Ethnic Wear Market Size 2025-2029

The ethnic wear market size is forecast to increase by USD 45.9 billion, at a CAGR of 8.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the expansion of the fashion industry and the increasing popularity of traditional clothing. Ethnic wear, with its unique designs and cultural significance, has gained prominence in the global fashion landscape. This trend is further fueled by the increased online presence of ethnic wear brands through e-commerce, making it more accessible to consumers worldwide. Seasonal demand is another key driver for the market. Traditional clothing holds cultural significance and is often worn during festivals and special occasions. As a result, there is a consistent demand for ethnic wear throughout the year, providing a steady revenue stream for businesses in this sector.

- However, challenges persist, including the need for authenticity and cultural sensitivity in design and production. Additionally, competition from mass-market fashion brands offering ethnic-inspired designs presents a significant challenge for ethnic wear brands. Navigating these challenges requires a deep understanding of consumer preferences and cultural nuances, as well as a commitment to authenticity and innovation. Companies that can effectively address these challenges and capitalize on the growing demand for ethnic wear will be well-positioned to succeed in this dynamic market.

What will be the Size of the Ethnic Wear Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market trends shaping the industry's landscape. Traditional techniques, such as block printing and weaving, coexist with modern designs, resulting in a fusion of cultural significance and contemporary fashion. Consumer preferences for lehenga cholis and salwar kameez remain strong, with price points and fabric weight influencing purchasing decisions. Brands position themselves in various sectors, catering to formal, casual, and daily wear markets. Modern designs incorporate traditional techniques, resulting in innovative creations. Quality control is paramount, ensuring garment durability and consumer satisfaction. Ethical sourcing and sustainable practices are gaining importance, with an increasing focus on fair trade and e-commerce platforms.

Consumers seek personal styling options, leading to seasonal collections and diverse target demographics. Textile dyes, thread count, and fiber content vary, with natural and synthetic options available. Digital printing and screen printing techniques add visual interest to garments. Garment care instructions are essential for maintaining the longevity of ethnic wear. Supply chain management and retail channels continue to evolve, with wholesale markets playing a crucial role in distribution. Price points and fabric weight influence consumer choices, with daily wear and casual options often more affordable than formal wear. Modern designs and traditional techniques blend seamlessly, creating a vibrant and ever-changing market landscape.

The market's continuous dynamism reflects the industry's ability to adapt to consumer preferences and cultural influences.

How is this Ethnic Wear Industry segmented?

The ethnic wear industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Women

- Men

- Kids

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- Germany

- APAC

- China

- India

- Japan

- Singapore

- South Korea

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

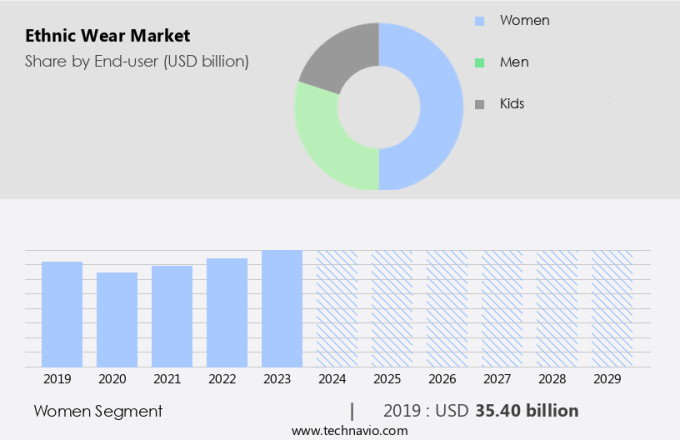

The women segment is estimated to witness significant growth during the forecast period.

Ethnic wear holds significant cultural significance and continues to be a popular choice for women worldwide. In 2024, the women's segment led the market, accounting for the largest revenue share. Factors such as cultural events, festivals, weddings, and other occasions drive demand for ethnic wear. Traditional techniques like block printing, weaving, and embroidery remain essential in creating authentic ethnic wear. However, modern designs, fusion styles, and consumer preferences for comfortable daily wear, formal occasion wear, and casual attire are influencing market trends. E-commerce platforms have emerged as a significant retail channel, enabling easy access to ethnic wear from various regions.

Seasonal collections and personal styling services cater to the evolving consumer preferences. Ethical sourcing and quality control are crucial factors in brand positioning, with many manufacturers focusing on fair trade and sustainable practices. Textile dyes, thread count, fiber content, and laundry instructions are essential considerations in the production process. Natural dyes and digital printing techniques have gained popularity due to their eco-friendly nature. Synthetic dyes and screen printing are also used for mass production. Effective supply chain management and marketing strategies are essential for retailers and wholesale markets. Salwar kameez, lehenga cholis, and sarees are popular ethnic wear styles. Fabric weight, price points, and size specifications vary depending on the style and occasion.

Overall, the market continues to evolve, blending traditional techniques with modern designs and trends to cater to diverse consumer preferences.

The Women segment was valued at USD 35.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

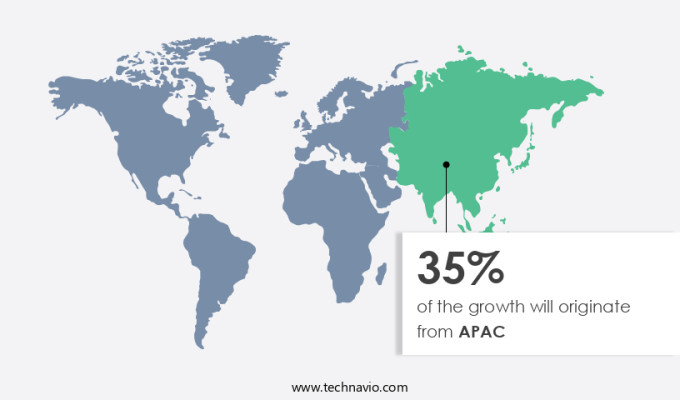

APAC is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Ethnic wear holds significant cultural significance in Asia, with traditional clothing worn for various occasions such as weddings, festivals, and religious ceremonies. APAC's rich diversity in styles and designs has fueled the popularity of ethnic wear, as modern designers incorporate traditional elements into contemporary clothing. This fusion of tradition and modernity has broadened the appeal of ethnic wear. The rise of e-commerce platforms and the convenience they offer have made these garments more accessible to consumers. Seasonal collections and personal styling services cater to consumer preferences for unique and authentic pieces. Brand positioning and ethical sourcing are crucial factors in the market.

Quality control and adherence to laundry instructions ensure the longevity of these garments. Fabric weight, modern designs, and price points vary depending on the specific ethnic wear style, such as lehenga cholis or salwar kameez. Consumers seek high-quality, authentic traditional clothing, leading to increased demand. Design trends include traditional techniques like block printing, weaving, and embroidery, as well as digital printing and screen printing using synthetic and natural dyes. Fiber content, thread count, and size specifications are essential considerations for both manufacturers and consumers. Supply chain management and retail channels, including wholesale markets, ensure the availability and affordability of ethnic wear.

Marketing strategies emphasize the cultural significance and personal expression offered by ethnic wear. Fusion styles that blend traditional and modern designs cater to diverse demographics and expanding consumer preferences. Daily wear, formal wear, and casual wear categories continue to evolve, offering consumers a range of options for incorporating ethnic wear into their wardrobes.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a vibrant and diverse sector, encompassing traditional clothing from various cultures around the world. From sarees and salwar kameez in South Asia, to hanboks in East Asia, kimonos in Japan, and dashikis in West Africa, this market caters to the growing demand for authentic and culturally rich apparel. Sustainable fabrics like silk, cotton, and linen are commonly used, while intricate embroidery, beadwork, and sequins add to the allure. Globalization and increased cultural awareness have fueled its growth, with consumers seeking unique and authentic pieces for special occasions and everyday wear. The market also offers customization options, allowing customers to personalize their garments with their preferred colors, designs, and sizes. Overall, this market is a testament to the rich cultural heritage and diversity that the world has to offer.

What are the key market drivers leading to the rise in the adoption of Ethnic Wear Industry?

- The expansion of the fashion industry is the primary driver, significantly boosting the demand for ethnic wear, making it a key market trend.

- Ethnic wear, characterized by its cultural significance and unique designs, is experiencing substantial growth in the global fashion industry. This trend is driven by the increasing popularity of fusion fashion, which blends traditional clothing with contemporary designs and materials. Ethnic wear's appeal lies in its ability to showcase the richness and diversity of various cultures and traditions. Seasonal collections, featuring intricate block printing, vibrant colors, and intricate embroidery, are increasingly being showcased at fashion shows and on e-commerce platforms. Consumers are drawn to the personal styling possibilities offered by ethnic wear, making it a popular choice for occasion wear.

- Designers and retailers are responding to this trend by focusing on ethical sourcing and fair trade practices, ensuring that the production of ethnic wear aligns with consumers' values. As a result, there is a growing emphasis on the transparency of the supply chain and the use of sustainable materials. Laundry instructions are also becoming a crucial consideration for consumers, as they seek to maintain the integrity of their ethnic wear pieces. Overall, the market is dynamic and evolving, offering exciting opportunities for designers, retailers, and consumers alike.

What are the market trends shaping the Ethnic Wear Industry?

- Ethnic wear is experiencing a significant increase in online presence, representing a prominent market trend. This growth signifies a notable shift in consumer preferences towards culturally authentic clothing options.

- Ethnic wear has witnessed notable growth in the digital realm, as consumers increasingly opt for online shopping experiences. The convenience of accessing a diverse selection of traditional clothing from home has driven this trend. Notable online marketplaces, such as Amazon, Flipkart, Myntra, Jabong, Utsav Fashion, and Craftsvilla, cater to this demand. Additionally, social media platforms like Instagram and Facebook serve as prominent showcases for independent designers and small businesses. Design trends in ethnic wear continue to evolve, with a focus on modern interpretations of traditional techniques. Consumer preferences lean towards affordable price points and lighter fabric weights for daily wear.

- Quality control is paramount to ensure authenticity and durability. Modern ethnic wear designs blend traditional aesthetics with contemporary styles, appealing to a broad audience. Online platforms provide a vast and immersive shopping experience, allowing customers to explore various options and make informed decisions. By catering to the diverse needs and preferences of consumers, the market continues to thrive in the digital age.

What challenges does the Ethnic Wear Industry face during its growth?

- The seasonal demand for ethnic wear poses a significant challenge to the industry's growth trajectory. Ethnic wear, a crucial segment of the fashion industry, experiences fluctuating consumer preferences based on seasonal trends and cultural occasions. Meeting this demand requires intricate planning, inventory management, and production adjustments, which can impact the industry's profitability and overall growth.

- Ethnic wear holds significant cultural significance and is often worn for formal occasions such as weddings, religious ceremonies, and family functions. The demand for ethnic wear is seasonal, as these events typically occur during specific times of the year. This seasonality can present challenges for businesses, as revenue and sales may fluctuate throughout the year. Ethnic wear is characterized by its unique textile dyes, thread count, fiber content, and various printing techniques, including digital printing and screen printing. The use of natural dyes adds to the authenticity and cultural significance of the garments. Proper garment care is essential to maintain the vibrancy and longevity of ethnic wear.

- Businesses in the market must cater to diverse target demographics and their unique preferences. Understanding the cultural significance and traditions associated with ethnic wear is crucial for businesses to effectively meet the needs of their customers. In terms of production, businesses may consider various factors such as fiber content, thread count, and printing techniques to create high-quality ethnic wear that resonates with consumers. The use of digital printing and screen printing can help businesses offer a wide range of designs and patterns to cater to diverse customer preferences. Maintaining the authenticity and cultural significance of ethnic wear while also ensuring its durability and affordability is a key challenge for businesses in this market.

- By focusing on quality, innovation, and cultural sensitivity, businesses can differentiate themselves and build a loyal customer base.

Exclusive Customer Landscape

The ethnic wear market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ethnic wear market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ethnic wear market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aurelia - This company specializes in providing contemporary ethnic wear for women, focusing on innovative design, superior fit, and premium quality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aurelia

- BIBA Apparels Pvt. Ltd.

- Diwan Saheb Fashions Pvt. Ltd.

- ELIE SAAB

- Esika World

- Fabindia Overseas Pvt. Ltd.

- High Street Essentials Pvt. Ltd.

- House of Torani

- Kalki Fashion

- Lemlem

- MAX

- Mr Dulha

- Nesavaali Ltd.

- Ochre and Black Pvt. Ltd.

- Pantaloons

- Rain and Rainbow

- Shanghai Tang

- TCNS Clothing Co. Ltd.

- Thebe Magugu Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Ethnic Wear Market

- In January 2024, global fashion retailer H&M announced the launch of its new ethnic wear line, 'H&M Ethnic,' in collaboration with Indian designer Sabyasachi Mukherjee. This strategic partnership aimed to cater to the growing demand for authentic ethnic wear globally (H&M Press Release, 2024).

- In March 2024, fashion e-commerce platform, Myntra, raised a Series F funding round of USD 150 million, led by South African retail giant, Woolworths Holdings Limited. This investment was aimed at expanding Myntra's reach and enhancing its technology platform (Myntra Press Release, 2024).

- In May 2024, luxury fashion house, Gucci, unveiled its first ethnic wear collection, 'Gucci Heritage,' in collaboration with Indian textile artisans. This collection marked Gucci's entry into the market, targeting the increasing global demand for culturally authentic fashion (Gucci Press Release, 2024).

- In April 2025, the Indian government announced the 'Textiles for Textile' initiative, providing incentives and subsidies to boost the production and export of ethnic wear. This policy change aimed to make India a global hub for ethnic wear manufacturing and enhance the sector's contribution to the country's economy (Ministry of Textiles, Press Release, 2025).

Research Analyst Overview

- The market, characterized by its rich diversity and cultural significance, is witnessing a technological revolution. Augmented reality is transforming the shopping experience, enabling customers to virtually try on designs and customize pattern details. Customer reviews and feedback mechanisms are shaping pricing strategies, ensuring affordability and value. Resource optimization through 3D printing and inventory management systems is reducing textile waste and carbon footprint. Intellectual property protection and design innovation are crucial in a global supply chain where copyright laws vary. Ethical labor practices and sustainable fabrics are prioritized for brand loyalty and consumer satisfaction.

- Social media marketing and influencer collaborations are driving trend analysis and fashion forecasting. Import/export regulations and water consumption are critical considerations for international trade. Sustainability and energy efficiency are key trends, with a focus on reducing waste and environmental impact throughout the product lifecycle.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Ethnic Wear Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.4% |

|

Market growth 2025-2029 |

USD 45.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.6 |

|

Key countries |

US, India, China, Japan, Canada, South Korea, Brazil, Argentina, Germany, and Singapore |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ethnic Wear Market Research and Growth Report?

- CAGR of the Ethnic Wear industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ethnic wear market growth of industry companies

We can help! Our analysts can customize this ethnic wear market research report to meet your requirements.