Facades Market Size 2025-2029

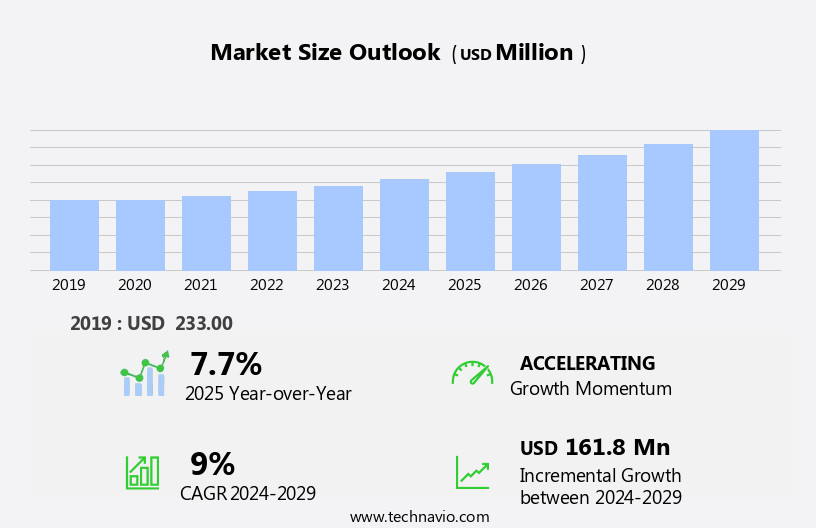

The facades market size is forecast to increase by USD 161.8 billion, at a CAGR of 9% between 2024 and 2029.

- The market is experiencing significant growth due to key trends such as the increasing demand for energy-efficient and sustainable construction materials. The increasing population and urbanization trends in these regions are fueling the demand for facade solutions, particularly in the commercial and residential sectors. However, the market faces challenges due to the high costs associated with raw materials and installation. These expenses can significantly impact the profitability of facade projects, necessitating innovative solutions to reduce costs while maintaining quality and durability. Companies in the market must navigate these challenges to capitalize on the burgeoning opportunities in emerging economies and establish a strong market presence.

- Strategic partnerships, technological advancements, and cost optimization strategies are potential avenues for companies to address the challenges and gain a competitive edge. Aluminum, magnesium oxide, glass, composite materials, and fiber cement are popular choices for facade applications due to their insulation properties and durability.

What will be the Size of the Facades Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and shifting industry trends. Across various sectors, including commercial and industrial buildings, the integration of lighting and fire safety systems is becoming increasingly crucial. Quality control and project management are key focus areas for ensuring the successful implementation of these complex systems. Seismic design, solar shading, and structural glazing are also gaining prominence in the construction industry. The building envelope, encompassing cladding systems, curtain walls, and rainscreen systems, is a critical aspect of modern architecture. Sustainability is a major consideration, with LEED certification and green building practices driving demand for energy-efficient solutions.

Material science innovations, such as insulated panels and thermal breaks, are essential for optimizing thermal performance and reducing lifecycle costs. Modular construction, ventilation systems, and support structures are other areas of ongoing development. Precast concrete and composite panels are popular choices for their durability and versatility. Wind load resistance, access panels, and door systems are also essential components of robust building design. Design software plays a pivotal role in facilitating the integration of these various elements, enabling architects and construction professionals to create efficient, functional, and aesthetically pleasing facades. The market's continuous dynamism underscores the importance of staying informed and adaptable to emerging trends and technologies.

How is this Facades Industry segmented?

The facades industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Residential

- Non-residential

- Product

- Ventilated facades

- Non-ventilated facades

- Material

- Glass

- Metal

- Plastic and fibers

- Stones

- Others

- Type

- Cladding

- Curtain wall

- Exterior insulation and finish system

- Siding

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

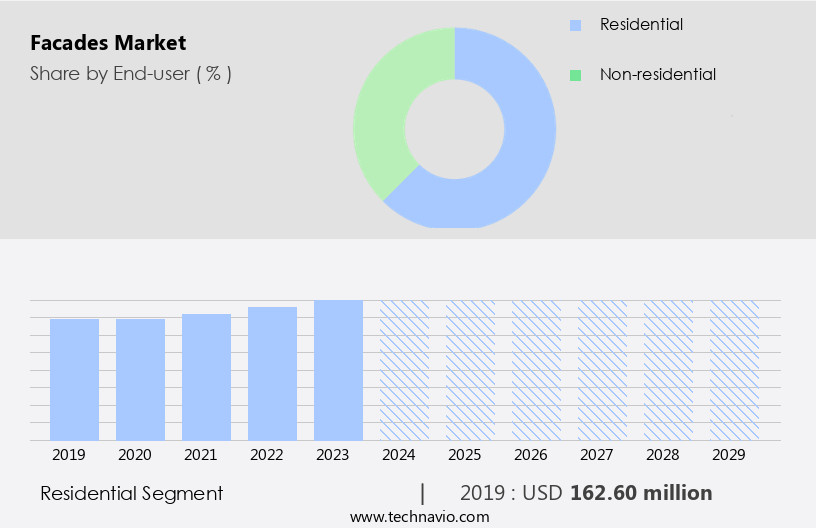

The residential segment is estimated to witness significant growth during the forecast period.

The market encompasses various sectors, including residential and industrial buildings. In the residential segment, the real estate industry has been a significant driver, with investments in housing and real estate by foreign investors. However, the residential market has faced challenges in 2023 due to escalating operational costs, raw material sourcing difficulties, excess construction capacity, and political uncertainties. To address energy efficiency and aesthetics, contractors are increasingly opting for glazed curtain walls in residential buildings. The population growth and land scarcity have escalated residential construction volumes. In the industrial sector, there is a growing emphasis on quality control, project management, and adherence to building codes.

Seismic design, solar shading, and structural glazing are crucial considerations in industrial buildings. Material science and thermal performance are critical factors in the selection of cladding systems, including glass facades, stone veneer, and composite panels. Modular construction, ventilation systems, and support structures are essential components of facade design. LEED certification, thermal breaks, and rainscreen systems are integral to green building practices. High-rise buildings require specialized framing systems, wind load resistance, and fire safety features. Metal panels, door systems, and lighting integration are essential elements of modern commercial building facades. The construction management process involves the integration of various facade components, ensuring air infiltration control, and minimizing lifecycle costs.

Precast concrete, insulated panels, and design software are essential tools for architectural design and engineering, enabling the creation of innovative and energy-efficient facade solutions. The market is continually evolving, with advancements in material science, energy efficiency, and design technology.

The Residential segment was valued at USD 162.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

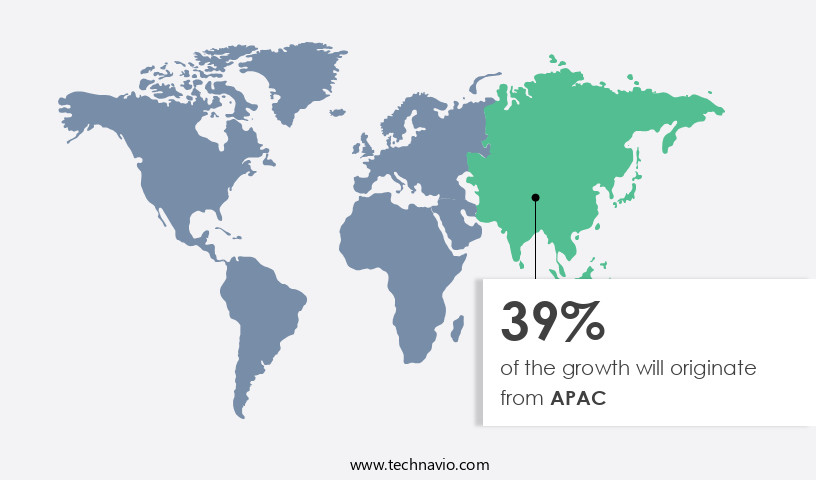

APAC is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia Pacific region is experiencing significant growth, driven by the construction industries in emerging economies such as China, the Philippines, India, Indonesia, and Thailand. In India, the construction market is projected to become the third-largest globally by 2030, and the government's implementation of a single-window clearance facility is expected to accelerate project approvals and construction activity. China, meanwhile, plans to invest over USD1 trillion in urban infrastructure projects by 2030. Acoustic performance, a crucial aspect of facade design, is gaining importance in both residential and commercial buildings. Quality control and project management are essential for ensuring the successful execution of complex facade projects.

Seismic design and wind load resistance are key considerations for structures in earthquake-prone regions and high-rise buildings, respectively. Solar shading and energy efficiency are vital for reducing a building's carbon footprint and improving thermal performance. Material science plays a significant role in the development of advanced cladding systems, including glass facades, curtain walls, rainscreen systems, and insulated panels. Structural glazing, access panels, and ventilation systems are essential components of modern building envelopes. Modular construction and precast concrete are gaining popularity due to their cost-effectiveness and sustainability. LEED certification, fire safety, and lighting integration are crucial factors in the design and construction of green buildings.

Thermal breaks, air infiltration, and water infiltration are essential for maintaining a building's energy efficiency and structural integrity. Building codes and design software are essential tools for ensuring compliance with regulations and optimizing building design. Composite panels, framing systems, and metal panels are popular materials for facade design due to their durability, low maintenance, and aesthetic appeal. Construction management and door systems are essential for ensuring the smooth execution of facade projects and maintaining building security. In conclusion, the market is evolving to meet the demands of sustainable, energy-efficient, and structurally sound building design. The integration of advanced materials, technologies, and design principles is driving innovation and growth in the industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Global Facades Market is transforming with innovative solutions like curtain wall systems and glass facades, enhancing aesthetic and functional appeal. Cladding materials and ventilated facade systems dominate the commercial facades market and residential facades market, prioritizing energy-efficient facades. Sustainable facade solutions and green building facades gain traction, driven by sustainable facade materials for green buildings and sustainable facade design trends 2025. Technologies such as building-integrated photovoltaics (BIPV) and smart glass technology for modern facades enable smart facades market growth. Facade retrofitting and high-performance glazing address modern needs, while energy-efficient facade solutions for high-rise buildings and ventilated facade systems for thermal comfort meet stringent environmental standards, shaping a dynamic, eco-conscious market.

What are the key market drivers leading to the rise in the adoption of Facades Industry?

- The primary catalyst for market growth is the increasing residential construction and infrastructure development activities.

- The market is experiencing significant growth due to the increasing number of residential construction projects worldwide. According to The World Bank Group, the global population has grown from 7.66 billion in 2018 to 8.0 billion in 2024, necessitating an increase in residential spaces. This population growth, coupled with regulatory support for construction projects, is driving the demand for facade systems in developing countries such as the UAE, Saudi Arabia, and China. Material science advancements have led to the development of high-performance window systems, thermal insulation, and energy-efficient facade solutions. Precast concrete, composite panels, rainscreen systems, and metal panels are popular choices for facade systems due to their durability, low maintenance, and thermal performance.

- These materials offer a favorable lifecycle cost, making them an attractive option for high-rise building projects. The focus on energy efficiency and sustainability in building construction is another factor driving the market. The use of advanced framing systems and insulation materials can help reduce energy consumption and improve a building's overall energy efficiency. As the construction industry continues to evolve, the demand for innovative and sustainable facade solutions is expected to increase.

What are the market trends shaping the Facades Industry?

- Emerging economies are experiencing significant population growth and urbanization, which represents a notable market trend. This demographic shift is presenting new opportunities for businesses across various sectors.

- The construction industry's expansion, driven by urbanization and infrastructure development, fuels the demand for facade systems in both residential and commercial buildings worldwide. Facades are integral to building design, offering benefits such as lighting integration, fire safety, wind load resistance, and water infiltration prevention. In the context of sustainability, the trend toward green building practices increases the demand for facades made from insulated panels and brick veneer. Design software aids construction management in creating harmonious and immersive facade designs, ensuring compliance with industry standards.

- The emerging economies of India, China, Indonesia, Russia, Turkey, and Brazil are expected to witness significant growth in construction activities, leading to increased demand for facades due to their insulation properties and ability to enhance a building's aesthetic appeal.

What challenges does the Facades Industry face during its growth?

- The significant increase in raw material and installation costs poses a substantial challenge to the industry's growth trajectory.

- Facade systems, which include acoustic performance solutions, solar shading, structural glazing, access panels, and seismic design, have seen an increase in raw material prices. The demand for materials such as metals, natural stone, wood, tiles, and glass has outpaced supply, leading to higher costs. The US, a significant exporter of lumber, struggles to meet the increased demand from markets like China and Southeast Asia. Additionally, trade disputes between the US and Canada over lumber imports have further escalated prices. These factors have resulted in increased expenses for transport and labor costs in the facade market.

- Project management teams must prioritize quality control to mitigate the impact of these rising costs on their industrial and residential building projects. Building codes require adherence to strict standards for safety and energy efficiency, making it essential for businesses to stay informed and adapt to market dynamics.

Exclusive Customer Landscape

The facades market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the facades market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, facades market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alania Building Systems Pty Ltd - This company specializes in innovative facade cladding systems, delivering superior thermal performance and moisture reduction.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alania Building Systems Pty Ltd

- Architectural Glass and Aluminum

- Asahi India Glass Ltd.

- Compagnie de Saint Gobain SA

- DANPAL

- Etex NV

- Everite Building Products Pty Ltd.

- First African

- James Hardie Europe GmbH

- Kingspan Group

- Knauf Insulation

- Nichiha Corp.

- Nippon Sheet Glass Co. Ltd.

- SHERA Public Co. Ltd.

- Sika AG

- Sto SE and Co. KGaA

- Terraco Holdings Ltd.

- Tremco CPG Inc.

- USG Boral

- Vietnam building material

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Facades Market

- In January 2024, leading facade manufacturer, Vitro Architectural Glass, announced the launch of its new solar control glass product line, SunGuard® XT, designed to improve energy efficiency and reduce carbon footprint in buildings. The company's press release stated that this innovation was in response to growing demand for sustainable facade solutions (Vitro Architectural Glass, 2024).

- In March 2024, global engineering and construction firm, Bechtel, entered into a strategic partnership with facade engineering specialist, Fassaden Technik, to expand its building envelope capabilities. This collaboration aimed to offer integrated design, engineering, and construction services for advanced facade systems (Bechtel, 2024).

- In May 2024, German facade manufacturer, Schüco International KG, completed a â¬150 million funding round, according to a report by Reuters. The investment was earmarked for research and development, production capacity expansion, and strategic acquisitions (Reuters, 2024).

- In February 2025, the European Union passed the new Energy Performance of Buildings Directive (EPBD), which mandates near-zero energy and carbon emissions for all new buildings by 2030. This regulatory initiative is expected to drive significant growth in the demand for energy-efficient facade systems (European Commission, 2025).

Research Analyst Overview

- In the dynamic market, construction sequencing plays a crucial role in optimizing design and fabrication techniques for energy-efficient and visually appealing building exteriors. Dynamic facades incorporate advanced features such as active design, thermal analysis, and performance simulation, which require careful planning and coordination during the project's early stages. Quality assurance is essential in ensuring the successful implementation of these complex systems, which involve recycled materials, smart facades, and green building materials. Facade engineering firms employ value engineering and risk management strategies to minimize project costing and contract negotiation complexities. Structural analysis and material selection are critical components of the design process, with a focus on sustainability and passive design principles.

- Building maintenance management and installation methods are also vital considerations, as facade systems require ongoing care and attention to maintain their performance and aesthetic appeal. Health and safety regulations, building permitting requirements, and performance monitoring are essential elements of the facade construction process. As the market continues to evolve, there is a growing emphasis on the use of advanced technologies, such as smart facades, to enhance building performance and reduce energy consumption. Overall, the market is a complex and ever-evolving landscape, requiring a multidisciplinary approach to design, engineering, and construction.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Facades Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

237 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2025-2029 |

USD 161.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.7 |

|

Key countries |

US, China, Japan, India, Canada, UK, South Korea, Germany, Brazil, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Facades Market Research and Growth Report?

- CAGR of the Facades industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the facades market growth of industry companies

We can help! Our analysts can customize this facades market research report to meet your requirements.