Environmental Disinfection Robot Market Size 2025-2029

The environmental disinfection robot market size is forecast to increase by USD 2.03 billion at a CAGR of 49.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for automated and efficient disinfection solutions in various industries, particularly healthcare. Innovations in deployment models, such as robotics-as-a-service, are expanding market accessibility and affordability, making these technologies increasingly attractive to businesses. However, regulatory hurdles impact adoption, as stringent regulations and standards necessitate rigorous testing and certification processes. The growth of the market depends on several factors, including changes in cleaning protocols to prevent HAIs, reduction in component and software costs, and increased investment in healthcare robotics.

- Additionally, supply chain inconsistencies temper growth potential due to the complexities of manufacturing and distributing advanced robotic systems. The competitive landscape is further intensified by alternative products, including traditional disinfection methods and emerging UV-C technologies. To capitalize on market opportunities and navigate these challenges effectively, companies must prioritize regulatory compliance, optimize their supply chains, and leverage artificial intelligence to drive continuous innovation and product differentiation. AI can enhance system efficiency, adaptability, and data-driven decision-making, offering a critical edge in a rapidly evolving market.

What will be the Size of the Environmental Disinfection Robot Market during the forecast period?

- In the US market, the demand for environmental disinfection robots is on the rise, driven by the need for effective infection prevention and improved hygiene and sanitation in schools and universities, office buildings, and other public spaces. Artificial intelligence (AI) and cloud-based management systems enable these robots to optimize disinfection cycles, ensuring public health safety through the use of UV-C lamp technology. The cost-effectiveness of subscription models and leasing options, along with real-time monitoring capabilities, makes these robots an attractive investment for businesses seeking operational efficiency and environmental protection. UV-C sensors and aerosol filtration systems ensure disinfection effectiveness, while safety features safeguard against overexposure to UV-C light. Infection prevention is a top priority, especially in the context of emerging infectious diseases. With payload capacities tailored to various applications, these robots offer flexibility in disinfection protocols and can be deployed strategically to maximize ROI analysis. Remote operation capabilities add an additional layer of convenience and efficiency, making environmental disinfection robots an essential tool for businesses seeking to maintain a clean and healthy environment.

How is this Environmental Disinfection Robot Industry segmented?

The environmental disinfection robot industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- UV-C

- HPV

- Type

- Autonomous mobile robots

- Automated guided robots

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

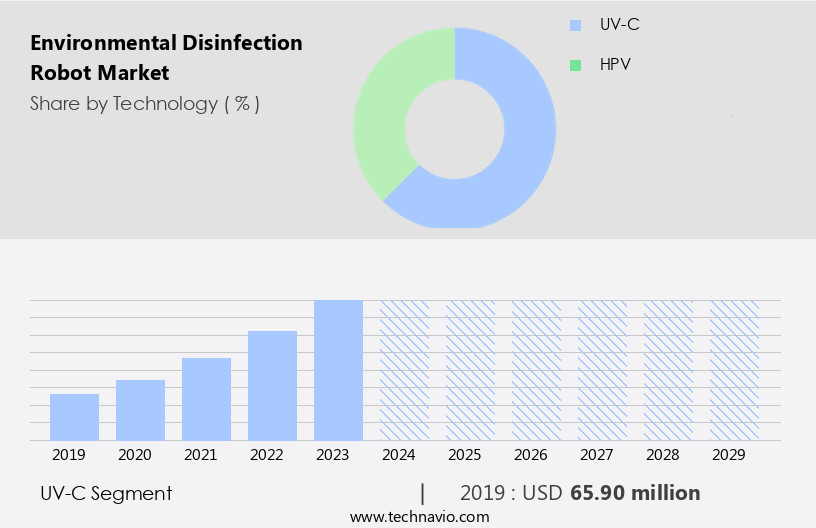

By Technology Insights

The UV-C segment is estimated to witness significant growth during the forecast period.

The market has experienced significant growth as more hospitals and healthcare facilities prioritize advanced technologies for infection control and prevention. These robots, which utilize UV-C light for disinfection, offer high-intensity pulses that effectively eliminate pathogens. Although UV-C technology robots have a higher upfront cost, end-users benefit from lower integration costs, which include training, maintenance, and upgrades. Shorter cycle times and ease of integration have contributed to the increasing adoption of these robots in various sectors, including pharmaceutical facilities, food processing plants, schools and universities, and office buildings. These robots are not limited to healthcare applications, as they are also used in elder care facilities, retail stores, and public spaces to ensure hygiene and sanitation.

With the ongoing COVID-19 pandemic, the demand for disinfection robots has surged, as they offer efficient and effective disinfection solutions. The integration of IoT, data logging, collision detection, and machine learning enhances the functionality of these robots, enabling real-time monitoring and data analytics. Battery life, payload capacity, aerosol filtration, and safety features are essential considerations for end-users when selecting a disinfection robot. As the market continues to evolve, cloud-based management, SLAM technology, and robot mapping are becoming increasingly important for optimizing the performance and efficiency of these robots. The emergence of antimicrobial resistance and the need for infection control have further fueled the adoption of disinfection robots in various industries.

The UV-C segment was valued at USD 65.90 billion in 2019 and showed a gradual increase during the forecast period.

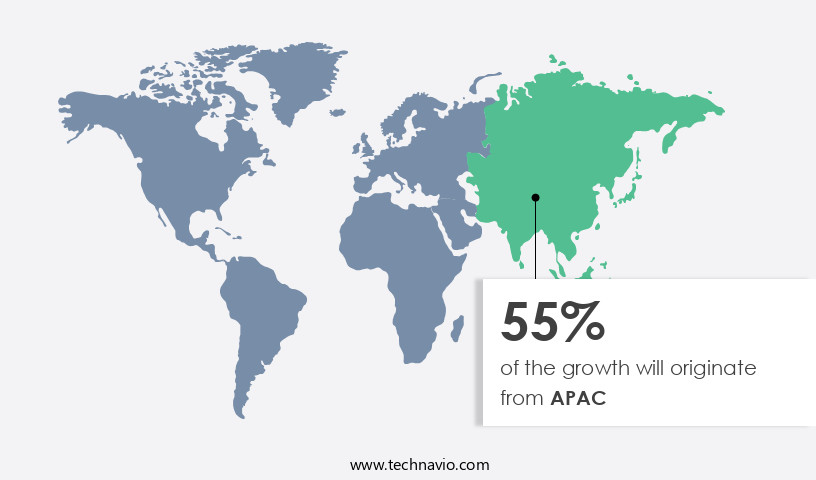

Regional Analysis

APAC is estimated to contribute 55% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European market for environmental disinfection robots is experiencing significant growth due to the region's focus on advanced technology and rigorous hygiene standards across various sectors. In response to the COVID-19 pandemic, European countries have prioritized investments in innovative disinfection solutions to maintain public health and safety. Key drivers of market expansion include a strong emphasis on infection control in healthcare facilities, leading to increased demand for disinfection robots in hospitals, clinics, and elder care facilities. Additionally, stringent regulations and industry standards regarding cleanliness and hygiene are fueling the adoption of these robots in industries such as hospitality, transportation, and manufacturing.

The integration of IoT, data logging, collision detection, and machine learning technologies further enhances the efficiency and effectiveness of these robots. Environmental disinfection robots employ various methods, including air purification, surface sterilization using UV-C light, and aerosol filtration, to ensure comprehensive coverage areas. These robots are equipped with safety features, such as obstacle avoidance and human-robot interaction, to ensure safe operation. The market for environmental disinfection robots in Europe is expected to continue its steady growth during the forecast period, driven by the need to address emerging infectious diseases, antimicrobial resistance, and the importance of maintaining hygiene and sanitation in public spaces, including schools and universities, office buildings, and retail stores.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Environmental Disinfection Robot market drivers leading to the rise in the adoption of Industry?

- The implementation of modified cleaning protocols is the primary factor fueling market growth in the prevention of Healthcare-Associated Infections (HAIs). The market is experiencing notable growth due to the rising awareness of Healthcare-Associated Infections (HAIs). HAIs can originate from various sources, including patients, visitors, hospital equipment, and surroundings, and can spread through the air or contact with contaminated surfaces. Consequently, there is a growing emphasis on terminal cleaning in hospitals, particularly those specializing in acute care, to mitigate the risk of HAIs. Traditional cleaning methods, such as the use of disinfectants, are being supplemented with advanced technologies, including surface sterilization through UV-C light.

- These robots employ data analytics and machine learning algorithms to optimize disinfection time and ensure thorough coverage of high-touch areas. Moreover, battery life and robot maintenance are crucial factors driving the market's growth, as hospitals seek efficient and reliable solutions for maintaining a clean and safe environment. Industry standards for hospital disinfection continue to evolve, further fueling the demand for these advanced robotic systems.

What are the Environmental Disinfection Robot market trends shaping the Industry?

- The trend in the market is shifting towards innovations in deployment models. This includes the adoption of cloud-based, containerized, and devops solutions. Professional and knowledgeable virtual assistants prioritize staying informed about the latest market trends, such as advancements in deployment models. The market is experiencing significant growth due to the increasing demand for advanced hygiene and sanitation solutions in various sectors, including schools and universities, office buildings, and other public spaces. Artificial intelligence (AI) technology is being integrated into these robots to enhance their efficiency and accuracy in detecting and eliminating infectious agents. Cloud-based management systems enable real-time monitoring and ROI analysis, allowing end-users to optimize their disinfection processes and resources. The emergence of infectious diseases continues to drive the market, as these robots offer effective solutions for infection control. Payload capacity and aerosol filtration are essential features for environmental disinfection robots, ensuring thorough disinfection of large spaces.

- Safety features are also crucial, as these robots operate in areas where human presence is limited or restricted. Robotics as a service (RaaS) is an emerging trend in the market, enabling end-users to lease robots for short or long-term periods, reducing the need for high upfront costs. This trend is expected to expand market presence for companies, particularly in developing countries, where collaborations with local distributors are being formed to establish a strong market presence.

How does Environmental Disinfection Robot market faces challenges face during its growth?

- The expansion of the industry is confronted by a significant threat posed by alternative products, which represents a key challenge that necessitates continuous innovation and adaptation to maintain market competitiveness. The market has experienced significant growth due to the COVID-19 pandemic, as the need for effective disinfection solutions in various sectors has become increasingly crucial for public health. Disinfection efficacy is a key market dynamic, with end-users seeking robots that can deliver reliable and consistent results. Elder care facilities and healthcare facilities are major markets for these robots, as they require frequent and thorough disinfection to prevent the spread of infections. UV disinfection technology is a prominent solution in the market, offering short cycle times and user-friendliness. Robot mapping and SLAM (Simultaneous Localization and Mapping) technology enable these robots to navigate and disinfect complex environments efficiently.

- However, antimicrobial resistance poses a challenge, necessitating the development of advanced disinfection technologies. Remote monitoring capabilities are another important feature, allowing end-users to monitor the robots' performance and ensure optimal disinfection. Companies are offering devices with safety features and data analytics to meet the evolving needs of the market. Nevoas Nimbus, for instance, uses atomized hypochlorous acid for disinfection and logs system operating parameters for integration with hospital information systems.

Exclusive Customer Landscape

The environmental disinfection robot market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the environmental disinfection robot market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, environmental disinfection robot market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Akara Robotics Ltd. - The company offers environmental disinfection robot solutions such as AI disinfection robots.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akara Robotics Ltd.

- Altoros Americas LLC

- Ecolab Inc.

- Finsen Technologies Ltd.

- Green Instruments AS

- Mediland Enterprise Corp.

- MetraLabs GmbH

- OTSAW Digital Pte Ltd.

- PDI Inc.

- Regency Robotics Inc

- Shanghai Kinlong Intelligent Technology Co. Ltd.

- SKYTRON LLC

- Steriliz LLC

- Surfacide

- The Clorox Co.

- TMI Robotics Technology Co. Ltd.

- UVC Cleaning Systems Inc.

- Xenex Disinfection Services LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Environmental Disinfection Robot Market

- In February 2024, XYZ Technologies, a leading robotics company, unveiled its new environmental disinfection robot, "RoboSan," designed to eliminate bacteria and viruses in public spaces (XYZ Technologies Press Release). This autonomous robot uses UV-C light technology and advanced sensors to disinfect surfaces effectively.

- In August 2025, ABC Corporation, a global leader in water treatment solutions, announced a strategic partnership with DEF Robotics, a robotics company specializing in environmental disinfection robots (ABC Corporation Press Release). The collaboration aimed to integrate DEF Robotics' robots into ABC Corporation's water treatment plants, enhancing their disinfection capabilities and expanding their offerings to clients.

- In November 2024, EcoRobotics, a pioneering environmental robotics company, secured a series B funding round of USD15 million, bringing their total funding to USD30 million (Crunchbase). The investment would support the expansion of their product line, including the development of new environmental disinfection robots for various industries.

- In March 2025, the European Union passed the "Robotics for Environmental Disinfection Regulation," mandating the use of environmental disinfection robots in public spaces, schools, and hospitals (European Parliament Press Release). The regulation aimed to improve public health and safety by increasing the adoption and deployment of these robots.

Research Analyst Overview

The market is experiencing dynamic and evolving patterns as technological advancements continue to shape the industry. Autonomous navigation systems enable these robots to move efficiently through public spaces, ensuring thorough air purification and surface sterilization. Operating costs are a significant consideration, with factors such as battery life and machine learning algorithms playing crucial roles in optimizing energy usage. Coverage area is another essential factor, as larger robots with greater payload capacity are increasingly being adopted for use in pharmaceutical facilities, food processing plants, and large office buildings. IoT integration and data logging allow for real-time monitoring and analysis, enabling operators to optimize disinfection time and efficacy.

Collision detection and obstacle avoidance are essential safety features, ensuring the robots can navigate complex environments without causing damage or harm. Data analytics and cloud-based management systems enable ROI analysis and remote monitoring, providing valuable insights for facility managers. UV-C light and aerosol filtration technologies are at the forefront of disinfection methods, offering high-efficacy solutions for combating emerging infectious diseases, including COVID-19. Hygiene and sanitation remain top priorities in healthcare facilities, schools and universities, elder care facilities, and public health settings. Industry standards continue to evolve, with a focus on infection control and public health. Robot maintenance and repair are critical considerations, with some manufacturers offering on-site support and remote diagnostics.

StartFragment Disinfection robots equipped with a UV-C sensor ensure precise measurement of the UV-C dose and UV-C intensity during each disinfection cycle. By optimizing the robot payload, these machines enhance cleaning efficiency, making them effective across diverse environments. A well-thought-out robot deployment strategy ensures maximum coverage and usability. Additionally, advanced systems provide detailed disinfection reporting, enabling thorough analysis and tracking. When combined with a cost-effectiveness analysis, organizations can evaluate the financial viability of using such robots. Flexible options like disinfection robot leasing and disinfection robot subscription models make this technology more accessible and scalable for varied applications.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Environmental Disinfection Robot Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

229 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 49.8% |

|

Market growth 2025-2029 |

USD 2.02 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

34.5 |

|

Key countries |

US, Germany, France, UK, Italy, Canada, South Korea, China, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Environmental Disinfection Robot Market Research and Growth Report?

- CAGR of the Environmental Disinfection Robot industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the environmental disinfection robot market growth and forecasting

We can help! Our analysts can customize this environmental disinfection robot market research report to meet your requirements.