India Elevator And Escalator Market Size 2025-2029

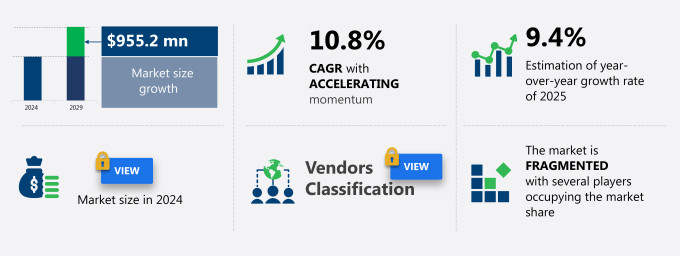

The elevator and escalator market in India size is forecast to increase by USD 955.2 million at a CAGR of 10.8% between 2024 and 2029.

- The elevator and escalator market is witnessing significant growth due to several key trends. The increasing number of high-speed metro projects worldwide is driving market growth, as elevators and escalators are essential components of these infrastructure developments. The integration of IoT and AI in vertical transportation systems is a significant trend, enabling predictive maintenance and optimizing energy consumption. Additionally, the rising demand for customization in elevators, including personalized features and designs, is another trend boosting market growth. These customizations can include size, design, structure, and cabin features such as walls, lighting, and floors. However, the high cost of repair and maintenance poses a challenge to market growth. Manufacturers are addressing this challenge by offering preventive maintenance services and energy-efficient solutions to reduce long-term costs for customers. Overall, the elevator and escalator market is expected to continue its growth trajectory, driven by these trends and the increasing demand for efficient and customized vertical transportation solutions.

What will be the Size of the market During the Forecast Period?

- The elevator and escalator market In the United States is experiencing strong growth, driven by the construction of high-rise buildings and infrastructure development in urban areas. With a focus on sustainable urban spaces, building owners are investing in vertical conveyance systems to enhance the functionality and efficiency of commercial buildings. The market is witnessing a growth in retrofitting projects to modernize existing vertical transportation solutions, ensuring compliance with building codes and enhancing safety features. Online shopping and the rise of smart cities are also fueling demand for advanced vertical transportation solutions.

- However, concerns over injuries, fatalities, and unsafe practices persist, emphasizing the importance of adhering to industry standards and ensuring the use of non-compliant products is minimized. The residential and commercial industries remain key sectors, with a growing emphasis on creating safe and efficient vertical transportation systems for their customers and tenants.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Elevator

- Escalator

- End-user

- Residential

- Non-residential

- Geography

- India

By Product Insights

- The elevator segment is estimated to witness significant growth during the forecast period.

The Indian elevator and escalator market is experiencing significant growth due to technological innovations In the sector. companies such as KONE, ThyssenKrupp, and Schindler are leading this transformation with energy-efficient and cost-effective solutions. KONE's digitally connected elevators, a first in India, represent this advancement. While low-rise buildings under 35 meters primarily use hydraulic technology due to lower maintenance costs, modern technologies like destination control systems, predictive maintenance, cloud-based monitoring, customized systems, access control systems, IT hubs, industrial hubs, tech companies, office spaces, commercial complexes, public spaces, transportation hubs, and residential spaces are increasingly popular for their efficiency and sustainability. IoT connectivity is a key driver, enabling remote monitoring and maintenance, reducing downtime, and enhancing user experience.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our India Elevator And Escalator Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of India Elevator And Escalator Market?

Growing number of high-speed metro projects is the key driver of the market.

- In the context of India's urban development, high-rise construction has gained significant momentum, leading to an increased demand for vertical transportation systems such as elevators and escalators. The construction of multi-story residential buildings, commercial buildings, and infrastructure development projects in both tier-1 and tier-2 cities have fueled this demand. Building owners are increasingly focusing on retrofitting projects to modernize their structures with sustainable urban spaces, adhering to building codes and regulations. In smaller cities, the implementation of smart systems, including energy savings, destination control systems, predictive maintenance, cloud-based monitoring, and customized systems, is becoming increasingly popular. The IT hubs, industrial hubs, tech companies, office spaces, commercial complexes, public spaces, transportation hubs, and various sectors such as hospitals, educational institutions, and the tourism industry, are all investing in vertical conveyance systems to enhance urban mobility and cater to the needs of residents.

- Moreover, the integration of IoT connectivity, AI, and automation in elevators and escalators is a growing trend, with a focus on touchless controls, high-speed elevators, and high-capacity elevators for industrial settings. Green building projects, eco-friendly materials, and sustainability goals are also key considerations for building automation systems. The passenger segment, hospitality sector, airports, train stations, and bus terminals are all major contributors to the vertical transportation market in urban areas. However, safety concerns, including injuries and fatalities due to unsafe practices and faulty designs, remain a significant challenge. The implementation of smart elevators and vertical transport systems that prioritize safety features, such as energy efficiency, elevator traffic flow, and access control systems, is crucial in addressing these concerns. Urban areas continue to face the challenge of ensuring safe and efficient vertical transportation systems as the demand for high-rise structures, or 'housing for all,' increases. The new installation segment for offices, malls, residential apartments, hotels, retail establishments, leisure parks, and other commercial spaces is expected to witness significant growth In the coming years.

What are the market trends shaping the India Elevator And Escalator Market?

Rising demand for customization in elevators is the upcoming trend In the market.

- The Elevator and Escalator Market is witnessing significant growth due to the increasing demand for vertical transportation systems in high-rise construction projects and sustainable urban spaces. High-rise buildings, multi-story residential buildings, commercial buildings, and infrastructure development initiatives are driving the market's expansion. Building owners are investing in retrofitting projects to modernize their structures with smart systems, energy savings, and improved safety features. Customization is a key trend In the market, with end-users demanding customized elevators based on their specific requirements. For instance, hospital elevators are designed for the transportation of patients, requiring large-capacity motors for speed and comfort, while emitting low noise levels for a quiet operation. The market is diverse, catering to various sectors, including IT hubs, industrial hubs, tech companies, office spaces, commercial complexes, public spaces, transportation hubs, and residential apartments.

- Additionally, energy efficiency, elevator traffic flow, and safety are major concerns for building automation systems, with smart elevators incorporating destination control systems, predictive maintenance, cloud-based monitoring, and touchless controls. The market encompasses high-speed and high-capacity elevators for industrial settings, as well as green building projects utilizing eco-friendly materials and green technologies. The market serves various industries, such as educational institutions, healthcare facilities, affordable housing, tourism industry, and the hospitality sector. Urban mobility and passenger safety are crucial considerations, with a focus on reducing injuries and fatalities caused by unsafe practices, faulty design, and accidents. Thus, the Elevator and Escalator Market is experiencing growth due to the increasing demand for vertical transportation systems in various industries and sectors. Customization, energy efficiency, safety, and smart technologies are driving the market's expansion, catering to the unique needs of end-users.

What challenges does India Elevator And Escalator Market face during the growth?

The high cost of repair and maintenance is a key challenge affecting the market growth.

- The market faces significant challenges due to the high operational costs and the need for continuous maintenance and monitoring. New installations of vertical transportation systems, including elevators and escalators, have an average lifespan of 20-30 years. However, issues such as machines getting stuck, call boxes malfunctioning, odd noises, and bumpy rides necessitate frequent maintenance and component replacements. These challenges are particularly prevalent in high-rise buildings, multi-story residential complexes, commercial structures, and infrastructure development projects. In response to these challenges, there is a growing trend towards modernization and retrofitting of existing buildings with smart systems. Sustainable urban spaces are becoming a priority, with a focus on energy savings, destination control systems, predictive maintenance, and cloud-based monitoring. Customized systems, access control systems, and IoT connectivity are also gaining popularity. Building owners are increasingly investing in smart elevators and escalators to improve urban mobility, enhance safety features, and meet building codes. The hospitality sector, tech companies, industrial hubs, and transportation hubs are leading the way in adopting these technologies.

- Additionally, green building projects, educational institutions, healthcare facilities, and affordable housing are also embracing smart vertical transportation systems. In the context of India's urbanization and infrastructure development, the demand for high-speed and high-capacity elevators and escalators is on the rise. Building automation systems, category-wise insights, and touchless controls are becoming essential components of modern vertical transportation systems. The passenger segment, including residents, office workers, and tourists, is driving the demand for safer, more efficient, and eco-friendly vertical transportation systems. Despite these advancements, safety remains a concern. Unsafe practices, faulty designs, and accidents continue to pose risks. Smart elevators and escalators, with their advanced safety features and automation capabilities, are helping to address these concerns. The integration of AI and IoT technologies is enabling real-time monitoring, predictive maintenance, and energy efficiency.

- Thus, the market is undergoing a significant transformation, driven by the need for modernization, energy savings, and safety. The adoption of smart systems, green technologies, and eco-friendly materials is shaping the future of vertical transportation in India's urban areas. The challenges of high operational costs and maintenance requirements are being addressed through innovative solutions that prioritize sustainability, accessibility, and affordability.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

Beacon Elevator Co. Pvt. Ltd.: The company offers elevator and escalator solutions such as Dam Elevators. Also, this segment focuses on producing vertical motion elevator technology.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Beacon Elevator Co. Pvt. Ltd.

- Blue Star Elevators India Ltd.

- City lift India Ltd.

- Easa Elevators Pvt. Ltd.

- ESCON Elevators Pvt. Ltd.

- Express Lifts Ltd.

- Fujitec Co. Ltd.

- Grj Elevator Pvt. Ltd.

- Hitachi Ltd.

- Johnson Lifts Pvt. Ltd.

- Kinetic Hyundai Elevator and Movement Technologies Ltd.

- KONE Corp.

- Mitsubishi Electric Corp.

- Otis Worldwide Corp.

- RP Bidyut Elevator

- Schindler Holding Ltd.

- SEPL India Ltd.

- thyssenkrupp AG

- Toshiba Corp.

- TRIO Elevators Co. India Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Vertical transportation systems play a crucial role In the development of sustainable urban spaces, particularly in high-rise buildings and infrastructure projects. These systems, which include elevators and escalators, facilitate efficient and convenient movement between floors, enabling the creation of multi-story residential buildings, commercial structures, and IT and industrial hubs. The demand for vertical transportation systems is driven by various factors, including the need for modernization and retrofitting of existing buildings to meet sustainable urban goals and building codes. In smaller cities, the construction of high-rise structures is on the rise, fueling the demand for these systems. Sustainability is a key consideration In the design and implementation of vertical transportation systems.

Additionally, green technologies, such as eco-friendly materials and energy savings features, are increasingly being incorporated into these systems. Smart systems, including destination control systems, predictive maintenance, and cloud-based monitoring, are also gaining popularity due to their ability to optimize energy usage and improve overall efficiency. Customized systems are another trend In the vertical transportation market. Access control systems, touchless controls, and automation are features that are increasingly being demanded by building owners and residents. These systems not only enhance the user experience but also provide added security and safety. The vertical transportation market is diverse, with applications ranging from high-rise construction projects and smart cities to IT hubs, industrial settings, and public spaces. The passenger segment, which includes offices, malls, hotels, retail establishments, and leisure parks, is a significant contributor to the market's growth. The hospitality sector, including hotels and resorts, also presents a significant opportunity for vertical transportation system providers. These establishments require high-speed and high-capacity elevators to cater to the needs of their guests. Airports, train stations, and bus terminals are other key verticals where vertical transportation systems are essential for efficient urban mobility.

However, despite the numerous benefits of vertical transportation systems, safety remains a critical concern. Unsafe practices, faulty design, and accidents can result in injuries and fatalities. Smart elevators and vertical transport systems that incorporate IoT connectivity and AI-powered predictive maintenance are helping to address these concerns, ensuring the safety and security of building occupants. Thus, the vertical transportation systems market is dynamic and diverse, driven by the need for sustainable urban spaces, modernization and retrofitting, and the demand for smart and efficient systems. Building codes, safety concerns, and the integration of green technologies and eco-friendly materials are key considerations for market participants. The market is expected to continue growing, driven by the increasing demand for high-rise structures and the need for efficient and sustainable vertical transportation solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.8% |

|

Market growth 2025-2029 |

USD 955.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.4 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across India

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch