Electrical Bushing Market Size 2024-2028

The electrical bushing market size is forecast to increase by USD 822.5 million at a CAGR of 5.22% between 2023 and 2028. The market is experiencing significant growth due to several key drivers. The modernization of existing power transformers in the utility segment is a major factor fueling market expansion. Additionally, the increasing investment in renewable energy sources, such as wind and solar power generation units, is driving demand for electrical bushings in the OIP (Onload Tap Changer) segment. Furthermore, new regulations mandating the replacement of old power transformers due to safety concerns and rising electricity consumption in commercial establishments are increasing the cost of power transformers, thereby boosting the market. Shunt reactors, another application area for electrical bushings, are also witnessing increased adoption due to their ability to improve power factor and enhance system stability.

The Electrical Bushing Market is a significant sector in the power industry, providing essential insulation components for various electrical equipment. These components play a vital role in ensuring the efficient and safe operation of electrical systems, particularly in transformers and switchgears. Two primary types of electrical bushings dominate the market: oil impregnated paper (OIP) and resin impregnated paper (RIP). OIP bushings are coated with insulating oil, which provides excellent insulation properties and moisture resistance. In contrast, RIP bushings are coated with a resin material, offering superior electrical performance and resistance to thermal aging. Transformers and switchgears are the primary applications for electrical bushings. Transformers are crucial in the power grid structure, facilitating the efficient conversion of electrical power from one voltage level to another. Switchgears, on the other hand, protect electrical circuits from overcurrent and faults.

Additionally, power demand continues to grow, driven by the expansion of the grid structure, railway systems, smart grids, and the renewable sector. The increasing adoption of renewable energy sources, such as wind and solar, necessitates the installation of power generation units and electrical networks to transport and distribute electricity. Commercial establishments, utility segments, and the electricity industry are significant consumers of electrical bushings. Shunt reactors and power capacitors, which are essential components in power systems, also require electrical bushings for insulation. The electrical network expenditure is a significant factor driving the growth of the electrical bushings market. The increasing investment in grid infrastructure and upgrades, particularly in developing countries, is expected to boost demand for electrical bushings. The renewable sector is another key market for electrical bushings, particularly in the medium voltage range.

Further, renewable energy sources, such as wind and solar, require electrical bushings for transformer and switchgear applications. SF6 and hybrid insulation systems are emerging trends in the electrical bushings market. SF6 is a gas insulation medium that offers higher voltage levels and improved electrical performance. Hybrid insulation systems combine both oil and resin impregnated materials to provide enhanced insulation properties. Insulation materials, such as porcelain and polymeric, are used in the production of electrical bushings. Porcelain provides excellent electrical insulation properties and is widely used in high voltage applications. Polymeric materials offer flexibility, ease of installation, and cost-effectiveness. In conclusion, the electrical bushings market plays a crucial role in the power industry by providing insulation solutions for transformers and switchgears. The growing power demand, investment in grid infrastructure, and the adoption of renewable energy sources are expected to drive the market's growth.

Market Segmentation

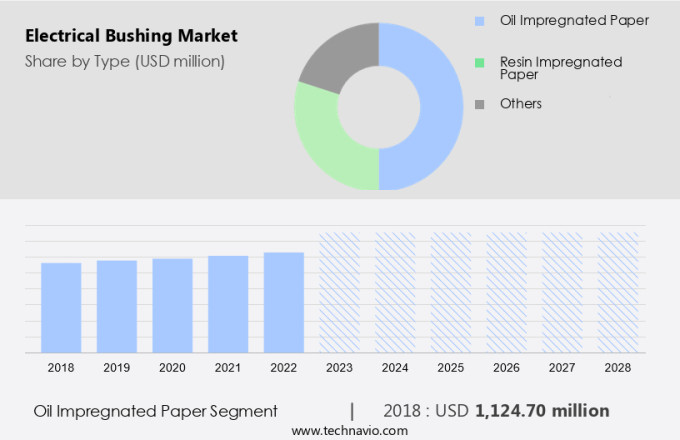

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Oil impregnated paper (OIP)

- Resin impregnated paper (RIP)

- Others

- Application

- Transformer

- Switchgear

- Others

- Geography

- Europe

- Germany

- APAC

- China

- India

- Japan

- North America

- US

- Middle East and Africa

- South America

- Europe

By Type Insights

The oil impregnated paper (OIP) segment is estimated to witness significant growth during the forecast period. In the realm of high-voltage power systems, Oil Impregnated Paper (OIP) bushings are the preferred choice due to their effectiveness in insulation. These bushings are manufactured by winding untreated kraft paper with conduction inserts around a central tube. The electric field is controlled by strategically placing aluminum layers at precise axial and radial positions within the conductive inserts. The condenser insulation undergoes a process of impregnation with mineral oil, enhancing the bushing's dielectric strength.

Furthermore, mineral oil, a common component in power transformers and switchgear is typically used for this purpose. The dominance of OIP bushings is evident in the global market, with approximately 75% of installed bushings adopting this design. This percentage is notably higher in countries like China and the USA. The oil-impregnated paper design is increasingly popular in substation transformer applications worldwide.

Get a glance at the market share of various segments Request Free Sample

The oil impregnated paper segment accounted for USD 1.12 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

Europe is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is witnessing substantial growth due to the expanding transmission and distribution (T&D) infrastructure, particularly in Asia Pacific (APAC). Countries such as China, India, Vietnam, Thailand, and the Philippines are experiencing a wave in urban population and industrial growth, leading to a heightened demand for electric power. Consequently, there is an increasing need for installing and expanding T&D equipment, including power and distribution transformers, within the existing grid to cater to the expanding network. Key applications for electrical bushings include circuit breakers, generators, reactors, and wall applications. In addition, the utilities sector, railways and metro systems, renewable energy, and aging power systems are significant end-users.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Modernization of existing transformers is the key driver of the market. The market is experiencing growth due to several factors. The aging grid infrastructure necessitates the installation of new transformers and the replacement of old ones, as many networks struggle to meet the escalating energy demand. Moisture ingress and broken tap connections pose significant challenges, increasing the risk of electrical flashovers and corrosive sulfur intrusion.

Lightning strikes can also cause broken connections, leading to power outages and potential damage to equipment. Regulatory reforms, such as those in India under the Accelerated Power Development and Reform Programme (APDRP), aim to reduce power losses and modernize electrical networks. These initiatives are driving market expansion. The need to upgrade and expand existing infrastructure to meet the increasing power demand is a primary growth factor.

Market Trends

Increasing investment in renewable energy sources is the upcoming trend in the market. The shift towards renewable energy sources is gaining momentum worldwide due to increasing awareness of the depleting fossil fuel resources and stringent carbon emission regulations. Renewable energy capacity, particularly in wind and solar, is anticipated to expand significantly in the coming years. Further, porcelain and polymeric bushings are commonly used in high voltage applications due to their excellent insulation properties. Industrial applications, particularly in the power generation sector, are increasingly adopting renewable energy sources to meet their energy demands.

Additionally, power capacitors are essential in these applications to maintain voltage stability and improve power factor correction. As the renewable energy market continues to grow, the demand for power capacitors is expected to increase, providing significant opportunities for manufacturers and suppliers.

Market Challenge

New regulations increase cost of power transformers is a key challenge affecting the market growth. The market in both Europe and the US has been subjected to increasingly strict regulations regarding energy efficiency in power transformers. In the US, the Department of Energy (DOE) implemented regulations for low-voltage dry-type power transformers in 2007, requiring manufacturers to meet the NEMA TP-1 minimum energy efficiency standard. This standard was revised in 2016 with new efficiency requirements. .

Additionally, the utility segment and commercial establishments are significant consumers of electricity, with power consumption increasing due to the integration of renewable energy sources and the operation of power generation units. Shunt reactors are employed to improve power quality and stability in electrical systems. The OIP segment is also growing as industries seek to optimize their electrical infrastructure and reduce energy losses. The market is expected to expand due to these factors.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ABB Ltd.: The company offers electrical bushing such as Condenser type O plus C.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALMACENES CORONA SAS

- Alutronic Kuhlkorper GmbH and Co. KG.

- Bharat Heavy Electricals Ltd.

- CG Power and Industrial Solutions Ltd.

- Eaton Corp. Plc

- Elliott Industries Inc.

- General Electric Co.

- GIPRO GmbH

- HSP Hochspannungsgerate GmbH

- Maschinenfabrik Reinhausen GmbH

- Megger Ltd.

- Nanjing Rainbow Electric Co., Ltd.

- Nexans SA

- Preis GmbH

- Radiant Enterprises

- Siemens AG

- Toshiba Corp.

- Webster Wilkinson Ltd.

- Weidmann Holding AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing power demand and the expansion of the grid structure. Transformers and switchgears are the primary consumers of electrical bushings in power infrastructure development. The transformer sub-sector is expected to dominate the market, given the large number of transformers used in the power generation sector. The use of oil impregnated paper and resin impregnated paper bushings in transformers and switchgears is prevalent. However, the shift towards resin bonded paper, resin impregnated synthetic, SF6, hybrid, and other advanced materials is gaining traction due to their superior insulation properties and ability to withstand high voltage and current.

Further, the renewable energy sector is another significant market for electrical bushings, with wind and solar power generation units requiring large numbers of bushings. Smart grids and renewable energy sources are expected to drive the market growth in the coming years. Railways and metro systems, utilities, and commercial establishments are other major consumers of electrical bushings. Aging power systems, moisture ingress, lightning strikes, broken connections, electrical flashover, corrosive sulfur, and broken tap connections are some of the challenges driving the demand for electrical bushings in the power infrastructure sector. Regulatory reforms and grid infrastructure development are also expected to boost the market growth. The medium voltage, voltage, extra high voltage, and industrial segments are expected to offer significant opportunities for electrical bushing manufacturers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.22% |

|

Market growth 2024-2028 |

USD 822.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.32 |

|

Regional analysis |

Europe, APAC, North America, Middle East and Africa, and South America |

|

Performing market contribution |

Europe at 32% |

|

Key countries |

US, China, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ABB Ltd., ALMACENES CORONA SAS, Alutronic Kuhlkorper GmbH and Co. KG. , Bharat Heavy Electricals Ltd., CG Power and Industrial Solutions Ltd., Eaton Corp. Plc, Elliott Industries Inc., General Electric Co., GIPRO GmbH, HSP Hochspannungsgerate GmbH, Maschinenfabrik Reinhausen GmbH, Megger Ltd., Nanjing Rainbow Electric Co., Ltd., Nexans SA, Preis GmbH, Radiant Enterprises, Siemens AG, Toshiba Corp., Webster Wilkinson Ltd., and Weidmann Holding AG |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch