eDiscovery Software Market Size 2024-2028

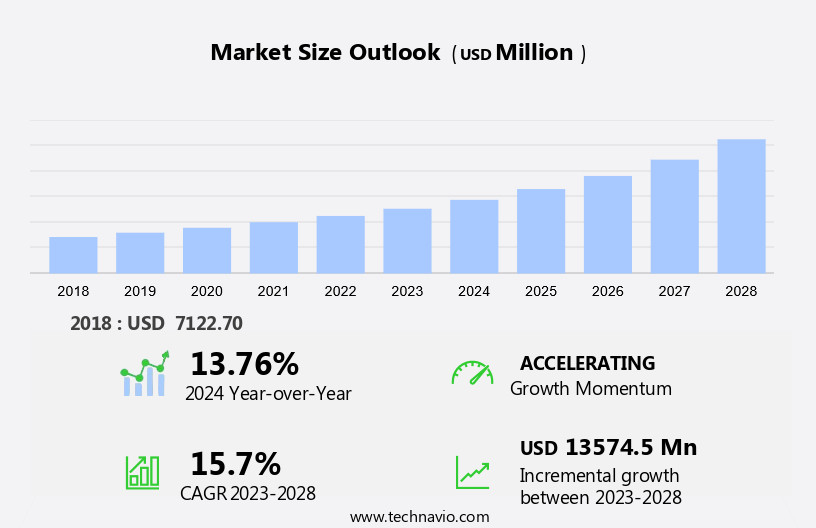

The ediscovery software market size is forecast to increase by USD 13.57 billion, at a CAGR of 15.7% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing volume of electronic data. With the proliferation of digital communication and collaboration tools, the amount of data being generated and stored electronically is expanding at an unprecedented rate. This trend is driving the demand for robust eDiscovery solutions that can efficiently process and analyze large volumes of data. However, this market also faces challenges that require careful attention. The automation and processing of social media data and collaboration tools present new complexities, as these data sources often contain unstructured information. Additionally, the risk of security breaches and the vast amounts of data being handled make data privacy and security a top concern.

- Companies must navigate these challenges to effectively capitalize on the opportunities presented by the growing eDiscovery market. By investing in advanced technologies and implementing robust data security measures, organizations can mitigate risks and stay competitive in this dynamic market.

What will be the Size of the eDiscovery Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities shaping its landscape. Seamlessly integrated solutions are transforming the electronic discovery process, enabling organizations to effectively manage complex data volumes. Visual analytics dashboards provide real-time insights into data processing workflows, facilitating early case assessments. Compliance requirements are met through robust data security protocols and metadata extraction, ensuring chain of custody and information governance. Advanced technologies, such as audio processing and video processing, expand the scope of ediscovery. Custodian identification and legal hold management are streamlined, while cloud-based ediscovery offers flexibility and scalability. Redaction tools and forensic data recovery are essential components, ensuring data preservation and secure data handling.

Native file processing and document review software are optimized for efficiency, while data deduplication and predictive coding technology enhance accuracy. The ediscovery platform incorporates advanced search filters, text analytics engine, machine learning algorithms, and NLP techniques, enabling AI-powered review and near-duplicate detection. Data collection methods are diverse, catering to various sectors and industries. Market activities remain ongoing, with continuous innovation driving the integration of new technologies and features into ediscovery solutions. The evolving nature of this market ensures that organizations can effectively manage their eDiscovery needs, adhering to legal and regulatory requirements while maximizing efficiency and accuracy.

How is this eDiscovery Software Industry segmented?

The ediscovery software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Solution

- Services

- Deployment

- On-premises

- Off-premises

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- APAC

- China

- Rest of World (ROW)

- North America

By Component Insights

The solution segment is estimated to witness significant growth during the forecast period.

The market is characterized by the prevalence of solutions that cater to diverse customer requirements, driving market growth. These solutions encompass various functionalities such as data security, file synchronization and sharing, data recovery, and backup. By enhancing data accessibility and collaboration, optimizing storage infrastructure, and ensuring business continuity, solutions play a pivotal role in addressing the increasing demand for effective and secure data management. Notably, Nuix eDiscovery software is a prime example, enabling the processing of large, intricate data sets and offering an intuitive platform for searching, reviewing, and analyzing their contents. Furthermore, the integration of redaction tools, chain of custody, forensic data recovery, information governance, metadata extraction, tar technology, data visualization tools, email threading, visual analytics dashboard, data processing workflow, early case assessment, compliance requirements, audio processing, custodian identification, legal hold management, cloud-based eDiscovery, video processing, ediscovery platform, data security protocols, data deduplication, data collection methods, native file processing, document review software, data preservation, image processing, advanced search filters, predictive coding technology, NLP techniques, text analytics engine, machine learning algorithms, AI-powered review, near-duplicate detection, and on-premise eDiscovery underscores the comprehensive nature of solutions in the market.

In summary, solutions dominate the component segment of the market due to their versatility and ability to cater to the evolving needs of businesses, including data security, data accessibility, and collaboration, while ensuring regulatory compliance and data preservation.

The Solution segment was valued at USD 3.88 billion in 2018 and showed a gradual increase during the forecast period.

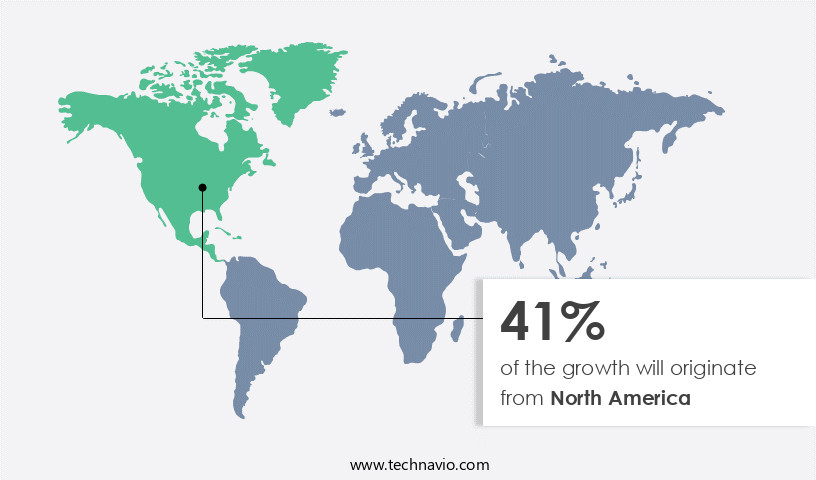

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the region's large number of companies and increased adoption of these solutions. Countries like the US and Canada lead the way, with companies such as Nuix and Relativity expanding their offerings to include media information management. The shift towards mobile content delivery models, heavily reliant on mobile devices, necessitates specialized solutions for archival and storage of digital information. EDiscovery software solutions are essential for litigation support, redaction, chain of custody, forensic data recovery, information governance, metadata extraction, and data processing workflow. They facilitate early case assessment, compliance requirements, and legal hold management.

Advanced features like data visualization tools, email threading, visual analytics dashboard, and predictive coding technology enhance the efficiency of the electronic discovery process. Security protocols, data deduplication, data collection methods, native file processing, document review software, data preservation, image processing, advanced search filters, and near-duplicate detection are integral components of eDiscovery platforms. Additionally, audio processing, custodian identification, and legal hold management ensure comprehensive eDiscovery. Companies prioritize data security, employing machine learning algorithms, text analytics engines, and AI-powered review to maintain data integrity. Cloud-based eDiscovery and on-premise solutions cater to various business needs. The market's evolution reflects the integration of video processing and NLP techniques to cater to diverse use cases.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of eDiscovery Software Industry?

- The escalating quantity of electronic data serves as the primary catalyst for market growth.

- In today's data-driven business landscape, enterprises generate vast amounts of data from various sources, making it essential to manage and analyze this information effectively. Advanced technologies, such as eDiscovery software solutions, have become indispensable for organizations to convert raw data into valuable insights for informed decision-making. These solutions offer features like metadata extraction, email threading, data visualization tools, redaction tools, and chain of custody, ensuring data integrity and compliance. Moreover, forensic data recovery and information governance are crucial aspects of eDiscovery software, enabling organizations to preserve data and maintain its authenticity.

- Cloud-based eDiscovery software solutions provide an affordable and efficient way to manage and analyze large volumes of data, making them increasingly popular among businesses. Tar technology further enhances the functionality of these solutions by enabling the preservation and restoration of data in its original state, ensuring its admissibility in litigation support.

What are the market trends shaping the eDiscovery Software Industry?

- The processing and automation of social media data and collaboration tools is an emerging market trend. This includes the utilization of advanced technologies to manage and analyze social media data, as well as the implementation of collaboration tools to enhance productivity and teamwork.

- EDiscovery software plays a crucial role in helping organizations manage and comply with legal requirements for electronically stored information (ESI). Advanced features such as visual analytics dashboards, data processing workflows, and early case assessment are essential for efficient eDiscovery. Compliance with various regulations, including those related to audio processing, custodian identification, legal hold management, and cloud-based eDiscovery, is a significant challenge. Moreover, the increasing use of collaborative tools and platforms necessitates continuous development of eDiscovery software platforms. These tools generate a vast amount of ESI, leading to an increasing number of discovery requests. Advanced analytics capabilities, including video processing, are necessary to extract data from these collaborative tools effectively.

- Organizations must adhere to corporate social media policies and continuously monitor and enforce business rules regarding sensitive data usage and potential data loss via social media channels. EDiscovery software solutions are essential in addressing these challenges and ensuring compliance with legal requirements.

What challenges does the eDiscovery Software Industry face during its growth?

- The increasing volumes of data and the associated risk of security breaches pose a significant challenge to industry growth. This issue, which is of great concern to professionals in the field, necessitates the implementation of robust security measures to protect sensitive information and ensure business continuity.

- In today's digital world, ensuring data security and integrity is paramount for businesses, particularly in the context of eDiscovery. An eDiscovery platform is an essential tool for managing and preserving electronically stored information (ESI) during litigation, investigations, or regulatory compliance. The platform must adhere to stringent data security protocols to protect sensitive data from unauthorized access or leakage. Data deduplication and collection methods are critical components of an eDiscovery platform. Data deduplication helps eliminate duplicate data, reducing storage requirements and costs. Effective data collection methods ensure the capture of all relevant ESI, including emails, instant messages, and social media content.

- Native file processing and document review software are essential for efficiently processing and reviewing large volumes of data. Image processing capabilities enable the handling of complex data formats, such as images and multimedia files. Advanced search filters facilitate quick and accurate data retrieval, saving time and resources. Data preservation is another crucial aspect of eDiscovery. Proper preservation techniques ensure the authenticity and reliability of data, preventing any potential alteration or loss. In addition, eDiscovery platforms must support various data formats and integrate with other systems, such as email servers and document management systems.

- In conclusion, eDiscovery platforms play a vital role in managing and securing electronically stored information. Effective data security protocols, data deduplication and collection methods, native file processing, document review software, data preservation, image processing, and advanced search filters are essential features of a robust eDiscovery solution. By investing in a comprehensive eDiscovery platform, businesses can mitigate the risks associated with information governance and ensure regulatory compliance.

Exclusive Customer Landscape

The ediscovery software market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ediscovery software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ediscovery software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alphabet Inc. - This company specializes in data retention and eDiscovery solutions for Google Workspace.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphabet Inc.

- CloudNine

- Commvault Systems Inc.

- Conduent Inc.

- CS Disco Inc

- Deloitte Touche Tohmatsu Ltd.

- Epiq Systems Inc.

- Everlaw Inc.

- Exterro Inc.

- FTI Consulting Inc.

- International Business Machines Corp.

- Ipro Tech LLC

- KLDiscovery Inc.

- Logik Systems Inc.

- Microsoft Corp.

- Nuix Pty Ltd.

- OpenText Corp.

- Relativity Global LLC

- Veritas Technologies LLC

- Xerox Holdings Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in EDiscovery Software Market

- In January 2024, Relativity, a leading eDiscovery software provider, announced the launch of RelativityOne GX, an advanced eDiscovery platform designed for government agencies and regulated industries. This new solution offers enhanced security features and scalability to manage large volumes of data (Relativity Press Release, 2024).

- In March 2024, OpenText, a global enterprise information management company, acquired Recommind, a pioneer in machine learning and artificial intelligence for eDiscovery. This strategic acquisition aimed to strengthen OpenText's eDiscovery offerings and expand its market presence (OpenText Press Release, 2024).

- In May 2024, IBM announced a significant partnership with Microsoft to integrate IBM's Watson Discovery and Microsoft's Azure platform for eDiscovery. This collaboration enables clients to leverage Watson's AI capabilities within Azure for more efficient and accurate eDiscovery processes (IBM Press Release, 2024).

- In February 2025, Kroll Ontrack, a leading data recovery, ediscovery, and information management company, secured a USD 50 million investment from Blackstone Growth. This funding will support Kroll Ontrack's continued growth and expansion in the eDiscovery market (Blackstone Press Release, 2025).

Research Analyst Overview

- In the market, audit trails play a crucial role in ensuring the integrity and accountability of data processing. The technology stack of leading eDiscovery solutions encompasses access controls, version control, and data mapping to manage and secure large volumes of data. Processing efficiency is a significant market trend, with advanced technology enabling faster data processing speeds and lower costs. Data encryption, role-based permissions, and integration capabilities are essential features for maintaining data security and facilitating seamless collaboration between team members. Legal holds, data backup, and data culling are critical functions for managing retention policies and reducing storage costs.

- A case management system, reporting features, and performance metrics enable effective tracking of discovery projects and ensuring a favorable cost-benefit ratio. Discovery rules and retention policies are essential for ensuring compliance with regulatory requirements. Storage capacity, workflow automation, and processing costs continue to be key areas of competition among eDiscovery companies. User interface design, disaster recovery, and processing throughput are also essential factors for improving review efficiency and overall user experience. Data security features, such as role-based permissions and data encryption, are increasingly important as organizations face growing threats from cyber attacks and data breaches.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled eDiscovery Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.7% |

|

Market growth 2024-2028 |

USD 13574.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

13.76 |

|

Key countries |

US, China, Germany, Canada, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this eDiscovery Software Market Research and Growth Report?

- CAGR of the eDiscovery Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ediscovery software market growth of industry companies

We can help! Our analysts can customize this ediscovery software market research report to meet your requirements.