Egg Tray Market Size 2024-2028

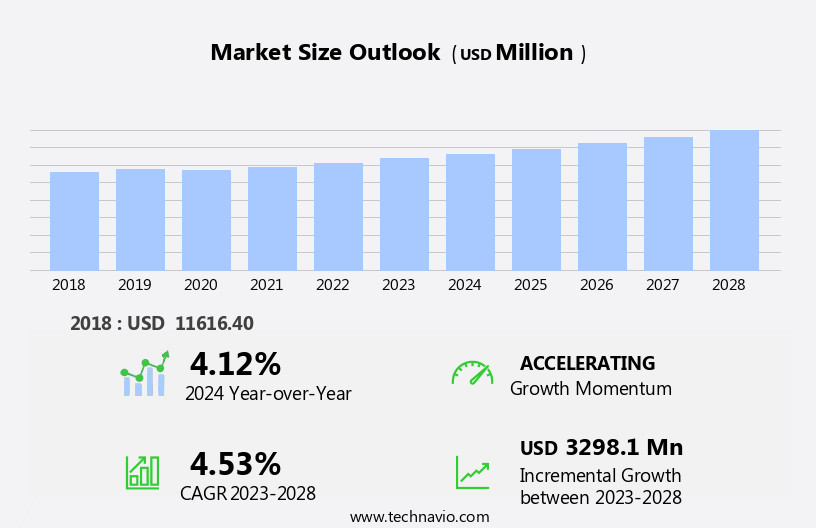

The egg tray market size is forecast to increase by USD 3.3 billion at a CAGR of 4.53% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increased production of eggs and the adoption of advanced packaging solutions. Producers are leveraging digital printing technology to create aesthetically appealing trays, catering to consumer preferences for visually appealing products. However, the egg industry faces health hazards, such as Salmonella contamination, which necessitates stringent regulatory compliance. These regulatory hurdles impact adoption, requiring egg producers to invest in costly safety measures. Moreover, supply chain inconsistencies, including fluctuations in egg supply and demand, temper growth potential.

- To capitalize on market opportunities, companies must prioritize food safety and supply chain resilience, while also focusing on innovative packaging designs to differentiate their offerings. Effective navigation of these challenges will enable businesses to thrive in the dynamic the market.

What will be the Size of the Egg Tray Market during the forecast period?

- The market in the US is experiencing significant growth, driven by the modernization of poultry farms and shifting customer attitudes towards nutritious food and sustainable packaging. Poultry businesses are increasingly utilizing paper egg trays, made from paper pulp and moulded fiber, due to their hygroscopic ability and smooth finish. These trays offer superior air permeability and lightweight properties, making them ideal for transportation. Environmental concerns have also influenced the market, with a growing preference for recycled paper and moulded fiber packaging. The market caters to various egg products, including medium eggs, liquid egg products, and frozen egg products.

- Customer demand for sanitary and sustainable packaging solutions has led to the adoption of paper egg trays in online grocery shopping. The market is also witnessing increased usage in agriculture, particularly for farm-fresh eggs. Plastic egg trays, while durable, face competition from paper trays due to their environmental impact. The market dynamics are further influenced by the physical properties and barrier properties of packaging materials, which are crucial for maintaining food safety and branding. Farmers and poultry businesses are increasingly turning to paper egg trays as a cost-effective and eco-friendly alternative to plastic trays.

- The market is expected to continue its growth trajectory, with cavities and durability remaining key considerations for companies.

How is this Egg Tray Industry segmented?

The egg tray industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Material

- Plastic

- Paper

- Geography

- North America

- US

- Mexico

- APAC

- China

- India

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

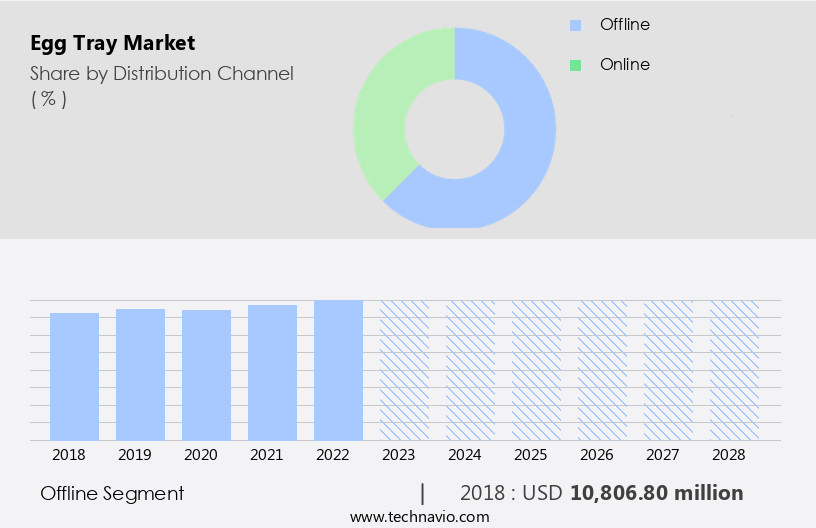

The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses various segments, including dried egg products, large and small eggs, and liquid, frozen, and foam egg products. Population growth and increasing health awareness have driven the consumption of eggs, leading to a significant demand for egg trays. Poultry businesses are a major consumer of egg trays, with farmers utilizing paperboard trays for transporting eggs from farms to processing plants. The market is witnessing a shift towards recyclable and environmentally friendly materials, such as recycled paper and paper pulp, in the production of egg trays. Convenience and lightweight properties are essential factors influencing the preference for egg trays in the retail supply chain.

However, issues like egg breakage and dampness remain challenges. Manufacturing techniques, such as injection molding and blow molding, are used to produce plastic egg trays, while product design focuses on air permeability and barrier properties to maintain egg freshness. Logistics and supply chain considerations play a crucial role in the market, with companies striving for modernization and waste reduction through efficient transportation and recycled materials. Regulatory compliance and safety standards are essential in the production and distribution of egg trays. Consumer tastes and dietary trends favor nutritious food, leading to the growth of specialty cartons and customized packaging solutions. The chicken industry's expansion and e-commerce platforms have contributed to the market's growth.

Molded pulp and moulded fiber packaging are gaining popularity due to their biodegradable and sustainable properties. The market faces challenges in regulatory compliance and customization difficulties, but innovations in product design and material science are addressing these concerns. In conclusion, the market is witnessing significant growth due to population growth, health awareness, and the expanding retail and poultry industries. The market is evolving to meet consumer preferences for convenience, lightweight, and environmentally friendly packaging, while addressing challenges like egg breakage and dampness through advanced manufacturing techniques and materials.

The Offline segment was valued at USD 10.81 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

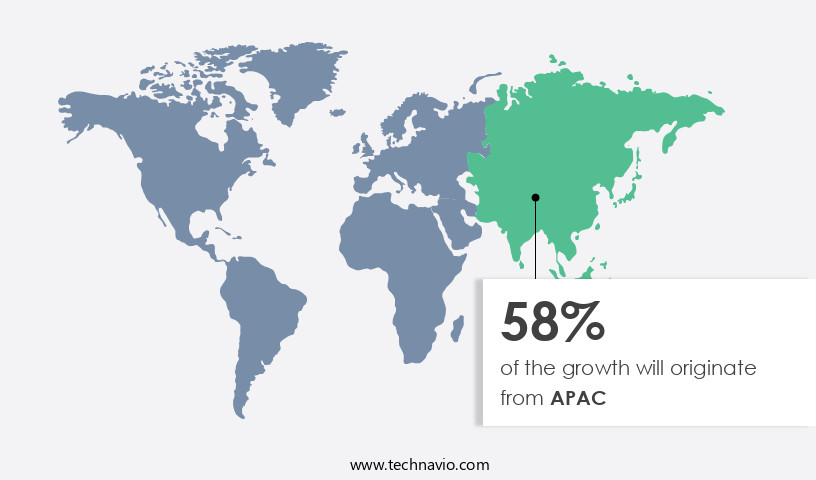

APAC is estimated to contribute 58% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, driven by population growth in Asia Pacific (APAC), where over 60% of the world's population resides. This demographic trend, coupled with the region's rising consumption of nutritious, protein-rich eggs, fuels the demand for egg trays. APAC is home to both established multinational players and local companies, leading to a competitive landscape that fosters innovation in manufacturing techniques and product design. Egg trays come in various forms, including paperboard, plastic, and molded fiber, each offering unique advantages. Paperboard trays are recyclable, lightweight, and biodegradable, making them an environmentally friendly choice. Plastic trays, while durable, face criticism for contributing to plastic waste.

Molded fiber trays, made from recycled paper pulp, offer a sustainable alternative. Consumer preferences lean towards convenience and hygiene, leading to the popularity of disposable egg trays and sanitary packaging. Logistics and transportation considerations also influence the choice of packaging materials. For instance, lightweight and air permeable trays facilitate easier shipping and storage. The poultry industry's modernization and regulatory compliance further propel the market forward. Farmers and producers must adhere to strict hygiene standards, necessitating the use of food-safe packaging materials. Moreover, dietary trends and health awareness influence consumer tastes, driving demand for organic, free-range eggs and correspondingly, specialized egg cartons.

Egg tray manufacturers employ various techniques to cater to diverse customer needs. For example, they create customized designs for branding purposes or to accommodate different egg sizes, such as large, medium, or small. Additionally, e-commerce platforms and online grocery shopping contribute to the market's growth. Despite these opportunities, challenges persist, including customization difficulties and regulatory compliance. Cavities in trays may lead to egg breakage, necessitating continuous improvements in product design and manufacturing processes. Labeling requirements and safety standards further add complexity to the supply chain. In conclusion, the market is a dynamic and evolving landscape, shaped by population growth, consumer preferences, and industry trends.

Players must navigate this complex environment, balancing sustainability, innovation, and regulatory compliance to meet the diverse needs of their customers.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Egg Tray market drivers leading to the rise in the adoption of Industry?

- The significant expansion in egg production serves as the primary catalyst for market growth.

- The market experiences significant growth due to increasing population and rising consumer income, leading to higher demand for nutritious food such as eggs. This trend is particularly noticeable in developing countries like China, India, and Japan, where per capita egg consumption hovers around 3. The preference for convenience and lightweight packaging, coupled with the growing trend towards using recyclable materials, has resulted in the widespread use of paperboard trays and specialty cartons. Manufacturing techniques have evolved to ensure egg trays possess desirable physical properties, such as air permeability and resistance to dampness, to maintain egg freshness.

- Dried egg products have also gained popularity due to their extended shelf life and ease of use. Logistics and efficient distribution systems are crucial to ensure the timely delivery of these products to consumers. Overall, the market is driven by population growth, changing consumption patterns, and the need for convenient, nutritious food solutions.

What are the Egg Tray market trends shaping the Industry?

- The use of digital printing and aesthetically appealing packaging is currently a significant trend in the market. This approach combines advanced technology with visually appealing designs to create engaging and high-quality products.

- The market is witnessing significant advancements, with a growing emphasis on using environmentally friendly materials in packaging solutions. Farmers and packaging material suppliers are increasingly turning to biodegradable materials such as recycled paper, paper pulp, and paperboard/cardboard for producing disposable egg trays. This shift is driven by consumer tastes leaning towards healthier and more sustainable options, as well as increasing health awareness and safety standards. Digital printing technology is playing a crucial role in the egg packaging industry, enabling clear and accurate labeling, inventory management, and customization. The durability of the packaging material is essential to ensure safety during shipping and storage, as well as to withstand various weather conditions.

- The use of recycled materials in egg trays is another trend gaining traction, as it contributes to reducing plastic waste and modernizing the supply chain. In conclusion, the market is undergoing modernization, with a focus on digital printing, environmentally friendly materials, and recycled materials. This approach not only meets the demands of health-conscious consumers but also aligns with government regulations and the global push towards sustainability.

How does Egg Tray market faces challenges face during its growth?

- The egg industry faces significant challenges from health hazards, which pose a threat to its growth and expansion. These risks, which can include salmonella outbreaks and other food safety concerns, must be carefully managed to maintain consumer trust and ensure the industry's continued success.

- The market in the Retail Supply Chain is influenced by various dynamics within the Chicken Industry. Avian influenza, also known as bird flu, poses a significant risk to egg production due to its impact on poultry farms. This viral disease, which affects birds, can spread rapidly among chickens kept in confined spaces. Since 2015, over 40 million birds have been affected by bird flu, with countries like China, Cambodia, Lao PDR, and Vietnam still experiencing outbreaks. When bird flu strikes, culling becomes necessary to prevent further spread. In response to hygiene standards and regulatory compliance, the egg industry has shifted towards more sustainable packaging solutions like Moulded Pulp and Moulded Fiber Packaging.

- These alternatives to plastic and cardboard trays offer advantages such as waste reduction and better protection for small eggs. Customization difficulties and cavities are challenges that manufacturers face when transitioning to these materials. Proper labeling and light-resistance are crucial factors to consider for these trays in the eCommerce sector. Transportation and logistics also play a vital role in ensuring the freshness and safety of eggs during distribution.

Exclusive Customer Landscape

The egg tray market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the egg tray market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, egg tray market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Al Ghadeer Group - The company specializes in innovative sports solutions, delivering high-quality products that cater to diverse athlete needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Al Ghadeer Group

- Brodrene Hartmann AS

- BWAY Corp.

- Cascades Inc.

- CDL SAS

- D and W Fine Pack

- DFM Packaging Solutions

- Dispak Ltd.

- Europak s.r.o.

- GI OVO BV

- Huhtamaki Oyj

- KSP Fibre Products Pvt. Ltd.

- Maspack Ltd.

- Ovotherm International Handels GmbH

- Pacific Pulp Molding Inc.

- Pactiv Evergreen Inc.

- Primapack

- S.K. Agro Foodtech Pvt. Ltd.

- Tekni Plex Inc.

- Teo Seng Capital Berhad

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Egg Tray Market

- In February 2024, Danish egg packaging manufacturer, OvaEgg, introduced a new line of recycled plastic egg trays, marking a significant stride towards sustainable agriculture and reducing plastic waste in the egg industry (OvaEgg Press Release). In May 2024, US-based egg producer, Cal-Maine Foods, partnered with automated grading and packaging solutions provider, Moba, to streamline their production processes and enhance their product offerings, aiming to increase their market share (Cal-Maine Foods SEC Filing).

- In January 2025, Dutch egg packaging company, Kip-Pak, announced a major investment of â¬15 million in a new production facility in Poland, expanding their geographic reach and catering to the growing demand for egg packaging solutions in Eastern Europe (Kip-Pak Press Release). In March 2025, the European Union approved new regulations on egg packaging, mandating the use of biodegradable materials for all egg cartons by 2028, a move that is expected to significantly impact the market and drive innovation in sustainable packaging solutions (European Commission Press Release).

Research Analyst Overview

The market experiences ongoing dynamics and evolving patterns, driven by various factors that shape the industry's landscape. Population growth and the resulting increase in demand for nutritious food sources have fueled the consumption of eggs, leading to a surge in the production and distribution of these versatile food items. One trend gaining traction in the market is the use of dried egg products and the shift towards more sustainable packaging solutions. Dried egg products offer extended shelf life and reduced transportation costs, making them an attractive option for poultry businesses and consumers alike. Moreover, the growing awareness of environmental concerns has led to the adoption of recyclable materials, such as paperboard, in the manufacturing of egg trays.

Convenience and lightweight design are essential factors influencing the market. Consumers increasingly demand packaging that is easy to handle and transport, while farmers and retailers require packaging that can withstand the rigors of the supply chain. The physical properties of egg trays, including air permeability and dampness resistance, play a crucial role in ensuring the safety and quality of eggs during transportation and storage. The market encompasses a diverse range of products, from standard/regular cartons to specialty designs, catering to various consumer preferences and needs. Plastic egg trays have long been a popular choice due to their durability and ease of use, but concerns over plastic waste and environmental impact have led to the emergence of alternative materials, such as biodegradable paper and molded fiber.

Product design and customization are essential considerations in the market. Farmers and retailers require packaging that meets specific requirements, such as hygiene standards, regulatory compliance, and branding considerations. E-commerce and online grocery shopping have further complicated the landscape, necessitating packaging solutions that can withstand the rigors of transportation and meet the demands of various retailers and consumers. The market is not without its challenges. Issues such as egg breakage, cavities, and labeling requirements can impact the quality and safety of eggs, while the use of raw materials and manufacturing techniques can impact the cost and sustainability of egg trays.

Additionally, the shift towards more sustainable packaging solutions presents challenges in terms of customization difficulties and the need for regulatory compliance. Despite these challenges, the market continues to evolve, driven by factors such as health awareness, consumer tastes, and modernization. The global poultry industry's ongoing growth and the increasing demand for sustainable packaging solutions are expected to fuel the market's expansion in the coming years. As the industry adapts to these trends, it will be essential for egg tray manufacturers to remain agile and responsive to meet the evolving needs of consumers and stakeholders alike.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Egg Tray Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.53% |

|

Market growth 2024-2028 |

USD 3298.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.12 |

|

Key countries |

China, US, India, Mexico, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Egg Tray Market Research and Growth Report?

- CAGR of the Egg Tray industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the egg tray market growth of industry companies

We can help! Our analysts can customize this egg tray market research report to meet your requirements.