Ethylene Market Size 2025-2029

The ethylene market size is forecast to increase by USD 63.3 billion at a CAGR of 6.5% between 2024 and 2029.

- The market is experiencing significant growth driven by the increasing demand for polyethylene products across various industries, including packaging, construction, and automotive. This trend is expected to continue as ethylene-derived plastics offer advantages such as durability, lightweight, and cost-effectiveness. However, market dynamics are influenced by the emergence of bio-ethylene, a sustainable alternative to traditional ethylene derived from fossil fuels. This shift towards renewable sources presents both opportunities and challenges for market participants.

- On the one hand, bio-ethylene offers a more sustainable production process and potential cost savings through government incentives and carbon credits. On the other hand, the production of bio-ethylene is currently more expensive than traditional ethylene, and scaling up production remains a significant challenge. Additionally, volatility in raw material prices, particularly for natural gas and crude oil, continues to impact the market's profitability and strategic planning. Companies seeking to capitalize on market opportunities and navigate challenges effectively must stay informed of these trends and be agile in their business strategies.

What will be the Size of the Ethylene Market during the forecast period?

- The market encompasses the production, trade, and application of ethylene, a colorless, flammable organic compound. Ethylene is a key petrochemical derivative and the primary building block for various ethylene-based derivatives, including polyethylene (PE), ethylene oxide, ethylene glycol, high-density polyethylene (HDPE), and low-density polyethylene (LDPE). These materials are widely used in various industries, including construction, flexible packaging, and the production of bio-based products, lightweight plastics, and market derivatives. The market size is substantial, driven by the increasing demand for ethylene-based derivatives in consumer goods, food, beverages, medications, and various industrial applications. The market's growth is influenced by factors such as the availability of shale oil output, which has led to increased ethylene production capacity.

- Additionally, the shift towards sustainable and eco-friendly alternatives, such as bio-polyethylene, is gaining momentum due to growing concerns about carbon footprint and the need for improved barrier qualities in packaging materials. Overall, the market is expected to continue its strong growth trajectory, driven by the diverse applications and demand for ethylene-based derivatives in various industries.

How is this Ethylene Industry segmented?

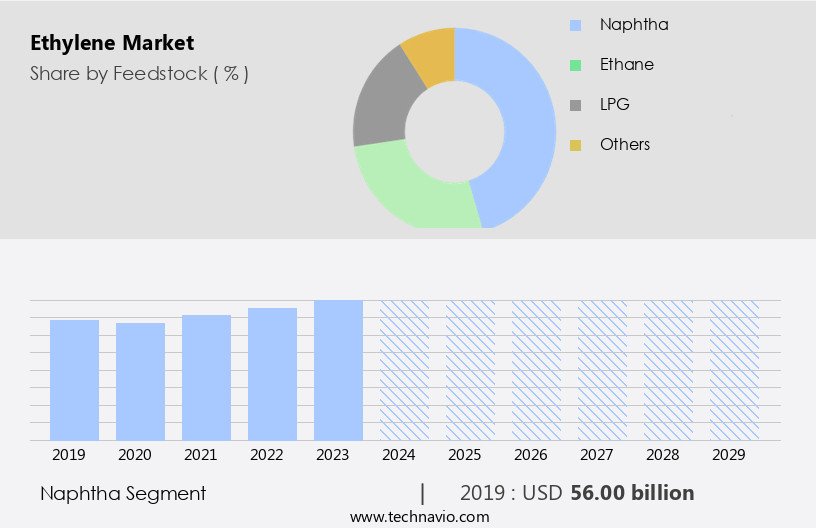

The ethylene industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Feedstock

- Naphtha

- Ethane

- LPG

- Others

- Application

- LDPE

- HDPE

- Ethylene oxide

- Vinyls

- Others

- Packaging

- Automotive

- Building & Construction

- Agrochemical

- Textile

- Chemicals

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Canada

- Middle East and Africa

- UAE

- Europe

- France

- Germany

- UK

- South America

- Brazil

- Rest of World (ROW)

- APAC

By Feedstock Insights

The naphtha segment is estimated to witness significant growth during the forecast period. Ethylene is a colorless, flammable organic compound used extensively as a raw material in the production of various plastics and petrochemical derivatives. The largest source of ethylene is naphtha, which accounted for over half of the global ethylene production in 2024. However, the naphtha segment is expected to lose market share due to its energy-intensive production process, which results in significant carbon emissions. One kilogram of ethylene production emits approximately 1.8-2 kilograms of carbon dioxide. Europe and APAC are the leading regions in naphtha-based ethylene production. Ethylene is a key ingredient in the production of polyethylene, ethylene glycol, high-density polyethylene (HDPE), low-density polyethylene (LDPE), vinyl acetate, and various ethylene-based derivatives.

Get a glance at the market report of share of various segments Request Free Sample

The naphtha segment was valued at USD 56.00 billion in 2019 and showed a gradual increase during the forecast period.

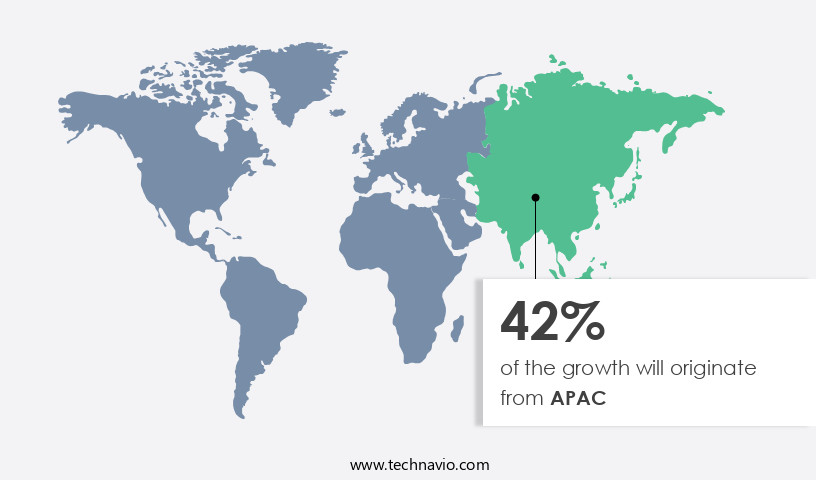

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Ethylene, a colorless and flammable organic compound, is a key petrochemical feedstock and chemical intermediate. It is extensively used in the production of polyethylene, ethylene glycol, and various ethylene-based derivatives such as high-density polyethylene (HDPE), low-density polyethylene (LDPE), vinyl acetate, and ethylene vinyl acetate. Ethylene is also used in the production of plastics, agrochemicals, textiles, and agrochemicals. The Asia Pacific (APAC) region is the largest market for ethylene, driven by the increasing use of plastic in packaging and construction industries in countries like China, India, South Korea, Singapore, Malaysia, and Japan. The growth of the retail and e-commerce industries in the region is a significant factor fueling the demand for packaging solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Ethylene Industry?

- Increasing demand for polyethylene products from various industries is the key driver of the market. The market is driven by the expanding demand for polyethylene products across various industries, including consumer electronics, construction, and automotive. Ethylene is a crucial component in producing HDPE, LDPE, and LLDPE, which are extensively used in manufacturing these products.

- The global plastic industry is experiencing significant growth, with China and India being the leading consumers. In India, the demand for plastics is primarily driven by the electronics sector, which is projected to expand at an annual rate of 17%. Factors such as increasing purchasing power, high penetration of electronic products, and rapid technological advancements are fueling this growth. The market is poised to benefit from this increasing demand for plastics, particularly in the electronics industry.

What are the market trends shaping the Ethylene Industry?

- Emergence of bio-ethylene is the upcoming market trend. Ethylene is a fundamental organic commodity chemical with significant applications as a feedstock for various downstream chemical products, particularly in the production of plastics. As the largest bulk chemical by volume in this sector, ethylene's market dynamics are influenced by the price fluctuations of crude oil and the depletion of fossil fuel resources.

- To mitigate these challenges, researchers and manufacturers are exploring alternative feedstocks for ethylene production, such as bio-ethanol. The US and Brazil, as major producers of bio-ethanol derived from corn and sugarcane, respectively, account for an 87% share of the global bio-ethanol production. Additionally, lignocellulosic biomass from wood and straw can also be utilized to produce bio-ethanol, contributing to the ongoing research and development efforts in this area.

What challenges does the Ethylene Industry face during its growth?

- Volatility in raw material prices is a key challenge affecting the industry growth. Ethylene, a critical building block in the production of various polymers and elastomers, is manufactured from ethane, naphtha, LPG, and other compounds. The price volatility of these raw materials, directly linked to natural gas and crude oil, poses significant challenges for ethylene manufacturers.

- Crude oil prices are influenced by the demand-supply imbalance and geopolitical instability in major oil-producing regions. Global natural gas prices in the overseas market are determined by production levels, economic conditions of producing countries, and import/export prices. These factors contribute to the unpredictability in the market, necessitating strategic planning and adaptability for manufacturers.

Exclusive Customer Landscape

The ethylene market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ethylene market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ethylene market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BASF SE

- Braskem SA

- Chevron Phillips Chemical Co. LLC

- China National Petroleum Corp.

- Eastman Chemical Co.

- Exxon Mobil Corp.

- Formosa Plastics Corp.

- Huntsman Corp.

- Koch Industries Inc.

- LyondellBasell Industries NV

- Merck KGaA

- Mitsubishi Chemical Group Corp.

- Mitsui Chemicals Inc.

- NOVA Chemicals Corp.

- Reliance Industries Ltd.

- Saudi Basic Industries Corp.

- Shell plc

- Sumitomo Chemical Co. Ltd.

- The Dow Chemical Co.

- TotalEnergies SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Ethylene Market

- In November 2024, Sinopec launched a new 1.2 million tonnes per year ethylene facility in Tianjin, China, increasing its subsidiary's total ethylene capacity to 2.5 million tonnes annually, with partial solar power integration to enhance efficiency.

- In December 2024, Eastman Chemical Company boosted its sustainable ethylene glycol production by 20%, focusing on bio-based ethylene derivatives for eco-friendly packaging and textile applications.

- In February 2025, Braskem collaborated with Toyo Engineering to build a bio-based ethylene plant in Thailand using sugarcane ethanol, targeting a 15% increase in bio-polyethylene output by 2027.

- In March 2025, LyondellBasell acquired a 35% stake in Saudi Arabia's NATPET, adding 1 million tonnes to its annual ethylene capacity, aiming for a 10% market share growth by 2028.

Research Analyst Overview

Ethylene is a colorless, flammable organic compound that serves as a fundamental building block in the production of various polymers and petrochemical derivatives. This versatile compound is derived from raw material sources such as natural gas and naphtha, and its demand is driven by numerous industries, including agriculture, consumer goods, construction, and healthcare. In the realm of agriculture, ethylene plays a crucial role as a ripening agent for fruits and vegetables, ensuring optimal harvest and preservation. In the consumer goods sector, ethylene is utilized in the production of high-density polyethylene (HDPE) and low-density polyethylene (LDPE), which are essential in creating lightweight plastics for various applications, such as packaging solutions.

In addition, the construction industry relies on ethylene to manufacture PVC pipes and other vinyl-based products, which offer superior chemical resistance and durability. Ethylene-based derivatives are also used in the production of textiles, agrochemicals, and rubber and plastics. The demand for ethylene in the packaging industry is significant due to its barrier qualities, which make it an ideal material for producing plastic bags, bottles, and containers for various food, beverages, and medications. Ethylene's role in e-commerce continues to grow as the demand for efficient and lightweight packaging solutions increases. The production of ethylene oxide and ethylene glycol is another essential application, as these derivatives are used in the manufacturing of various chemicals, soaps, and detergents.

Moreover, ethylene vinyl acetate (EVA) is another ethylene-based derivative that is widely used in the production of adhesives, sealants, and coatings. The market is influenced by various factors, including the availability and price of raw material sources, such as natural gas and naphtha. The emergence of shale oil output and the shift towards bio-ethanol as a raw material source have significantly impacted the market dynamics. The growing emphasis on environmental protection and the production of bio-based ethylene and bio-polyethylene have also influenced market trends. The use of ethylene in luxury automobiles, particularly in the production of high-performance plastics, highlights its importance in the automotive industry.

Furthermore, ethylene derivatives are also used in the production of ethylene-vinyl acetate (EVA) copolymers, which are used in pipe applications and as binders in the production of carbon fiber reinforced polymers. The demand for ethylene in the production of ethylene oxide and ethylene glycol is driven by the demand for petrochemical feedstocks and chemical intermediaries. Ethylene's role in the production of various polymers and petrochemical derivatives makes it an essential component in numerous industries, from agriculture to healthcare, construction to consumer goods. The market is subject to various environmental concerns, including its carbon footprint and its contribution to climate change and carbon emissions.

In addition, efforts to reduce the carbon footprint of ethylene production and promote the use of bio-based ethylene and green polyethylene are ongoing. Ethylene's role as a raw material source for various industries and its versatility make it a critical component in the global economy. Its production and application continue to evolve, driven by technological advancements, market demands, and environmental concerns.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Ethylene Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market growth 2025-2029 |

USD 63.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

China, US, Japan, Canada, India, UAE, Germany, UK, France, and Brazil |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ethylene Market Research and Growth Report?

- CAGR of the Ethylene industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Middle East and Africa, Europe, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ethylene market growth of industry companies

We can help! Our analysts can customize this ethylene market research report to meet your requirements.