Data Governance Market Size 2024-2028

The data governance market size is forecast to increase by USD 5.39 billion at a CAGR of 21.1% between 2023 and 2028. The market is experiencing significant growth due to the increasing importance of informed decision-making in business operations. With the rise of remote workforces and the continuous generation of data from various sources, including medical devices and IT infrastructure, the need for strong data governance policies has become essential. With the data deluge brought about by the Internet of Things (IoT) device implementation and remote patient monitoring, ensuring data completeness, security, and oversight has become crucial. Stricter regulations and compliance requirements for data usage are driving market growth, as organizations seek to ensure accountability and resilience in their data management practices. companies are responding by launching innovative solutions to help businesses navigate these complexities, while also addressing the continued reliance on legacy systems. Ensuring data security and compliance, particularly in handling sensitive information, remains a top priority for organizations. In the healthcare sector, data governance is particularly crucial for ensuring the security and privacy of sensitive patient information.

What will be the Size of the Market During the Forecast Period?

Data governance refers to the overall management of an organization's information assets. In today's digital landscape, ensuring secure and accurate data is crucial for businesses to gain meaningful insights and make informed decisions. With the increasing adoption of digital transformation, big data, IoT technologies, and healthcare industries' digitalization, the need for sophisticated data governance has become essential. Policies and standards are the backbone of a strong data governance strategy. They provide guidelines for managing data's quality, completeness, accuracy, and security. In the context of the US market, these policies and standards are essential for maintaining trust and accountability within an organization and with its stakeholders.

Moreover, data volumes have been escalating, making data management strategies increasingly complex. Big data and IoT device implementation have led to data duplication, which can result in data deluge. In such a scenario, data governance plays a vital role in ensuring data accuracy, completeness, and security. Sensitive information, such as patient records in the healthcare sector, is of utmost importance. Data governance policies and standards help maintain data security and privacy, ensuring that only authorized personnel have access to this information. Medical research also benefits from data governance, as it ensures the accuracy and completeness of data used for analysis.

Furthermore, data security is a critical aspect of data governance. With the increasing use of remote patient monitoring and digital health records, ensuring data security becomes even more important. Data governance policies and standards help organizations implement the necessary measures to protect their information assets from unauthorized access, use, disclosure, disruption, modification, or destruction. In conclusion, data governance is a vital component of any organization's digital strategy. It helps ensure high-quality data, secure data, and meaningful insights. By implementing strong data governance policies and standards, organizations can maintain trust and accountability, protect sensitive information, and gain a competitive edge in today's data-driven market.

Market Segmentation

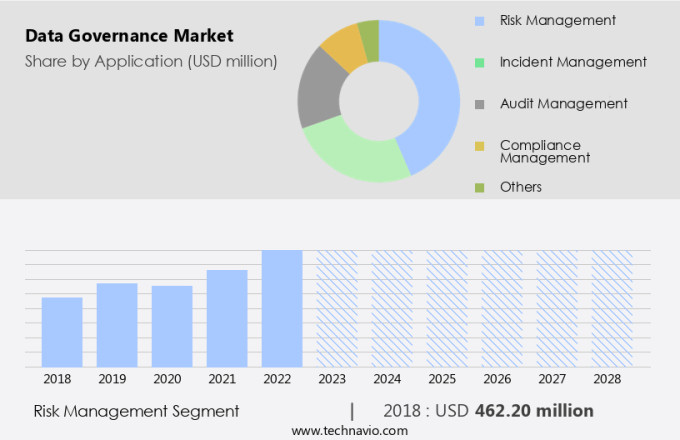

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Risk management

- Incident management

- Audit management

- Compliance management

- Others

- Deployment

- On-premises

- Cloud-based

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Sweden

- APAC

- India

- Singapore

- South America

- Middle East and Africa

- North America

By Application Insights

The risk management segment is estimated to witness significant growth during the forecast period. Data governance is a critical aspect of managing data in today's business environment, particularly in the context of wearables and remote monitoring tools. With the increasing use of these technologies for collecting and transmitting sensitive health and personal data, the risk of data breaches and cybersecurity threats has become a significant concern. Compliance regulations such as HIPAA and GDPR mandate strict data management practices to protect this information. To address these challenges, advanced data governance solutions are being adopted. AI technologies are being integrated into data governance platforms to enhance data quality management, data architecture management, and reference data management.

Furthermore, this automates the measurement and oversight of operational risk, consolidating various data points, including risk and control self-assessments, loss events, scenario analyses, and key risk indicators, into a unified solution. Effective data governance is essential to maintaining data security, ensuring regulatory compliance, and improving overall business performance.

Get a glance at the market share of various segments Request Free Sample

The risk management segment accounted for USD 462.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, particularly the United States and Canada, there is a significant focus on implementing high-quality data governance practices. Strict regulatory frameworks, such as the California Consumer Privacy Act (CCPA) and the Health Insurance Portability and Accountability Act (HIPAA), require organizations to protect and secure their information assets. Compliance with these regulations is essential for maintaining trust and accountability with customers and stakeholders. The financial sector also faces stringent regulations, including the Sarbanes-Oxley Act (SOX) and the Dodd-Frank Act, which demand data integrity and accuracy. With the increasing adoption of big data and digital transformation, effective data management strategies have become crucial for businesses to gain valuable insights through business intelligence. Data governance policies and standards are vital for ensuring data security, privacy, and compliance in this data-driven era.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Stricter regulations and compliance requirements for data is the key driver of the market. In today's data-driven business landscape, effective data governance has become a necessity for organizations to manage and protect their valuable data assets. The explosion of data volumes from various sources, including IoT technologies, necessitates stringent data governance practices. Data duplication and loss pose significant risks to businesses, particularly when it comes to personal data and confidential information. Governments and regulatory bodies are responding to these challenges by implementing rigorous regulations to safeguard sensitive data. For instance, the Health Insurance Portability and Accountability Act (HIPAA) in the US imposes strict rules on the handling of patient records in the healthcare sector, while medical research institutions must adhere to stringent data accuracy standards.

Furthermore, the European Union's General Data Protection Regulation (GDPR) is another landmark regulation that sets the bar high for data governance. It requires businesses to obtain explicit consent from individuals before processing their data and provides them with the right to access, rectify, or delete their information. As data becomes an increasingly valuable asset, organizations must invest in strong data governance solutions to ensure data security, privacy, and compliance. By implementing effective data governance practices, businesses can mitigate risks, enhance data quality, and build trust with their customers and stakeholders.

Market Trends

The increasing focus of companies on new product launches and innovations is the upcoming trend in the market. Data governance is a critical area of focus for businesses as they navigate the complexities of managing data usage, particularly in the context of remote workforces and healthcare data. companies are responding to these challenges by introducing advanced solutions to help organizations maintain accountability, ensure data resilience, and make informed decisions. This innovative solution automates repetitive tasks for data stewards, enabling them to manage modern data governance complexities more effectively.

Furthermore, with the increasing volume and variety of data being generated from IT infrastructure, medical devices, and other sources, organizations need to maintain accurate metadata and governance policies. Failure to do so can result in compliance risks and data misuse. By leveraging such solutions, businesses can enhance their data governance practices and make more informed decisions based on accurate and reliable data.

Market Challenge

Continued reliance on legacy systems in organizations is a key challenge affecting market growth. Legacy systems, which refer to outdated computer systems and technologies, pose significant challenges in the realm of data governance. These systems, despite their age and complexity, are essential for numerous organizations due to the vast amounts of critical data and accumulated business logic they hold. However, their reliance on outdated hardware or software platforms and obsolete programming languages can hinder data governance efforts. The escalating demand for data completeness, security, and meaningful insights in today's data-driven world is increasingly difficult to meet with legacy systems. The data deluge from remote patient monitoring, IoT device implementation, and other digital transformations further complicate matters.

Furthermore, data oversight becomes a challenge due to the lack of advanced features and capabilities in these systems. Sensitive information, which is a crucial aspect of data governance, is at risk in legacy systems. Ensuring data completeness and security becomes a complex task, making it imperative for organizations to invest in sophisticated data governance solutions. As the volume and variety of data continue to grow, the importance of effective data governance becomes increasingly apparent. Organizations must address the challenges posed by legacy systems to gain a competitive edge and make informed business decisions.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alation Inc. - The company offers a platform that automates policy assignment and compliance monitoring across all data assets, making data governance standards easier to enforce.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alex Solutions

- Alteryx Inc.

- Ataccama Corp.

- Broadcom Inc.

- Collibra

- erwin

- Informatica Inc.

- International Business Machines Corp.

- Microsoft Corp.

- OneTrust LLC

- Open Text Corporation

- Oracle Corp.

- Precisely

- Privacera Inc

- Salesforce Inc.

- SAP SE

- SAS Institute Inc.

- Securiti, Inc

- Syniti

- Talend Inc

- TIBCO Software Inc.

- Varonis Systems Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

In today's digital world, the importance of strong data governance cannot be overstated. With the escalating demand for high-quality data, secure data has become a critical asset for businesses across industries. Policies and standards for data governance are essential to ensure trust and accountability in the handling of sensitive information. The advent of big data, digital transformation, and IoT technologies have led to an unprecedented data deluge. This has made data management strategies, business intelligence, and data volumes more complex than ever. Data duplication and loss are significant concerns, especially with the increasing use of remote patient monitoring, medical research, and healthcare data governance.

Furthermore, data accuracy, completeness, and security are paramount in industries such as healthcare, where personal and confidential data are involved. The use of sophisticated data governance solutions is essential to manage data usage, resilience, and accountability. Data oversight is crucial for meaningful insights and informed decision-making, especially in the context of remote workforces and the implementation of IoT devices. Data breaches and cybersecurity defenses are also critical components of data governance, with compliance regulations and AI technologies playing a significant role. Data management, data quality management, data architecture management, reference data management, and master data management are all essential aspects of data governance.

Furthermore, usability, integrity, availability, security, procedures, and a governing body are key elements of a successful data governance strategy. Whether deployed on-premises, hosted, or on the cloud, data governance solutions must be flexible and adaptable to meet the unique needs of different verticals, including telecommunications, healthcare, and IT infrastructure. Business intelligence and data analytics rely on high-quality data, and data governance ensures that the data used is accurate, complete, and secure. Effective risk management, process management, network management, and data usage policies are all crucial elements of a comprehensive data governance strategy.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.1% |

|

Market growth 2024-2028 |

USD 5.38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

20.5 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 36% |

|

Key countries |

US, Germany, Canada, Singapore, Australia, UK, France, The Netherlands, India, and Sweden |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Alation Inc., Alex Solutions, Alteryx Inc., Ataccama Corp., Broadcom Inc., Collibra, erwin, Informatica Inc., International Business Machines Corp., Microsoft Corp., OneTrust LLC, Open Text Corporation, Oracle Corp., Precisely, Privacera Inc, Salesforce Inc., SAP SE, SAS Institute Inc., Securiti, Inc, Syniti, Talend Inc, TIBCO Software Inc., and Varonis Systems Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch