Emerging Molecular Diagnostics Market Size 2025-2029

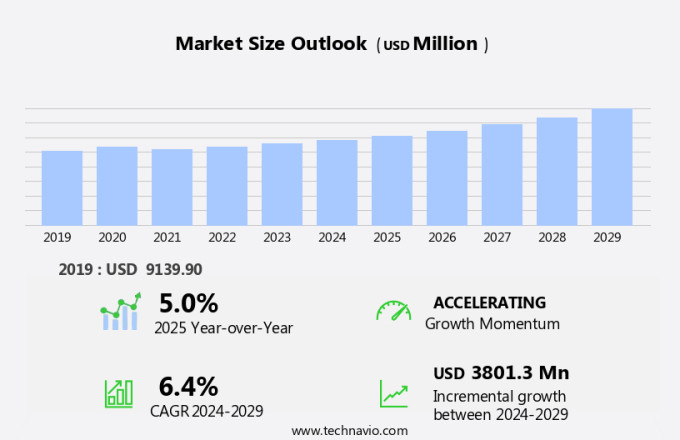

The emerging molecular diagnostics market size is forecast to increase by USD 3.8 billion, at a CAGR of 6.4% between 2024 and 2029.

- The market is driven by the prevalence of chronic diseases and the continuous launch of innovative diagnostic solutions. The increasing burden of chronic diseases worldwide necessitates early and accurate diagnosis, fueling market growth. Furthermore, the introduction of advanced molecular diagnostics, such as next-generation sequencing and liquid biopsy, offers enhanced diagnostic capabilities and improved patient outcomes. However, the high cost associated with molecular diagnostics poses a significant challenge for market expansion. These advanced diagnostic techniques often come with substantial investment requirements, limiting their accessibility to a broader patient population.

- To address this challenge, market participants are exploring cost-effective solutions, such as automation and standardization, to make molecular diagnostics more affordable and accessible to a wider range of healthcare providers and patients. Companies that successfully navigate this cost barrier while maintaining diagnostic accuracy and efficiency will gain a competitive edge in the market.

What will be the Size of the Emerging Molecular Diagnostics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Molecular diagnostics, a dynamic and evolving field, continues to redefine disease detection and management across various sectors. This market is characterized by continuous unfolding of new technologies and applications, with a focus on enhancing accuracy, speed, and accessibility. PCR testing and real-time PCR remain cornerstones of molecular diagnostics, driving early detection and enabling precise identification of genetic mutations. CE marking, a critical regulatory approval, ensures compliance with stringent quality standards, while oncology diagnostics and biomarker discovery offer new avenues for personalized treatment. Sample preparation and data analysis software are essential components, optimizing workflow and enabling big data analytics for predictive and prognostic diagnostics.

Point-of-care testing, a growing trend, offers convenience and quick turnaround times, while privacy concerns necessitate robust data security measures. Assay development, a continuous process, is fueled by advances in technologies like next-generation sequencing (NGS), microarray technology, and machine learning. Diagnostic kits and research institutions collaborate to bring these innovations to market, navigating complex regulatory landscapes and reimbursement policies. Molecular diagnostics also intersects with healthcare providers, influencing treatment optimization and disease monitoring through companion diagnostics, liquid biopsy, and imaging techniques. The market's dynamics continue to unfold, with emerging trends like digital PCR, home testing, and artificial intelligence (AI) shaping the future of this dynamic industry.

How is this Emerging Molecular Diagnostics Industry segmented?

The emerging molecular diagnostics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- PCR

- NGS

- Microarray technologies

- Others

- End-user

- Hospitals and clinics

- Diagnostics laboratories

- Others

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Technology Insights

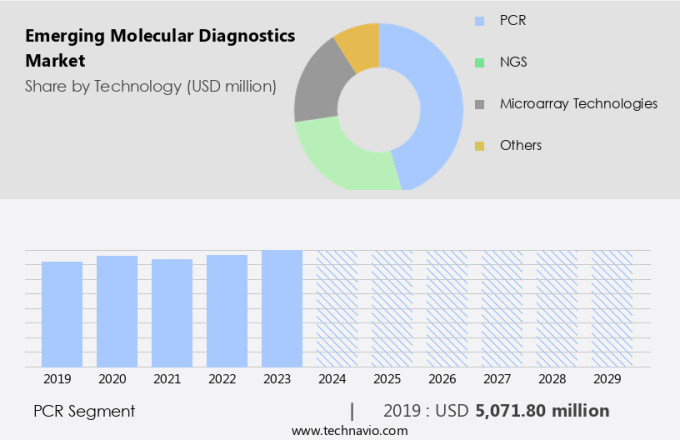

The pcr segment is estimated to witness significant growth during the forecast period.

The market is driven by the widespread adoption of polymerase chain reaction (PCR) technology, a crucial laboratory technique that amplifies specific DNA segments with high precision. PCR's versatility is evident in its applications, including the diagnosis of bacterial and viral infections, where its sensitivity and specificity enable rapid identification of pathogens for timely treatment. In the realm of genetic disorders, PCR plays a pivotal role in identifying mutations and abnormalities, facilitating early intervention and management through screening programs. Beyond PCR, other advanced technologies such as mass spectrometry, capillary electrophoresis, and next-generation sequencing (NGS) are revolutionizing molecular diagnostics. Mass spectrometry offers high-throughput screening capabilities, while capillary electrophoresis ensures accurate separation and identification of biomolecules.

NGS enables the analysis of an entire genome or transcriptome, opening new possibilities for biomarker discovery and personalized medicine. Data analysis software, quality control, and patent protection are essential components of the molecular diagnostics market. Data security is another critical concern, as the handling of sensitive patient information requires robust protection measures. Regulatory approvals, such as CE marking and FDA clearance, ensure the safety and efficacy of diagnostic platforms and kits. Diagnostic laboratories, healthcare providers, and research institutions are key stakeholders in the molecular diagnostics market. They rely on diagnostics to optimize treatment, monitor diseases, and facilitate clinical trials. Point-of-care diagnostics and home testing are gaining popularity due to their convenience and affordability.

The market is also witnessing the integration of artificial intelligence (AI) and machine learning algorithms for predictive diagnostics and assay development. These technologies streamline workflow optimization and improve turnaround time. Companion diagnostics, liquid biopsy, and prognostic diagnostics are other emerging trends in the molecular diagnostics market. Supply chain management and pricing strategies are crucial factors influencing market access and growth. Infectious disease diagnostics and oncology diagnostics are significant market segments, with a growing demand for early detection and accurate diagnosis. The market is expected to continue evolving, driven by advancements in technology, clinical validation, and regulatory policies.

The PCR segment was valued at USD 5.07 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

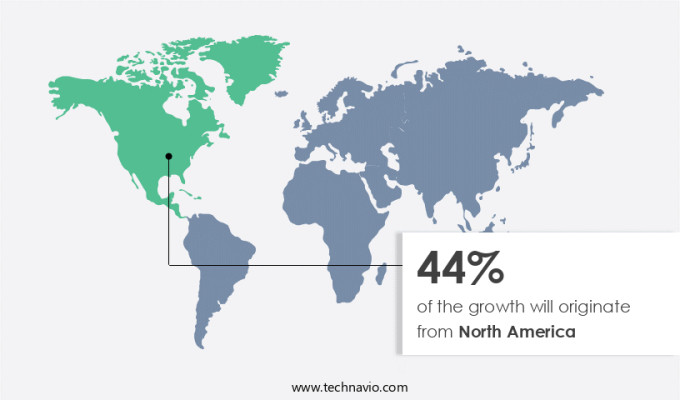

North America is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American molecular diagnostics market is experiencing significant growth due to demographic shifts, increased healthcare spending, and the implementation of advanced diagnostic technologies. The aging population in the United States, projected to reach 80 million by 2050, is a major driver for this market. This demographic trend increases the demand for sophisticated diagnostic tools to manage age-related diseases and conditions. Regulatory approvals for high-throughput screening, mobile diagnostics, and point-of-care tests expand market access and enhance patient care. Intellectual property protection, data security, and quality control are essential considerations for market participants. Healthcare providers are increasingly adopting molecular diagnostics for early detection and disease monitoring, particularly in oncology and infectious diseases.

Technologies such as capillary electrophoresis, mass spectrometry, and next-generation sequencing (NGS) are transforming diagnostics, enabling faster and more accurate results. Clinical validation and ce marking ensure diagnostic accuracy and regulatory compliance. Artificial intelligence (AI) and machine learning are revolutionizing diagnostics, with applications in biomarker discovery, assay development, and predictive analytics. Companion diagnostics and personalized medicine are gaining traction, offering more effective treatment strategies. Market access, reimbursement policies, and supply chain management are critical factors influencing market dynamics. Diagnostic kits, molecular diagnostics reagents, and distribution channels are essential components of the market ecosystem. Research institutions and clinical trials contribute to the development of new diagnostic technologies and applications.

Infectious disease diagnostics and treatment optimization are key areas of focus, with a growing emphasis on rapid turnaround times and cost-effective solutions. Privacy concerns and data security are essential considerations for molecular diagnostics, with regulatory frameworks such as FDA clearance and data protection regulations shaping the market landscape. The market is expected to continue evolving, with emerging technologies such as digital PCR, liquid biopsy, and real-time PCR driving innovation and growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and innovative sector, characterized by the development and implementation of advanced technologies for detecting and analyzing genetic material. This market encompasses various applications, including infectious disease diagnosis, genetic testing, and personalized medicine. Key players in this field are pushing the boundaries of diagnostics through next-generation sequencing, polymerase chain reaction, and loop-mediated isothermal amplification techniques. Molecular diagnostics offer several advantages over traditional methods, including increased accuracy, faster turnaround times, and the ability to identify genetic mutations and biomarkers. Furthermore, this market is driven by factors such as rising healthcare costs, an aging population, and a growing emphasis on personalized medicine. The integration of artificial intelligence and machine learning algorithms is also revolutionizing molecular diagnostics, enabling more accurate and efficient analysis of complex genetic data. Overall, the market represents a significant opportunity for innovation and growth in the healthcare industry.

What are the key market drivers leading to the rise in the adoption of Emerging Molecular Diagnostics Industry?

- The prevalence of chronic diseases serves as the primary market driver, as a significant portion of healthcare expenditures is allocated towards managing and treating these conditions.

- The global molecular diagnostics market is experiencing significant growth due to the increasing prevalence of chronic diseases, particularly cancer and hypertension. Chronic conditions require advanced diagnostic tools for early detection and effective management, making molecular diagnostics an essential solution. According to recent research, cancer remains a leading cause of mortality worldwide, with approximately 1.8 million new cases reported in the US in 2023, equating to around 5,370 new cases daily. Furthermore, cancer-related deaths were projected to reach around 609,818, or roughly 1,670 deaths per day. This high incidence and mortality rate underscore the urgent need for precise and early diagnostic solutions.

- Molecular diagnostics, which include high-throughput screening, capillary electrophoresis, mass spectrometry, and liquid biopsy, among others, offer such solutions. These technologies enable the detection of genetic mutations, biomarkers, and other molecular changes associated with various diseases. Additionally, advancements in data analysis software, quality control, and intellectual property protection are facilitating market access for healthcare providers and enhancing the overall value proposition of molecular diagnostics. Regulatory approvals, clinical validation, and patent protection are crucial aspects of the market's growth, ensuring the delivery of accurate and reliable diagnostic results. Mobile diagnostics, which allow for on-site testing and rapid results, are also gaining traction due to their convenience and efficiency.

- Overall, the molecular diagnostics market is poised for continued growth as it addresses the pressing need for advanced diagnostic solutions in the face of the rising burden of chronic diseases.

What are the market trends shaping the Emerging Molecular Diagnostics Industry?

- The emerging trend in the market involves product launches centered around molecular diagnostics. This sector is poised for significant growth.

- The market is experiencing significant growth due to continuous innovation and new product launches. In 2023, Thermo Fisher Scientific, Inc. Introduced the QuantStudio, Applied Biosystems, Absolute Q AutoRun dPCR Suite, marking a significant advancement in digital PCR technology. This new tool offers improved precision and automation, enabling more accurate and reliable molecular diagnostics. It supports a wide range of applications, from basic research to clinical diagnostics. The market's growth is driven by the increasing demand for early detection and personalized medicine, particularly in oncology diagnostics. Ce marking and regulatory approvals, such as FDA clearance, are crucial for market entry.

- Assay development, biomarker discovery, and big data analytics are key areas of focus for market participants. However, data security concerns and privacy issues are major challenges that need to be addressed. Point-of-care diagnostics and predictive diagnostics are emerging trends in the market. Overall, the market's growth is expected to continue, driven by the increasing demand for accurate and efficient molecular diagnostic tools.

What challenges does the Emerging Molecular Diagnostics Industry face during its growth?

- The high cost attached to molecular diagnostics poses a significant challenge and hinders the growth of the industry.

- Molecular diagnostics, driven by advanced technologies such as microarray and next-generation sequencing (NGS), are revolutionizing healthcare by enabling accurate and timely disease diagnosis. However, the high costs associated with these tests remain a significant challenge for the market. The expense varies based on the test type, technology employed, and laboratory setting. For instance, Polymerase Chain Reaction (PCR) tests, widely used for detecting genetic material, range from USD50 to USD500 per test, while NGS tests, which provide comprehensive genetic information, cost between USD1,000 and USD5,000 per test. These tests involve sophisticated technology and extensive data analysis, contributing to their higher price point.

- To mitigate these costs, market players are focusing on workflow optimization, reimbursement policies, and supply chain management. Additionally, the integration of imaging techniques, artificial intelligence (AI), and companion diagnostics with molecular diagnostics is expected to improve turnaround time and treatment optimization. Research institutions and diagnostic kit manufacturers are collaborating to develop cost-effective solutions while maintaining diagnostic accuracy. The implementation of these strategies is crucial for the market's growth and sustainability.

Exclusive Customer Landscape

The emerging molecular diagnostics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the emerging molecular diagnostics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, emerging molecular diagnostics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - This company specializes in innovative molecular diagnostics, introducing systems like Alinity, which streamline clinical chemistry and immunoassay testing for improved speed, productivity, and compactness. The Alinity system's integration of these testing types within a single instrument reduces laboratory space requirements, making it an essential tool for modern diagnostic facilities. By combining advanced technology and efficient design, this company's offerings enable healthcare professionals to deliver accurate results more efficiently.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Agilent Technologies Inc.

- Becton Dickinson and Co.

- Bio Rad Laboratories Inc.

- BioMerieux SA

- Danaher Corp.

- ELITechGroup SAS

- F. Hoffmann La Roche Ltd.

- Freenome Holdings Inc.

- GRAIL Inc.

- Hologic Inc.

- Invitae Corp.

- Natera Inc.

- OmniScience

- Paragonix Technologies Inc.

- Siemens Healthineers AG

- Solone Life Sciences India Pvt. Ltd.

- Thermo Fisher Scientific Inc.

- U Gen Biotechnology Inc.

- Veracyte Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Emerging Molecular Diagnostics Market

- In January 2024, Thermo Fisher Scientific, a leading life sciences solutions provider, launched the Oncomine Dx Target Test v2, an advanced molecular diagnostic assay for identifying actionable genomic alterations in solid tumors (Thermo Fisher Scientific Press Release). This test expands the company's oncology diagnostics portfolio, catering to growing demand for personalized cancer treatments.

- In March 2024, Illumina and Grail, two major players in molecular diagnostics, announced a strategic collaboration to develop and commercialize multi-cancer early detection tests (Illumina Press Release). This partnership combines Illumina's expertise in genomic sequencing and Grail's innovative technology, aiming to revolutionize cancer screening and diagnosis.

- In May 2024, Quidel Corporation, a diagnostic solutions provider, completed the acquisition of Bio-Techne Corporation's molecular diagnostics business for approximately USD1.2 billion (Quidel Corporation Press Release). This acquisition significantly expanded Quidel's molecular diagnostics offerings, enabling the company to cater to a broader range of customers and applications.

- In April 2025, the European Commission approved the marketing authorization for Roche's cobas Liat Respiratory Panel, a molecular diagnostic test for the simultaneous detection and differentiation of 16 respiratory viruses and influenza A and B (Roche Press Release). This approval marks a significant milestone for Roche, expanding its diagnostic portfolio and addressing the growing need for rapid and accurate respiratory virus testing.

Research Analyst Overview

- The In-Vitro Diagnostics (IVD) market, encompassing technologies such as DNA and RNA extraction, SNP detection, and gene expression analysis, is experiencing significant growth driven by the increasing demand for accurate and specific diagnostic tests. Economic modeling and cost-benefit analysis are essential components of market penetration strategies, as diagnostic sensitivity and specificity are critical factors in ensuring GMP compliance and reducing false positives and negatives. RNA and DNA extraction techniques require stringent sample stabilization and storage conditions to maintain assay performance characteristics. External controls and calibration standards are integral to ensuring diagnostic accuracy and minimizing errors. Quality assurance and medical device regulations mandate rigorous internal controls, including data management and technology transfer, to secure competitive advantage.

- Protein analysis and technology licensing are also emerging trends, as molecular biomarkers offer promising opportunities for disease detection and treatment. Strategic alliances and collaborations are essential for market success, as the IVD industry continues to evolve and adapt to technological advancements.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Emerging Molecular Diagnostics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2025-2029 |

USD 3.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

US, UK, Germany, China, Japan, Canada, India, South Korea, Australia, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Emerging Molecular Diagnostics Market Research and Growth Report?

- CAGR of the Emerging Molecular Diagnostics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the emerging molecular diagnostics market growth of industry companies

We can help! Our analysts can customize this emerging molecular diagnostics market research report to meet your requirements.