbers, raising concerns among consumers. To mitigate these risks, organizations must establish robust data governance frameworks and implement scalability solutions for handling large data volumes. Time series forecasting, data deduplication methods, anomaly detection algorithms, power consumption optimization, network bandwidth optimization, and data visualization dashboards are essential components of an effective data management strategy. These technologies enable organizations to securely process and analyze data, ensuring data accuracy and integrity.

- Moreover, power consumption optimization and network bandwidth optimization are crucial for maintaining a cost-effective and efficient data management infrastructure. By implementing these solutions, organizations can minimize their carbon footprint and reduce operational costs. In conclusion, as data continues to grow exponentially, it is essential for businesses to prioritize data security and privacy while ensuring scalability and efficiency. By adopting advanced data management technologies and implementing robust data governance frameworks, organizations can mitigate cybersecurity risks, maintain data accuracy, and gain valuable insights from their data.

Exclusive Customer Landscape

The edge analytics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the edge analytics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, edge analytics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB - The company provides advanced analytics solutions, including ABB Ability Edge, which enables real-time data analysis and monitoring in industrial applications, enhancing operational efficiency and productivity.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB

- Analytic Edge

- CGI Inc.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Equinix Inc.

- FIRST PRIVACY Holding GmbH

- FogHorn Systems

- Greenwave Systems

- Hewlett Packard Enterprise Co.

- Iguazio Ltd.

- Intel Corp.

- International Business Machines Corp.

- Oracle Corp.

- Predixion Software

- PTC Inc.

- SAP SE

- SAS Institute Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Edge Analytics Market

- In January 2024, IBM announced the launch of its new AI-powered edge analytics platform, "IBM Edge Application Manager," designed to process data in real-time at the edge, reducing latency and enhancing decision-making for industries like manufacturing and healthcare (IBM Press Release).

- In March 2024, SAS and Microsoft formed a strategic partnership to integrate SAS analytics capabilities into Microsoft Azure IoT Edge, enabling real-time analytics for industrial IoT applications (Microsoft News Center).

- In May 2024, Sentient Technologies raised a USD 100 million Series C funding round, led by Tiger Global Management, to expand its edge AI capabilities and accelerate the development of its AI research platform (Sentient Technologies Press Release).

- In April 2025, NVIDIA and Arm collaborated to bring Arm-based NVIDIA Jetson AGX Xavier modules to the edge, aiming to accelerate AI workloads and edge analytics deployments (NVIDIA Press Release).

Research Analyst Overview

- The market is experiencing significant growth, driven by the increasing demand for real-time data processing and analysis. Maintenance scheduling and system upgrade procedures are crucial aspects of edge analytics, ensuring optimal performance and regulatory compliance. Alerting and notification systems enable businesses to respond promptly to anomalies, while hardware upgrades and capacity planning methods facilitate scalability. Remote diagnostics tools and sensor network deployment enable proactive maintenance, reducing downtime and improving efficiency. Data acquisition methods, deployment automation, and data privacy compliance are essential for secure and accurate data processing. Log analysis techniques and security vulnerability assessments help identify and mitigate risks, while risk management strategies ensure business continuity.

- System monitoring tools and error handling mechanisms enhance system reliability and performance. Cost optimization strategies, such as model training datasets and contract negotiation, are essential for managing edge analytics expenses. Performance tuning, software updates, resource allocation, and company management are critical for maintaining a competitive edge in the market. Data preprocessing techniques ensure data quality and facilitate effective analysis, ultimately driving better business outcomes.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Edge Analytics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 23% |

|

Market growth 2024-2028 |

USD 9687.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

18.4 |

|

Key countries |

US, China, UK, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Edge Analytics Market Research and Growth Report?

- CAGR of the Edge Analytics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the edge analytics market growth of industry companies

We can help! Our analysts can customize this edge analytics market research report to meet your requirements.